Recommended

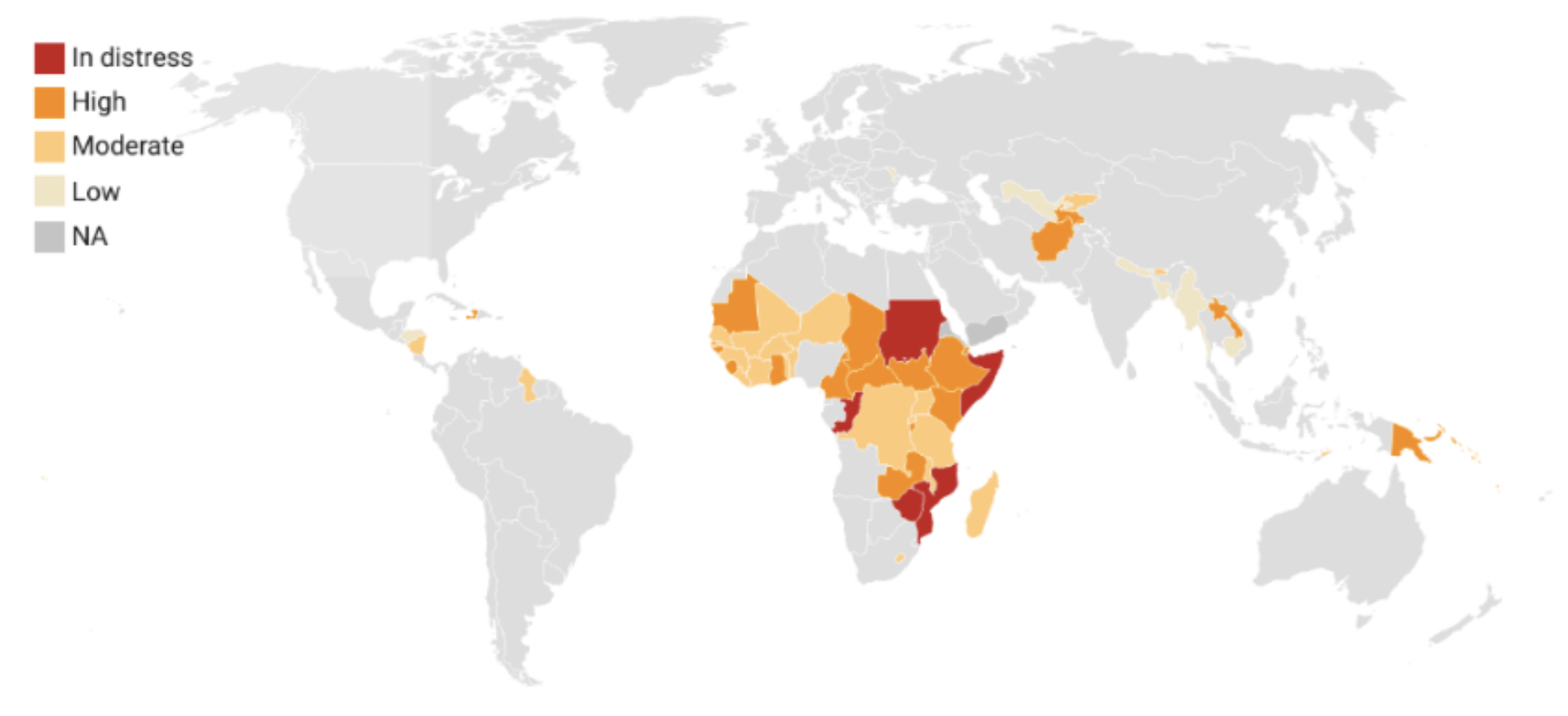

One of the most serious challenges facing the global economy today is the impending sovereign debt crisis in many middle- and low-income countries. The fiscal outlook in some of these countries appeared dire even before interest rates started climbing and spending related to COVID-19 caused debts to soar. Several economies face growing debt service payments at a time when capital is flowing out from the developing world. These pressures are bearing down on more countries and involve a larger amount of sovereign debt than at any other time in recent history.

Restructuring may be the only option available to return some of these countries to a sustainable level of debt. However, while much has changed in the way creditors, debtors, and the international community approach sovereign debt restructurings since Argentina’s 2001-16 debacle (Makoff, 2024), restructuring sovereign debt remains subject to costly delays.

Since the late 1950s, the leading forum for official bilateral debt management has been the Paris Club. However, the Paris Club’s capacity to foster cooperation among creditors has decreased over the past few decades with the rise of new bilateral lenders, notably China.

Enter the Common Framework

Recognizing the need to address the mounting debt overhang more forcefully, G20 members endorsed the Common Framework for Debt Treatments in November 2020 at a meeting in Riyadh.

Unlike its short-lived and ineffective predecessor, the Debt Service Suspension Initiative, the Common Framework was intended to address fundamental debt sustainability concerns in low-income countries through rescheduling and debt relief, including debt cancellations in exceptional circumstances, based on debt relief targets generated by the joint IMF-World Bank debt sustainability analysis.

