When Tesla purchased $1.5 billion worth of bitcoin in February of this year—driving its price to a giddy new high of $57,000—cryptocurrency enthusiasts cheered the move as a signal of Bitcoin’s growing role in the formal economy.

But, as with most things Bitcoin, this interpretation is based more on hope than fact. Bitcoin has failed to live up to the hype that it would democratize finance by enabling cheap, instantaneous, and secure payments that could be conducted without having to rely on stodgy old financial institutions like banks and credit card companies.

Bitcoin has failed to meet this vision due to its excessive price volatility, slow transaction processing, difficult user experience (e.g., users who lose their passwords also lose access to their bitcoin), and excessive concentration (a recent Bloomberg article estimates that roughly 1,000 users hold 40 percent of all bitcoin). Some have even questioned whether bitcoin has any social value at all. Rather than being a viable currency at scale, Bitcoin is and will remain a speculative asset, in a class with gold, tulips, and Beanie Babies.

Unlike these other assets, however, Bitcoin introduces unique risks and harms. Because of the pseudo-anonymity it provides, Bitcoin has become a vehicle for illicit finance—though it still plays a much smaller role than (anonymous) cash. And because new bitcoins are created through a computationally intensive process known as “mining,” the Bitcoin network has become a massive draw on the world’s energy resources. It’s as if Beanie Babies not only facilitated narco-trafficking but also used more energy than all 3,040 large hospitals across the United States combined.

Recent estimates of the energy used by Bitcoin mining range from about 75 (Digiconomist) to 140 (University of Cambridge) terawatt hours (TWH) per year. Because the code that underlies the Bitcoin network only allows a set amount of bitcoin to be created at given intervals (currently set at a rate of 6.25 bitcoin every ten minutes), all that power just increases the rate at which computers must work to produce the same amount of cryptocurrency.

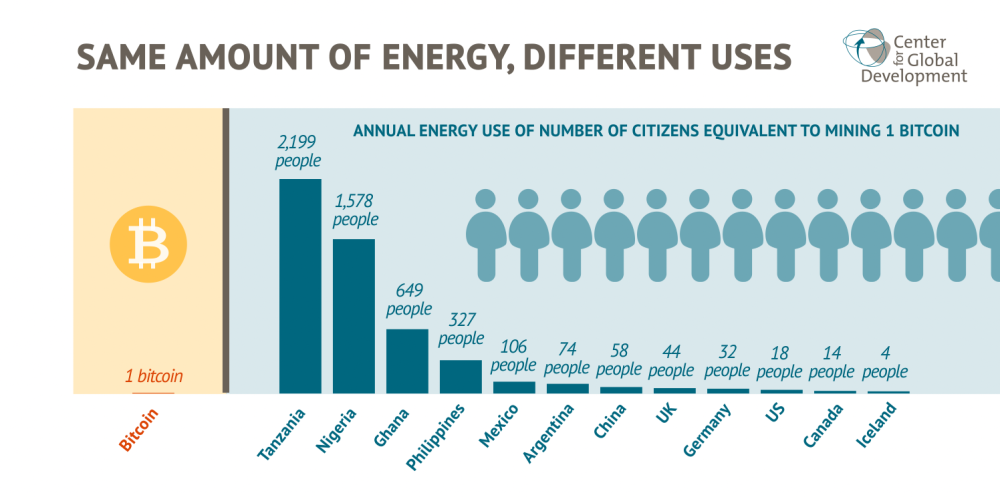

The Bitcoin network’s spiraling energy needs are truly staggering when compared to other potential uses. Based on the lower 75 TWH per year estimate, each new bitcoin currently uses roughly 228,000 kilowatt hours (KWH) to produce. In other words, the production of just one bitcoin consumes as much energy as 18 Americans or more than 1,500 Nigerians per year.

Source: Authors’ calculation using data from Bitcoinenergyconsumption.com and the World Bank

This highly unproductive use of so much energy has a colossal environmental footprint and raises an ethical question at a time when nearly half of humanity lives without reliable electricity.

What are the policy options?

-

Ban large-scale bitcoin mining operations. While governments can keep bitcoin out of the formal economy, it is impossible to shut down the Bitcoin network without shutting down the internet more broadly. The pseudo-anonymity offered by the Bitcoin network also prevents governments from identifying individual miners and curbing their activities. It is easier, however, for authorities to identify the large facilities that contribute the vast majority of computing power to cryptocurrency mining. Indeed, China’s Inner Mongolia regional government announced that it plans to ban all cryptocurrency mining farms by the end of April 2021 in order to help meet carbon-reduction targets set by the national government.

-

Tax mining activity. Ideally, governments could force cryptocurrency miners to internalize the negative environmental cost they create by taxing their energy consumption. Once again, however, the pseudo-anonymity of the Bitcoin network prevents effective action: without being able to identify individual miners, governments can’t enforce tax compliance (though this hasn’t stopped the IRS from trying). At the very least, governments should ensure that their tax codes don’t encourage mining by allowing miners to deduct electrical costs from their business income, as the IRS surprisingly does. They should also consider taxing large-scale facilities, since these are easier to identify.

-

Promote greater efficiency. Cryptocurrency supporters argue that because miners have an incentive to minimize their energy cost they will naturally seek out the most efficient hardware and the cheapest electricity, which will ultimately lead to improvements in computing efficiency that will spill over to other industries. But the Bitcoin network’s ever-growing appetite for energy means that efficiency gains will, at best, slow the growth in consumption.

-

Incentivize greater reliance on renewable energy. It’s already true that many large mining facilities have been located near low-cost low-carbon energy sources for this very reason. For example, many of the world’s largest mining facilities are located near renewable energy sources (hydro, wind, and solar) in China, Georgia, and Iceland. At present, however, most cryptocurrency mining is still carbon-intensive. (A recent report by the Cambridge Center for Alternative Finance estimates that more than 60 percent of the energy used for cryptocurrency mining still comes from fossil fuels.) Whatever is left of the global carbon budget should really be used for much greater human benefit.

The boon of bursting the Bitcoin bubble

Because each of these solutions is incomplete, the price of bitcoin will remain the most important determinant of the network’s energy demand. The most hopeful case for the environment is that the price of bitcoin falls low enough to push most miners out of business, leaving behind only those with access to cheap renewable energy and the most efficient mining rigs. Such a market correction could be triggered by either a security failure that calls into question the network’s viability or a mass sell-off.

It is hard to predict the events that trigger the panic sell-off stage of a speculative bubble. Some crypto analysts have suggested that the pseudonymous creator of Bitcoin, Satoshi Nakamoto, has enough bitcoin that he could derail the market by selling them off. If true, Satoshi could do the world a favor by recognizing that, although blockchain is a useful innovation, Bitcoin itself fails as an effective and sustainable currency.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Adobe Stock