Recommended

Blog Post

Blog Post

More From the series

CGD NOTES

A new IMF rapid credit window could provide some $30 billion to cover the vaccine financing needs for most developing countries through 2021-22. The mechanism would facilitate collective action to negotiate increased production, the main obstacle to achieving vaccine coverage and rectifying the gross inequities in current distribution. It would remain in place for future global pandemic responses.

COVID-19 vaccine production lags far behind demand, especially from developing countries. Low- and middle-income countries (not counting China and India)—some 3.6 billion people—will not have full access to vaccine until beyond 2022, leading to tragic loss of life, a delayed global economic recovery, and increased risk of new variants extending the worldwide pandemic. This outcome represents a major failure of international cooperation. It results from an inadequate advance ramp-up in global production, and inadequate initial financing. The IMF can play its part in addressing these two shortcomings by urgent redesign of its main rapid response instrument to be even more effective than it was in 2020. For the still urgent needs of this pandemic—and for the future—it could provide immediate financing to bolster initiatives, including along the lines of COVAX, that empower developing countries with greater collective clout to negotiate the required increase in production.

We propose a new “Multilateral Vaccine Purchase (MVP)” window within the IMF’s Rapid Financing Instrument (RFI) and its concessional equivalent, the Rapid Credit Facility (RCF). Countries could access up to 25% of IMF quota under this window annually, 50% cumulatively, for advance vaccine purchase. These amounts would be in addition to other access under the RFI/RCF (currently 100% annual/150% cumulative under the regular and exogenous shocks windows; and 80%/133% under the natural disaster window). The MVP window would remain in place for future pandemic need. It would be available to all member countries, though demand would be expected to come mainly from low- and middle- income countries.

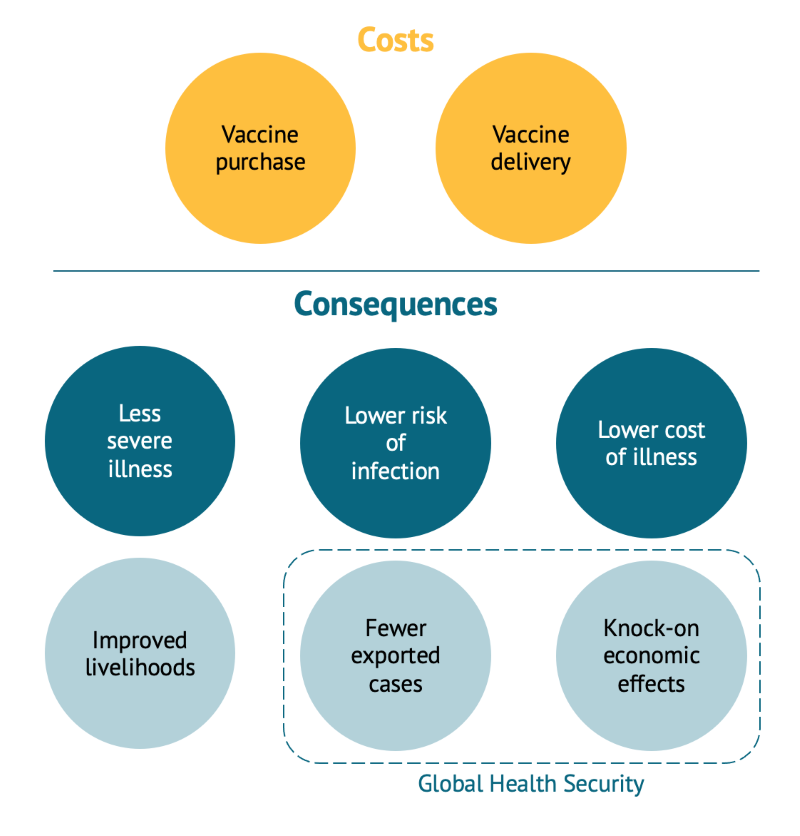

The shortfall in vaccine financing to developing countries can be estimated only very roughly at some $24 billion for 2021-22, though such a figure is highly dependent on assumptions of cost, which vary widely, commitments and delivery schedules, and coverage of population. Assuming $10 per person, the cost of vaccines for the whole population of these 129 countries would be $36 billion. Two-thirds of the population of these developing countries could be left without vaccine coverage based on estimates of existing contracts to supply only one third.[1] The coverage appears even lower (under 10%) for low-income countries alone. These figures may be incomplete, yet coverage could be still lower if deliveries are delayed, or much higher if rich countries reallocate some of their commitments, which in some cases are for multiples of their population.

