Recommended

Blog Post

Low-income and many emerging market economies face a challenging outlook for maintaining, let alone increasing, health and other social expenditures (as noted in these recent blogs here and here). This predicament is primarily attributed to these nations channeling a growing proportion of their revenues towards interest payments on both domestic and external debts. The situation has been further exacerbated by the surge in interest rates in advanced economies over the past two years, with the United States experiencing its highest rates in 22 years. The accompanying depreciation of currencies of low-income and emerging market economies has compounded the problem. In previous blogs, we’ve argued that the international community should consider implementing measures to alleviate the debt burden and enhance concessional financing, particularly for low-income countries, during these challenging times.

In this blog, we delve into the situation of a Group of 36 countries grappling with debt distress or at risk of falling into debt distress. We find that the situation of six countries is precarious, demanding immediate attention. Providing support to these countries at this juncture, either through debt relief or additional concessional financing for the health sector, would yield substantial benefits.

Rising interest costs

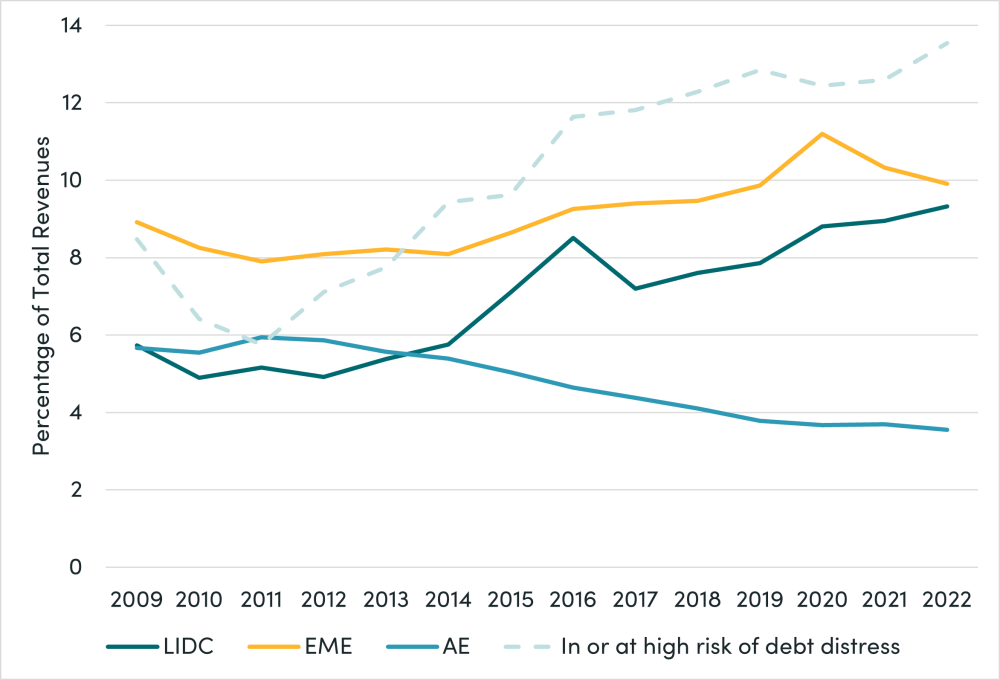

Figure 1 illustrates the escalation of interest costs in relation to revenues in countries in debt distress or at a high-risk of debt distress since the Great Recession. We find that average interest costs in this Group of 36 are three times that in advanced economies. They are also higher than the average in low-income and emerging market economies taken together.

Figure 1. General government interest expense

Source: International Monetary Fund (IMF), World Economic Outlook (WEO)

Note: 36 countries from IMF’s August 31, 2023, List of LIC DSAs in or at high risk of debt distress. Ten countries in debt distress: Republic of Congo, Ghana, Grenada, Lao P.D.R., Malawi, Somalia, Sudan, São Tomé and Príncipe, Zambia, and Zimbabwe. 26 countries at high risk: Afghanistan, Burundi, Cameroon, Central African Republic, Chad, Comoros, Djibouti, Dominica, Ethiopia, The Gambia, Guinea-Bissau, Haiti, Kenya, Kiribati, Maldives, Marshall Islands, Micronesia, Mozambique, Papua New Guinea, Samoa, Sierra Leone, South Sudan, St. Vincent and the Grenadines, Tajikistan, Tonga, and Tuvalu.

