Against the odds, a plucky little IMF engine—the Resilience and Sustainability Trust, or RST—has won plaudits for its efforts to support countries formulating policies to tackle climate change. It has taken up the challenge with only $30 billion as firepower, against the trillions needed from all sources. The IMF deserves credit for getting the RST operational in late 2022, overcoming many technical obstacles. So far 17 countries have received loan commitments from the Resilience and Sustainability Facility (RSF), the financing arm of the RST.

The RST’s potential impact goes beyond the financial support it provides to help offset the costs of climate adaptation and build a reserve buffer. Lasting success depends on the strength of countries’ policy programs for climate mitigation and adaptation, and this in turn is influenced by the conditions attached to the RSF loans. It is here where the RST needs to be more ambitious to avoid its efforts running out of steam. The RST needs to move more quickly and gain more traction. Yet to do so requires a new approach—a new type of conditionality—that recognizes that the IMF’s role is even more obviously catalytic than in traditional programs, that the process to build domestic policy consensus is even more complex than usual, and that the relationship between any individual policy action and impact on resilience is more tenuous than ever.

My new policy paper sets out the case for three main changes. These proposals were outlined last year and are more pressing after more than a year of operational experience:

-

First, the IMF would establish a new mechanism for transparency and accountability that would make central—and give greater traction to—the authorities’ statement of policy objectives and the policies to achieve them. As part of formal RSF conditionality, authorities would be required to produce and publish a new resilience and sustainability policy statement (RSPS) aimed at increasing accountability of government agencies and international institutions providing support, facilitating domestic policy consensus, and catalyzing additional financing.

-

Second, the IMF should focus more clearly on a few critical actions within its areas of expertise, and measure their impact. These would include carbon pricing, including eliminating fossil fuel subsidies; for oil- and gas-producing countries, levying default penalties on methane emissions—a classic example of the IMF applying its innovative fiscal policy advice to improve incentives; incorporating into a country’s medium-term budget the many policies required to meet country plans for adaptation and commitments to mitigation; adopting measures to limit financial sector risks; and targeting a reserve buildup.

-

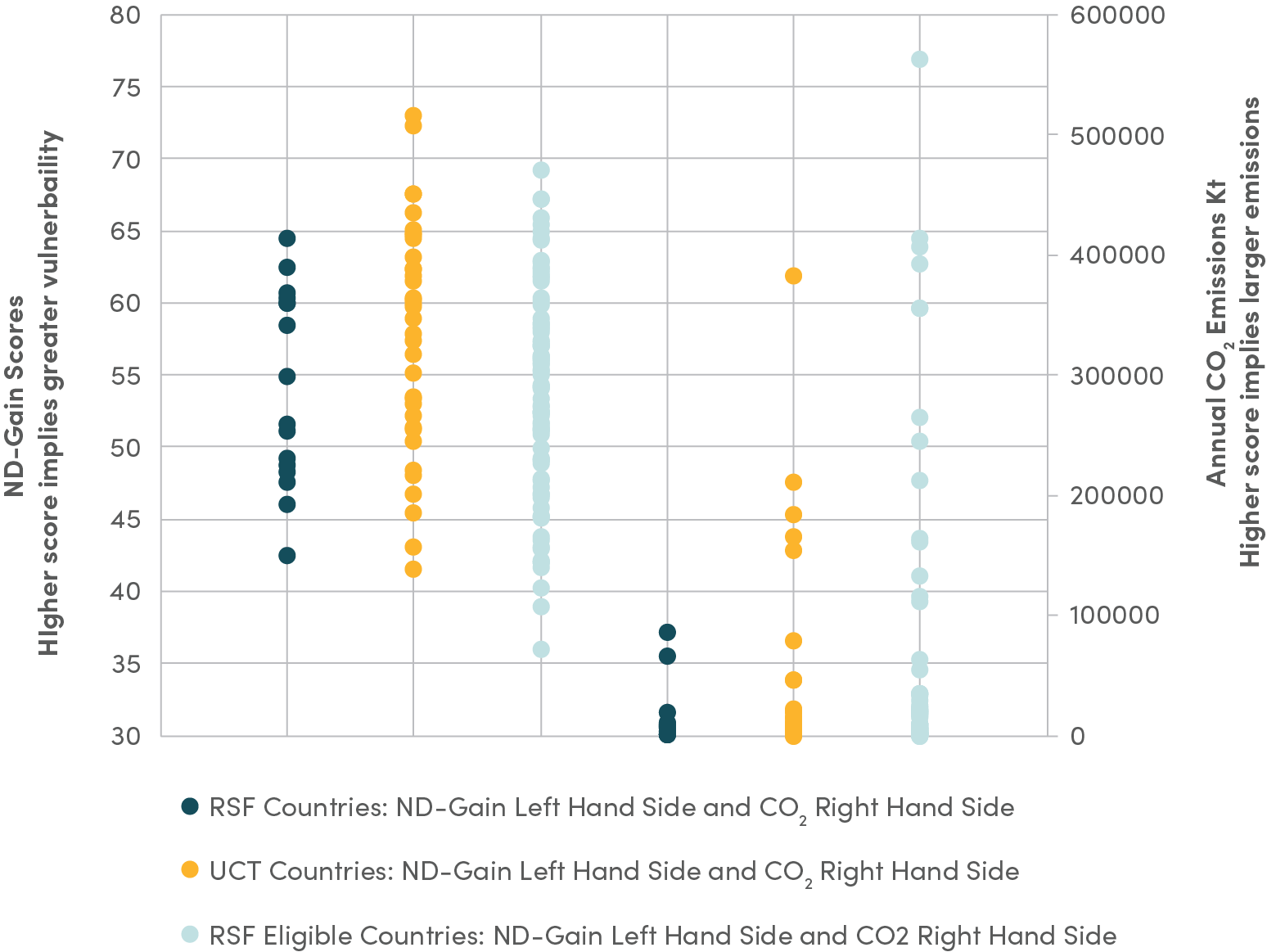

Third, it should introduce a low-access credit tranche to the RSF, allowing more countries to access the RSF by relaxing the condition to have a regular IMF program or monitoring arrangement in place. The idea is to engage with as many countries as possible given the urgency of action worldwide, including those that would otherwise delay because of the stigma of an IMF program.

Some of the bigger locomotives of change are still desperately needed to carry a fair share of the burden that climate change generates for economic policy. Much more serious financial commitment on a global scale is needed, and, when the IMF looks back at the mid-century mark at whether it did enough on climate change in the years since 2024, much will depend on whether it had developed a new code of conduct for member countries for climate-related economic policies that all countries—large and small—could aspire to. In the short term, the IMF should integrate its RSF work into its broader responsibilities by a major initiative to substantially expand its surveillance role. Those countries most vulnerable to climate change would benefit most from whatever influence the IMF can bring to bear on the largest economies to urge more adherence to mitigation and adaptation pledges. And the IMF’s unique global role is critical to this purpose.

But in the meantime, the RST needs all the help it can get to be fit for purpose. It has made a good start but needs a boost. Can the RST move faster and gain more traction? With the proposed reforms, I think it can.

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.