Recommended

Blog Post

Blog Post

The new year has hardly begun, but fears of a looming recession persist. Pandemic-era increases in health spending are unlikely to continue in low- and middle-income countries. Growing fiscal pressures—such as high debt, increasing interest rates, and declining foreign aid and revenues—bode ominously for government spending, including government spending on health.

This blog explores the question of whether rising debt in relation to GDP will impinge on future health spending. High and rising debt means countries must set aside a larger share of their revenues for interest payments. This, in turn, entails less would be available for other spending, such as for health. We examined the long-term relationship between debt and the resulting high interest payments, and government health spending in 76 low- and lower-middle-income countries during two periods when external shocks hit: the Great Recession of 2008-2010 and the recent period including the pandemic of 2018-2020.

Our main finding is that low-income countries may be particularly vulnerable to reductions in domestic government health expenditure as government debt grows, and at far higher levels of debt than the Great Recession. Further, interest payments in recent years have increased, taking up a larger share of revenues and leaving less budget space for other areas. Focusing on efficiency-enhancing strategies would thus allow these countries to stretch their resources further. Initiatives for debt restructuring or additional external financing will be crucial and require political will.

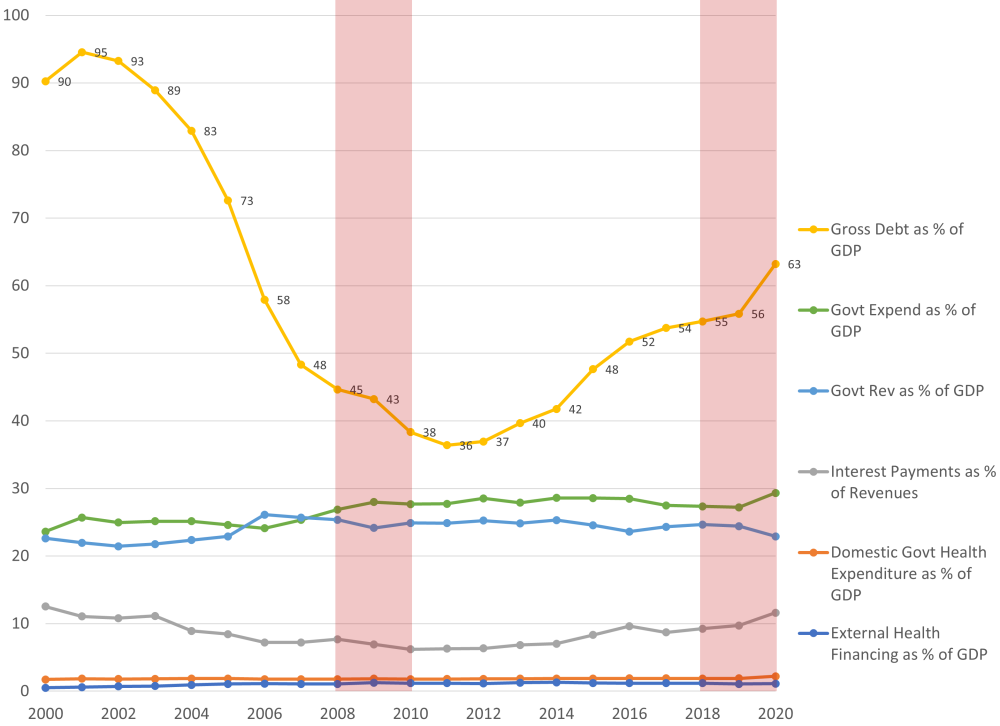

Government debt has grown tremendously in the last decade for low- and lower-middle-income countries. Gross government debt as a percentage of GDP was relatively modest at around 36 percent in 2011 after the Great Recession. But it has since seen a continued upward trend, hitting 56 percent in 2019 and jumping to 63 percent in 2020, as these countries sought to mitigate the impact of the pandemic on their populations through social programs in the face of eroding revenues (see Figure 1). The math is simple: government expenditures consistently exceeded revenues each year since 2008. Those deficits accumulate, growing gross debt to its present height. Meanwhile, interest payments as a share of government revenues reached 11.6 percent in 2020, nearly double the figure of 6.2 percent in 2010.

