Recommended

Blog Post

Blog Post

This note is part of a body of research that examines the current state of play on COVID-19 treatments. These pieces provide a deep dive into key cross-cutting areas—demand, voluntary licensing for generic supply, and deployment—and offer policy actions for 2023 and beyond. See here for more from CGD on COVID-19 treatments.

Introduction

In December 2021, the US Food and Drug Administration (FDA) granted emergency use authorizations for two oral antiviral treatments against COVID-19: a nirmatrelvir/ritonavir combination, developed by Pfizer and sold under the name Paxlovid, and molnupiravir, developed by Merck and sold under the name Lagevrio. Both treatments reduced hospitalization in unvaccinated, high-risk individuals in clinical trials by 89 percent and 30 percent, respectively.

Paxlovid was hailed as a potential game-changer for its ability to keep vulnerable patients out of the hospital. In April 2022, the World Health Organization (WHO) concluded, based on available evidence, that Paxlovid was “the best therapeutic choice for high-risk patients to date” and strongly recommended the medication for “mild and moderate COVID-19 patients at highest risk of hospital admission.”

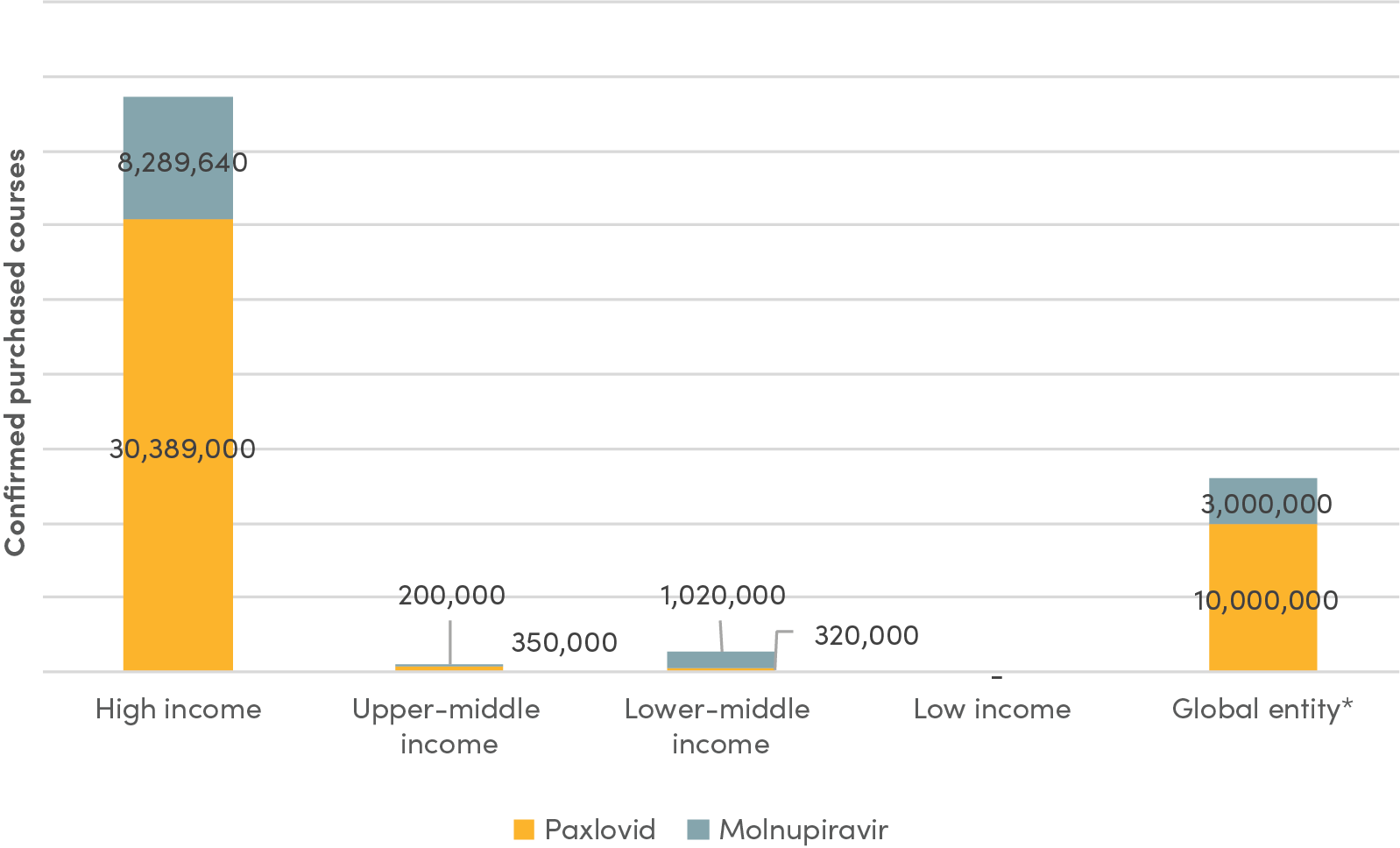

However, Paxlovid is not yet available in lower-income countries, where low vaccine coverage persists and high-risk individuals continue to go mostly untreated. This concerning reality is partly explained by the fact that wealthier countries pre-purchased the initial supply of new antiviral treatments in the first half of 2022 (see Figure 1). But it is also explained by extremely low demand for COVID oral antivirals in lower-income countries, despite the WHO’s recommendation.

This CGD note examines five interlinked demand-side challenges related to the current state of play with oral antivirals. We offer three policy recommendations to support governments and their donor partners in assessing how these treatments should fit into wider COVID-19 response efforts in lower-income countries—both as the trajectory of the pandemic evolves and as government health spending and aid budgets are squeezed by macroeconomic and fiscal challenges.

We argue that registering, financing, purchasing, and deploying these treatments at appropriate, realistic volumes in lower-income countries is wiser than continuing to make bold announcements backed by unrealistic plans to scale access to oral antivirals across countries. Timely, equitable access to oral antiviral treatments would be crucial if—or when—a dangerous new variant emerges, especially in settings where vaccination coverage remains low. Policymakers should also apply lessons learned from COVID-19 vaccine deals and long-term contracts for doses that are no longer needed.

