Recommended

As the COVID-19 pandemic accelerates, global leaders are quickly realizing that we need a bigger, better toolbox to effectively fight the novel coronavirus. In some cases, we need to quickly scale up production of existing health products and technologies—personal protective equipment (PPE) for health workers and others on the front-lines; ventilators for patients in critical condition, including ones that can work in low-income country (LIC) settings; effective antiviral drugs (pending better efficacy data from ongoing trials); and cleaning and sanitizing supplies for the broader population. In other cases, we need rapid research, development, and scale-up for completely new health technologies—point of care diagnostics, testing kits/platforms to be used in the community, new or repurposed therapies, and digital technologies to support epidemiological tracking and contact tracing. And then, of course, there’s the holy grail: development and widespread administration of a safe and effective vaccine that offers population-wide protection, ultimately allowing a global return to business-as-usual.

So how can we optimize our chances of getting these high-value health technologies as quickly as possible—and in the massive quantities we need? Many have (rightly) focused on getting urgent supply-side measures underway (i.e., financing through up-front grants, donations, or requisitions) for the most pressing supply constraints. These include investments in early-stage R&D and clinical trials; requisition of existing supplies for public health use; repurposing of existing manufacturing capacity for priority equipment (with calls to further expand this by government mandate); donations of goods from the private sector and international actors; and public-private partnerships to expand testing capacity.

But in addition to these important steps, we also need to tackle the demand (market) side of the equation, especially for vaccines. Whereas diagnostics can quickly come to market without safety risks for immediate use, and experimental therapies mostly relying on repurposing existing drugs with known safety profiles (where efficacy can be established within 1-2 month trials), an effective vaccine would only come to market after a far longer timeframe required to establish safety and efficacy in vast numbers of otherwise healthy individuals. A safe and effective vaccine would be enormously valuable, but the longer development timeline (at least 12-18 months) creates large market risk for potential developers (would people want to buy it?) on top of substantial scientific risk (would the product work?). By the time a vaccine comes to market, perhaps no one would want or need it anymore. What if the disease dies out naturally (as happened with SARS or MERS), is fully controlled (like the 2014/2015 West African Ebola outbreak), or enough people contract it and recover to establish herd immunity, perhaps as a result of a managed strategy of using testing to enable social distancing measures to be relaxed and economic activity revived? What if someone else comes to market first with a better vaccine and a company’s up-front investment was for nothing? What if we have enough affordable and effective therapeutic options available to manage the threat of COVID-19, such that a vaccine is no longer needed?

These are all great outcomes for society at large—but highly problematic if you’re a company considering whether potential R&D costs are likely to be justified by ex post facto sales of a successful product, and therefore highly problematic for the global community that desperately needs a vaccine in case those scenarios do not come to pass. We have also seen moves, discussed below, to restrict patent rights for COVID vaccines and therapies; there is a strong public health rationale for doing so, but perceived intellectual property (IP) risk will also inevitably deter private sector investment. The bottom line: if we want industry to invest up-front in the high-cost, risky business of vaccine development, we need to offer the promise of a predictable market for an effective vaccine that offers both access for all and a reasonable return on investment—de-risking market (commercial) uncertainty while still expecting companies to absorb the scientific risk that their products will fail.

