Recommended

Introduction

With the COVID-19 pandemic hitting government balance sheets especially hard in low-income countries, the World Bank’s shareholders—including the United States—agreed to an advance replenishment of its grant and low-interest loan window, the International Development Association (IDA). By holding a pledging session one year early, donors sought to ensure IDA, which serves the world’s poorest countries, would have the resources to provide financing where it was needed most. In December 2021, following the final meeting of the 20th replenishment of IDA (IDA20), the World Bank announced a $93 billion replenishment package, leveraging $23.5 billion in contributions from 48 high- and middle-income countries. The United States reclaimed its position as IDA’s top donor, pledging $3.5 billion over three years to support pandemic response and an economic rebound in the world’s poorest countries.

The United States has long had a vested interest in the World Bank, and in IDA in particular, working to ensure it is well run and resourced appropriately, and that its policy agenda reflects US interests. The US Congress plays a pivotal role in overseeing US engagement with the institution—managed by the Treasury Department—and providing funding to enable the US to meet its commitments. Due to the acceleration of IDA19, the US has two IDA installments due this year. The president’s fiscal year 2023 (FY23) budget request includes funding for a final payment to deliver on its IDA19 commitment and a partial first installment toward the latest US pledge to IDA.

What is IDA?

The International Development Association (IDA) is the concessional lending arm of the World Bank. IDA provides grants and low-cost loans to countries in which annual per capita incomes fall below an established threshold. IDA is one of the largest sources of development assistance for the world’s poorest countries. It is also a crucial tool for resource-constrained governments to borrow on affordable terms compared to other creditors, including Chinese entities.

Figure 1. IDA financing to lower-income countries has increased in response to the pandemic and its economic effects, much of it in the form of grants

Source: World Bank Group annual reports and financial data

How does IDA’s model work?

IDA grants and loans are funded by contributions from donor countries (including the United States), loan repayments, profits from other World Bank entities, and as of 2018, by issuing bonds in international capital markets. This hybrid financing model has allowed IDA to expand lending in recent years, leveraging its balance sheet to borrow from both commercial markets and bilateral partners at concessional rates. Contributions to IDA represent excellent value for money. Each dollar contributed by donor countries mobilizes an estimated four dollars in additional IDA commitments. In fact, close to 75 percent of the $93 billion IDA20 replenishment package will be funded from resources other than donor contributions.

IDA financing to countries is provided in the form of below-market-rate loans (offering low or no interest rates and long repayment periods) or even grants—as a result, its resources must be periodically replenished through donor contributions. These “replenishments” typically occur every three years; the last regularly scheduled replenishment took place in 2019. But spurred by high demand for support related to the pandemic, IDA front-loaded lending during the crisis. Donors and IDA management agreed to accelerate negotiations on IDA’s latest replenishment (IDA20) by one year.

How does the US support IDA?

Figure 2. China has increased its support in recent replenishment cycles, while US pledges to IDA have remained relatively steady and even decreased slightly

Source: IDA replenishment reports

In addition to being the largest shareholder in the World Bank, the United States has historically been among the leading donors to IDA. But emerging donors have scaled up contributions to IDA over the past decade. From 2010 to 2020, China went from IDA’s 30th to its 6th largest donor. In contrast US contributions to IDA have fallen from their peak a decade ago. In recent replenishment cycles, the United States maintained a steady position as IDA’s second or third largest contributor, regularly trailing the UK. With its pledge to IDA20 in December, the US will reclaim the role of top IDA donor, but Congress will need to appropriate funding to enable the US to deliver on its pledge of $3.5 billion over three years.