Figure 1: Gross government debt has grown tremendously, as expenditures have consistently exceeded revenues over 2008-20

Notes: Authors calculations using International Monetary Fund (IMF), World Economic Outlook (WEO), and World Health Organization (WHO) Global Health Expenditure Database (GHED) data for low- and lower-middle-income countries (n=76) as classified by the World Bank on government finances and health expenditures

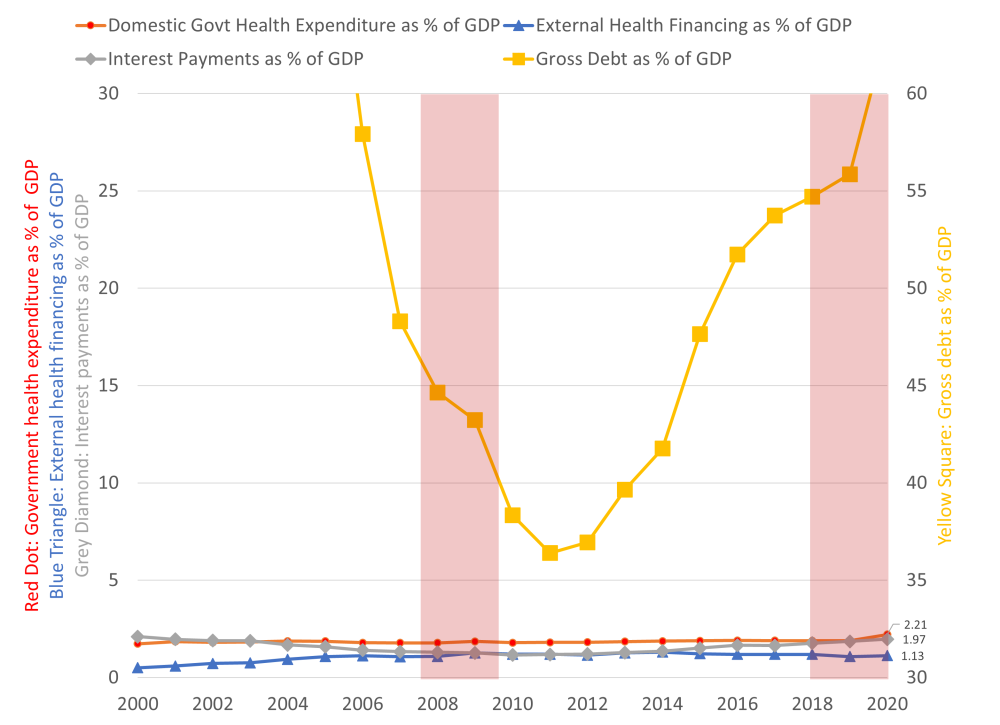

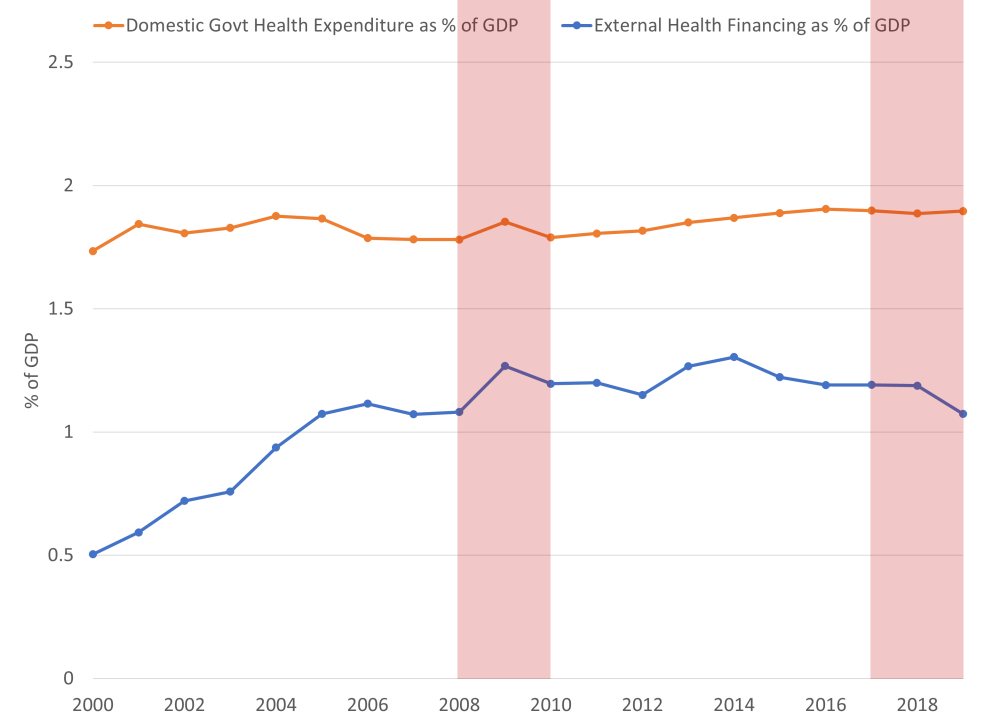

During this period, domestic government health expenditure grew from a low level of 1.73 percent in 2000 to 2.2 percent of GDP in 2020—a 27 percent increase, though the recent increase in 2020 is unlikely to be sustained (see Figure 2). In comparison, during the Global Health golden era, external health financing began growing in the early 2000s, reaching its peak in 2014, but declining ever since, today accounting for 1 percent of GDP on average in low- and lower-middle-income countries. Aggregate government expenditures in these countries were consistently higher than revenues.

Notably, interest payments were nearly double that of external health financing or as much as domestic health spending in 2020 (see Figure 2), indicating their importance in size as countries address budget space for health, particularly low-income countries.

Figure 2: Even as government debt has grown precipitously, health spending has flatlined over 2000-20

Notes: Authors calculations using IMF, WEO, and WHO GHED data for low- and lower-middle-income countries (n=76) as classified by the World Bank on government finances and health expenditures