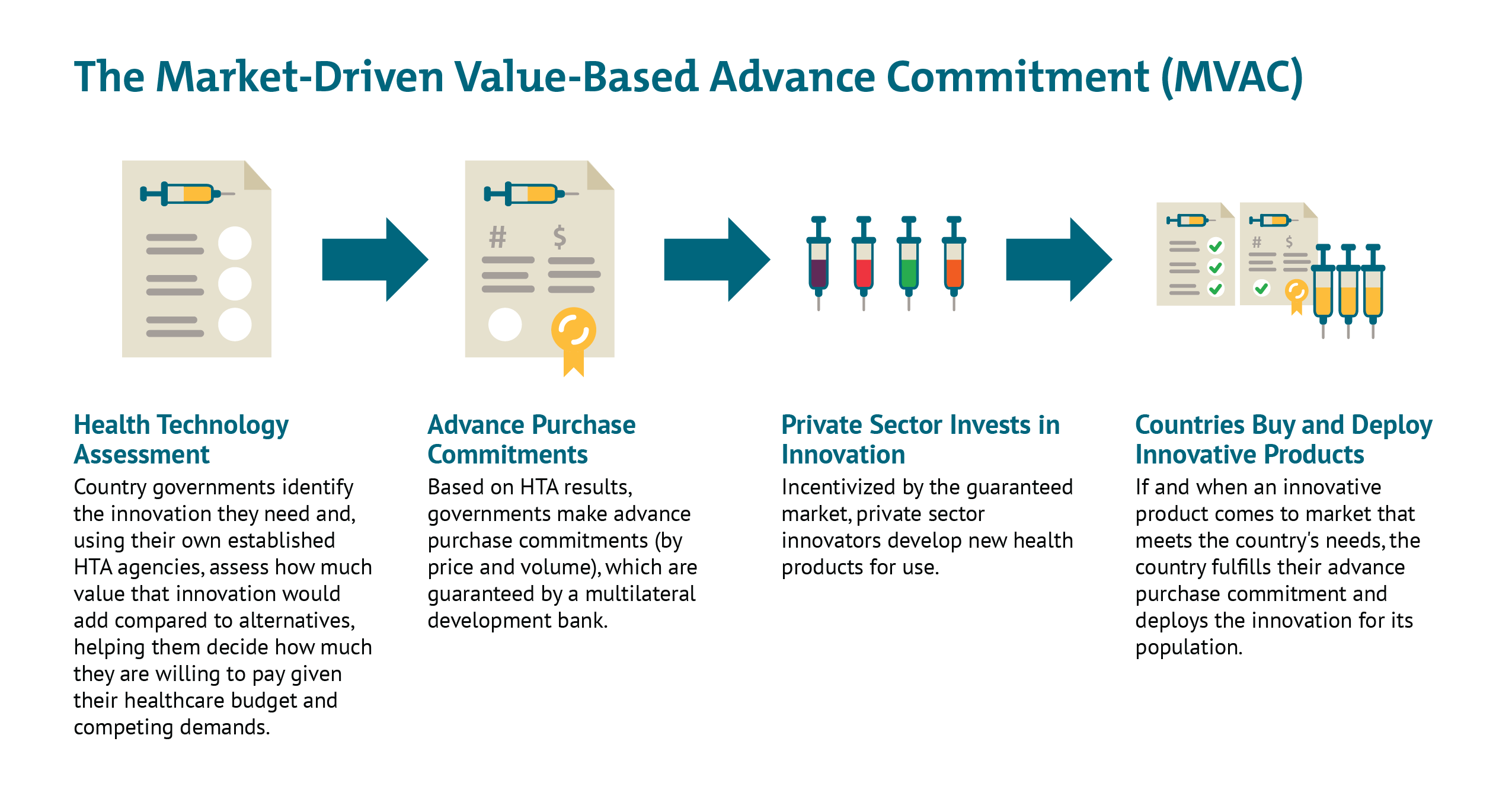

Since long before the novel coronavirus pandemic, CGD researchers, together with other colleagues, have worked to strategically de-risk health technology markets and strengthen demand-side incentives for priority diseases, particularly those affecting the poor and vulnerable in low- and middle-income countries (LMIC). More than a decade ago, researchers at CGD helped develop the advance market commitment (AMC) used to incentivize development of a pneumococcal vaccine tailored to the LMIC disease burden. Once deployed at Gavi, the AMC helped accelerate investments in manufacturing capacity for rapid scale-up of the vaccine, which has saved an estimated 700,000 lives by 2020. More recently, building from the AMC model, we developed a new idea to help address intractable health challenges like tuberculosis where markets are failing—the market-driven, value-based advance commitment (MVAC)—which leverages value-based demand from LMIC payer agencies to create a market for new health technologies.

