Subscribe

Subscribe today to receive CGD’s latest newsletters and topic updates.

All Commentary

Filters:

Topics

Facet Toggle

Content Type

Facet Toggle

Blog Type

Facet Toggle

Time Frame

Facet Toggle

Blog Post

April 23, 2024

The ongoing global demographic transition is massive in scale and likely impact. For most of the past 200 years, the vast majority of the world’s countries have seen population growth, particularly working-age population growth. As they’ve gone through the "demographic transition" toward lower birth...

Blog Post

April 18, 2024

Achieving the UN Sustainable Development Goals (SDGs) and addressing global challenges will require a step change in private investment in emerging markets and developing economies (EMDEs). Only a small fraction of the trillions in private assets under management are currently directed to EMDEs.

Blog Post

April 17, 2024

In the wake of COVID and amidst global crises, care has increasingly become recognized as a global issue critical for sustainable development and gender equality. Yet, there are still massive gaps in care policies, services, and financing, and there is much more work that needs to happen to ensure u...

Blog Post

April 16, 2024

Last month The Gambia’s National Assembly advanced a bill that, if ratified, would make it the first country to overturn a ban on female genital mutilation. These moves—supported by the predominantly male legislature—reflect the precarious nature of gains made in gender equality and have implication...

Blog Post

April 15, 2024

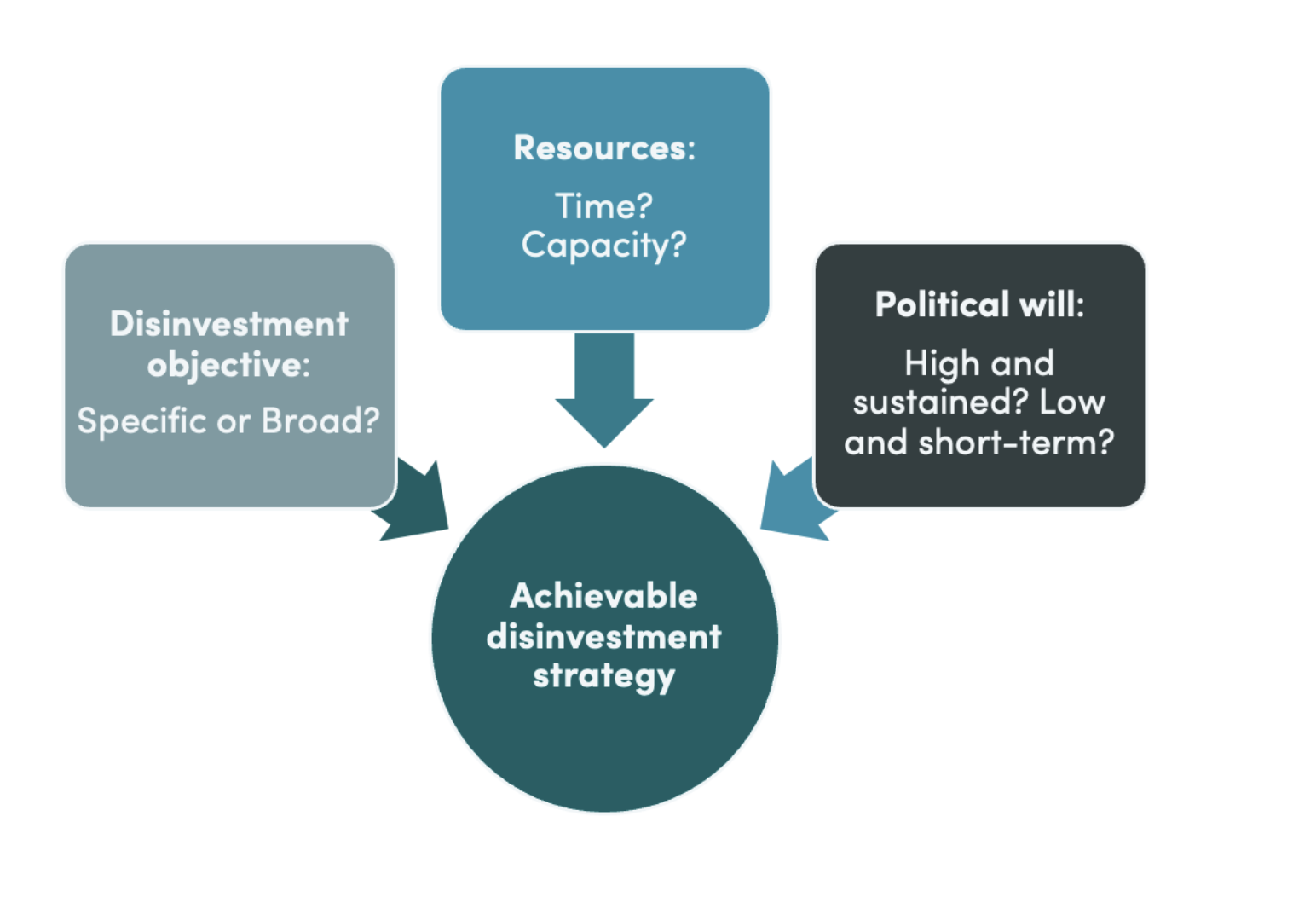

In theory, disinvestment offers the potential to release resources for achieving UHC during challenging fiscal times. However, in practice, it is time- and resource-consuming and results in less benefit than expected at the outset. The opportunity cost of launching an initiative needs to be weighed ...