Recommended

Introduction

The time is now for a historic International Development Association (IDA) replenishment. The world’s poorest countries’ recovery from the COVID-19 economic downturn will largely hinge on the scale of the emergency relief and investment programs over the next few years. According to the International Monetary Fund (IMF) by the end of 2022, per capita income could be 18 percent below pre-crisis projections for low-income countries and 22 percent for emerging and developing countries. [1] The World Bank estimates that the global pandemic could push between 55 and 63 million people in IDA countries into extreme poverty.[2]

IDA is the largest source of concessional loans and grant finance for the world’s poorest countries. Its ability to sustain its high levels of crisis financing over the medium-term could profoundly affect the pace and strength of economic recovery for many low-income countries. Due to high pandemic related demand, IDA is frontloading its financial support, creating a significant shortfall for the last year of the three-year replenishment cycle. In this context, IDA donors and management have decided to accelerate the replenishment negotiations for IDA-20 by a year. This will allow IDA to commit the bulk of its current IDA-19 funding program over two years instead of three.

The overarching objective for IDA-20 should be to maintain or exceed the $35 billion annual loans and grants program that IDA is deploying now. This means that IDA-20 will need to grow by at least a third relative to IDA-19. To do this, IDA donors will need to scale up their contributions relative to recent IDA replenishments, a challenging proposition during a time of belt tightening and competing funding. For this reason, a large replenishment will also require IDA to use the leveraging capacity of its own balance sheet more aggressively while drawing on some of its equity base.

State of Play

The last IDA replenishment concluded in December 2019, with donors agreeing to an $82 billion replenishment over three fiscal years starting in July 2020 and ending in June 2023 (i.e., roughly $27 billion per year in loan and grant commitments). But to help meet financing needs related to the global coronavirus pandemic, IDA is frontloading its program and will likely have committed over 40 percent of the total in the first year (ending in June 2021). IDA management’s intent to commit an additional $35 billion over the coming fiscal year (July 2021-June 2022) will deplete most of its IDA-19 envelope. As a result, donors and management are taking the unprecedented step of moving up the next replenishment by a year.

Financing Model

IDA has historically operated primarily on a cash in, cash out basis, unlike the hard loan windows of the multilateral development banks (MDBs) whose funding models more closely resemble those of commercial financial institutions. In practice, this has meant that IDA needs to be recapitalized (“replenished” in MDB parlance) every three years by its donors.

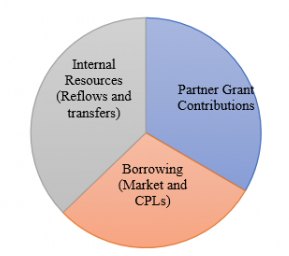

In 2017, IDA introduced a hybrid financing model by issuing debt in commercial bond markets against its equity (i.e., outstanding loans) to supplement its other sources of finance. The bulk of IDA’s program now comes from a combination of donor grants, internal reflows from loans and, more recently, borrowing (from both markets and bilateral donors in the form of concessional partner loans).

This has made IDA’s financial model more efficient while supporting significantly larger replenishments: IDA increased its program by close to 50 percent from IDA-17 to IDA-18 despite a slight decline in donor grant financing.[3] IDA was able to generate additional concessional loans by blending market issuances with donor funds, leading to a larger level of concessional loans and grants.

While IDA borrowing has proven to be a critical source of leverage it remains conservative. Prior to introducing market borrowing in IDA-18, IDA deployed a significant portion of its donor grant contributions as concessional loans which allowed it to build around $175 billion in equity. As a result, IDA has more equity than any other MDB, including the IBRD. But IDA has currently a modest $16 billion in capital market debt outstanding, less than 10 percent of its equity base. In contrast, IBRD has over $250 billion in market debt outstanding or six times its equity base. IBRD can leverage significantly more than IDA because it benefits from callable capital from its shareholders and a higher credit quality loan portfolio than IDA. But IDA’s prudential ratio show it can stretch further to help meet the urgent and expansive needs of its clients during this historic crisis.

Proposal

The overarching financial objective for IDA-20 should be to at least maintain, but preferably exceed, a $35 billion annual program (for a total of $105 billion) while also meeting the grant and concessional financing needs of its client countries. A total replenishment envelope of $105 billion would be the largest in IDA’s history, amounting to roughly 4 percent of IDA countries’ GDP. It would equate to a near 30 percent increase in the overall IDA-20 package relative to IDA-19. And it would require IDA and donors alike to step up.

How would this work?