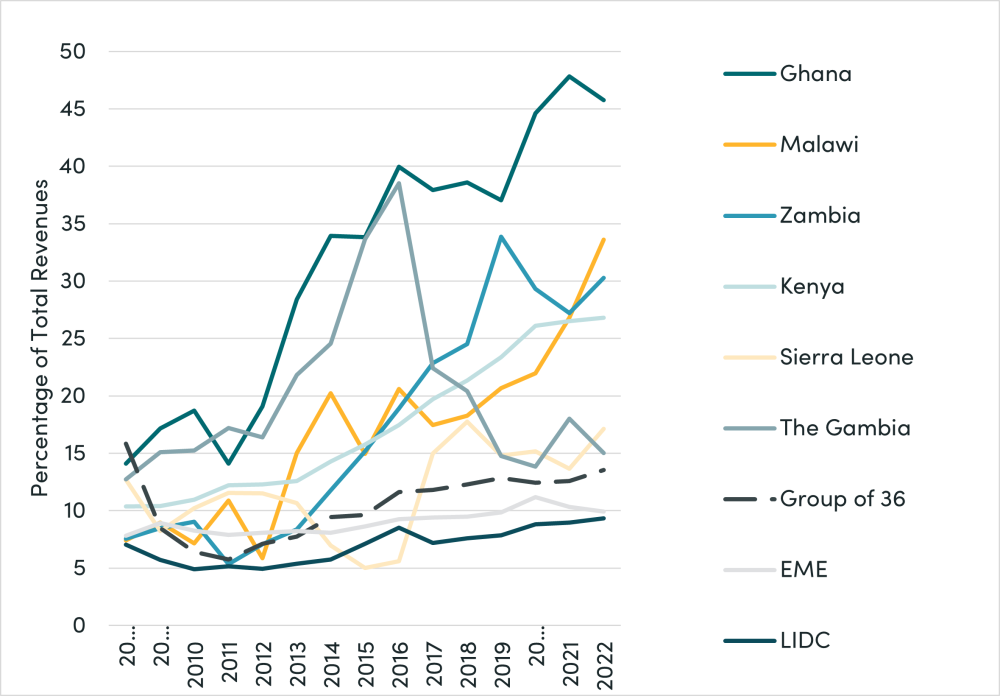

Six countries—The Gambia, Ghana, Kenya, Malawi, Sierra Leone, and Zambia— stand out with significantly higher interest payments as a share of their revenues compared to the average for the Group of 36 (Figure 2). In 2022, these costs constituted 46 percent of revenues in Ghana and exceeded 30 percent in both Malawi and Zambia.

Another way of viewing the deteriorating ratio of interest payments to revenues is to examine the evolution of domestic revenues as a share of output. Growing revenues contribute to expanding the fiscal space of a country to support government spending. However, revenues in these six countries remained either stagnant or did not keep pace with the rising interest costs. Fiscal dividends (in the form of higher revenues) from domestic spending financed through borrowing were not sufficient to cover growing interest costs, suggesting less than fully productive spending.

Figure 2. General government interest expense in six focus countries

Source: IMF WEO

Note: Three countries in debt distress: Ghana, Kenya, Zambia; three countries at high risk of debt distress: Gambia, Malawi, Sierra Leone. “Group of 36” represents the average of all countries in or at high risk of debt distress.