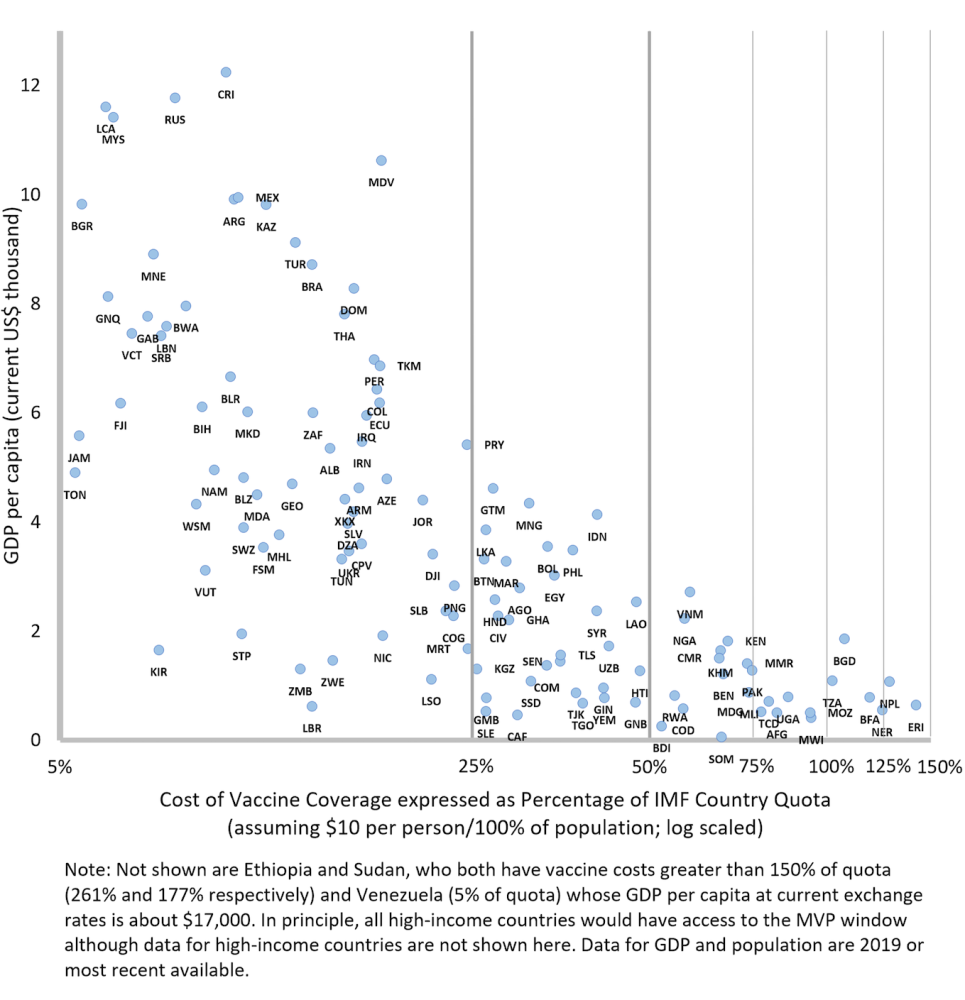

Access under the new MVP window would be sufficient to cover the vaccine financing needs for most, though not all, developing countries. If all low- and middle-income countries (not counting China and India) were to draw enough from the MVP source alone to fully vaccinate their population at $10 per person, IMF disbursements would total $31 billion—$8 billion for countries eligible to draw on the Poverty Reduction and Growth Trust (PRGT) and $23 billion for others from the IMF’s general resources. Not all of this amount would be required for 2021-22, since many countries have at least some vaccines already paid for, alternative sources of finance, or no balance of payments need. On the other hand, some 27 countries would have a residual gap that is not covered under the proposed MVP access limits, totaling $5 billion in the absence of any other funding. In general, access limits are more binding for poorer countries paying the same per person for vaccines as richer countries (See Figure 1). To ensure they are not left behind, these 16 low-income and 11 lower middle-income countries (20 from Africa, 4 from South Asia, and 3 from Southeast Asia) would depend on other sources of funding to close the gap (and for all but 8 of them the gap is less than potential access remaining under other RFI/RCF windows).[2] If financing needs were higher than $10 per person, IMF disbursements would be higher in total under the MVP’s proposed access limits, though more countries would have to use or seek other financing to ensure full coverage.

