Recommended

The Sustainable Development Goals (SDGs) face a key dilemma. Although major multilateral institutions like the World Bank and the other core multilateral development banks (MDBs) have played a leadership role in shaping the SDG financing framework, there is a significant misalignment between the structure of these institutions and SDG financing needs. Specifically, the SDGs put countries, not multilateral institutions or foreign donors, at the forefront in achieving desired outcomes. Further, the SDG financing agenda identifies an important role for the private sector and other nonsovereign actors. Although the MDBs will remain key players in SDG financing, other leading actors—and particularly, other ways of organizing across institutions—will be needed to meet the SDGs.

The International Development Finance Club (IDFC) is uniquely positioned to play a leadership role on the SDGs. A diverse group of development finance institutions (DFIs), IDFC members collectively embrace a strong country-led focus and private-sector orientation. Members represent a variety of models. Some act as national banks, focused primarily on domestic financing. Others act as bilateral aid agencies and DFIs. Still others act as regional and multilateral development institutions. Together they bring considerable financial and strategic resources to meet SDG financing needs, and they appear to be well matched to respond to key SDG requirements, including the call for nationally led development strategies and the need for substantial private-sector and nonsovereign investment, particularly in infrastructure.

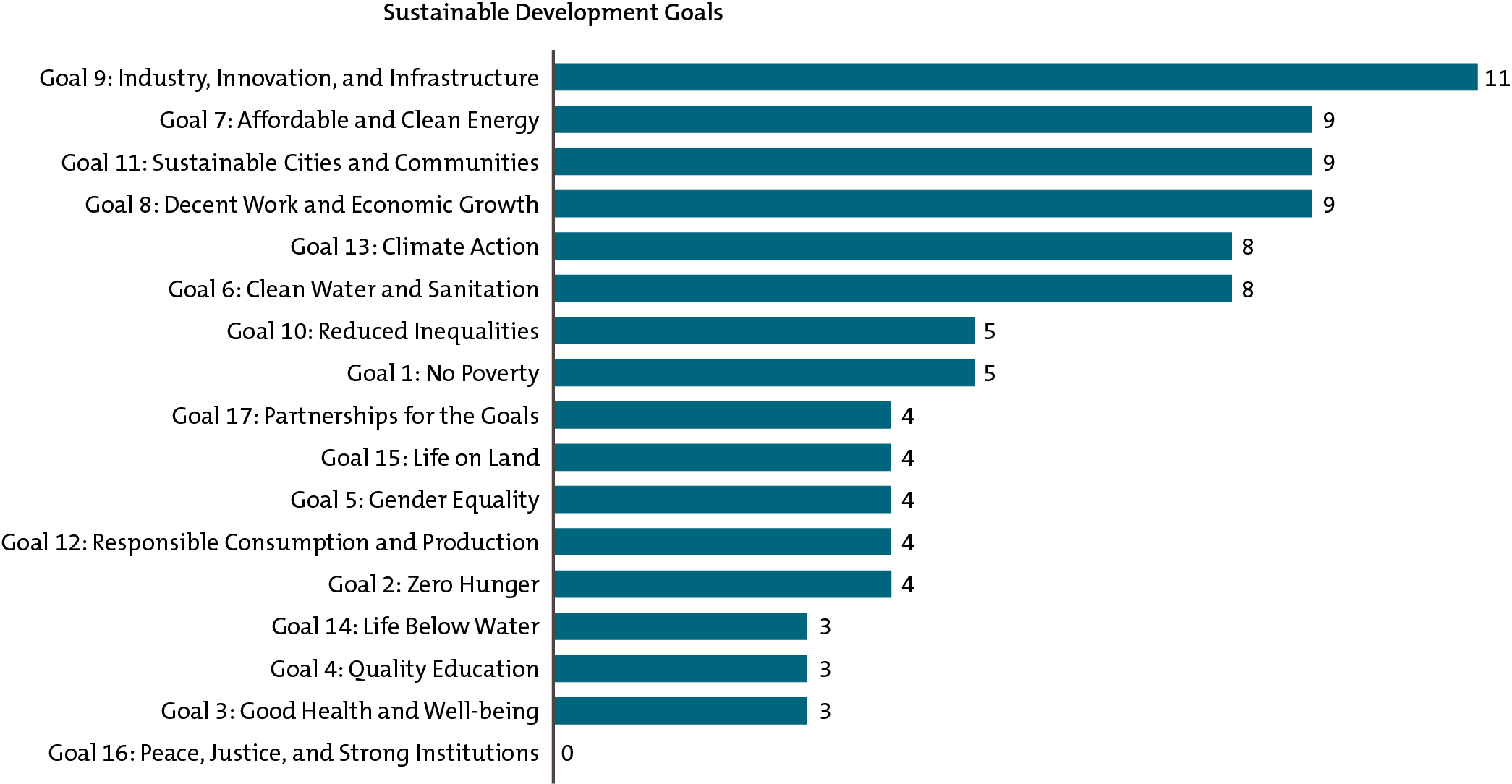

This report surveys 22 IDFC member institutions to identify the club’s role in meeting SDG financing needs. Through institutional snapshots, aggregated financial data, qualitative inputs, and case studies, the report reveals a high degree of SDG relevance in these development institutions. We find that the total assets of IDFC institutions are significantly greater than the total assets of core MDBs, indicating that as an organization, IDFC has untapped power as an organizing platform for the SDG agenda. We also find a high degree of alignment between IDFC-reported activities and the full range of SDGs, though only a minority of IDFC members inform their operations with an explicit SDG strategy. Most relevant to the question of leveraging private financing for the SDGs, especially infrastructure, our survey indicates that as a group, IDFC members primarily finance nonsovereign entities, especially private firms, in the course of pursuing development objectives.

The IDFC could play a stronger leadership role on behalf of its membership by better aligning its mandate with the SDG agenda. We see a future in which IDFC members adopt common standards for SDG frameworks and for tracking the inputs and outputs relevant to the SDGs. Members should consider the degree to which they wish to make the club a meaningful platform for coordination, deliberation, and visibility for the broader SDG agenda. This agenda implies a widening set of demands on members and may require a more robust secretariat to support a wider range of reporting activities, information gathering, agenda setting, and convening.

Through a greater commitment to SDG-oriented activities, IDFC members could demonstrate the value of organizing around national, bilateral, and multilateral development institutions to address the leading development challenges in the years ahead.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.