Hypothetical IDA-20 Financing Ranges ($B)

| Sources of Finance | Donor Decrease (15 percent) | Donor Flat | Donor Increase (15 percent) |

|---|---|---|---|

| Partner Grant Contributions | 20 | 23.5 | 27 |

| MDRI | 3.9 | 3.9 | 3.9 |

| Internal Resources | 32 | 32 | 32 |

| Borrowing | 45 | 45 | 45 |

| Total | 100.9 | 104.4 | 107.9 |

CGD staff estimates

* Internal resources includes reflows, carryforward from previous replenishment, investment income, and income transfers from other organizations

IDA should set an ambitious but realistic donor fundraising target. The most well-trodden path to growing IDA is through an increase in partner contributions. But in the context of tightening donor envelopes and competing demands on donor resources, a 30 percent increase in total donor contributions is likely a political non-starter. Complicating the fundraising picture is that donors need to meet their IDA-19 pledges in full while starting a new IDA cycle a year early, which raises the specter of a “double IDA payment” first year one of IDA-20.[4]

IDA-19 Top 10 Contributors in $M

| 1. | UK | 3,894 |

| 2. | Japan | 3,226 |

| 3. | USA | 3,004 |

| 4. | Germany | 1,812 |

| 5. | France | 1,631 |

| 6. | China | 1,200 |

| 7. | Canada | 1,112 |

| 8. | Sweden | 974 |

| 9. | Netherlands | 945 |

| 10. | Italy | 662 |

Source: IDA-19 Deputies Report

Most notably, the United Kingdom—IDA’s single largest donor for the past several cycles—will be significantly constrained by the recent 30 percent cut in its overseas development assistance budget. For this reason, simply maintaining a flat overall donor funding level in IDA-20 may prove to be an ambitious target.

At the same time, a 15 percent increase could be doable if the United States decides to go up. For the United States, a 15 percent increase would bring its total IDA-20 commitment to around $3.5 billion, a level still below its high-water mark of around $3.9 billion under the Obama administration but likely enough to restore the U.S. to the position as top IDA donor. However, factoring in the double payment to IDA-19 and IDA-20 in year one, the total U.S. contribution over the IDA-20 period would be closer to $4.5 billion (or a 50 percent increase over the last three-year period). While a heavy lift, a large U.S. contribution could motivate other shareholders to stretch their financing. To get total donations over the 15 percent growth mark, IDA would need to secure a large increase from China (over the past couple of cycles China has doubled its grant contribution to IDA), alongside a 15 percent average increase from a combination of Japan, major European donors and Canada.

IDA should significantly expand its market borrowing program. IDA currently has $174.8 billion in equity and around $16.5 billion in outstanding market debt. IDA’s financial indicators show that IDA has significant room to grow before breaching its prudential limits. IDA’s main measure of capital adequacy is Deployable Strategic Capital (DSC) which is the capital available to support future commitments over and above the current portfolio.[5] IDA’s DSC ratio (i.e., DSC as a percentage of equity) must stay at or above 0 percent. In December 2020, IDA’s DSC was $62.7 billion, and the DSC ratio stood at 34.7 percent, at roughly the same levels since the model was introduced in 2017.[6] A $45 billion borrowing program combined with a 15 percent increase in contributions could reduce IDA’s DSC to an estimated $33 billion or a DSC ratio of 17 percent above the 0 floor. (In contrast, the DSC could fall closer to 13 percent if donor contributions go down by 15 percent.)

Indicative Uses of IDA-20 Finance ($B)

| Non-Concessional | 20 |

| Concessional Loans | 55 |

| Grants | 33 |

| Total | 108 |

CGD staff estimates

IDA should also blend some of its equity with the debt proceeds so they can be on-lent on concessional terms. The benign interest rate environment also makes this financially attractive. IDA’s cost of funds are at record lows, so the price of “concessionalizing” its market lending has also gone down to around 15-20 cents. Under this scenario, using equity to buy down around $25 billion in market debt would not reduce IDA’s overall equity levels, but simply reduce the pace of its growth. Given the exigencies of crisis finance, this should be a tradeoff that shareholders are willing to embrace. Taking a long-term donor perspective, investing aggressively in IDA countries’ recovery today should reduce the need for large IDA replenishments a decade from now. Questions about the longer-term sustainability of the financing mix and rebuilding DSC space should be left to IDA-21.