Figure 1. Vaccine cost as a percentage of IMF quota for low- and middle-income countries

Source: “World Development Indicators,” World Bank, 2021.

“IMF Members' Quotas and Voting Power, and IMF Board of Governors,” IMF, 2021.

“SDR Valuation,” IMF, 2021.

Meeting the immediate balance of payments need to finance countries’ advance purchase of vaccines is one step in the process of ensuring a significant increase in vaccine production capacity worldwide. The innovative COVAX scheme has provided access to vaccine supplies to many countries but could have been empowered to do much more. The slower-than-desirable ramp-up of vaccine production reflects the failure to anticipate the full global need, and insufficient collective demand by low- and middle-income countries backed by immediate financial support for COVAX; full payment was required in advance to place large orders quickly. Consequently, COVAX had a weaker position to negotiate scaled-up production.

The strong presumption behind the IMF making foreign exchange immediately available under the MVP is that countries will channel these resources through COVAX or similar initiative in response to a call for advance purchase commitment. Though the aim is to empower countries through collective action, there may be instances in which COVAX would agree to countries making alternative arrangements to secure vaccine in the context of a coordinated international effort to increase supply. The onus will be on COVAX or similar initiatives to negotiate well on both supply and price; and to procure scaled-up production, not just compete with rich countries over existing supply.

The IMF could make its voice heard with member countries and in international fora to urge the importance of cooperation in securing greater manufacturing capacity. A prerequisite would be much greater transparency about commitments and projected vaccine coverage. The IMF could also support streamlining vaccine approvals across jurisdictions, by standardizing application procedures; considering advance legal authorization to trigger mandated vaccine production-sharing arrangements between drug companies, who may lack incentives to manufacture vaccines; and formulating plans in advance to procure ingredients and counter protectionist behavior. The speed at which lives are saved and the global economy recovers – in this or a future pandemic—depends on such initiatives.

Proposing this innovation raises the following questions on the appropriate role of the IMF:

First, should IMF lending be directed at purchases of a single commodity?

-

The IMF would not buy the vaccine itself but enable member countries to do so, for a broader purpose. The squeeze on foreign exchange faced by many countries during the pandemic reflects an immediate balance of payments need that is exacerbated by the costs of vaccine purchases and related medical supplies. Moreover, in the absence of a rapid acquisition of vaccine, the pandemic will be prolonged, the economic recovery delayed, and the balance of payments difficulties exacerbated. In supporting a country’s policy of advance vaccine purchases, the IMF lending therefore meets a balance of payments need and helps to alleviate the risk of protracted balance of payments difficulties.

-

The IMF has not in the past been averse to supporting multilateral schemes focused on one commodity. Between 1971 and 1984, the IMF responded to what was then seen as an important problem—it lent to countries that were required under international agreements to purchase buffer stocks of their export commodities at times when prices would otherwise be cyclically depressed. International agreements on tin, sugar, rubber, and cocoa were approved by the IMF and credits were extended to 18 countries, from Australia to Zimbabwe.[3] If IMF approval was warranted to help countries finance their purchases of tin, sugar, and rubber under international agreements to stabilize commodity prices, it seems quite apt in a modern context to help countries finance advance vaccine purchases under a multilateral arrangement to save lives, stabilize a pandemic, and mitigate its economic consequences.

Second, why the IMF and not institutions with expertise in health care?

-

The responsibility for the provision of health care, negotiations over the contracts to supply vaccines, and the development of capacity to produce and distribute vaccines, all firmly belong in the domain of other international organizations and national governments working together. The IMF is the global institution with an unparalleled ability to provide immediate balance of payments financing, as in this case, while supporting other multilateral efforts.

-

To ensure appropriate accountability, the IMF Executive Board (analogously to its role in the buffer stock financing precedent) would first approve an international arrangement for pandemic response that would include calls for countries to pool funds to make advance purchases, specifying the range of items covered. Member countries would then request drawings under the MVP window that conform with the terms of those arrangements. Such procedures would make clear that the IMF was supportive of the international efforts but was not involved in the detailed design and implementation of the scheme to meet particular health care needs.

Third, why aren’t existing IMF financing instruments sufficient?

