Jordan is now hosting just over 650,000 registered Syrian refugees, with some estimating the total number, including unregistered persons, closer to double that. Even with international assistance, the cost of providing refuge to so many people has strained the budget of the Jordanian government. At the same time, international partners, notably the IMF, have been insisting that Jordan take actions to bring down government debt to “more sustainable levels” through increasing fiscal discipline to tame government deficits. These dual imperatives by the international community—host more refugees and tame the budget—seem to put Jordan in an untenable situation as long as the refugee crisis continues. Something will have to give—the question is how, what, and when?

Some background—government debt and macroeconomic support

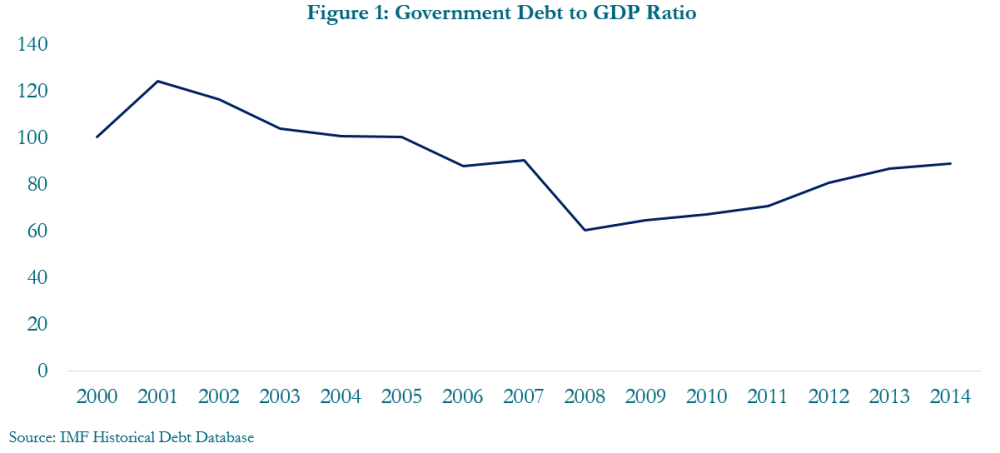

In March 2008, Jordan bought back a substantial portion of its debt from its Paris Club creditors. Using proceeds from privatization receipts and grants, Jordan made a one-time payment of US$2.1 billion to its creditors, thereby reducing its external debt from 46 percent of GDP to 28 percent of GDP, and bringing the total debt stock (external and domestic) to about 60 percent of GDP—the borderline of what is considered a sustainable debt stock over the long term (Figure 1). In reducing the stock of debt, Jordan reduced debt service payments by about 1.75 percent of GDP per year, restructured the external debt stock away from non-dollar denominated debt, and provided a positive signal to investors and rating agencies on the prospects of the Jordanian economy.[1]

Since 2008, the debt stock steadily increased, climbing to over 95 percent of GDP in 2016 as a result of various external shocks, including the global financial crisis, the Arab Spring, and disruptions of fuel supplies from Egypt. In August 2016, Jordan requested support from the IMF and put forward an economic program designed to consolidate fiscal policies, advance structural reforms, and lower public debt.[2] Importantly, the IMF program provides the framework for mobilizing financial assistance to help meet the costs of dealing with the refugee crisis, with most support coming from official creditors, like the World Bank, the European Union, and bilateral donors.[3] This makes official support for refugee funding potential contingent upon good performance under the IMF-supported program, thus linking continued financial support to fiscal rectitude and debt reduction.