Figure 1. Purchase of oral antiviral therapeutics by country income category

Source: Duke Global Health Innovation Center, updated November 2022.

Note: * Data for the category “Global entity” represents the number of courses that have been allocated for purchase by the Global Fund and UNICEF.

Five missing elements

Five factors are at the root of low demand for oral antiviral treatments: the lack of robust, compelling data and evidence; lack of a reliable supply of generic products; unaffordable prices; poor visibility of demand; and inadequate resources for delivery and deployment. We focus our analysis on nirmatrelvir/ritonavir as the most promising oral antiviral to date.

1. Lack of clinical and economic evidence on antiviral treatments to inform government priorities

Limited information in two areas has contributed to low demand for nirmatrelvir/ritonavir in lower-income countries: (1) clinical efficacy against dominant variants and real-world effectiveness data; and (2) economic evidence on value-for-money and cost-effectiveness.

First, current data—and public impressions—on effectiveness, rebounding, and drug interactions have deterred officials from prioritizing antiviral treatments for public spending. Evidence thus far is mainly based on clinical trials with controlled conditions in high-income countries, conducted before the Omicron wave. According to the Cochrane review, data are only available for nonvaccinated people at increased risk for disease progression receiving treatment within five days of symptom onset.

Real-world evidence, especially from lower-income countries, on how the product works outside of clinical trials—where patients may not receive medicines within five days of symptom onset—or in patients with some immunity from vaccination or natural infection is still minimal. A handful of studies in standard risk groups and vaccinated individuals have started (and some completed), but full results are not yet published. Effectiveness against dominant (e.g., Omicron) and emerging variants also requires further study. To date, no findings from completed studies in low-resource country settings have been published.

Policymakers, providers, and patients also have concerns about rebounding and drug interactions with nirmatrelvir/ritonavir. The true frequency of rebounds is still unknown, but rebounding may happen more frequently with Paxlovid than without (3 out of 11 versus 1 out of 25). And concerns about Paxlovid’s interactions with other drugs are intensified by the fact that older and higher-risk individuals who are stronger candidates for Paxlovid are also more likely to be on medications for comorbidities. Notably, management of drug interactions can be more difficult in low-resource health settings with incomplete patient medical records and other system complexities.

