Recommended

POLICY PAPERS

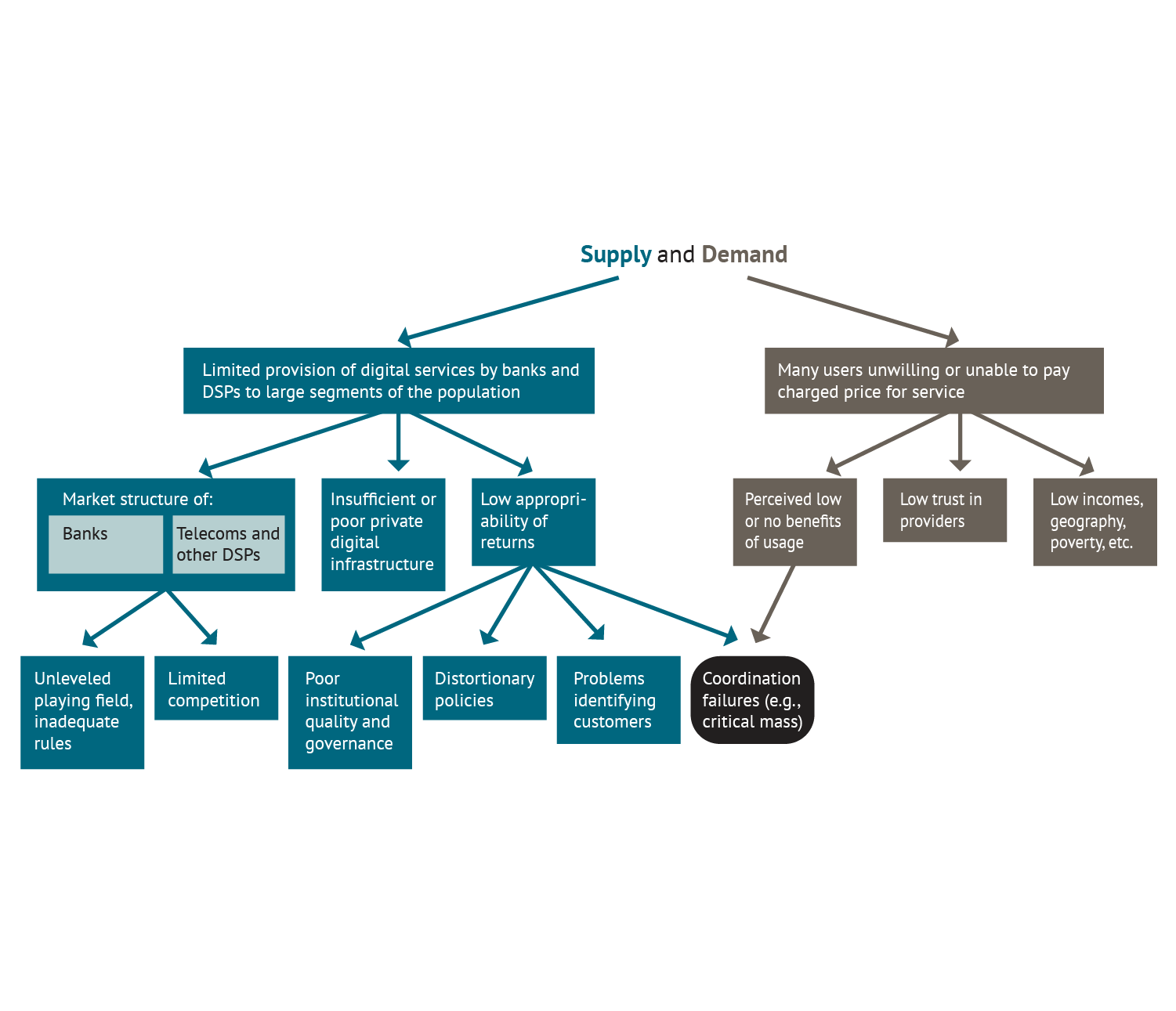

This paper explores the reasons why digital payment services in Mexico are used to a much lower extent than would be expected considering the country’s level of development and the authorities’ efforts to expand these types of services during the past two decades. The paper applies the analytical framework proposed by Claessens and Rojas-Suarez (2020), which consists of identifying the binding constraints preventing an increase in the usage of digital payment services, among a set of alternative explanations. The methodology starts by evaluating the price and usage of digital payment services to discover whether constraints may be on the supply side, the demand side, or both. The main findings suggest that the crucial binding constraints on the expansion of digital payment services in Mexico are mainly on the supply side of the decision tree. Indeed, we identify the regulatory framework seems to be a binding constraint, since it creates an unlevel playing field among the providers of digital payment services. Current regulation could also be a constraint on increasing the provision of digital financial infrastructure, particularly for expanding cash-in and cash-out access points in rural areas. Thus, relaxing the regulatory constraint could enable the expansion of digital payment services. In addition, there is evidence suggesting that a coordination failure, reflected in a strong preference for transacting in cash, might be a binding constraint in the country. Perceived low or nonexistent benefits from using digital payment services could be the source of the coordination failure, since it prevents the formation of a critical mass of users, which in turn discourages suppliers from offering these services.

Este paper explora las razones por las cuales los servicios de pago digital en México están tan subutilizados pese al nivel de desarrollo del país y los esfuerzos realizados por las autoridades mexicanas para expandir este tipo de servicios durante las últimas dos décadas. El paper usa el marco conceptual propuesto por Claessens y Rojas-Suarez (2020) y que consiste en identificar los factores, dentro de una serie de posibles explicaciones, que limitan el uso de servicios de pago digital. La metodología comienza evaluando el precio y el uso de los servicios de pago digital para identificar si las limitantes vienen dadas por el lado de la oferta, por el lado de la demanda, o por ambos. Los hallazgos principales sugieren que los factores clave que limitan la expansión de estos servicios en México se encuentran el lado de la oferta. De hecho, hemos identificado que el marco regulatorio parece ser un factor limitante en sí, ya que crea desigualdad entre los proveedores al desnivelar en la “cancha de juego”. La regulación actual también podría afectar el suministro de infraestructura financiera digital, en concreto, dificultando la expansión del acceso a servicios como los depósitos y retiros de efectivo en áreas rurales. Por tanto, relajar las limitaciones regulatorias podría facilitar la expansión de los servicios de pago digital. Además, dada la fuerte preferencia por las transacciones en efectivo, existe evidencia que existen fallos de coordinación. La percepción de que los beneficios relativos al uso de servicios de pago digital son bajos probablemente sea la fuente de este fallo de coordinación, pues previene la formación de una masa crítica de usuarios que, a su vez, desincentiva la oferta de estos servicios.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.