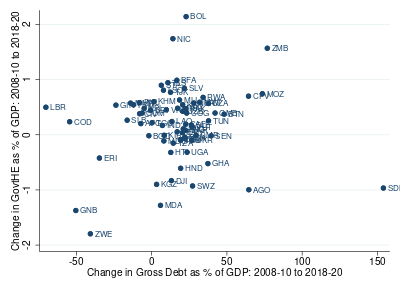

When we plot the changes in government health expenditure over 2008-10 to 2018-20, against changes in gross government debt over the same period, there is minimal correlation (see Figure 3, panel a, Pearson’s ρ=0.069), and even smaller correlation between government health expenditure and external health financing over the period (see Figure 3, panel b, Pearson’s ρ=0.029).

The latter relationship pertains to questions on the fungibility of domestic health spending and external health financing, which have been analyzed ad nauseam (i.e. Did year-on-year decreases in foreign aid lead to increases in government health spend? Did decreases in government spend lead to increases in foreign aid? Etc.) While we don’t delve into this (arguably unanswerable) question, this crude analysis over a ten-year period does not appear to show any correlation. In short, there may be year-on-year correlations found in past cross-country time-series studies, indicating potentially short-term effects, but in the long-term, the fungible aid “problem” seems to balance out, at least for low- and lower-middle-income countries (and this may further not be true for certain individual country cases or for upper-middle-income countries).

Figure 3: Between 2008-2020, there was little relationship between changes government health expenditure vs. changes in gross debt for low- and lower-middle-income countries, or vs. changes in external health financing

Notes: Authors calculations using IMF, WEO, and World Health Organization data for low- and lower-middle-income countries (n=76) on government finances and health expenditures