Furthermore, limited COVID-19 testing data makes it difficult for policymakers to assess the real burden of disease associated with COVID. In tandem, data on hospitalizations and deaths from COVID-19 continue to be incomplete. The lack of regular and accurate data, coinciding with potentially lower hospitalization rates and deaths, may bolster the perception that the pandemic is over and help explain why policymakers are no longer prioritizing the COVID-19 response.

Second, there is no evidence on the cost-effectiveness of oral antivirals in low- and middle-income country (LMIC) contexts. To date, no analysis has compared the relative costs and health gains associated with the introduction of nirmatrelvir/ritonavir (or molnupiravir) in lower-income settings. To fill this gap, the Health Economics Program at the Africa Centres for Disease Control and Prevention (Africa CDC), in collaboration with iDSI/CGD, is undertaking a project on the cost-effectiveness of COVID-19 oral antivirals (stay tuned for more updates from CGD and our partners in the coming months).

Further, oral antivirals are competing with COVID-19 vaccines, including boosters, that may provide greater health impact per dollar spent. The share of the population in LMICs that has received two shots is steadily increasing, as is the number of booster doses per 100 people across all income levels (though inequities in coverage across income groups mirror inequities in primary vaccination coverage).

Uncertainty—and unfavorable perceptions—about the benefits and costs of oral antivirals, including their distribution and delivery (discussed in more detail below), raise important questions about whether these treatments provide the best value-for-money compared to other COVID-19 interventions, including vaccination, especially as health systems reel from the fallout of the pandemic and face renewed pressures from macroeconomic shocks.

2. Lack of available quality-assured generic products, due in part to regulatory delays

As one step to help speed equitable access, Pfizer, Merck, and the Medicines Patent Pool (MPP) signed voluntary licensing agreements in late 2021 to enable select generic manufacturers to provide nirmatrelvir/ritonavir and molnupiravir in roughly 100 LMICs. These agreements are notable for their speed and reach: MPP has offered sublicenses to 38 companies for production of nirmatrelvir/ritonavir and to 23 generic producers for molnupiravir. However, generic antivirals are not expected to be available in these countries until 2023, and several large middle-income countries are excluded from the deals (e.g., Argentina, Brazil, Thailand, Malaysia).

The voluntary licensing agreements include an explicit clause that generic manufacturers must receive regulatory approval from WHO’s Prequalification (PQ) program and/or from a Stringent Regulatory Authority (SRA). As a designated SRA, the US FDA represents one pathway for regulatory approval. Yet, despite the Biden administration’s stated commitment to “rapid review of generic products for global COVID-19 response,” the US FDA has not yet included nirmatrelvir/ritonavir (or molnupiravir) in the list of medicines considered for submission to its tentative approval program.

In the absence of an alternative regulatory pathway within the US FDA or another SRA, the regulatory approval process for all generic oral treatments is fully centralized within WHO’s PQ program. In practice, this means that all 38 manufacturers of active pharmaceutical ingredients (APIs) and finished products must apply to WHO’s PQ program to receive quality assurance, and it is not clear precisely how long the WHO PQ process will take. To date, the WHO PQ program has accepted 16 dossiers for assessment, including 5 dossiers for finished products and 11 dossiers for APIs. WHO has also had advisory meetings with 14 additional manufacturers of finished products that are interested in clarifying requirements or reviewing data required to support a possible biowaiver for bioequivalence studies.

The large number of assessments, which will increase further once APIs are prequalified in the coming months—coupled with insufficient resources within the WHO PQ program—will prolong regulatory timelines and thus cause delays in generic product availability in eligible LMIC markets. National marketing authorization is expected in 2023; specific filing dates will depend on several factors, including the exact timeline for the WHO PQ process, prior experience of licensees with key regulatory processes, innovator cooperation to share the comparator product for bioequivalence studies, market viability and visibility, and potential inclusion by the US FDA in its tentative approval program (discussed below).

3. Lack of affordability

In the absence of generic products, Paxlovid remains prohibitively costly for at-scale deployment in most low-and middle-income countries. Several ACT-A global partners have signed agreements to expand access to antiviral treatments in the shorter term. Still, prices are likely to be unfavorable. (In general, price transparency is limited.)