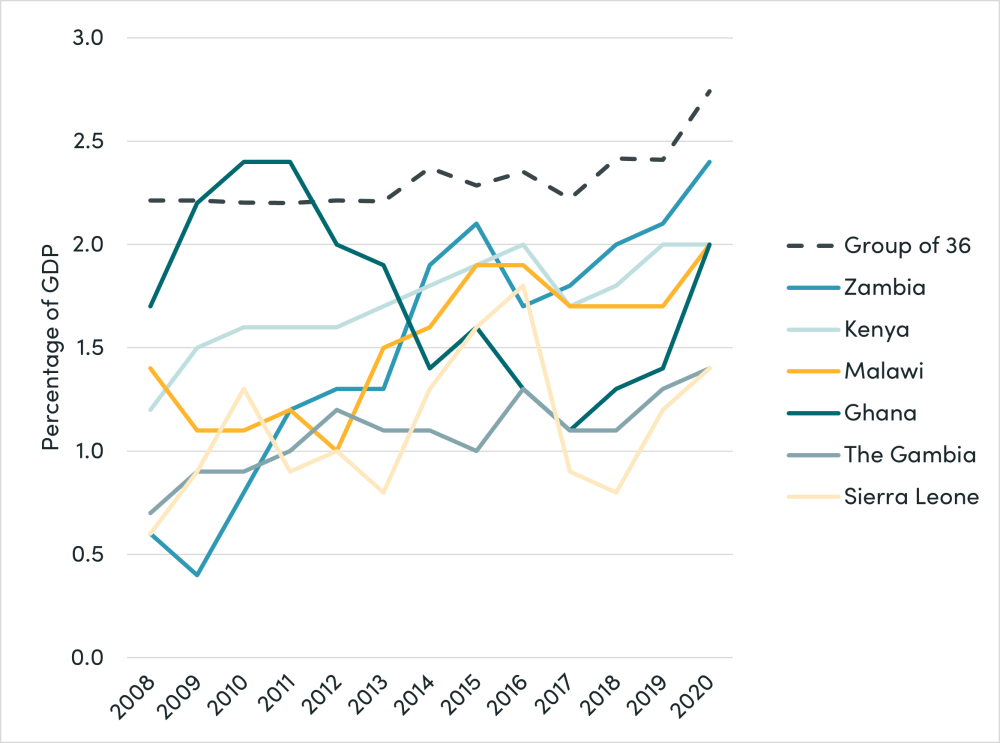

Rising interest payments and domestic health spending

Regrettably, the high interest costs in the six countries did not allow domestic health spending to increase by as much as in the Group of 36. As a share of GDP, heath spending in the six countries was less than the average in the Group of 36 (see Figure 3). Health spending from domestic sources averaged less than two percent of GDP, while rising somewhat in 2020—a spending increase that is unlikely to be sustained given the prevailing fiscal outlook. In contrast, education spending as a share of GDP consistently exceeded health spending (by approximately a margin of two percentage points of GDP).

Figure 3. Domestic general government health expenditure for six focus countries

Source: IMF WEO

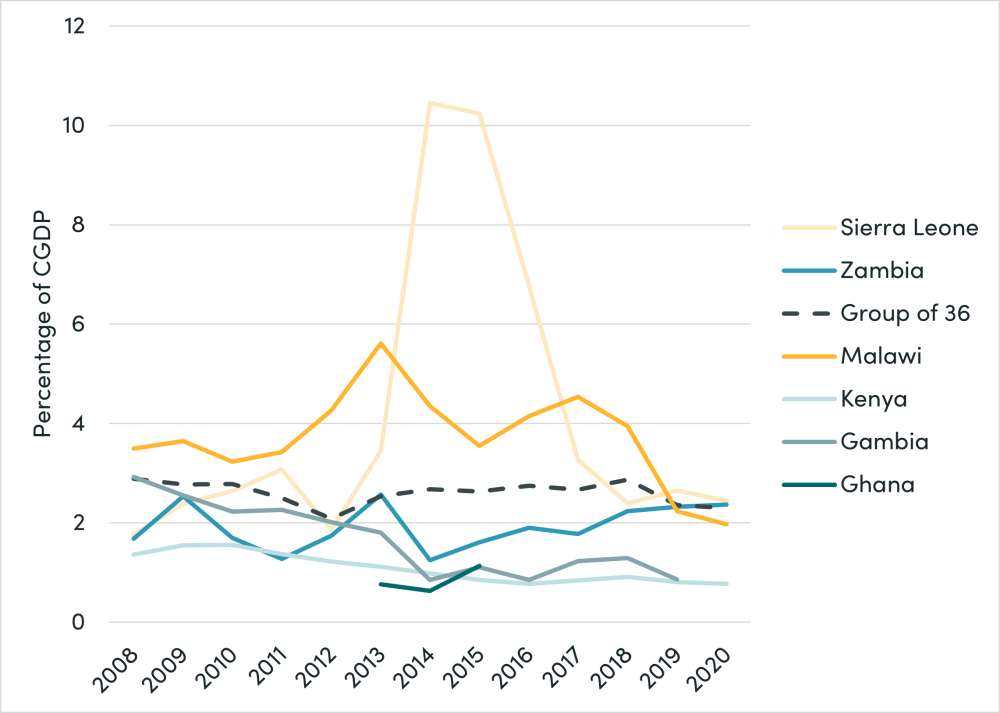

External support for the health sector

Historically, the health sector of countries currently in debt distress or facing a risk of falling into debt distress received significant support from donors. Averaging about three percent of GDP in 2008, such support typically surpassed the allocations from country’s own budgets (see Figure 4). Leaving aside the debate on merits of foreign aid, such support nevertheless enabled countries to maintain health services that would have been unfeasible with domestically generated revenues.

Figure 4. External health expenditure (as percentage of GDP) in six focus countries

Source: WHO Global Health Expenditure Database

External support, AKA foreign aid, for the health sector in most of the Group of 36 countries has been on the decline since 2008 at a time when their own budgets have come under pressure from rising interest costs. For the six focus countries, average donor support rose from 2 percent of GDP to 3.3 percent of GDP in 2014 and subsequently fell back to 2 percent of GDP in 2020.

Bottom line: The international community and donors should either extend debt relief or provide additional concessional financing for the health sector, at a minimum for the six countries representing 140 million people, if not for the Group of 36 countries facing pressures from rising debt.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: africa / Adobe Stock