Below, we consider demand-side options for de-risking the market, incentivizing innovation, and scaling a potential vaccine for the COVID-19 crisis. Many of these same mechanisms could be used, with some adaptations, for other priority equipment and technologies, though the market failures there may be less severe. We focus here on the immediate crisis at hand, but this moment also offers an opportunity for governments to think bigger. How can all governments look beyond COVID-19 to other emerging and yet unknown pathogens—from novel viruses to drug-resistant bacteria—and put in place responsive, resilient, fit-for-purpose systems for high-value innovation and scale-up? And how can LMIC governments use demand side incentives to proactively tackle the routine and intractable health challenges their citizens face, from TB to HIV, snake bites, and renal failure?

Relevant Characteristics of a Potential COVID-19 Vaccine Market

To understand the potential scope and appropriate application of demand-side incentives, it’s worth outlining a few important characteristics of the likely market for a theoretical vaccine:

- Shared burden and demand across high-income, middle-income, and low-income countries: Unlike most other infectious disease challenges (most of which are predominantly concentrated in LMICs—for example Zika, rabies, and Ebola), the impacts of COVID-19 are broadly shared across countries at different wealth levels. And while the outbreak started in China, where it took a massive toll on lives and the economy, the burden is now most concentrated in some of the wealthiest countries on earth: Italy, France, Spain, and the United States, among others. But the virus is already spreading (prompting dramatic national shutdowns) across much of Africa, Latin America, and Asia. If coronavirus remains a major health threat by the time a vaccine comes to market, we can expect enormous demand in the high-income country (HIC) market—but also a need to equitably scale production for LMIC populations with much less ability to pay.

- Non-viability of a traditional profit-maximizing sales strategy: In the current environment, innovator companies (and national governments) are likely to find that a traditional profit-maximizing sales strategy is simply not politically or economically viable. Given the level of need and widespread economic, health, and social ramifications of an uncontrolled pandemic, governments in LMICs (and perhaps HICs as well) are very likely to take whatever steps are necessary to secure affordable vaccines for their populations, including by invoking flexibilities under the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), like compulsory licensing. Already, the government of Costa Rica and advocacy groups are calling for a global shared pool of rights for COVID-related IP with “free access or licensing on reasonable and affordable terms,” arguing (justifiably) that these are vital and urgent global public goods. Germany, likewise, is giving itself legal authority to limit patent protection related to pandemics as necessary, as is Canada. Companies and politicians alike are similarly finding that a traditional sales/IP strategy will provoke enormous popular backlash. US Health and Human Services Secretary Alex Azar infamously refused to promise a congressional committee that a coronavirus vaccine would be broadly affordable; the popular outcry eventually forced the Trump administration to walk back his remarks. And just this past week, Gilead asked the government to rescind special “orphan drug” status for remdesivir (a potential COVID-19 therapy)—which would have offered further market exclusivity—after finding itself on the receiving end of widespread outrage.

- Need for massive, rapid scale-up: If and when a vaccine is made available, the scale of production needs will be enormous. In addition to incentivizing necessary R&D, we would need to have large-scale manufacturing capacity in place and ready to start production. While some existing capacity could be reassigned, new capacity will be needed; ideally, at least some additional capacity would have to be built in advance of the clinical trial results, increasing the risk/losses in case of failure.

- Existence of substantial push funding: Many governments and foundations are already paying at least part of up-front costs for early stage R&D, sometimes through private companies. We need to account for these public investments to avoid “double-paying” on both sides, while also maintaining an incentive for private sector investments.

In short, we have potentially immense but unpredictable global need; we need solutions that combine the urgency of market entry with the imperative for quick global scale up, including to countries with less ability to pay; and we need a system that creates incentives for potential vaccine development through private investment while simultaneously recognizing public R&D contributions and the non-viability of a traditional sales strategy. If we succeed now, we can both accelerate the fight against COVID-19 and set the groundwork for a faster global response to the next crisis.