For instance, the Global Fund and Pfizer recently signed an agreement to provide 6 million doses of Paxlovid at a not-for-profit price. If low enough, this could change the decision-making calculus for purchasers—but details, including pricing specifics, have not yet been disclosed. Further, many governments may (understandably) be reluctant to place orders for Paxlovid using their Global Fund allocations. UNICEF’s contract with Pfizer for 4 million courses will potentially require countries to use national budgets or donor funds to finance purchases. The original plan was to start delivery in April 2022 and continue through the end of the year as a way to provide short-term access while generic manufacturers scale up production. However, UNICEF continues to renegotiate the terms of the agreement related to access conditions. The Africa CDC also agreed to a memorandum of understanding with Pfizer for Paxlovid at the not-for-profit price, but with the exception of Zambia, plans to procure doses have not yet been publicly announced. Details on lowest-tier pricing and whether African markets will be prioritized in Pfizer’s delivery “queue”—given lower vaccination rates—remain unknown. Greater visibility into global access pricing and production cost estimates would be valuable, even as supply and demand estimates shift over time.

In tandem, to ensure affordable access to generic products once they become available, global health partners have negotiated pricing agreements with generic manufacturers. In May 2022, the Clinton Health Access Initiative (CHAI) announced a deal with several generic manufacturers to make nirmatrelvir/ritonavir available in LMICs for under $25 per treatment course. The negotiated price point for the generic product offers a sizeable reduction from the $530 price paid by the US government for Paxlovid.

