Recommended

The IMF has now approved ten new loans to countries under its new Resilience and Sustainability Trust (RST), established in 2022 to provide financial support on concessional terms to countries facing long-term structural challenges arising from two key threats: climate change and pandemic preparedness. Five of these loans have been extended to countries in Africa, where the effects of these challenges are particularly damaging.

But overall demand for IMF support under the RST from other countries in the region is extensive. What can be said about the experience of African countries with IMF climate finance to date? How have IMF-supported programs been designed and implemented under the RST? What can be said about the access of African countries to RST financing?

Our overall assessment of the five RST programs in Africa approved so far—for Kenya, Niger, Rwanda, Senegal and Seychelles—is that the IMF is providing useful support for climate action. But serious issues remain on the financing side.

Useful policy support for climate resilience agendas

National planning and institutional capacity are more advanced in certain cases than in others. But in all cases, the need for action is well-recognized and the programs are assisting and buttressing the authorities’ own efforts to strengthen climate resilience, which are already well advanced.

The programs identify specific reform measures in priority areas to be implemented over the course of the programs. The actions are in policy areas related to those covered by the IMF in the past—e.g., public expenditure management, incorporation of risks in budget and investment planning, improving regulatory frameworks for finance—but nevertheless designed in close collaboration with climate experts from the World Bank and other relevant development partners. Thus, it appears that the concern expressed by several observers that the IMF is getting involved in an area where it has little expertise is being managed adequately.

Table 1. Number of specific reform measures under each country’s RST-supported program.

|

Country |

# of semi-annual RST- |

# of reform measures |

Average per review |

|---|---|---|---|

|

Kenya |

9 |

5 |

1.8 |

|

Niger |

11 |

4 |

2.75 |

|

Rwanda |

13 |

5 |

2.4 |

|

Senegal |

10 |

5 |

2 |

|

Seychelles |

11 |

6 |

1.83 |

|

Average for all countries |

10.8 |

5 |

2.16 |

The additional conditionality associated with the RST programs—on top of the programs that are also required to be in place for a country to be eligible—does not appear excessive. As illustrated in Table 1, there are on average two reform measures set to be implemented every six months under semi-annual program reviews. Implementation of program targets remains to be seen, but in Rwanda’s case, the only program far enough along where a review has taken place, all three reform measures slated for the first program were implemented. Moreover, another measure scheduled for the subsequent review was implemented ahead of schedule. Also, implementation has been facilitated by technical assistance from IMF experts, often coordinated with the World Bank and others.

Recent analysis by Gupta and Brown at the Center for Global Development raises the concern that the reform measures may not be sufficiently ambitious to ensure the achievement of underlying objectives. They note that roughly three quarters of the measures under approved RST programs are “low-depth” measures that only pave the way for more important future reforms that have a long-lasting impact. That may be the case, but as they themselves note, the countries receiving assistance under the RST programs are at the beginning of the process of climate transition, so the reform measures can be considered initial steps. Setting unduly ambitious targets beyond the capacity or readiness of country authorities would run the risk of lack of ownership and failed implementation. That said, the prevalence of “low-depth” measures in these initial programs implies the need for follow-up actions over an extended period, quite possibly in the context of follow-up assistance from the IMF and other development partners.

