Subscribe

Subscribe today to receive CGD’s latest newsletters and topic updates.

All Commentary

Filters:

Topics

Facet Toggle

Content Type

Facet Toggle

Blog Type

Facet Toggle

Time Frame

Facet Toggle

Blog Post

November 18, 2019

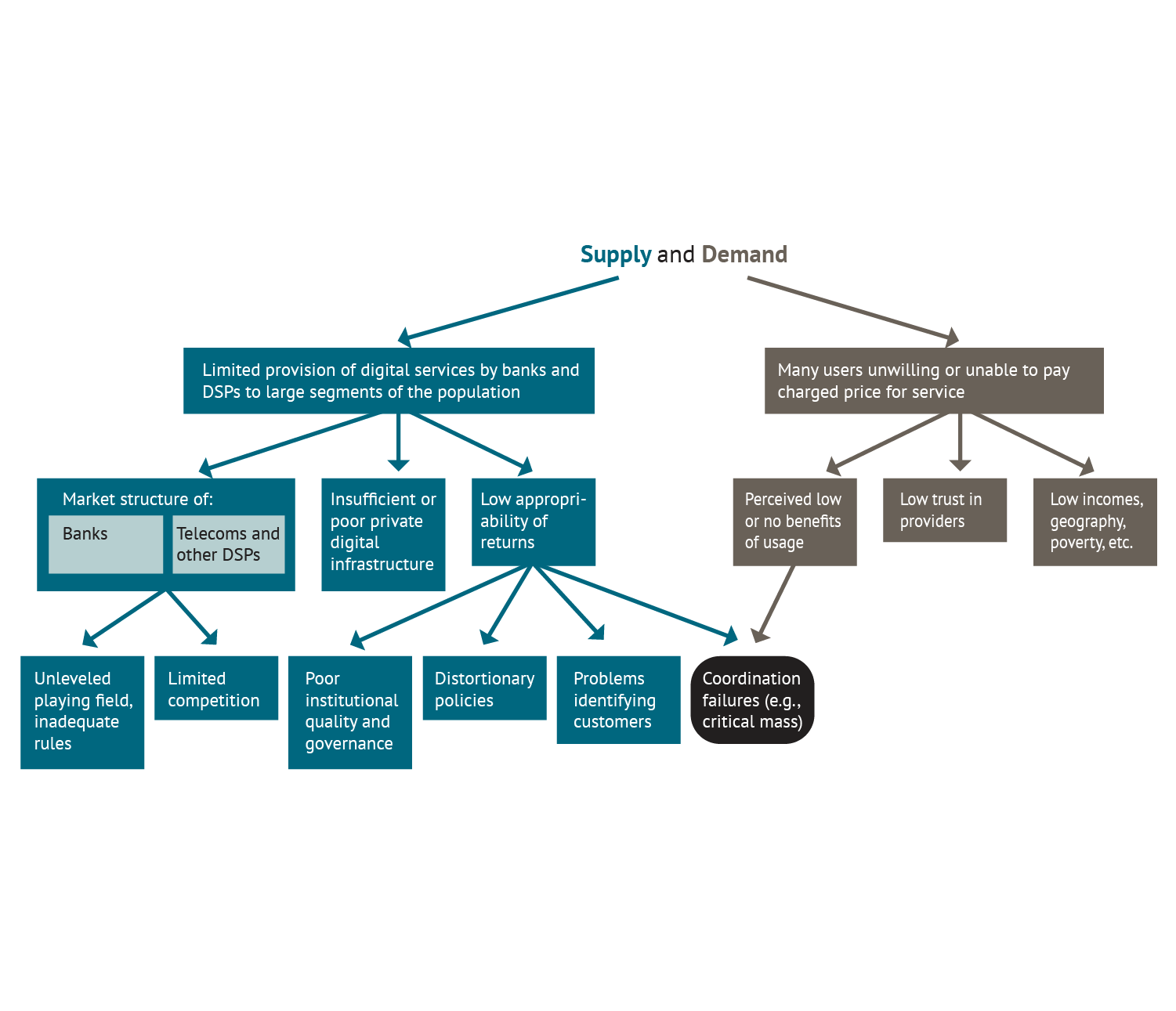

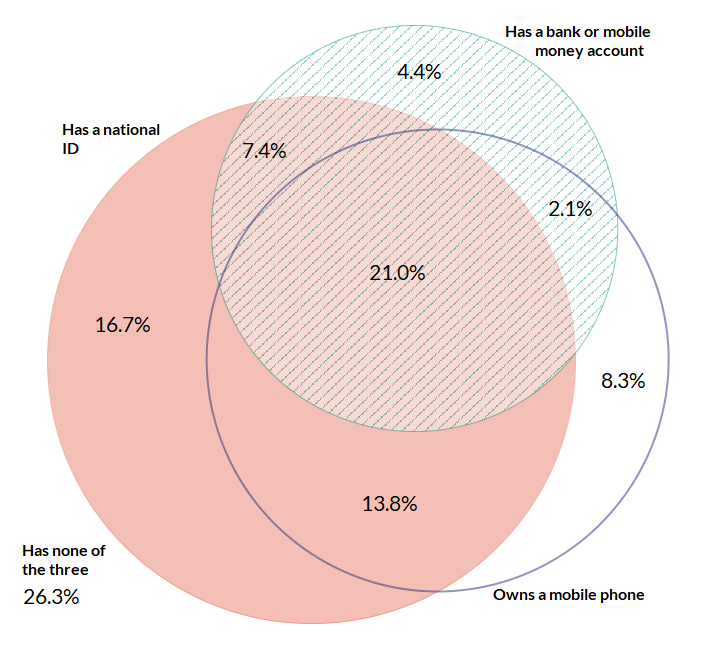

On October 10, CGD, in collaboration with the Alliance for Financial Inclusion (AFI), held a workshop in Mexico City to discuss CGD’s innovative tool that serves to diagnose the crucial impediments to digital financial inclusion in specific country contexts. There, we shared a draft of CGD’s&nb...

Blog Post

October 31, 2019

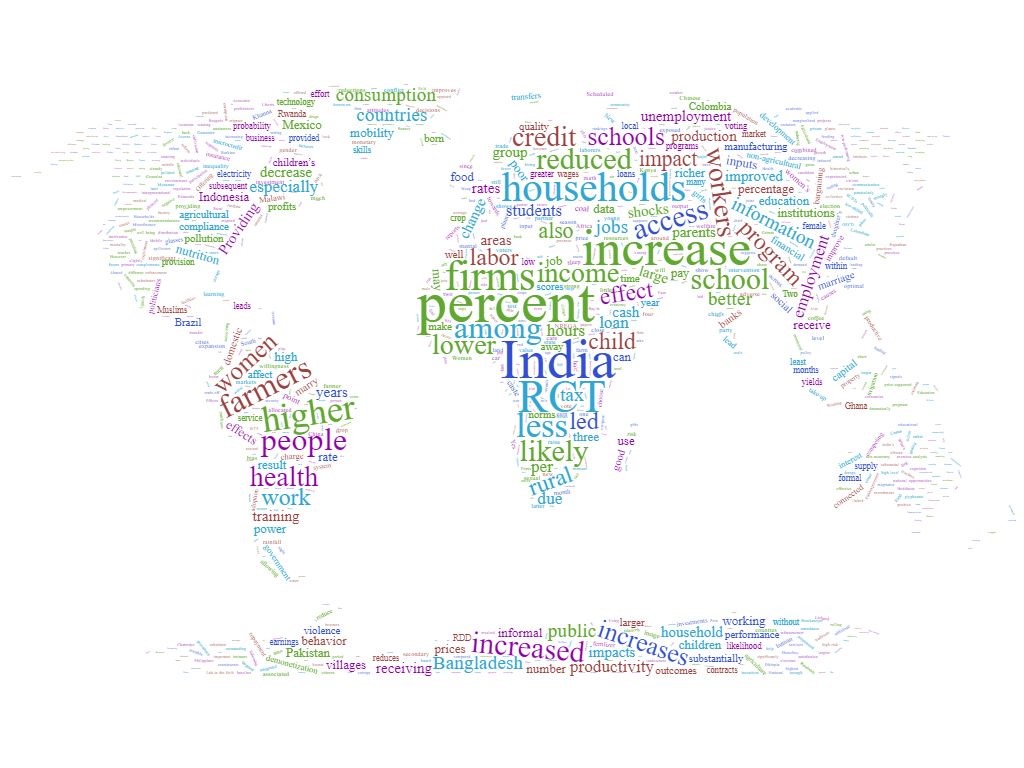

Despite a broad recognition that increased access to financial services can bring significant benefits to the poor, catalyzing economic development, financial inclusion in emerging markets and developing economies continues to lag far behind expectations. While a large number of countries have ...

Blog Post

August 12, 2019

Ethiopia has its sights set on becoming Africa’s next tech hub, rivalling Nairobi, Lagos, and Cape Town. But in its quest for digital supremacy, Ethiopia will need to take steps to create an enabling environment for the digital startup sector, which across Africa is driven in large part b...

Blog Post

July 17, 2019

I’ve been given two kinds of arguments in support of not borrowing for social sector projects. The first is about their ability to repay the borrowing by generating enough foreign exchange. And the second is skepticism about the productivity of government spending in these areas. Let me ...

Blog Post

April 23, 2019

As Basel III is transforming the global financial landscape, we hope that policymakers from both advanced economies and EMDEs, as well as multilateral organizations, can work together effectively to ensure that Basel III truly becomes a global public good—promoting financial stability and supp...