In addition to surge capacity, IDA’s hybrid financing model also gives IDA flexibility to allocate resources as needs evolve. IDA could opt to allocate the funding envelope in any number of ways. Here’s one possible scenario:

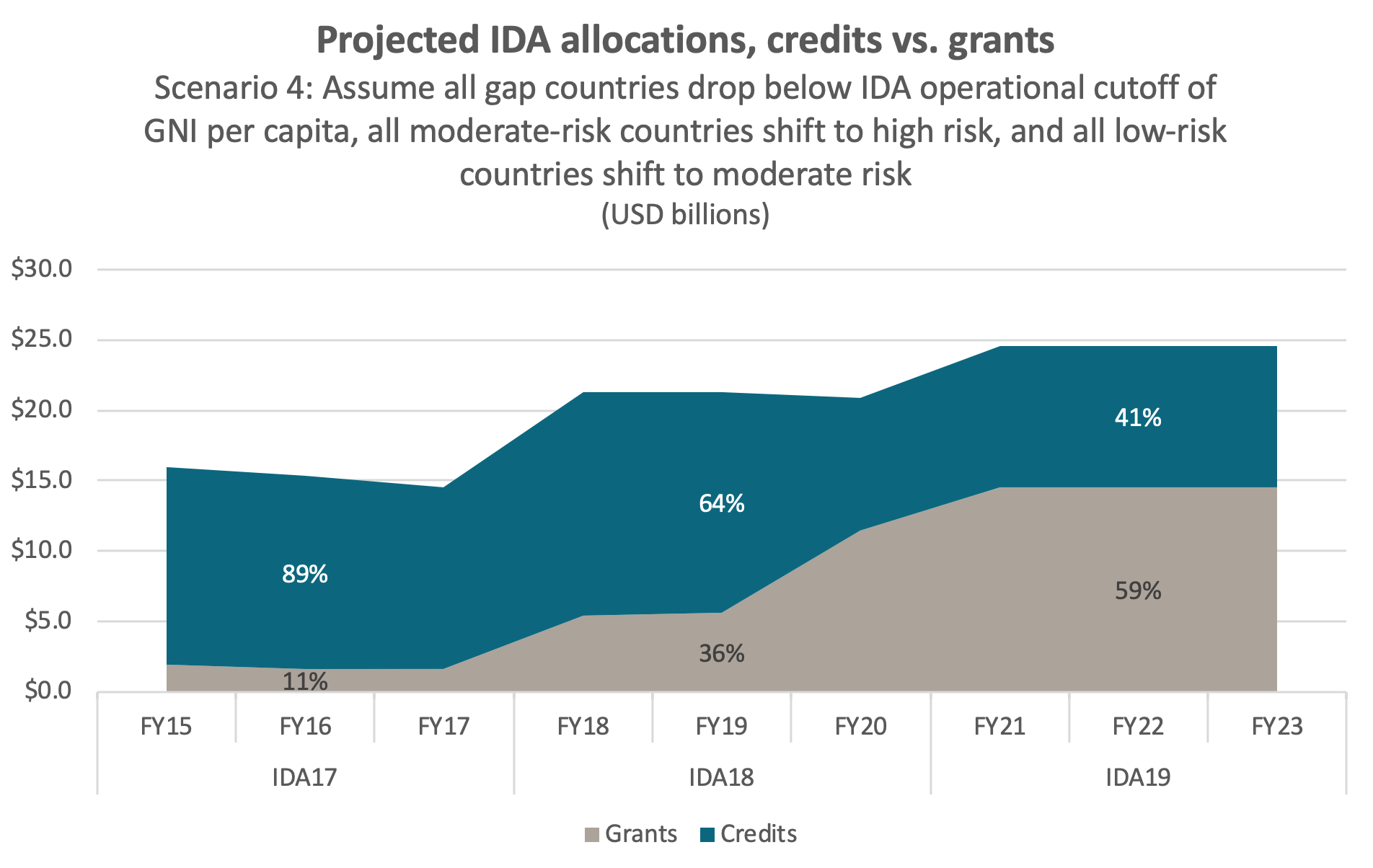

Around $33 billion in grant financing. By expanding sources of concessional financing (i.e., market borrowing and concessional loans), IDA could direct most of its donor financing and a small amount in reflows to cover grants. In IDA-19 total grant financing is around $8-$9 billion a year, or a quarter of IDA’s annual program. The financing framework proposed here would allow IDA to scale up its grant financing to around $11 billion a year if debt dynamics continue to deteriorate. In a previous piece, Scott Morris, Alysha Gardner and I estimate that in the extreme event that moderate-risk IDA countries shift to high risk, grant financing needs could account 38 percent of IDA funding. While this scenario remains unlikely, IDA could scale up its grant program to meet such a high outer-bound grant financing level (though it would require scaling back the concessional lending program by a concomitant amount.)

