Recommended

With the abandonment of its Zero COVID policy, the Chinese economy is expected to rebound and contribute substantively to global economic growth in the latter part of 2023. This is projected to add to world demand for oil, more than offsetting falling demand from advanced countries whose economies are projected to slow down significantly in response to high and still-rising interest rates. Overall, these developments are likely to push international oil prices higher, with potentially calamitous consequences for several emerging and low-income countries already confronting high public-debt-to-GDP ratios and rising interest payments as a share of revenues.

How should low- and low-middle-income countries respond to rising oil prices? Should they let domestic energy prices rise to allow a full passthrough of international prices? Are there any lessons that one can draw from the extensive measures adopted by European governments in 2022 to shield their populations from higher energy costs?

We conclude that low- and low-middle-income countries cannot afford to emulate European economies in the way the latter have subsidized energy consumption. But these countries face the same political constraints in adjusting energy prices that European countries have encountered. There is a way, however, to level the playing field for low- and low-middle-income countries—giving them debt relief, thereby freeing resources that could be used to shield vulnerable population groups against higher energy costs. Of course, over the medium term these countries will also need to raise additional revenues, improve the efficiency of existing spending programs, and raise energy prices to levels that support environmentally sustainable development. But in the near term, debt relief would provide some breathing room to implement a more politically palatable pace of price increases for energy, even if this involves the provision of temporary energy subsidies.

Energy support in Europe

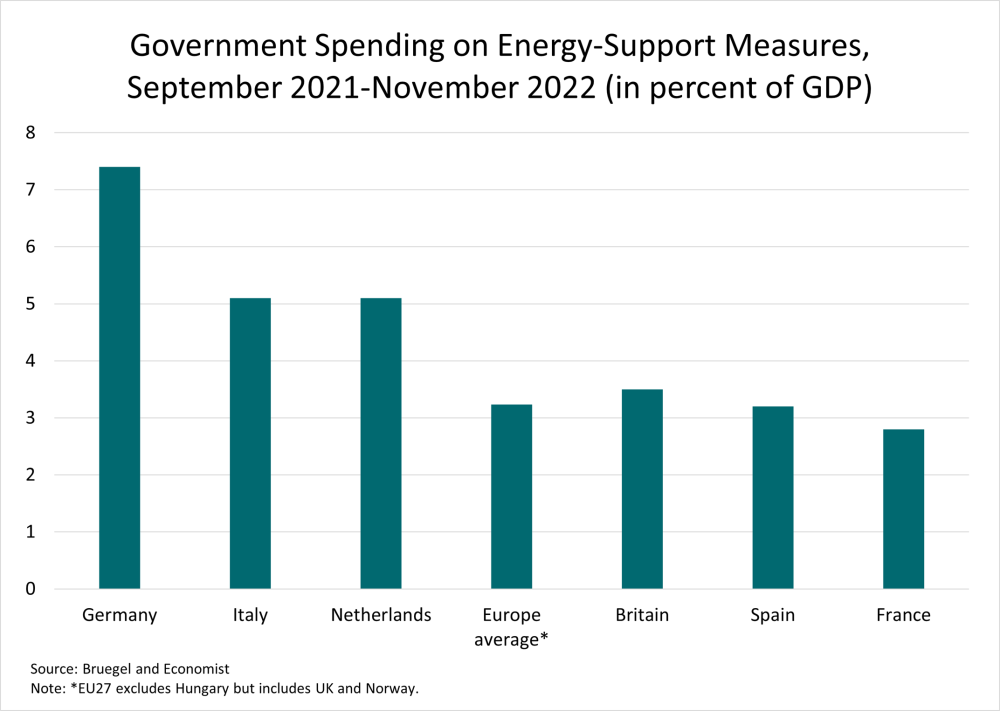

Energy prices began rising in late 2021 but spurted up sharply in response to Russia’s invasion of Ukraine in February 2022. In reaction, virtually all European governments capped prices for energy consumers and lowered taxes (such as value-added taxes) on energy. The cost of these measures varied across Europe in 2022, with Germany allotting 7 percent of GDP, the highest figure, and Finland and Sweden apportioning 0.5 percent of GDP or less. On average, these measures are estimated to have cost European governments 4 percent of GDP (see figure).