The Common Framework also abandoned the voluntary approach to private sector participation, introducing instead the “comparability of treatment” of all official bilateral and external private creditors. Inherited from Paris Club, the principle-- requiring that creditors give at least as much relief as G20 creditors-- was intended to avoid de facto subordination of some creditor claims.

To date, acceptance of the Common Framework has been slow: only four countries—Chad, Ethiopia, Ghana, and Zambia—have applied for debt relief under this framework and some applicants experienced delays in processing.

Some officials blamed China for taking too long to respond. China has the largest exposure to developing countries, and so cannot be ignored or sidelined. In some cases, numbers simply do not work without China’s active involvement in debt restructuring process.

Yet others recognized that the process has become too cumbersome: the Common Framework brings together a large number and different types of creditors under a set of rules that are vaguely defined and unenforceable.

A Collective Action Problem?

In his seminal contribution to the theory of public choice, “The Logic of Collective Action”, Professor Mancur Olson (1965) stated:

“Unless the number of individuals in the group is quite small, or unless there is a coercion or some other special device to make individuals act in their common interest, rational, self-interested individuals will not act to achieve their common or group interests. … These points hold true even when there is unanimous agreement in a group about the common good and the methods of achieving it.”

Thus, it is unlikely that a large group of creditors with varying incentives would achieve an outcome consistent with their group interests just because it is in individual members’ best interest. To do that, as Olson (1965) suggested, would require a combination of elements of coercion and enticement, and better coordination.

Designing the Modified Common Framework

The proposed approach—a Modified Common Framework—contains methods of coercion, enticement, and coordination that would address the collective action problem embedded in the Common Framework.

Improving Coordination

The experience of Iraq and Argentina provide a valuable contrast of cases where high-level lobbying by the U.S. of creditor community has succeeded in mobilizing unprecedented support (Iraq) and where lack thereof may have caused a messy and prolonged ordeal (Argentina). The Common Framework should be relaunched with high-level representatives of the US and China appointed as emissaries to spearhead the process.[1] Where China has the exposure, it should be offered the co-chairmanship in all official creditor committees and should be allowed to provide debt relief on a present-value basis as part of a menu of options available to creditors.

One of the main handicaps of the Common Framework is that deals are made in different rooms often subject to different or changing rules and assumptions. Reducing this uncertainty and making sure everyone is at the table when the main parameters are worked out is essential for completing restructurings on a timely basis.

Adding Elements of Enticement

Introducing state-contingent instruments (e.g., GDP warrants) in the restructuring mix of new securities would allow private creditors to share the upside of future recovery and make them more likely to accept deals. Such contingent instruments have been introduced in sovereign restructuring cases before, with discussions on Zambia explicitly making the amount of debt relief contingent on the debtor’s ability to service debt in the future.

Another way to encourage more participation would be to offer “most favored creditor” clauses.[2] These clauses should help guarantee that no one gets a better deal than others in the same category of creditors, thus eliminating the first mover and holdout advantages.

Adding Elements of Coercion

Use of the Comparability of Treatment principle in some cases may block good paths toward debt restructuring.[3] In some cases, it may be better to have a two-tier Comparability of Treatment formula, that is one for official creditors and another for all external private creditors. This approach could create more options for creditors and faster resolutions.

Creditor countries often do not want to be seen as refusing debt relief to poor countries. Thus, “naming and shaming” may be useful in some cases. Raising the stakes high enough (e.g., via regular reporting by G20, the UN, and the International Financial Institutions regarding the outcomes of debt negotiations) could dissuade from falling out of line. The IMF’s requirement to have its standard financing assurances from bilateral creditors before providing new lending is useful in this regard as it puts pressure on potential holdout bilateral creditors to participate.

Expanding the Perimeter to Include Domestic Debt

In some cases (e.g., Ghana), it is virtually impossible to return public debt to sustainable levels without restructuring domestic debt. Including domestic debt in the perimeter of the debt exchange would help share the burden of debt relief more evenly across all creditors and make them more likely to accept restructuring deals.

Restructuring domestic debt is generally more complicated than dealing with external debt. If domestic debt is to be included in the perimeter of debt restructuring (as outlined in IMF, 2021), decision on how deeply to restructure those claims should be based on the concept of the Net Debt Relief curve discussed in Grigorian (2023).[4]

More work is needed to fine-tune these proposals. One thing is clear: without measures to address the collective action problem embedded in the Common Framework, the promise of a clean start for some developing countries will remain elusive.

[1] Although cooperation between the US and China may sound like a pipe-dream in the current geopolitical environment, they have in the past cooperated on projects where things were not a zero-sum game.

[2] These types of clauses were used in Argentina (2005) and Ukraine (2015-16) and proposed by Zambia.

[3] For example, a high level of haircut accepted by official creditors (e.g., because the country has a disproportionate amount of official bilateral debt relative to private debt) may generate insufficient interest among private bondholders to trigger Collective Action Clauses, thus rendering the exchange incomplete and opening opportunities for litigation by holdout creditors.

[4] The paper shows that, when bank recapitalization and financial stability costs are explicitly factored in, debt relief accrued to the sovereign will have an inverted U-shaped relationship as a function of the haircut imposed on domestic holders of debt.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: fivepointsix / Adobe Stock