Potential Demand-Side Responses

Given this landscape, how could a demand-side incentive best be structured? Below we consider three high-level scenarios, with some brief thoughts on their potential upsides and pitfalls:

- Business as Usual: In this scenario, we have intensive push funding (as we are currently seeing) but no explicit demand-side intervention. One or more companies will likely proceed to market with a vaccine (supported by public and philanthropic funding), but other companies will opt against up-front investment given the high commercial risk; the vaccines that make it to market may be inferior to others that potentially could have been developed because of push funders “picking winners” from the early prospects, before their push money is exhausted. If and when an effective vaccine comes to market, there will be fierce competition among countries to access it first, driving up the price and (likely) meaning that the wealthiest countries receive preferential access because of their higher ability to pay (as happened with H1N1, where wealthy countries quickly bought up almost all global vaccine supply and vaccines arrived late to LMICs). Gavi and other global funders may be able serve LICs with a genericized version (supported by voluntary licensing), but there may well be a delay in doing so given limited manufacturing capacity. MICs, in turn, would likely remain underserved by both the market and global donors; instead, they would most likely turn to compulsory licensing and engage local biologic producers while the wealthier population segments pay out of pocket—but again, with a significant delay and inevitable legal fights.

- An Advance Market Commitment (AMC): In this scenario, country governments and/or foundations—ideally in partnership—put aside a pot of money dedicated to purchase of a potential vaccine meeting a prespecified target product profile (TPP), which does not yet exist and would need to be agreed upon. It could be structured as a market entry prize (lump sum) or a price-volume commitment; either way, the price/prize would be fixed in advance. As a condition of receiving the AMC guarantee, governments could also require the successful innovator(s) to license their vaccines out to local biologic producers at low or zero cost, helping facilitate widespread scale-up.

The AMC approach would help resolve some of the challenges with the “business as usual” scenario. It would provide a guaranteed commercial market for a successful vaccine and thereby offer a strong demand-side incentive to get a vaccine to market; it would also resolve some of the IP issues by facilitating widespread voluntarily licensing and pre-agreed prices for governments to pay. However, this approach could create other problems. A “winner-take-all” approach would reward the first company to market with a fixed prize, with no consideration of that product’s value proposition (other than meeting the pre-specified TPP). While some volume within the overall committed pot of money could be reserved for subsequent entrants (as in the Gavi-led pneumococcal vaccine AMC), this could still mean that the world gets stuck purchasing suboptimal vaccines with other (potentially superior) products “locked out” of the AMC and so dissuaded from clinical development and market entry. On the other hand, “good enough” first or subsequent entrants which meet only part of the TPP may find themselves shut out of the market. - A Market-Driven, Value-Based Advance Commitment (MVAC): In this scenario, the world builds on the AMC with a couple of important adaptations. Most importantly, the MVAC incorporates an assessment of value; a more effective vaccine would receive a more generous market entry prize (either a lump sum or price/volume commitment), and the total contribution from each country would scale as a function of their respective abilities to pay. Early health technology assessment (HTA) would be used to understand how helpful a vaccine would be in different country contexts and the ability of each country to pay (but not overpay); the results would then be “locked in” to provide overall market predictability. Further, the MVAC could use a financial intermediary like a multilateral development bank to underwrite countries’ own advanced purchase commitments, so countries do not need to put scarce resources aside until an effective product comes to market. HICs and MICs alike could participate in the mechanism to guarantee a large total market/entry prize, but their contributions to the total market would vary based on their respective ability to pay and population sizes. Governments could also consider constructing the MVAC to offer multiple value-based entry prizes to multiple developers that meet the minimum effectiveness threshold as an incentive to keep many different potential innovators in the game. This would hedge risk against late failure of one or more early candidates and against the possibility of safety risks after widespread deployment requiring restricted use or withdrawal from the market of the first entrant. As a condition of accessing this guaranteed market, HIC and MIC governments could require the successful innovator(s) to license their vaccines out to generic producers at low or zero cost, helping facilitate widespread scale-up across LICs (potentially financed with Gavi support).