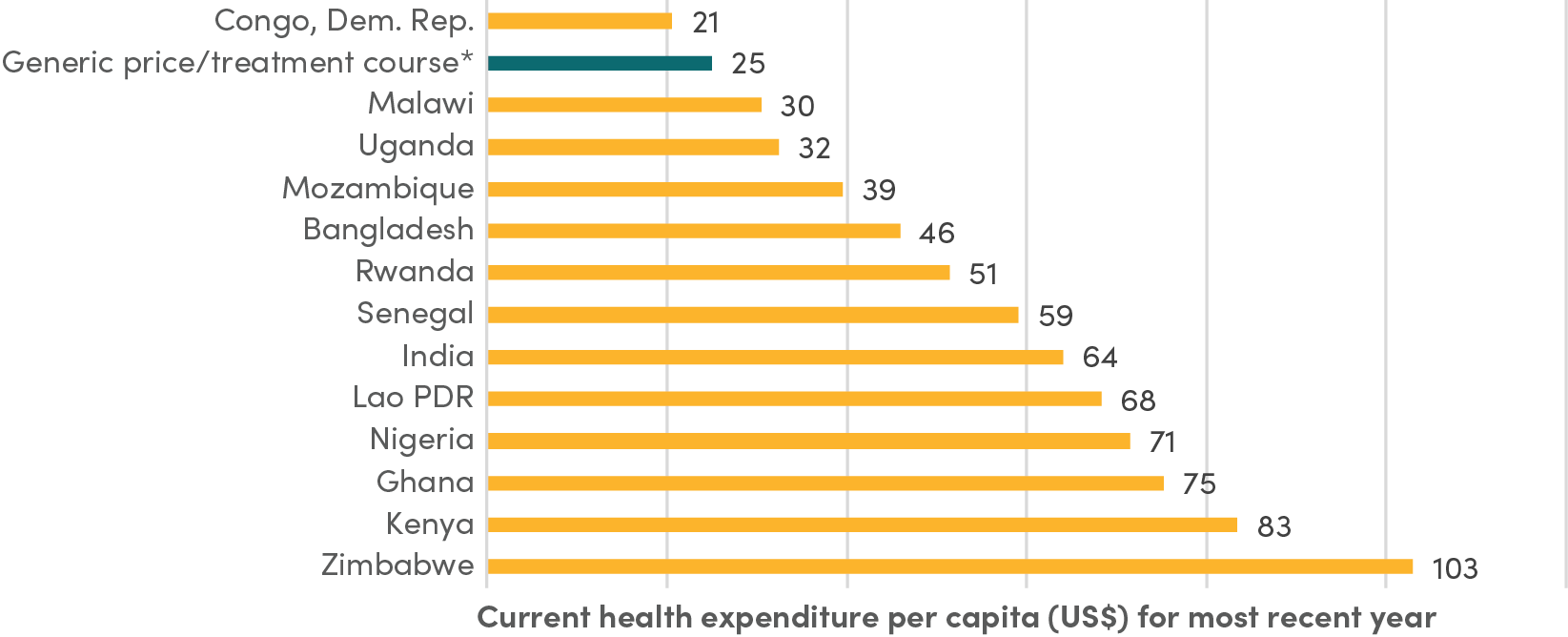

Still, $25 per treatment course represents a significant cost in many contexts. For instance, it exceeds total health expenditure per person per year in the Democratic Republic of the Congo and is equivalent to about 50 percent of health spending per person per year in countries like Bangladesh and Rwanda (see Figure 2).

Figure 2. Comparison of negotiated generic price to health expenditure per capita in select countries

Source: World Health Organization Global Health Expenditure database (apps.who.int/nha/database).

Note: *Generic price/treatment course refers to the price that CHAI negotiated with several generic manufacturers, which depends on minimum volume requirements.

However, this generic price agreement depends on minimum volume requirements: “for each manufacturer, the ceiling price of $25 per treatment course will apply if the aggregate of all orders for public sector use in the 95 LMICs during the year is anticipated to meet or exceed one million treatment courses and any single order is for a quantity of least 50,000-treatment courses.”[1] It is unlikely that generic manufacturers will lower prices further given current costs of APIs, which are unlikely to change until economies of scale are achieved once purchasers buy in greater volumes.

Notably, the $25/treatment course price does not account for the full cost of delivering these treatments to patients, which includes deploying test-and-treat protocols and provider training. And there could be additional costs if a longer treatment course for nirmatrelvir/ritonavir is recommended to address rebounds.

4. Lack of visibility of current and future demand

Licensing alone does not provide sufficient incentives for manufacturers to build new or reconfigure existing capacity. In the current context, generic manufacturers have limited visibility into future demand trajectories. This uncertainty perpetuates a “wait and see” approach that further stalls generic supply; in turn, the lack of available quality-assured generic products prolongs decisions from purchasers to place orders. CHAI’s generic Paxlovid deal seeks to help address these challenges, but as discussed, it is not yet clear whether the minimum volume purchase requirements will be reached to unlock the $25 per treatment course price.

As seen throughout the COVID crisis, uncertain future demand for medical countermeasures can pose obstacles to production scale-up and capacity maintenance. Little to no visibility into current and future pipelines for oral therapeutics weakens incentives for generic manufacturers, some of whom may decide to defer filing for regulatory approval. And given the full set of obstacles in the regulatory approval process, plus broader uncertainty in demand, licensees could ultimately decide not to enter the market.

Forecasting future demand is extremely challenging in the face of multiple epidemiological and policy uncertainties. For instance, assessing potential clinical need for oral antivirals depends on timely tracking of COVID caseloads via testing. Estimating clinical need involves identifying the number of people that could benefit from the treatment based on eligibility for the drug (i.e., risk status and positive tests) and epidemiological trends (e.g., emerging variants, immunity over time, and vaccination progress). Assessing potential demand, on the other hand, requires accounting for additional factors related to regulatory guidance, country priorities, rapid test availability and turnaround, and other policy considerations. In partnership with COVID GAP, CHAI has forecasted demand for oral antivirals in LMICs. Under different scenarios, their estimates for 2022 ranged from 3.1 million to 14.8 million treatment courses. While modeling COVID caseloads is inherently difficult, future demand for oral antivirals should continue to be framed around case numbers in high-risk groups found to benefit the most from treatment.

To address the market failure arising from limited visibility on demand, policymakers can employ a range of tools to organize and signal demand to manufacturers. Measures include pooled purchasing, volume guarantees, technology transfers, subsidies, loans, and grants. Ideally, the right combination of financial and technical measures would help incentivize adequate manufacturing capacity, such that economies of scale ultimately help drive down prices.