-

The proposed window has advantages not present in other financing options. The balance of payments need is the same, but the speed and effect of the window’s operation is different. When a multilateral scheme such as COVAX makes a call for upfront financing from countries to negotiate ramped-up production, only a specific window such as the MVP with no conditions can mobilize the financing sufficiently quickly. The scheme’s effectiveness relies on encouraging as many countries as possible to subscribe fully upfront – and in a very short time period—in order to pool their collective clout. The early commitment to COVAX is important, even if there is, at that stage, doubt on the timeline for approval and availability of vaccines. Delays to discuss broader policy understandings, as under other windows in the RFI/RCF, beyond a commitment to cooperate with the Fund, would hinder effectiveness.

-

Importantly, with no stigma attached, the proposed window should encourage as many countries as possible to participate in this collective action given the domestic and global benefits, even attracting those who have not sought recourse to IMF financing. Indeed, many countries do not draw fully on their reserve tranche or SDR holdings, let alone apply for a “first credit tranche” loan that has no conditions or phasing. They may still welcome access to such vaccine financing while preserving foreign exchange reserves.

Fourth, should the IMF take the risk of extending loans under this window?

-

In the broad picture, the additional exposure under this window with the proposed access limits is unlikely to exceed $30 billion, amounting to only some 3% of the available financing from the IMF.[4] (To get some sense of proportion, this amount pales in comparison to the size of recent $1,900 billion rescue package in the United States).[5] That said, the IMF must always place appropriate safeguards on its loans, this window included. Individual country exposure of the IMF with such limited access (up to 25% in the first year) could still, within the scope of cooperating with the Fund, oblige future safeguard assessments. Against any potential risk to the IMF of subsequent inability of some countries to repay, alternative risks should also be assessed. Much larger risks flow from a delayed global recovery and from larger calls on the IMF if the pandemic is prolonged, in part caused by delays in vaccine access. Even countries in debt distress would therefore be allowed this limited access to the IMF and, better still, donors could contribute grants to cover the drawings to finance the advance purchase requirements or provide a large effective grant component through subsidy schemes. As noted, up to 27 countries would in any case require some financing from own resources or donors if their vaccine needs exceed the proposed cumulative access limits.

The MVP window should help mitigate the inequitable global distribution of vaccines that has left behind many low- and middle-income countries; the RFI/RCF more generally is designed to alleviate the equally dramatic unevenness of financial support across countries to absorb the COVID-19 economic shocks. Advanced economies have injected an average of some 16% of GDP to mitigate the effects of the shock, while for low-income developing countries, the equivalent is just 4% of GDP.[6] And while high-income countries have self-financed their fiscal actions, many developing countries are constrained by limited access to foreign exchange reserves or new borrowing, and by the failure of the creditor community writ large to agree to at least temporary debt service relief. As part of the IMF’s emergency support, rapid financing totaled $31 billion for 74 mainly low- and middle-income countries, corresponding to an average of about 1.5% of GDP.[7]

The catalytic financing role that the IMF performs is diminished if there is no mechanism for broad debt relief on existing country obligations during the period of the pandemic shock. So far, moral suasion has failed to bring all creditor groups to follow the example of the IMF (through a dedicated trust) and others in arranging relief on debt service falling due. For some countries, debt distress and difficulty providing financing assurances then hampers further access to IMF resources. While further efforts are made to secure broad-based debt relief mechanisms and to initiate policy reforms where needed, the ability of the IMF to provide emergency support under the RFI/RCF regular and exogenous windows should be maintained by extending the higher access limits that were raised temporarily in 2020 and 2021.

Increased lending from the concessional PRGT means that the PRGT subsidy resources should eventually be replenished. The increased call on the PRGT, including through the RCF and the proposed MVP window, puts additional pressure on the PRGT that will need to be addressed at some point.[8] However, the immediate implementation of the MVP window can proceed without such replenishment or agreement on SDR reallocation.

The most urgent assignment for the IMF is the creation of the Multilateral Vaccine Purchase (MVP) window. The proposed initiative would give greater traction to the IMF’s present and future pandemic response by speeding up vaccine coverage for 2021-22, particularly in low- and middle-income economies that lack ample foreign exchange reserves, and by allowing for an extension of its scope to meet the likely needs of future pandemics. Redesigning its own response instrument will place the IMF in a stronger position in international fora to urge greater cooperation to formulate a much-needed strategy for an immediate increase in manufacturing capacity. The IMF can play a crucial role to reduce the lag in ramping up vaccine production, with the aim to save lives, limit the contagion of the virus, and mitigate the economic consequences.