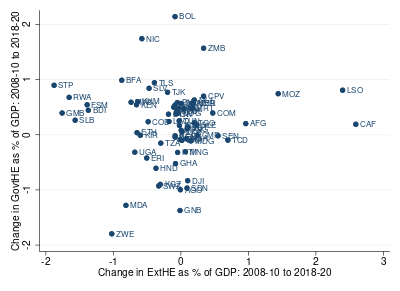

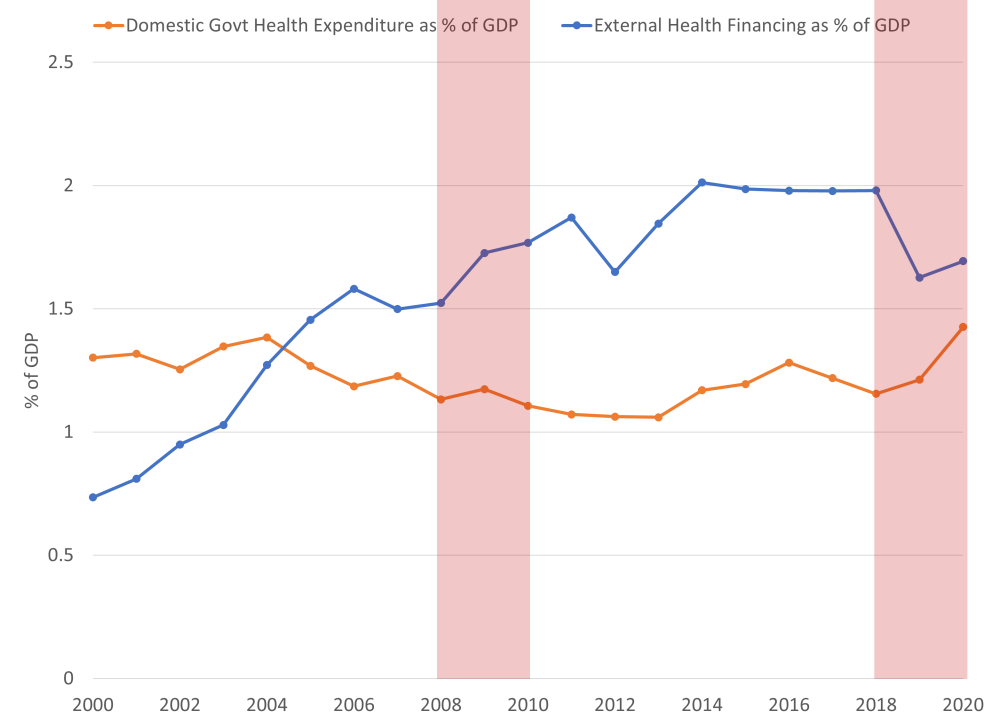

However, when restricting the sample to low-income countries only (n=27), these crude correlations turn slightly negative, although still quite minimal, when examining government debt (Pearson’s ρ=-0.03) and slightly more pronounced when examining external health financing over the period (Pearson’s ρ=-0.11) (not shown in graph). This finding indicates that low-income countries may be more vulnerable to impacts of growing debt than lower-middle-income countries. In addition, external health financing greatly exceeded government health expenditures for low-income countries (see Figure 4, panel b). Thus, low-income countries should be prioritized as policymakers consider supportive measures (such as debt restructuring and provision of additional external financing) in 2023.

So what’s the bottom line of this exploratory analysis? Interest payments were relatively small during the first period and have grown sharply higher in the second. This is likely to squeeze public spending, including on health, in the absence of debt restructuring or additional external financing which requires political will and international leadership to raise the priority of debt on the political agenda of international financial institutions. Addressing today's debt crisis requires new thinking and urgent efforts.

On top of this, higher food and fuel prices as a result of the Ukraine war and a slowing global economy, will make it harder for policymakers in these countries to maintain critical spending programs. Yet, fiscal tightening is inevitable in some, if not many, countries, which would exert downward pressure on all spending programs, including health. In the short term, there are limits to how much these countries can raise additional domestic revenues. In these circumstances, could external financing be stepped up in selected low-income countries to protect the health sector?

Figure 4: External health financing has greatly exceeded government health expenditures for low-income countries

Notes: Authors calculations using IMF, WEO, and World Health Organization data for low- and lower-middle-income countries (n=76) and low-income countries only (n=27) on government finances and health expenditures

With thanks to Javier Guzman for helpful comments.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Adobe Stock