Recommended

Blog Post

The COVID-19 pandemic had a severe impact on all countries—advanced, emerging, and low-income alike. To mitigate its consequences and protect lives and livelihoods, countries increased public spending on healthcare and implemented programs to support their economies and unemployed populations in 2020. This increase in health spending was significant for emerging market economies (EMEs) and low-income developing countries (LIDCs), as their domestic health spending had been relatively low prior to the pandemic. Nevertheless, spending in many countries remains far short of what is needed to provide universal health care and meet the Sustainable Development Goals (SDGs). Considering the prevailing fiscal outlook, it remains uncertain whether even maintaining (let alone increasing) health outlays can be sustained in the long term. The future of such spending in countries currently experiencing or at high risk of debt distress is particularly troubling. A country is in debt distress when its ability to service domestic and external debt is impaired. This blog post delves into these issues based on more recent health spending and fiscal data to determine which countries may find themselves unable to sustain current levels of health spending, let alone increase them.

Fiscal deficits and public debt

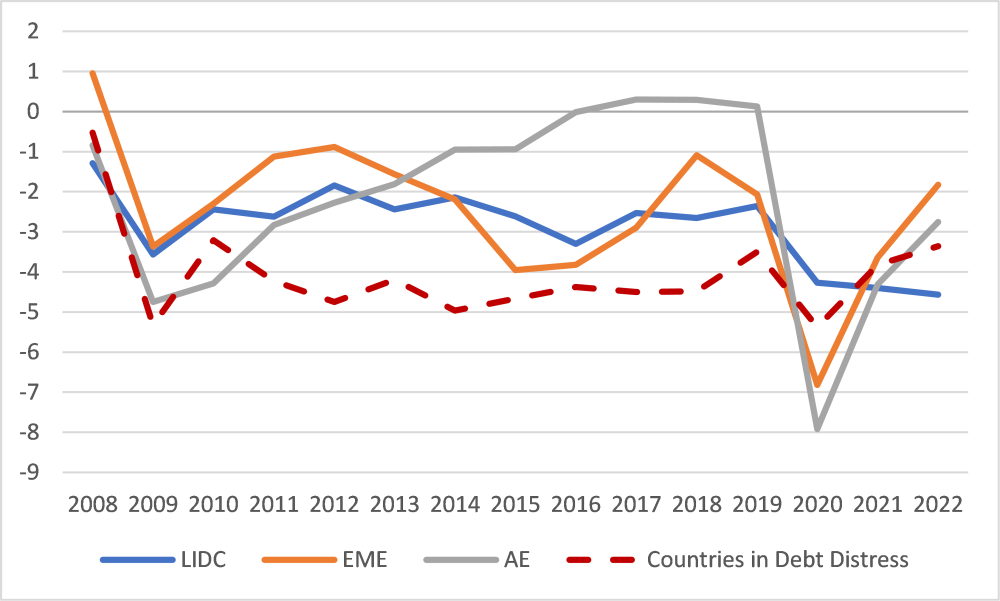

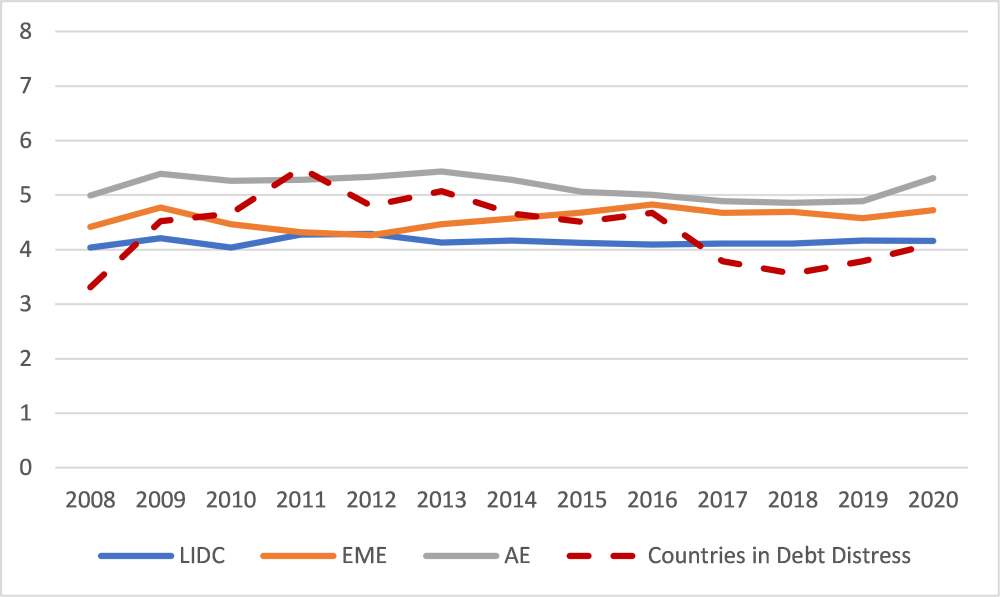