For instance, Gavi’s success in financing vaccines for deployment in lower-income countries is in part due to its ability to negotiate lower prices by organizing demand across countries. Pooled procurement mechanisms have been found to help lower prices (though reductions are smaller when supply is concentrated among a few manufacturers). Further, in the case of vaccines, an analysis comparing capacity subsidies, concessional loans, and volume guarantees found that when a government or global health entity has a stronger outlook on medium-term demand but the vaccine developer has a more conservative view of future demand, volume guarantees are the only viable instrument to incentivize socially optimal manufacturing capacity.

During the COVID crisis, various platforms, such as COVAX at the global level and PAHO and the Africa Medical Supplies Platform at the regional level, have served as mechanisms to pool demand across multiple countries, with varying degrees of success. To date, however, there has been little clarity on the use of these mechanisms for procurement of oral antiviral treatments. There is also uncertainty about available financing at the global and regional levels to procure generic oral antiviral products for/on behalf of LMICs. As attention to COVID wanes amidst multiple competing priorities, global response efforts are severely cash strapped, particularly for therapeutics and diagnostics. The Second Global COVID-19 Summit held in May 2022 resulted in few new announcements for additional financing commitments.

5. Lack of adequate resources to develop the infrastructure needed to get treatments to patients

Limited financing for deployment of oral antiviral treatments further compounds challenges for patient access. This is another parallel to the COVID vaccine rollout, for which delivery financing was late and insufficient. To be effective, Paxlovid must be taken within five days of symptom onset, which is often made possible through rapid self-testing. But tests are not widely available or used in many places. COVID-19 testing rates in nearly all low- and lower-middle-income countries have remained far below the ACT-A daily target of one test per 1,000 people throughout the course of the pandemic; high-income countries test an average of 59 times or more than low-income countries. And across countries and regions, testing rates have dropped significantly in recent months.

Thus not only is there limited funding (and subsequent demand) to procure antiviral treatments, but there are also few resources available to develop the appropriate test-and-treat infrastructure needed to distribute tests and treatments. Importantly, countries that procure oral antivirals, either via their own financing or via global health procurers such as the Global Fund or UNICEF, do not have a good sense of the resources and implementation support that will then be made available to deploy these products via test-and-treat programs.

Encouragingly, several joint efforts to prepare better test-and-treat infrastructure have been initiated in recent months. These include over $120 million for test-and-treat programs from the Global Fund, USAID, and UNITAID, launched at the Second Global COVID-19 Summit. USAID is providing $20 million in technical assistance to pilot test-and-treat fast-paced implementation in 10 countries: Bangladesh, Botswana, Côte d’Ivoire, El Salvador, Ghana, Lesotho, Malawi, Mozambique, Rwanda, and Senegal. And the COVID Treatment Quick Start Consortium, a joint initiative of CHAI, Duke University, and the COVID Collaborative with funding from Open Society Foundations, the Conrad N. Hilton Foundation, and Pfizer plus 100,000 donated courses of Paxlovid from Pfizer, seeks to provide oral antivirals for COVID-19 in 10 target countries: Ghana, Kenya, Laos, Malawi, Nigeria, Rwanda, South Africa, Uganda, Zambia, and Zimbabwe.

Both USAID and its partners, as well as the COVID Treatment Quick Start Consortium, have expressed plans to identify best practices and lessons learned from their sets of pilot countries, which should then be used to inform wider test-and-treat scale-up both within countries with available generic supplies and those without access to generics. Some donors have highlighted the importance of using these initiatives to demonstrate to the global health community that COVID-19 treatments are a viable, long-term addition to vaccination in pandemic response. Still, a core component of these efforts must include consideration of the economic and clinical rationale for deploying test-and-treat strategies amid other COVID response strategies, global health security considerations, and essential health service priorities.

And while there is some overlap in these initiatives’ focus countries (Ghana, Malawi, Rwanda), the extent of coordination between the two efforts is not immediately evident. Details on progress in deploying the required funding needed to get these products into countries also remain unclear.

Additional resources are also needed for demand generation, including more effective strategies for communicating with providers and patients, especially considering the data availability and perception challenges discussed above. Improved knowledge and confidence are prerequisites for greater use and health impact. Testing different delivery vehicles, including possible private channels, is important to understanding which deployment strategies work best in different contexts. Investing in test-and-treat infrastructure and delivery mechanisms as soon as possible, before generics come to market, must be a priority.

