Recommended

Event

Financial Regulation for Financial Inclusion: What Should Policymakers Do?On October 10, CGD, in collaboration with the Alliance for Financial Inclusion (AFI), held a workshop in Mexico City to discuss CGD’s innovative tool that serves to diagnose the crucial impediments to digital financial inclusion in specific country contexts. There, we shared a draft of CGD’s forthcoming paper: A Decision Tree for Improving Financial Inclusion. The event brought together more than 20 high-level representatives from central banks, ministries of finance, and other authorities involved in the design and implementation of their countries’ national strategies for financial inclusion.

Policymakers from Latin America (Ecuador and Mexico), the Middle East, North Africa (Egypt, Jordan, and Pakistan), South Asia (the Philippines), and sub-Saharan Africa (Ghana and Nigeria) learned and discussed this new methodology and applied it to their own local settings. Following the same structure, we held our second workshop with Peruvian authorities on October 28, in Lima, where discussions with policymakers regarding the application of the Policy Decision Tree continued.

These workshops were possible thanks to the tremendous support of hosts Mexico’s Ministry of Finance and Peru’s Superintendency of Banks and Insurance.

Bridging policy needs and research

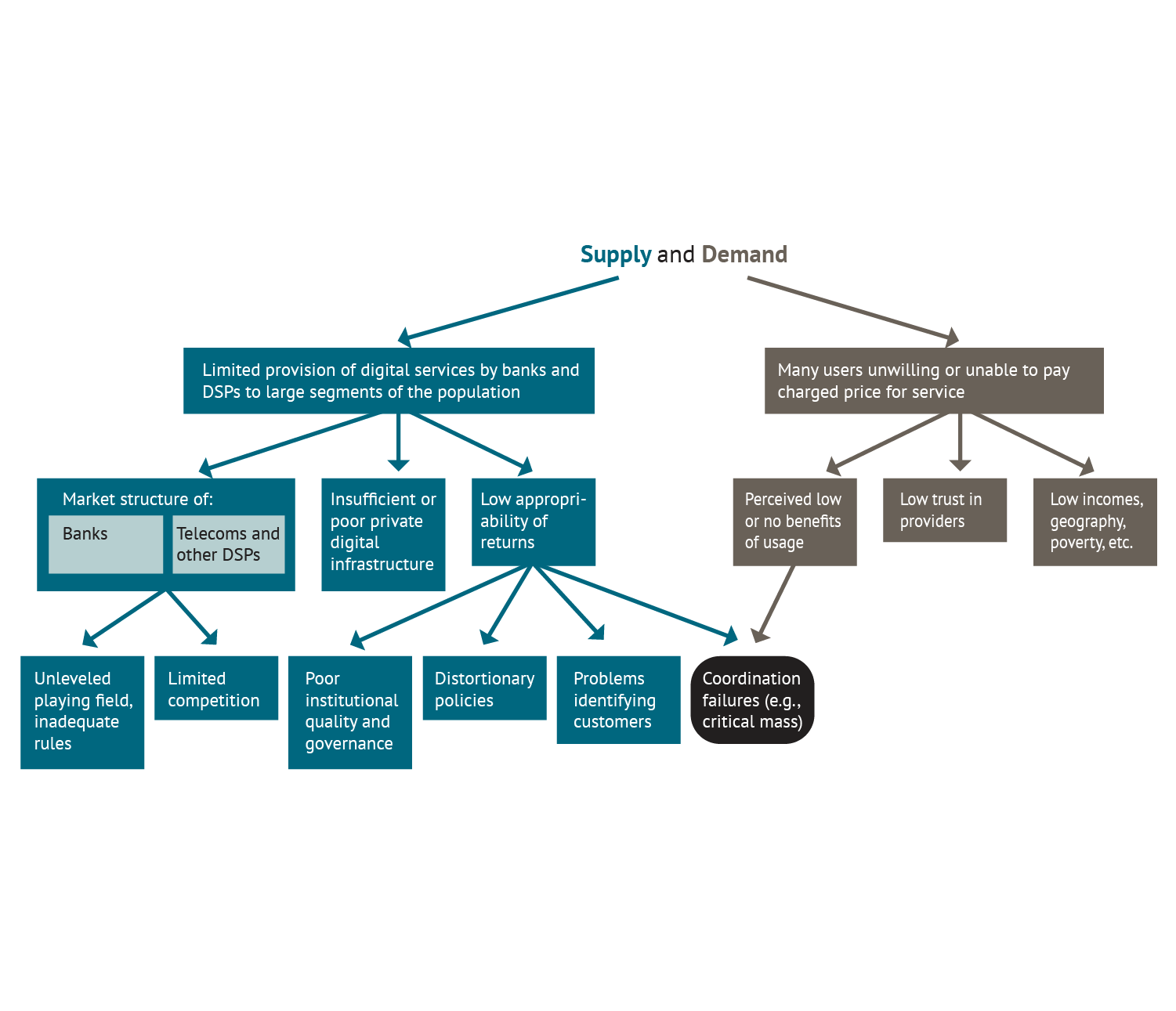

In recent years, there has been a substantial push for increasing access to digital financial services (DFS), and numerous countries have created detailed national strategies to reach this goal. However, policymakers have been missing a tool to help them guide their decisions about which policies should be prioritized and which measures might have the largest impact on financial inclusion. This project intends to fill that void and meet policymakers’ needs by developing the Decision Tree methodology, which identifies the main country-specific impediments (binding constraints) for improving financial inclusion. For more information regarding CGD’s analytical framework, read our introductory blog post.

The workshops in Mexico City and Lima provided a bridge between research and policymakers’ views. The goal of the workshops was to enrich the construction of the Decision Tree by discussing the applicability and usefulness of the methodological tool in participants’ countries. Given the enthusiasm and positive feedback we received, we are confident that the Decision Tree can help better design financial inclusion policies.

The workshop in Mexico was led by Liliana Rojas-Suarez and Stijn Claessens. The workshop started with welcoming remarks by Juan Pablo Graf (Head of the Banking, Securities and Saving Unit from the Ministry of Finance of Mexico) and a brief discussion on the current state of national financial inclusion strategies by Robin Newnham (Head of Policy Analysis from AFI). The presentation of the Decision Tree methodology by Liliana Rojas-Suarez and Stijn Claessens followed.

