Recommended

SDGs. Billions to trillions. South-South development cooperation. Development finance. If these terms resonate with you (positively or negatively), and you’ve never heard of the International Development Finance Club (IDFC), you should rectify that. At least, that’s the conclusion we’ve drawn after a year-long study of the IDFC and its member institutions. This work has culminated in a new CGD report, The International Development Finance Club and the Sustainable Development Goals: Impact, Opportunities, and Challenges.

In 2010, a diverse group of international development actors came together to promote dialogue and information-sharing between like-minded development finance institutions. This “club” has evolved to include 24 members, representing the full scope of public development finance institutions, including bilateral aid organizations (such as France’s Agence Française de Développement); domestic national development banks (such as Brazil’s Banco Nacional de Desenvolvimento Econômico e Social); regional development banks (such as West Africa’s Banque Ouest Africaine de Développement); and inter-regional financing institutions (such as the Islamic Corporation for the Development of the Private Sector).

| Multilateral | National | ||

| Domestic Only | Blend | Int'l Only | |

|

|

|

|

In our report, we look at the IDFC in context with the global need for SDG financing. Through survey instruments and a careful review of annual reports and public data, we mapped out the collective identity of the club in four areas: financing and nonfinancing activities; governance arrangements; operational standards; and engagement in SDG activities. Here are a few findings from our research we think you should know.

1. Total IDFC assets exceed the collective assets of the core multilateral development banks

Total assets of IDFC member institutions compared with total assets of core MDBs (US$ millions)

Measured on an asset basis, IDFC members in aggregate represent a far larger share of development financing globally than do the core multilateral development banks (MDBs)—$3.8 trillion compared with $1 .5 trillion. China Development Bank (CDB) alone has significantly more assets under management than the MDBs as a group. Setting aside CDB, the balance of IDFC assets is roughly on par with core MDB assets. More than anything else, this scale of official finance points to the potential power of the IDFC as an organizing platform when it comes to the SDG agenda.

2. IDFC work reaches beyond national governments

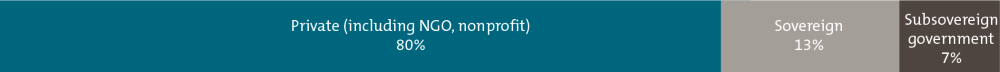

IDFC members’ total commitment amount by type of borrower

In contrast to the MDB system, which predominantly finances sovereign governments, IDFC members mostly support nonsovereign entities, particularly private firms but also provincial and local governments. This orientation speaks to their role in carrying forward SDG objectives around leveraging private financing, an identified need in funding especially the infrastructure-related SDG goals. At the same time, the relatively small share of financing for sovereign governments may provide a misleading view of IDFC members’ relevance for policymakers, since each member has direct ties to national governments through the composition of its board of directors and other governance arrangements.

3. The activities of IDFC institutions are highly aligned with the SDGs, despite a lack of specific strategy in this regard

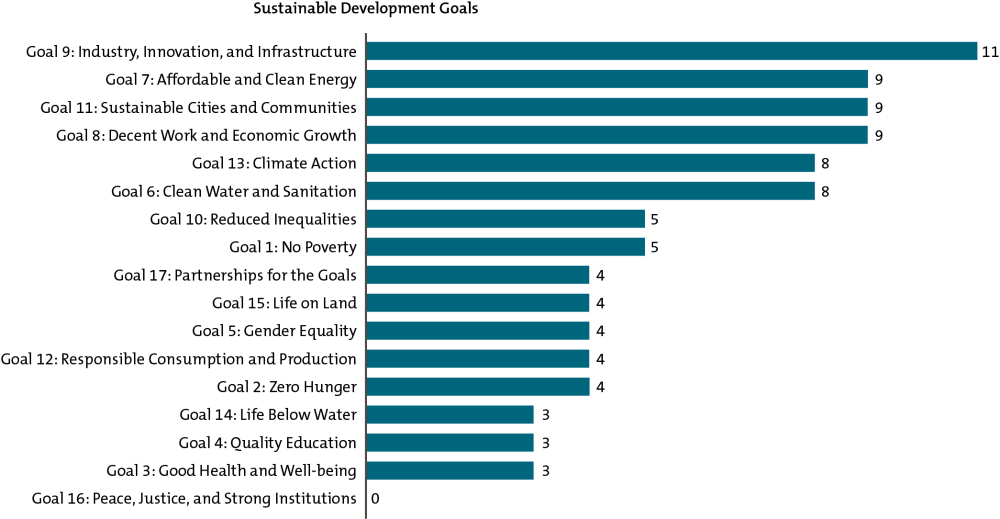

Number of IDFC institutions active within each SDG

There is a high degree of alignment between the SDGs and reported IDFC activities. SDGs related to infrastructure, industry, and environmental goals are most commonly identified among IDFC members, which is consistent with the sectoral patterns of financing described in other parts of the report.

A minority of IDFC members have an identifiable SDG framework or strategy that informs operations. Fewer still track operations according to an SDG-related strategy.

This last finding partially provided the catalyst for our recommendations at the conclusion of the report. We recommended several steps the club could take to increase its development impact—primarily by strengthening the IDFC Secretariat to pursue a broader SDG mandate, leading to collective annual reporting, internal dialogue, and deliberation on standard setting, and cross-institutional project collaboration. We also call for the creation of SDG strategic frameworks and tracking mechanisms at the institutional level.

IDFC members already play a leading role in the development finance landscape. The IDFC itself has the potential to bring this prominence to bear in development policy discussions, adding its unique voice to those of longstanding actors like the MDBs, the UN, and the OECD.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.