One crucial factor contributing to the increase in fiscal deficits (the excess of public spending over revenues) across all economies in 2020 was the higher expenditure on measures to protect the population and the economy from the adverse effects of the pandemic (Figure 1). In advanced economies, fiscal deficits increased the most, followed by EMEs and then LIDCs. Unfortunately, the fiscal deficits for countries in debt distress remained weaker than LIDCs as a group. The extent to which fiscal deficits increased in 2020 depended on each country's fiscal space, which is defined as the capacity to undertake discretionary fiscal policies without jeopardizing market access and debt sustainability. EMEs, LIDCs, and countries in debt distress (DD) faced further constraints on their fiscal space due to falling revenues.

Figure 1. General government fiscal balance

(Percentage of GDP)

Source: Fiscal Monitor 2023

Notes: Countries are aggregated by their income levels: low income developing countries (LIDC), emerging market economies (EME), and advanced economies (AE); the aggregates are unweighted averages.

The countries in debt distress: Republic of Congo, Ghana, Grenada, Lao P.D.R., Malawi, Mozambique, Somalia, Sudan, São Tomé and Príncipe, Zambia, and Zimbabwe.

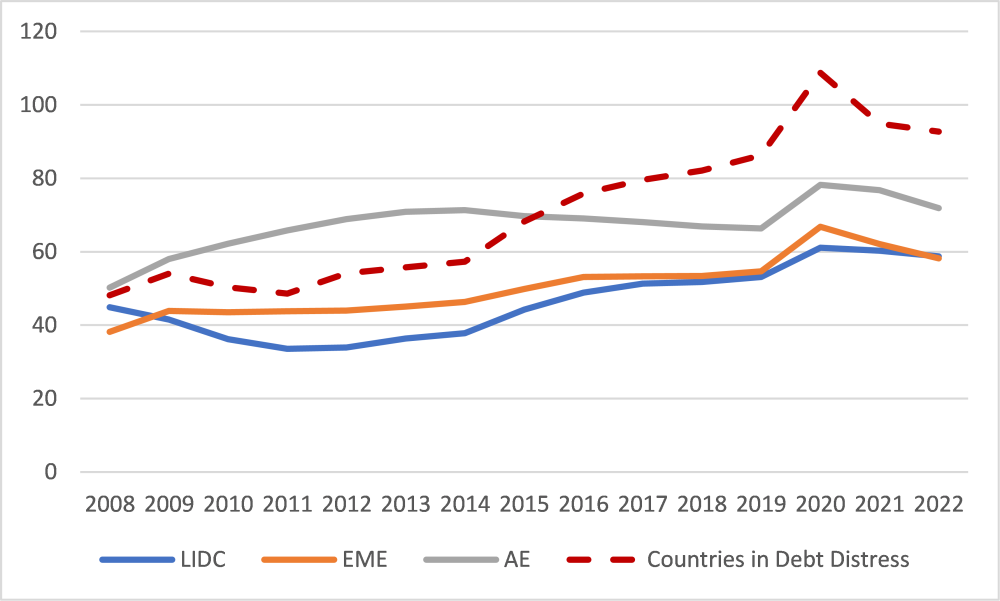

The increases in the debt-to-GDP ratio were about the same in absolute terms in both AEs and EMEs in 2020. The picture is different for LIDCs and DDs. The rise in debt-to-GDP ratio in LIDCs was less than in AEs and EMEs, but it was significantly larger in DDs (Figure 2). LIDCs in general were conservative in their spending during the peak of the pandemic. Yet even this modest increase in spending was enough to exhaust their fiscal space, leading many LIDCs to fall into debt distress or increase their risk of doing so.