The cost of supporting refugees

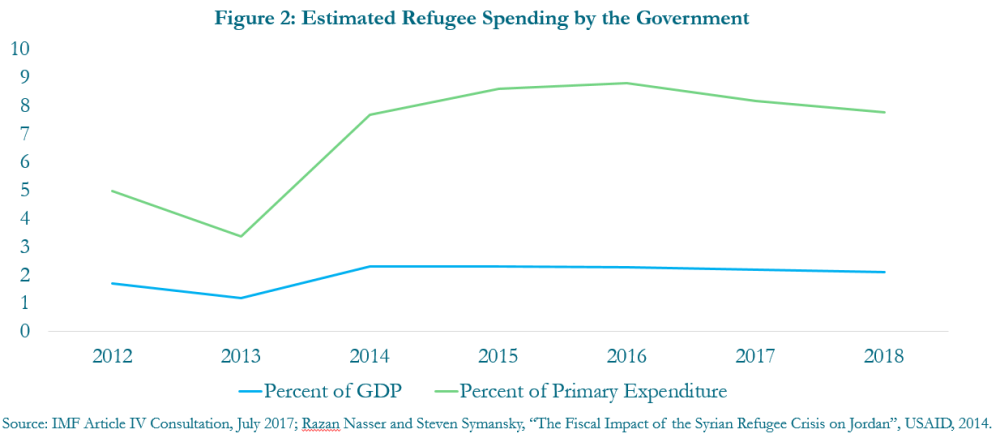

Clearly, Jordan’s economic difficulties existed well before the emergence of the Syrian conflict and refugee crisis. But the influx of refugees has aggravated an already difficult situation. Using USAID estimates of per-refugee budgetary costs of spending, and multiplying by the number of refugees (roughly 650,000), it appears that refugee spending costs the government just under 2.25 percent of GDP per year, or about 9 percent of non-interest government expenditure (Figure 2).[4] The uptick that is visible on the graph in 2015 reflects not a radical increase in refugee spending (as is evident from percent of GDP), but a reduction of government spending in 2015 of 8 percent of GDP, which largely resulted from ending the importation of fuel for electricity generation.

These refugee support numbers are likely a lower bound estimate—unregistered refugees certainly cost the government something, at least indirectly. An upper bound estimate would be about double—assuming full costing for 1.3 million refugees, as claimed by some in the government.

The economic program objectives

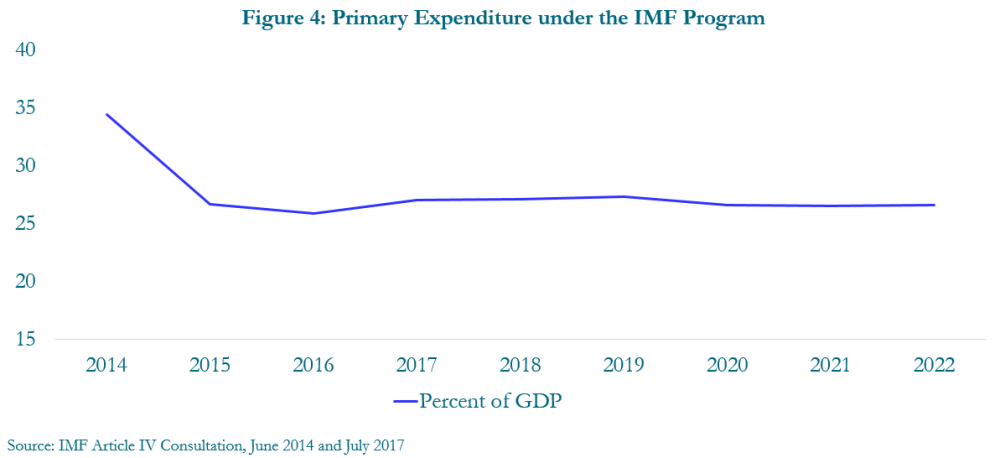

As noted above, the IMF-supported program aims at undertaking a series of structural reforms, particularly of some key parastatal enterprises, and exerting more fiscal discipline to bring down the overall debt level of the country. With the 2016 debt level at 95.1 percent of GDP, the program aims at bringing it down to 77 percent of GDP by 2022, allowing for a slight uptick in 2017 to 95.6 percent (Figure 3). This is accomplished primarily by an improvement in the primary fiscal balance[5] from a deficit of 0.4 percent of GDP in 2014 to a surplus of 5.1 percent of GDP in 2022.[6] Primary expenditures remain flat in percent of GDP throughout the rest of the program (Figure 4), with the adjustment in the primary balance coming about through increased revenues.

So, what does this mean for the government of Jordan? One way to measure the impact is to look at what is available for government expenditures other than refugee expenditures. In 2012 (before the Syrian refugee crisis began), non-refugee spending was 29 percent of GDP. That amount had been reduced to 23 percent of GDP in 2016 (Figure 5). Given that GDP was growing, these amounts were roughly the same in nominal dinars.