Like the AMC, the MVAC de-risks the commercial market, resolves potential IP issues, and offers an avenue for widespread, rapid uptake across countries with divergent abilities to pay. But the MVAC is a superior option because it incorporates flexibilities to reward value—and ensures we continue to incentivize investments in the best (and safest) possible products. The MVAC signals to industry that the market values their up-front investments and those investments have the potential to pay off down the line. And beyond the immediate challenge at hand, the MVAC sets a sustainable precedent for future emerging challenges, helping prove to developers that a market will exist for high-value innovations and they should invest aggressively to tackle global challenges.

Work is needed to explore these options. In our view the MVAC offers a better route as it differentiates price according to efficacy, so incentivizing development and use of vaccines with higher rates of disease prevention, while ensuring that vaccines are available at manufacturing cost for LICs. Without consideration of value, countries risk getting locked into purchasing inferior or cost-ineffective products that divert scarce resources from other potential COVID-19 responses, including potential therapies, non-pharmaceutical interventions like testing/contact tracing, and later, superior vaccines that may be boxed out of the market if all funding immediately flows to a first, poor-value or minimally efficacious entrant. Though the consideration of vaccine value for a pandemic virus will necessarily differ from routine vaccination—in large part due to the enormous social and economic costs of existing non-pharmaceutical interventions—it can nonetheless build on existing systems for vaccine value assessment that are well-established, supported by WHO guidelines, and used to inform listing decisions and pricing in countries like the UK as well as in LMICs like Thailand, the Philippines and the PAHO region. Adjustments can be made to ensure that any push funding of a successful candidate is taken into account, and that value-based prices for HICs and MICs only apply to the volume required for the innovators to get an appropriate return on investment, with much lower prices applying after that point.

Additonal Design Issues to Consider

- Funding will be needed for LICs to purchase the vaccine, even at cost prices, given the potential size of the target vaccinated population. The International Finance Facility for Immunisation could be used to raise funds.

- Work can begin now to formulate and align behind a TPP for essential and desirable vaccine attributes, considering needs in both HIC and LMIC settings. The TPP should be linked to an understanding of appropriate vaccination strategies depending on different scenarios for the progress of the outbreak when the vaccine comes to market.

- A vaccine licensed by the US Food and Drug Administration will likely attract a Priority Review Voucher for medical countermeasures. This can be sold for around $100m and will provide another source of revenue.

- Because many vaccine developers in the race for COVID-19 vaccines are leveraging platforms and vectors used in other products (such as candidate vaccines for Ebola, HIV, and RSV), there may be ways to leverage complementary investments or incentives that would support other promising vaccines in their portfolios, particularly for infectious diseases that have more predictable markets. For instance, if there were an agreement to purchase an RSV vaccine built on the same platform by a large procurer, for example Gavi, this could ease the development of the COVID-19 vaccine and help manage the risk of large investments needed now to expand manufacturing capacity.

- In anticipation of a widely licensed potential vaccine, governments could enter into a two-part contract with potential contract biological manufacturers who would receive licenses from the innovator. The first part of the contract would enter force immediately to build and hold manufacturing capacity for production of a vaccine (at a flat rate), even before a vaccine has come to market. The second part of the contract would enter force once a vaccine is licensed and the reserved manufacturing capacity is put to use (on a per-unit cost-plus basis). Countries could solicit potential suppliers through open bidding to ensure they receive manufacturing capacity at competitive prices. High-quality manufacturing, meeting standards agreed by regulators and the innovator company—and vigorously enforced by regulators—would be a key requisite.

Action is required now to set in place appropriate funding and incentive tools. We have made the case for a coordinated advance commitment that can incentivize private sector delivery of high-quality vaccines against COVID-19 while ensuring that the populations of LICs gain access through commitments on price, investment in additional manufacturing capacity, and funding to support procurement.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.