Three priority policy actions

As many countries move towards managing COVID-19 as an endemic disease, response efforts must adapt to keep pace with shifting contexts. In this section, we propose policy priorities across three areas to help ensure global, regional, and national responses reflect the current state of play on manufacturing, registration, procurement, and deployment of oral antiviral treatments in lower-income country contexts.

1. Generate more and better evidence to determine the costs and benefits of different oral antivirals in lower-income countries, including as part of test-and-treat pilots

Policymakers face important opportunity costs when determining which interventions provide the best health for the money in their country contexts. Access to timely data can help guide decisions on how to allocate scare health resources and balance priorities across different COVID-19 medical countermeasures (e.g., oral antiviral treatments versus vaccines)—and between COVID-19-focused interventions and other essential health services, including routine vaccination.

Oral antiviral treatments can serve as a potentially important line of defense, but more information is needed to make consequential decisions about how these treatments should fit with wider COVID response efforts in lower-income countries given an expanding arsenal of medical countermeasures, all amidst competing health system priorities and constrained resources. Specifically, policymakers need access to relevant clinical and economic evidence to inform the extent to which oral antiviral treatments should be prioritized in LMIC responses going forward. Partners should prioritize completing the ongoing pilots to set up the infrastructure for test-and-treat programs in select countries alongside efforts to generate additional evidence to determine the costs and benefits associated with oral antivirals in lower income countries.

First, where feasible, trials should be embedded within test-and-treat initiatives to generate real-world data from lower-income country contexts. Testing different delivery approaches to rapidly deliver oral medications should be a pivotal component of any multipronged medical countermeasures strategy. This approach will help provide more information about treatment outcomes among different population groups, including vaccinated individuals and those who are not high risk for severe illness—and will also provide information on the effectiveness of oral antivirals in settings where there may be longer lags between diagnosis and treatment onset. And generating evidence about the most cost-effective test-and-treat delivery modalities for oral medications confers additional benefits for future pandemic responses.

Second, economic evaluation, including cost-effectiveness analyses that assess relative costs and impacts, should be conducted to determine whether oral antivirals delivery good value-for-money for domestic public resources in different settings and for different sub-populations. Analysis that quantifies the costs and health impact while also taking into consideration budget constraints and population health needs is critical to inform important policy questions. For instance, at what price are different treatments locally cost-effective to be prioritized for purchase and distribution with public resources? How should oral antivirals be distributed? And which sub-populations should be targeted? Analyses should compare the cost-effectiveness of deploying oral antivirals to no intervention, as well as to the newly available bivalent boosters.

2. Expand the US FDA tentative approval pathway to include generic oral antivirals to speed delivery in low- and middle-income countries

Providing additional pathways for regulatory approval by expanding capacity beyond WHO PQ represents an important policy lever to speed approval of generic products manufactured by MPP-selected licensees. Specifically, the US FDA should activate its tentative approval process. Including nirmatrelvir/ritonavir and molnupiravir on the list of medicines considered for submission to the FDA’s tentative approval program would make the regulatory assessment of generic oral antivirals faster and less centralized.

The tentative approval process has been successfully used to review several antiretroviral (ARV) drugs (that are not eligible for marketing approval in the US) for use in HIV programs in LMICs. Under this mechanism, the FDA creates a publicly available list of quality-assured ARVs that meet FDA standards for safety, efficacy, and quality to inform purchasing by global procurers such as PEPFAR and the Global Fund. Following the same approach taken for ARVs, the US FDA could also waive the (relatively small) fee for reviewing applications for tentative approval; USAID could reimburse the FDA for waived fees.

Additional support in the form of outreach and technical assistance to licensed generic manufacturers interested in using this process will be essential given that only 17 percent and 29 percent of MPP FP licensees for molnupiravir and nirmatrelvir/ritonavir, respectively, have previously used the FDA tentative approval process for HIV antiretrovirals. These efforts should build on the existing guidelines, procedures, and documentation that have been developed as part of the existing PEPFAR process.