Figure 2. General government gross debt

(Percentage of GDP)

Source: World Economic Outlook 2023.

Health spending

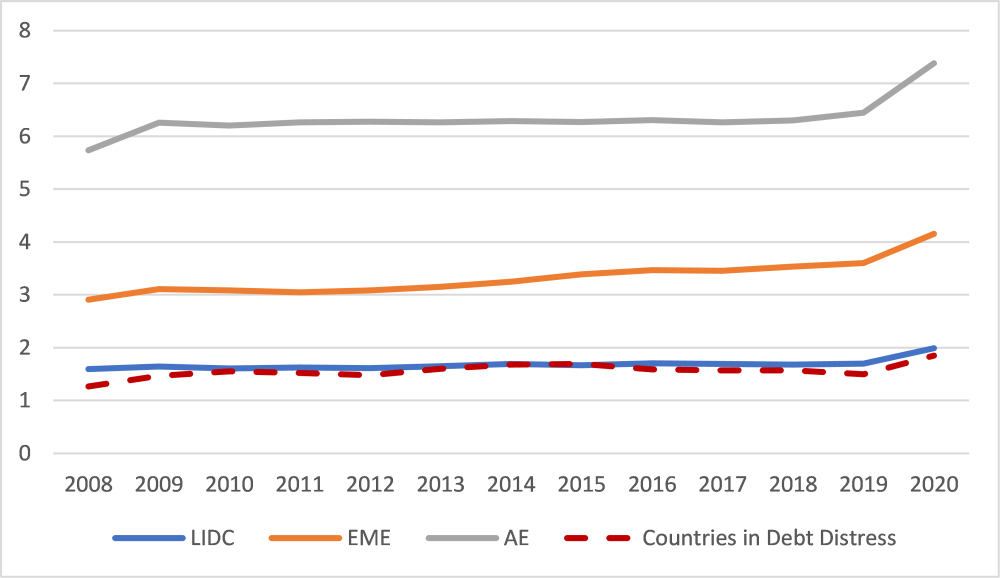

A study published last summer tentatively estimated that median health expenditures in LIDCs and low-middle income countries (a category which includes many EMEs and all LIDCs) increased by 0.42 to 0.75 percentage point of GDP in 2020. This was a substantial increase, considering that the average health spending in EMEs had remained stable at around 3 percent of GDP during the period of 2008-2018, while in LIDCs (including those in DDs) spending had hovered under 2 percent of GDP. This development was welcomed by the international health community, which has advocated for higher health spending in these countries, especially when they allocate nearly twice as much of their GDP to education.