Mixed results in terms of financing

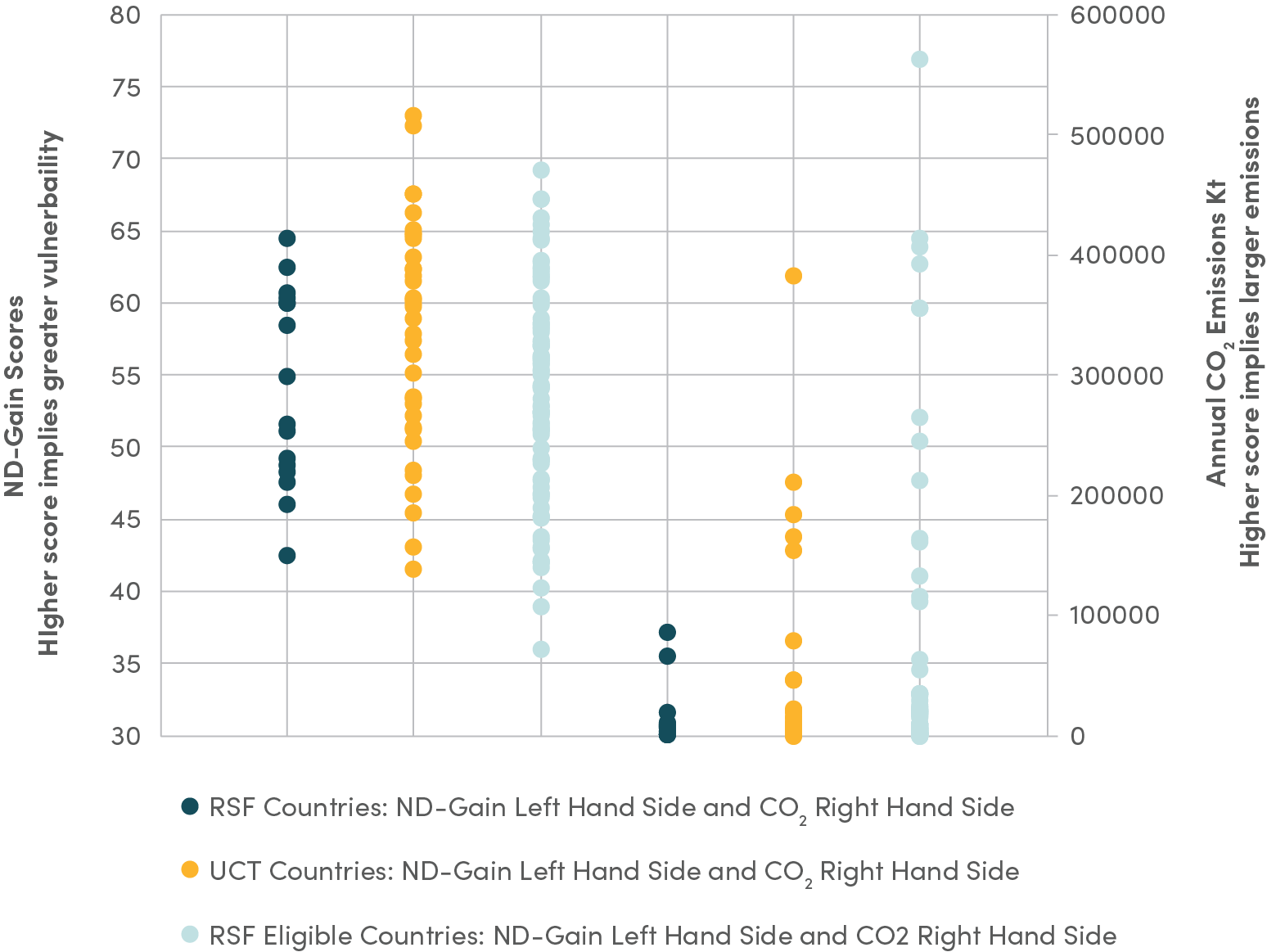

While the experience with the operational aspects of the initial programs may be generally positive, we see serious issues on the financing side. As was known from the outset, the financing needs for countries seeking to deal with the effects of climate change are on a scale far in excess of what the RST-supported programs can offer, particularly for low-income and highly vulnerable countries in Africa. It is therefore imperative that the IMF makes its best efforts to maximize the financial support being offered under the RST, including by securing more funding from its major shareholders, strengthening the catalytic effect of the instrument, and tailoring its access policy to country-specific circumstances.

In this context, it is of serious concern that access under the recently approved RST programs has been diminishing relative to the first batch of cases. While the first three RST programs (Costa Rica, Barbados, and Rwanda) involved loans equivalent to the facility’s maximum limit of 150 percent of quota, the more recent programs have seen much reduced amounts. For those in Africa, only Seychelles had equivalent access. For Kenya, Niger, and Senegal, access was cut by half, to the facility’s starting norm of 75 percent of quota. With little difference in the quality and the strength of proposed reforms and balance of payments needs if anything higher in the face of high global inflation, terms of trade losses, and external financing constraints, the reduction seems to reflect rationing of available resources in the face of strong demand from members. During the IMF Board’s review of RST resource adequacy in April, many Executive Directors cautioned against the provision of loans at the maximum level in view of the pipeline of requests and the fact that fundraising pledges were still not all effective.

Nevertheless, the IMF’s capacity to meet its stated climate finance goals is contingent on its ability to ensuring the appropriate mix between financing and adjustment in RST programs. To keep the RST financing meaningful in the face of daunting near and long-term challenges and ensure evenhanded treatment of RST program countries, it would be appropriate for the IMF to raise the amounts provided in subsequent programs to the limit of 150 percent of quota, with lower access, if any, being justified based on objective criteria. The recent call by the IMF Managing Director for an IMF quota increase is welcome and would lead to greater financing as well but is likely to be modest and will take some time to come into being, if supported by the membership. If resource constraints for the trust become an issue, donors should be called upon to pledge additional support, as the IMF Managing Director did last June when she called for a 50 percent increase in the size of the RST on the sidelines of the Paris Summit for a New Global Financing Pact.

Beyond that, we would also argue for a review of the cumulative access limit itself. Given the fact that the climate transition and associated reforms take many years, countries will need commensurate financial support. While successor RST-supported programs are allowed under current rules, with repayments to take place over 20 years with a 10-year grace period, available access would be severely limited. A significant hike in the cumulative access limit—say, a doubling—would be warranted to support the successful continuation of reform efforts.

Finally, it is noteworthy that the RST programs have so far focused exclusively on climate issues. The IMF has yet to allocate any resources from the RST to support pandemic preparedness, the second structural challenge the trust was intended to address. With studies showing considerable probability of another pandemic occurring in the years ahead, preparedness of institutions and policies may well need to be a focus of attention of future programs.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.