The authors are grateful to Masood Ahmed, David Andrews, Mark Plant, Minouche Shafik and others who contributed helpful comments. All errors are the authors’ alone.

References

Andrews, David. “Financing a Possible Expansion of the IMF’s Support for LICs”, Center for Global Development. Center for Global Development, February 9, 2021. April 5, 2021.

Boughton, James M. Silent Revolution: the International Monetary Fund, 1979-1989. Washington, D.C.: International Monetary Fund, 2001. 742-744.

“Covid-19 Deals Tracker: 9.60 Billion Doses Under Contract.” Bloomberg. Bloomberg, March 9, 2021. April 1, 2021. https://www.bloomberg.com/graphics/covid-vaccine-tracker-global-distribution/contracts-purchasing-agreements.html.

“COVID-19 Financial Assistance and Debt Service Relief.” International Monetary Fund. International Monetary Fund, March 2021. April 2021. https://www.imf.org/en/Topics/imf-and-covid19/COVID-Lending-Tracker.

“Fiscal Monitor Database of Country Fiscal Measures in Response to the COVID-19 Pandemic.” International Monetary Fund. International Monetary Fund, January 2021. https://www.imf.org/en/Topics/imf-and-covid19/Fiscal-Policies-Database-in-Response-to-COVID-19.

“IMF Data Query Tool.” International Monetary Fund, April 2021. April 2021. https://www.imf.org/external/np/fin/tad/query.aspx.

“IMF Members' Quotas and Voting Power, and IMF Board of Governors.” International Monetary Fund. International Monetary Fund, April 2021. April 2021. https://www.imf.org/external/np/sec/memdir/members.aspx.

Andrews, David and Mark Plant “Enabling Substantial IMF Lending to Low-Income Countries for the Recovery”, Center for Global Development. Center for Global Development, February 9, 2021. April 5, 2021.

“President Biden Announces American Rescue Plan.” The White House. The United States Government, March 12, 2021. https://www.whitehouse.gov/briefing-room/legislation/2021/01/20/president-biden-announces-american-rescue-plan/.

“Questions and Answers: The IMF's Response to COVID-19.” International Monetary Fund. International Monetary Fund, March 30, 2021. https://www.imf.org/en/About/FAQ/imf-response-to-covid-19.

“World Bank Country and Lending Groups.” The World Bank. World Bank Group, 2021. April 2021. https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups.

“World Development Indicators.” Databank. The World Bank, 2021. April 1, 2021. https://databank.worldbank.org/source/world-development-indicators.

“SDR Valuation.” International Monetary Fund. International Monetary Fund, 2021. April 1, 2021. https://www.imf.org/external/np/fin/data/rms_sdrv.aspx

So, Anthony D, and Joshua Woo. “Reserving Coronavirus Disease 2019 Vaccines for Global Access: Cross Sectional Analysis.” BMJ, 2020, m4750. https://doi.org/10.1136/bmj.m4750.

[1] For estimates of commitments by country, see for example, “Covid-19 Deals Tracker: 9.60 Billion Doses Under Contract,” Bloomberg, 2021. For an earlier analysis of the lack of coverage for developing countries, see Anthony D So and Joshua Woo, 2020.

[2] For details on RCF and RFI approvals, see “COVID-19 Financial Assistance and Debt Service Relief,” IMF, 2021 and “IMF Data Query Tool,” IMF, 2021.

[3] For details of the buffer stock financing facility, see Boughton, 2001.

[4] The IMF has stated its lending capacity to be $1 trillion. See “Questions and Answers: The IMF's Response to COVID-19,” IMF, 2021.

[5] For details of the March 2021 package, see The White House, 2021.

[6] Estimates of fiscal injections by country can be found in “Fiscal Monitor Database of Country Fiscal Measures in Response to the COVID-19 Pandemic,” IMF, 2021.

[7] For a country breakdown of IMF financial assistance, see “IMF Financing and Debt Service Relief,” IMF, 2021. GDP data are from the World Bank Databank, see “World Development Indicators,” World Bank, 2021.

[8] For further details, see Andrews and Plant, 2021 and Andrews, 2021.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.