Around $55 billion in new concessional lending for IDA countries at low and moderate risk of debt distress. The concessional lending would be generated from reflows, debt and equity (i.e., future reflows) to buy down the terms.

At least $20 billion in IBRD priced lending. These funds could be allocated to blend countries or IDA-only countries with the capacity to take on more debt, as well as private sector projects through the Private Sector Window (PSW).

Risks (and How to Mitigate Them)

How will the rating agencies respond? Some IDA stakeholders raise concerns about the prospective reactions of rating agencies—who rate IDA AAA—to an expansion in borrowing. But this seems overly cautious given that the DSC would still be well within prudential limits. Shareholder and IDA management could explain to the rating agencies that the increase in risk through lower DSC levels is part of a package alongside robust levels of donor contributions, a clear indication of the strong levels of shareholder support that IDA enjoys, a key metric in how some of the rating agencies evaluate IDA.

As a further cushion, IDA could consider asking its highly rated shareholders to issue an exceptional joint guarantee for IDA that could act as temporary callable capital. This would reinforce shareholder support for IDA’s financial expansion and their willingness to backstop it.

Shareholders should request IDA to obtain ratings evaluation service (RES) which provides a shadow rating based on several scenario scenarios.

Could a big ramp up in borrowing disincentivize donor contributions (i.e., substitution risk)? This has been a perennial concern since the launch of IDA’s hybrid model and the use of concessional partner loans. The reality is that these financial innovations have allowed IDA to grow significantly and rendered partner contributions more financially efficient since they leverage a bigger program. Moreover, IDA cannot sustain a large grant program over time absent donor contributions.

Will the market undermine IDA’s development mandate? Donor-funded concessional windows were largely set up to insulate MDBs from having to balance development objectives with the exigencies of capital markets. When IDA’s hybrid model was introduced many stakeholders worried that the vagaries of maintaining a AAA would implicitly push IDA to eschew riskier countries or embrace a less concessional model. In practice, IDA’s policy-based allocation (PBA) model—which allocates resources to countries according to a set formula—and its traffic light system for allocating loans and grants based on country’s debt sustainability have helped maintain the integrity of IDA’s resource allocation process. And since the IDA hybrid model was introduced, IDA has actually increased its program in fragile states.

Is the model sustainable if interest rates go up? IDA’s hybrid model is sensitive to interest rate fluctuations especially under a scenario where IDA uses equity to buy down market loans to concessional levels. In a benign interest rate environment this is a financially appealing arrangement, but should interest rates shoot up significantly, it would make this model more expensive (i.e., it would require more reflows and/or grants to buy-down market rates to concessional terms). IDA stakeholders should be prepared to take this risk today with the understanding that the model could need adjusting if conditions tighten. For instance, IDA could seek to borrow on longer terms or enter interest rate swaps.

Conclusion

The financing scenarios laid out here illustrates a financially efficient and ambitious approach to financing IDA-20. There are many different configurations that this framework can support depending on how much donors can pitch in. And the more donors step up, the more IDA can do. But in a once-in-a-century crisis, IDA’s large equity base gives it room to meet the moment even if donors’ pockets prove to be shallow. Over the next nine months, IDA stakeholders should work closely to agree on a framework that puts IDA’s equity to the most productive use possible for the world’s poorest countries. In a once in a century global crisis, this is not just smart financial policy, but also a moral imperative.

[1] https://blogs.imf.org/2021/02/24/the-great-divergence-a-fork-in-the-road-for-the-global-economy/

[2] https://blogs.worldbank.org/voices/covid-19-could-leave-lasting-economic-scars-poorest-countries-its-everyones-best-interest

[3] http://documents1.worldbank.org/curated/en/348661486654455091/pdf/112728-correct-file-PUBLIC-Rpt-from-EDs-Additions-to-IDA-Resources-2-9-17-For-Disclosure.pdf

[4] Each donor has a different payment schedule for IDA. Some donors, including the U.S. pay their IDA contributions in three equal annual installments, while others opt to disburse their payments over a longer encashment period.

[5] DSC is the difference between Total Resources Available (i.e., IDA’s equity plus accumulated provision for loan losses) minus Total Resources Required (the minimum capital required to cover losses under a downside scenario) minus a small Conservation Buffer.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.