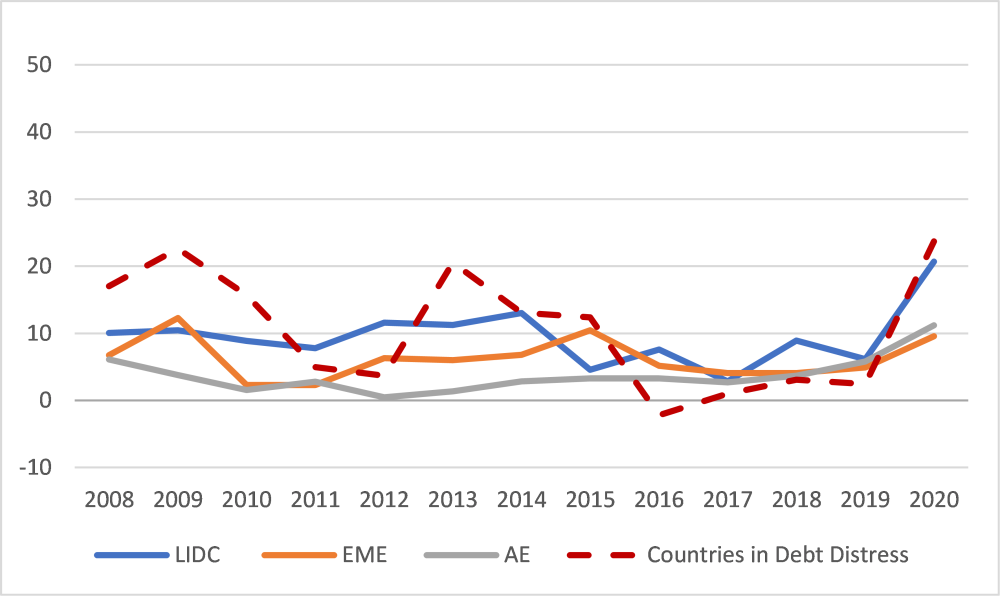

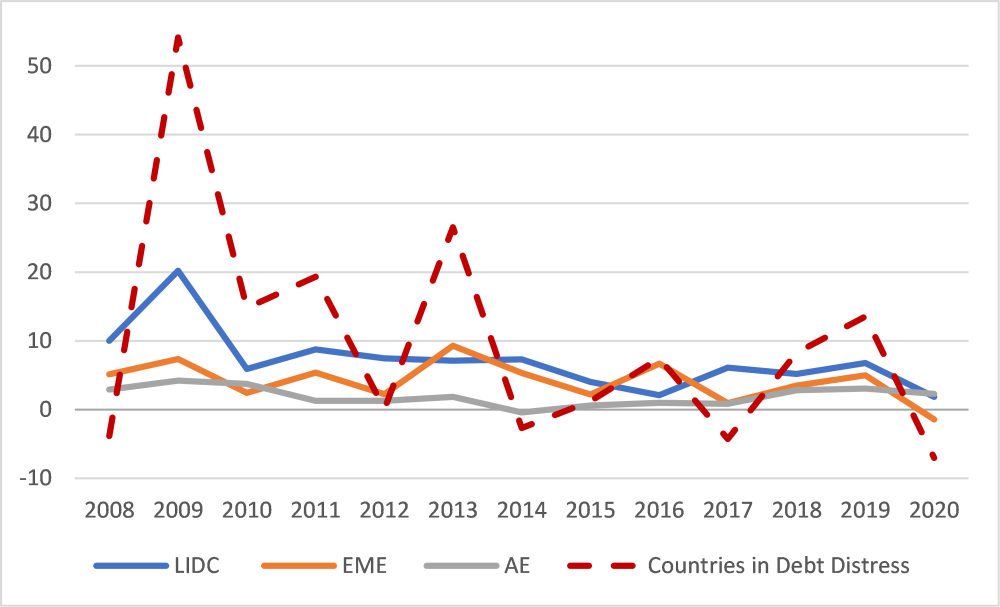

However, the actual increase in health spending in 2020, both as a share of GDP and in real terms, was lower than the preliminary estimates suggested (figures 3 and 4).

Figure 3. Domestic general government health expenditure

(Percentage of GDP)

Figure 4. Real health expenditure growth

(Annual percentage change)

Sources: World Economic Outlook 2023,

World Health Organization

Several factors contribute to this discrepancy. Firstly, the estimates were based on a survey conducted in mid-2020 by IMF staff, and countries may have adjusted their plans as the fiscal year progressed. Secondly, the health sector often faces challenges in executing its budget effectively, with some countries not fully utilizing up to 40 percent of the allocated resources. Finally, inadequate transparency in procurement processes and the lack of timely audits of public spending in the health sector have been observed, leading to large discrepancies between projected and actual spending. In 2020, as countries declared health emergencies, they bypassed the legislature to speed up spending on health. By contrast, all other spending was approved by parliaments.

Despite the lower-than-estimated increase, the data confirms that EMEs, LIDCs, and DDs did increase health spending as a share of GDP in 2020. In reflection of the availability of fiscal space, AEs increased health spending the most by 1 percent of GDP on average, while the average increase in EMEs was 0.6 percent of GDP and in LIDCs (as well as DDs), it was roughly half of that in EMEs. (The median increase in EMEs and LIDCs was 0.4 percent of GDP in contrast to 1.2 percent of GDP in AEs). As a result, the share of health sector in budget outlays increased in EMEs and LIDCs but fell in AEs as these countries spent more on programs to support the economy. Real health spending also increased in EMEs, LIDCs, and DDs in 2020. The increase was over 20 percent in LIDCs and DDs. (The median increase in health spending in EMEs and LIDCs in 2020 was 9.4 percent and 14 percent respectively.)

That said, the health sector’s position vis-à-vis education did not change in 2020 (Figure 5). Both EMEs and LIDCs continue to spend more on education than the health sector by a large margin. However, real education spending fell in 2020 (Figure 6).