The support to European energy consumers expanded throughout the course of 2022. Until the middle of the year, Germany had allocated around 1 percent of GDP, which increased sharply by the end of 2022 because of its greater dependence on Russian energy. France allocated about 1.8 percent of GDP until June—considerably more than Germany, although it only spent 3 percent of GDP by year end.

A key implication is that European households (including those with high incomes) and enterprises did not have to cut consumption in the face of higher prices. This subsidization of consumption sustained demand for fossil fuels and had adverse effects on other countries by keeping global prices high. It also contributed to global warming, contrary to commitments made by European governments at international fora, such as COP27 international climate conference in 2022 to cut back on the use of fossil fuels.

This raises an obvious question: What led European countries to adopt energy support measures? We can think of three plausible reasons: First, higher prices for energy—a critical input for manufacturing and the supply of services—would have adversely affected international competitiveness, with important consequences for employment. Second, energy constitutes a large share of a typical household’s budget, particularly during the winter months. A passthrough of higher international prices to domestic prices would have meant that many households faced a choice between staying warm during the winter months and paying for other essential items and services. Finally, it would have been politically unpopular in European countries to let energy prices rise. It risked provoking demonstrations such as those witnessed in France in 2018—the “gilets jaunces” (yellow vests) protests. This consideration, in our view, was perhaps the most important.

European countries were able to fund energy support measures because they had the fiscal space to do so. The IMF has defined fiscal space as “the room for undertaking discretionary fiscal policy relative to existing plans without endangering market access and debt sustainability.” Neither the market access nor the debt sustainability of European countries was adversely affected by outsized outlays on energy subsidies. Despite increased spending on energy subsidies, the debt-to-GDP ratio of European countries is projected to fall to 91 percent in 2023 from a pandemic-era peak of 97 percent in 2020.

Can low and middle-income countries emulate European countries?

The answer is no, because their fiscal space is highly constrained. Government debt in low- and low-middle-income countries as a percentage of GDP has grown sharply over the past decade, and many of these countries are viewed to be at a high risk of debt distress. From a relatively modest 36 percent of GDP in 2011, government debt in low- and low-middle-income countries had risen to 56 percent in 2019 and then surged to 63 percent of GDP in 2020 because of weak or negative economic growth, eroding revenues, and spending pressures to address the pandemic. Higher debt has meant a significant share of annual revenues is consumed by interest payments, which nearly doubled as a share of government revenues from 6.2 percent in 2010 to 11.6 percent in 2020. This group of countries has no room for the magnitude of discretionary spending the European economies deployed to protect their populations. On average, low-income and low-middle income countries did take some steps to protect their populations against the impact of higher energy prices in the aftermath of Russia’s invasion of Ukraine, but this spending averaged only 0.4 percent of GDP by June 2022—about a tenth of the spending undertaken in Europe. There are countries, such as Burkina Faso which spent even less (0.2 percent of GDP) than the average.

Economists (including ourselves) generally recommend that countries eliminate energy subsidies because they waste resources, disproportionately benefit higher-income population groups, and take away resources for higher-valued social programs and infrastructure. Energy subsidies globally, including the cost of externalities associated with their consumption, cost 6.8 percent of world GDP in 2020. Accordingly, low- and low-middle-income developing countries have been advised to phase out energy subsidies by engendering a consensus for raising energy prices, notwithstanding political protests this policy has evoked in several countries (e.g., Ecuador and Nigeria). This policy recommendation makes eminent sense for countries with limited resources for development confronting extreme poverty.

But recent experience of European countries has added a new twist to the policy debate. Why should low- and low-middle-income developing countries adjust energy prices in the face of an external shock (the war in Ukraine) when European countries do not follow the same policy prescription? Developing countries have resisted adjusting energy prices or have resumed providing energy subsidies because of political resistance from the population—the same considerations that have prevented European countries from freeing energy prices. The big difference is that developing countries are faced with severe constraints on their fiscal space, unlike European countries.

Is there a way to level the playing field for low- and low-middle-income countries?

A first step is to recognize that low and low-middle income countries face the same domestic political opposition to raising energy prices that European countries have encountered. Next, the international community should take urgent steps to help provide the fiscal space developing countries need to take a more flexible, gradual, and politically viable approach to addressing high energy costs. This will require lowering their public debt burden through additional financing and debt restructuring. Admittedly, this requires hard political decisions, but this is the only way to level the field for low- and low-middle-income countries.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Adobe Stock