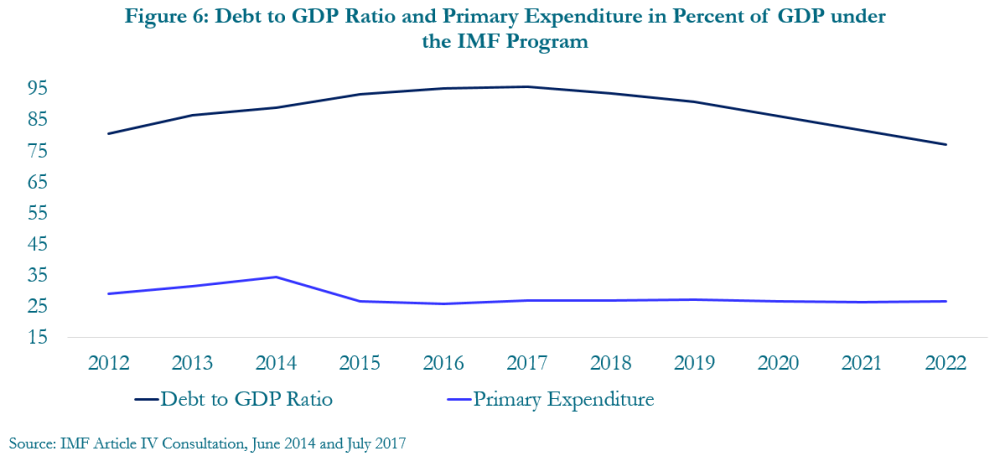

The bottom line is that the Fund-supported program included about a 3 percent compression in expenditure to bring debt under control while refugee spending was increasing (Figure 6).

The years to come

The important question then is whether the fiscal compression enshrined in the program can be maintained. Given recent domestic turmoil in the country, the authorities may be having difficulties meeting their program goals. In this regard, a careful look at the program is warranted.

As noted above, spending as a percent of GDP is held constant over the course of the program period. In 2016 and 2017, debt is not programmed to decline in these years and the revenue-enhancing measures required are specified in the program documents.[7]

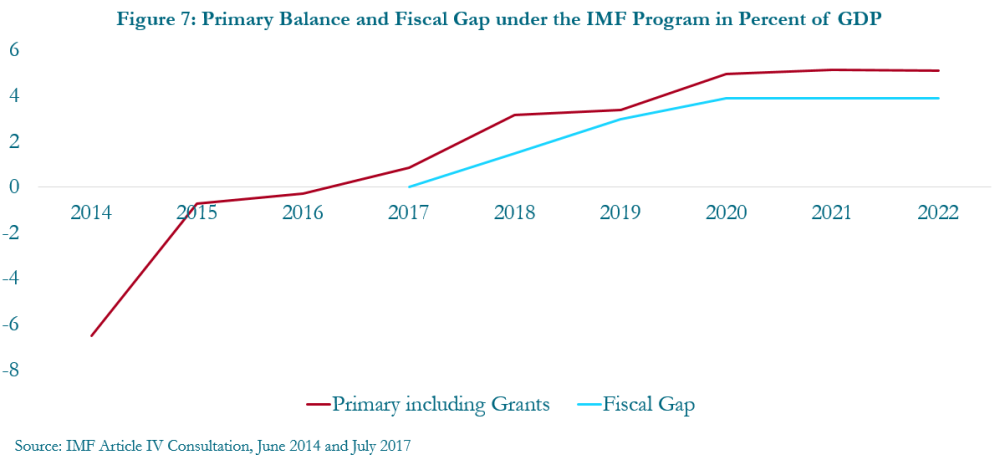

However, the major push for a reduction is programmed for 2018–22. The needed measures were not identified, implying an implicit financing gap (Figure 7) of up to 3.9 percent of GDP in 2020–22. This implies that, in addition to the efforts made by the government in 2015-17 to correct fiscal imbalances, significant ongoing improvements will need to be made in the out years if debt targets are to be reached.[8] The beginning of these enhanced fiscal efforts has begun with the government of Jordan raising excise taxes on many goods and beginning consideration of income tax reforms.[9]

The question is whether these measures are necessary—does the debt level need to be reduced? The arguments for reduction center first around sustainability—a high debt level limits current and future borrowing space, especially in the case of macroeconomic shocks. Second, an increasing interest burden crowds out other spending. Do either of these arguments hold water?