Figure 5. General government education expenditure

(Percentage of GDP)

Figure 6. Real education expenditure growth

(Annual percentage change)

Sources: World Economic Outlook 2023, World Bank World Development Indicators

Outlook for health spending

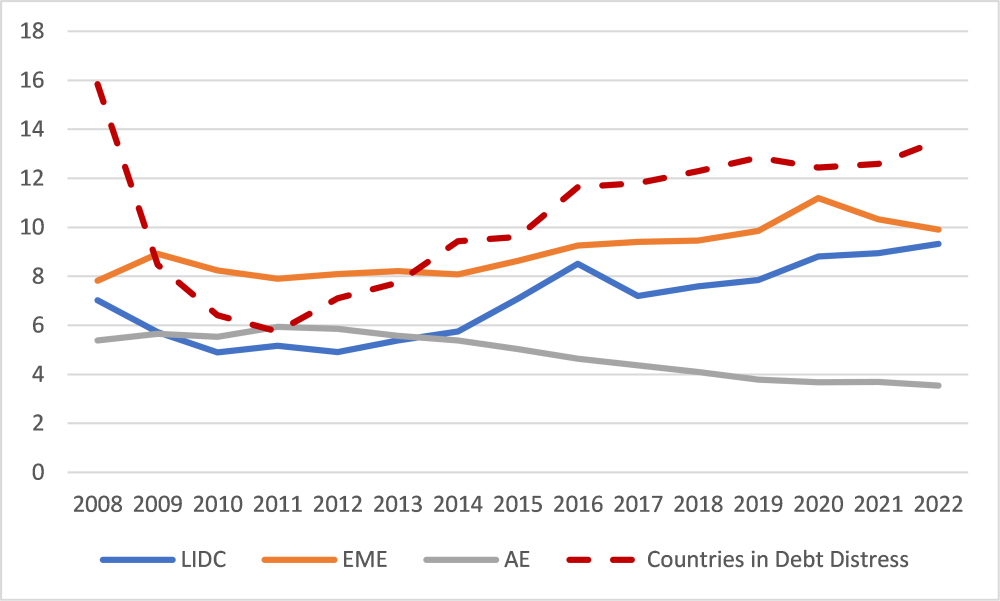

Prospects for maintaining or raising spending for health and other social sectors in EMEs, LIDCs, and DDs do not appear promising, due to rising debt-to-GDP ratios and the increasing share of revenues dedicated to interest payments on both domestic and external debt. The normalization of monetary policy in advanced economies has led to higher interest rates for EMEs, LIDCs and DDs. Combined with currency depreciation, interest payments in local currency on loans contracted when international interest rates were low have risen significantly. Additionally, the ongoing conflict in Ukraine and resulting higher oil prices for a substantial period in 2022–23 have further strained these countries' ability to service their debt. Since 2011, both EMEs and LIDCs have experienced an increase in interest payments as a share of revenues, unlike advanced economies. The increase is particularly sharp for DDs (Figure 7). In Ghana and Zambia, the ratio of interest to revenues stood at whopping 50 percent and 30 percent in 2020 respectively, showing the difficult choices these countries are facing between fulfilling interest obligations and funding health services.

Figure 7. General government interest expense

(Percentage of total revenues)

Source: Fiscal Monitor 2023

Way forward

To move forward, EMEs and LIDCs need to allocate more resources to the health sector and social sectors in general to address rising income inequality and meet the SDGs while supporting the transition to cleaner energy. There are several pathways through which these countries can generate more fiscal space. First, although these countries have, on average, been collecting more revenues from domestic sources since 2000, there is still potential to increase revenue by broadening tax bases and improving tax compliance. It is estimated that they could raise at least an additional 3 to 4 percent of GDP through these measures. Secondly, these countries could generate resources equivalent to 3 percent of GDP by implementing efficiency-enhancing measures in their spending programs. Finally, the international community needs to take steps to alleviate the debt burden and increase concessional financing for countries in debt distress. A debt pause, as advocated by the United Nations and extended at the minimum to countries in debt distress, would go a long way in helping these countries meet their critical social needs.

Benedict Clements is a professor at the Universidad de las Américas in Ecuador.

Saida Khamidova is an independent researcher.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: sunnytoys / Adobe Stock