The second, and most important, part of the workshop was dedicated to the interactive participation of policymakers. Initially, each country delegation separately applied the Decision Tree to identify their own binding constraints for the usage of alternative financial services. The results of individual country’s deliberations were then presented to the rest of participants, who engaged in an open discussion about the lessons learned. Country-specific conclusions drawn from the workshops were very different from one another, which warns against generalizations and stresses the importance of a profound and thorough analysis of each particular case to define binding constraints.

Three takeaways from the workshops

The workshops generated rich takeaways and recommendations that will shape our research and the debate on financial inclusion policies moving forward:

- It is crucial to incorporate policymakers’ views into research: following CGD’s mission, this event was a clear example of the importance and benefits of bringing decision-makers early into the research process. The Decision Tree project aims to meet the need for a diagnostics-tool to define concrete financial inclusion policies and, as such, the methodology presented during the workshops will be revised and improved thanks to the inputs from policymakers. Promoting the interaction between policymaking and research is a powerful approach to reach better practical recommendations.

- Countries can find effective and innovative answers through cooperation and peer learning: The workshops were a fantastic opportunity for policymakers to share and discuss their own diagnostics of the most important constraints to financial inclusion. These analyses were improved by the exchange of views among participants. Indeed, these workshops have contributed to strengthening peer-learning networks on diagnostic strategies for financial inclusion.

- Undertaking deep country-specific analysis will maximize the benefits of the Decision Tree, while considering cross-country analysis is a useful complement: we encourage and emphasize the need for in depth country-specific diagnostics to understand the binding constrains on financial inclusion. At the same time, these workshops stressed the value of cross-country comparisons. Participants’ feedback reaffirmed that the Tree methodology should be used to carry out country-specific case studies to reach complete and definite diagnoses.

What’s next?

By early next year, we will publish and share a finalized working paper about the Decision Tree methodology through both CGD and AFI’s networks. We hope that this tool will continue to foster better communication and cooperation between research and policymaking to better inform regulatory decisions and guide research. We expect to start in depth case studies applying the Decision Tree in selected countries early on in the new year.

All materials related to this project will be regularly updated on the Decision Tree landing page.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Center for Global Development