An alternative scenario

Running an alternative scenario where debt levels are maintained at the 2016 level of 95.1 percent of GDP until 2022 (Figure 8), how much more fiscal space does this give the authorities, recognizing that higher debt levels imply higher debt servicing costs. And how long could such a debt level be sustained?

To focus on the effect of the overall debt ceiling objectives, the following assumptions were made for the scenario:[10]

- Real GDP growth and inflation remain the same as in the IMF-supported program projections.

- The dollar/dinar exchange rate remains constant as in the IMF-supported program projections.

- The foreign/domestic composition of the debt remains the same as in the IMF-supported program, year by year.

- The debt service is calculated from the effective interest rate used in the IMF-supported program.

- Adjustments to the stock of debt from sources other than the primary balance remain the same as in the IMF-supported program.[11]

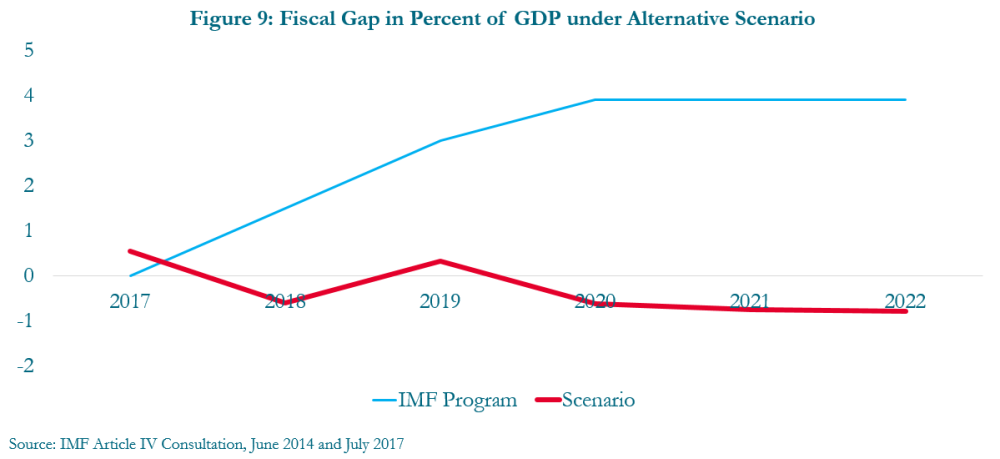

There are several ways to compare the results of the no-debt-decline scenario to the IMF-supported program projections. Recalling that the IMF-supported program has a financing gap for 2018–22, one could ask the size of the gap under the alternative scenario, assuming revenues and non-interest expenditures remain the same as in the IMF program (Figure 9). The fiscal gap disappears in the out years, giving the government more than enough room to continue spending at current levels without taking additional revenue measures.