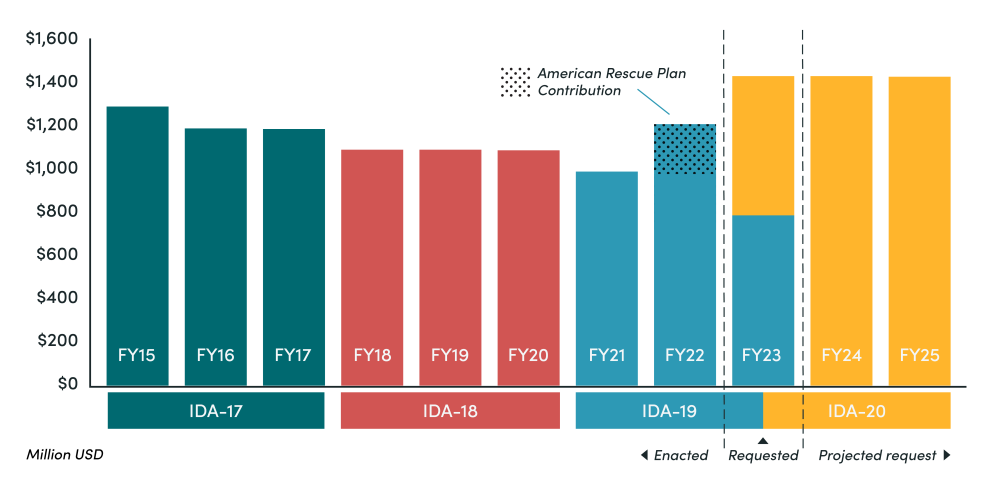

Figure 3. Contributions to IDA are typically paid in over three years. Uniquely, the FY23 budget request would provide funding to fulfill the remainder of the US commitment to IDA19 and contribute an initial payment toward its IDA20 pledge

Source: US budget documents and author calculations

*American Rescue Plan contribution references the transfer of unobligated money, appropriated under the American Rescue Plan Act of 2021 (P.L. 117-2), toward US FY22 IDA19 contribution.

Support for IDA complements US bilateral aid, including assistance for pandemic response and recovery. IDA is uniquely prepared to respond to crises, boasting established in-country connections and a long track record of providing technical assistance across a range of key sectors. In addition, the scale of funding available through IDA is unmatched. As the largest source of concessional finance for low-income countries, IDA’s ability to continue historic levels of crisis finance could have a significant impact on the trajectory of an inclusive global recovery from the pandemic.

IDA will need donors to deliver new funds for FY23 to continue both the institution’s regular lending and its impressive crisis response. Compared to pre-crisis levels, IDA scaled up its commitments significantly in 2020—achieving a greater scale in both relative and absolute terms than peer institutions.

Shaping IDA’s priorities and policy agenda

Historically, the US has played a significant role in shaping the World Bank’s agenda, including IDA’s goals and objectives. As part of each replenishment process, IDA works with shareholders to develop a set of policy commitments to accompany its financing package. US engagement in IDA20 replenishment negotiations, alongside allies and partners, helped inform replenishment reports, result frameworks, and special theme papers. Central areas of focus for IDA20 include:

- Debt sustainability: For several years, the US has emphasized the need to focus on debt sustainability. Debt relief is an efficient method to provide fiscal relief for low-income countries in crisis. As country governments increase public spending, and ultimately public borrowing, to respond to the ongoing pandemic and its economic fallout, their ability to manage and pay down preexisting debts is constrained. While continuing its other debt transparency and management initiatives, IDA plans to support 50 IDA countries in publishing comprehensive public and publicly guaranteed debt reports or fiscal risk statements as part of IDA20.

- Infrastructure finance: The multilateral development banks have an essential role to play in closing the global infrastructure gap. IDA offers concessional finance through its Regional Window (RW), which received a top-up in the IDA20 replenishment. The RW supports projects that strengthen regional integration and bolster economic corridors. As Congress and the White House look to scale up global infrastructure finance as an alternative to Chinese lending, IDA20 will help increase the resources available for sustainable physical infrastructure.

- Gender equity and women’s economic empowerment: The IDA20 special theme paper on gender and development recognizes the gendered impacts of the pandemic, including on women’s access to finance, quality employment, and preexisting unpaid care burdens. Resources from the replenishment will support at least 15 IDA countries to expand access to quality, affordable childcare, especially for low-income parents. And the IDA20 final report pledges to support over 30 governments to improve data collection for gender-sensitive policymaking—laying the foundation to support an evidence-based, inclusive recovery.

- Bolstering vaccine rollout and strengthening pandemic preparedness: Another key priority in IDA20 is accelerating the rollout of COVID-19 vaccinations, therapeutics, and diagnostics to help end the current pandemic and bolster preparedness for future global health threats. Included in the human capital special theme paper, IDA20 will introduce incentives for countries to boost vaccination rates and take steps to close preparedness gaps. Backed by sufficient resources, lending and expertise from the multilateral development banks can be effective tools in the global effort to curb the current pandemic and prepare for future threats.

Thanks to Clemence Landers, Scott Morris, and Rakan Aboneaaj for comments and suggestions on an earlier draft.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.