This approach also presents an opportunity to enhance information sharing and collaboration across different regulatory entities. For instance, after products receive tentative approval (which takes roughly six months), the information could be shared with WHO, and approved products could then be included on WHO’s list of prequalified medicines, which is a prerequisite for procurement by global health entities such as the Global Fund and UNICEF. Additionally, products receiving tentative FDA approval could also be included in the WHO Collaborative Registration Procedure to speed registration processes conducted by national regulatory authorities in LMICs.

While leveraging the FDA’s tentative approval process is one way to reduce the time for COVID-19 antivirals to reach LMIC markets, it is important that this mechanism is not utilized on a one-off, ad-hoc basis during future health crises. Taking a longer-term view on preparedness, and considering the need to speed regulatory approval during future pandemics, it is imperative to institutionalize specific pathways such as the FDA’s tentative approval process within SRAs and test and develop more routinized accelerated processes and alternate approval pathways for antivirals and other medical countermeasures beyond these reference regulatory agencies. For instance, MPP voluntary licensing agreements could designate functional and WHO-listed regulatory authorities (as per the WHO Global Benchmarking tool) as eligible to review low-risk products (such as oral solids).

3. Broker advance purchase agreements with generic manufacturers to expand access to generic antiviral products

To help stabilize the demand side of the market, global and regional entities should deploy advance purchase commitments with licensed generic manufacturers, conditional upon regulatory approval. For instance, one or more global or regional entities (e.g., the Global Fund and/or the Africa CDC) should sign a prepurchase agreement with select generic manufacturers conditional upon regulatory approval. Such an agreement could be used as a lever to help meet the minimum annual volume requirements (initially just for 2023) under the generic pricing deal between CHAI and generic manufacturers to unlock the $25 per treatment course price. This would require a commitment of $25 million to purchase 1 million treatment courses at $25 per course.

The goal would be twofold. First, given broader uncertainties about future demand and other existing agreements to purchase the originator product for LMICs, purchases could initially be used to stabilize demand and build a modestly sized regional stockpile, including the requisite number of diagnostics, which could then be activated to rapidly deploy treatment courses in the event a future variant emerges. Second, commitments to purchase in larger volumes would more clearly signal demand, tied to specific sources of funding, potentially helping to unlock more favorable prices for LMIC markets. Stabilizing demand would be especially important for supply availability in the event that a dangerous new variant emerges.

Beyond 2023, as the situation evolves, global and regional entities should right-size their strategy, potentially scaling up or down both the volumes and specific products they commit to purchase. Future purchases made under such agreements could be used to replenish the existing stockpile as needed, and/or could also be made available for partner countries to procure from regional and/or global pooled mechanisms.

Pooled financing from donors will likely continue to account for the bulk of available resources to purchase oral antiviral treatments in LMICs and more evidence to better assess the economic and clinical rational for public and aid spending is needed (see recommendation 1).

Subsidizing the supply of oral antivirals contributes an important global good, thus providing an economic case, beyond altruism, for donors to play a role in deploying financial and technical instruments to stabilize the demand-side of the market. However, these approaches should be tailored and adjusted as more evidence becomes available about the extent to which oral antivirals represent good value-for-money in LMIC contexts.

Conclusion

Almost a year after two oral antiviral treatments received emergency use authorization, demand is extremely low. We explain why this is the case through a combination of interlinked factors: limited data and evidence, lack of more affordable generic products, suboptimal visibility of current and future demand, and the absence of robust health system infrastructure to deliver treatments (and tests) to patients. Given uncertainties, we argue that governments and their donor partners should generate and use data and evidence to consider the economic and clinical rationale for registering, financing, purchasing, and deploying oral antiviral treatments in specific lower-income country contexts, alongside other COVID-19 medical countermeasures. In the more immediate term, we also highlight policies that can be deployed to help speed the supply of more affordable generic products, which could be especially important if, or when, a more dangerous variant emerges.

Thanks to Katherine Bliss, Rachel Silverman Bonnifield, Alan Staple, and Prashant Yadav for feedback on an earlier version of this note.

[1]The generics manufacturers in CHAI agreements have committed to file for WHO PQ or SRA approval by first quarter of 2023.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.