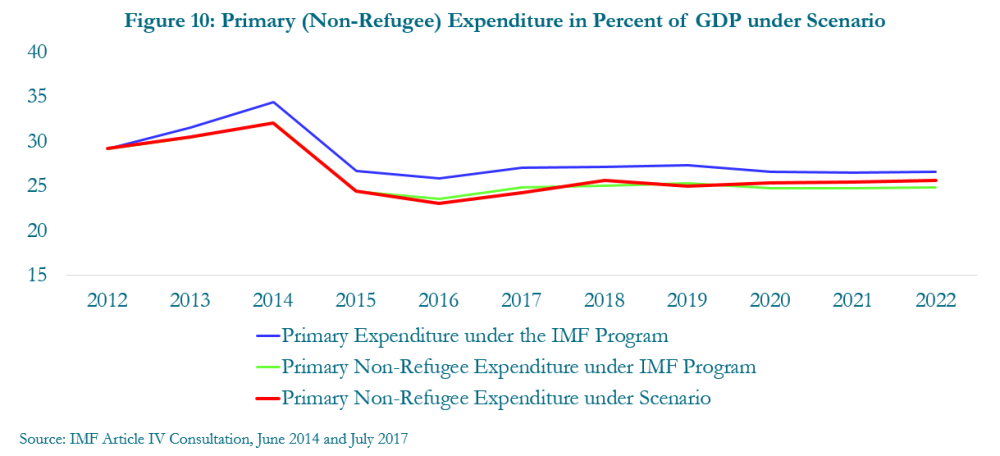

But the potential for expenditure beyond the program targets is limited by the fact that debt service will be higher, given the higher debt stock. The debt service difference widens over the period to about 1 percent of GDP. Assuming refugee-related spending stays constant in nominal terms, the scenario shows that non-refugee primary spending could be increased by about 0.8 percent of GDP by 2022 (Figure 10).

Of course, the Jordanian government could give itself more room for expenditure on priority areas by taking fiscal measures—either to increase revenues or reduce non-priority spending.

One caveat is needed: this scenario assumes Jordan can find the needed financing to run a higher deficit and that the cost of the increased debt does not increase substantially.

Some closing thoughts

There are many scenarios that could be run, but the main point is straightforward—the objective of decreasing the debt-to-GDP ratio constrains the fiscal position and thus leaves less room for spending. With demands on the government to address the refugee crisis, the case for bringing down the fiscal deficit needs to be very strong.

Eventually, debt levels will have to come down as interest payments on debt will crowd out other spending. But that could wait resolution of the refugee crisis. On the other hand, if the crisis is never resolved, the Jordanian government will be put in an increasingly unsustainable position, and continued fiscal stringency imposed from the outside will lead to a collapse of other government functions. Then a more permanent solution will need to be found.

The question then is, when do we reach the point of no return?

[1] “Jordan: Article IV Consultation,” International Monetary Fund, August 2008, https://www.imf.org/en/Publications/CR/Issues/2016/12/31/Jordan-2008-Article-IV-Consultation-Staff-Report-and-Public-Information-Notice-on-the-22304.

[2] “Jordan: Request for an Extended Arrangement Under the Extended Fund Facility,” International Monetary Fund, September 2016, https://www.imf.org/en/Publications/CR/Issues/2016/12/31/Jordan-Request-for-an-Extended-Arrangement-Under-the-Extended-Fund-Facility-Press-Release-44267.

[3] Ibid., page 22.

[4] This includes both current expenditure and indirect costs from needed infrastructure expenditure.

[5] The primary fiscal balance is the difference between government revenues (including grants) and non-interest expenditures.

[6] There was a large decrease in current expenditure between 2014 and 2015 because of the cessation of transfers to the National Electric Power Company (NEPCO) and the Water Authority of Jordan (WAJ), which had been necessary to subsidize fuel imports after disruptions of supply from Egypt. In 2015, domestic sources of fuel became available, ending the need for subsidies amounting to about 7 percent of GDP.

[7] The subsequent analysis is based on projections in the IMF staff report. I have not put in actual figures for 2016 or 2017, nor more recent projections, as the intent of the analysis is to examine how the program was designed ex ante.

[8] This is not atypical of IMF programs, as disbursements by the IMF and donors are contingent upon good performance over the three years of the program, in this case 2016-18, and the outer year projections are recalibrated on an ongoing basis.

[9] “Jordan Unveils Major IMF-guided Tax Hikes to Reduce Public Debt,” Reuters Business News, January 2018, https://www.reuters.com/article/us-jordan-economy-reforms/jordan-unveils-major-imf-guided-tax-hikes-to-reduce-public-debt-idUSKBN1F42Q9.

[10] For all program assumptions see “Jordan: Article IV Consultation,” International Monetary Fund, July 2017, https://www.imf.org/en/Publications/CR/Issues/2017/07/24/Jordan-2017-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-45117.

[11] These net additions to the debt stock come from various one-off transfers and changes in the stock of guarantees, asset changes, and interest revenues. They amount to 1.6 percent of GDP in 2017 and decline to 0.8 percent of GDP in 2022. Automatic debt dynamics are calculated separately in the simulation.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.