Recommended

Key recommendations

- Confront China over harmful lending practices through a structured and goal-oriented bilateral policy dialogue, enlisting like-minded countries to provide support in multilateral settings like the World Bank and G20.

- Cooperate with China on the two most pressing global challenges, the COVID-19 pandemic and climate change.

- Compete with China to offer development finance that puts development first.

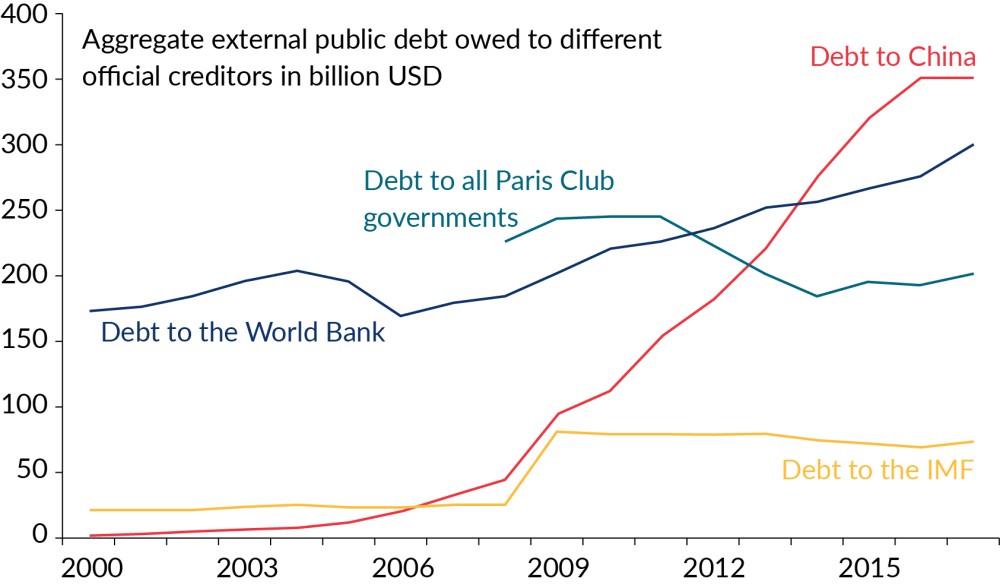

Dealing with China’s role in developing countries is fraught. The Belt and Road initiative is emblematic of a global approach defined by government-directed financing for large-scale infrastructure projects. Over the past decade, China has pursued this model aggressively, making it the largest creditor to developing countries globally. Today, China’s outstanding claims on developing country governments stand at $350 billion, far exceeding the claims of the United States and all other wealthy country lenders combined, which stand at $200 billion (figure 1).[1]

Figure 1. China is the largest official creditor in Developing Countries

Reprinted with permission from Horn, Reinhart, and Trebesch, 2019.

As much as current US policy has sought to characterize China’s lending program in blunt and strictly negative terms, the reality is mixed. It is a myth that massive Chinese lending has only supported white elephant projects and bridges to nowhere. In reality, evidence suggests that Chinese financed infrastructure projects have had positive economic effects for many developing countries.[2] These successes, measured in miles of railway and kilowatts of energy across Asia, Africa, and Latin America, have posed a challenge for US policymakers as they have sought to convince developing countries that China’s money should be rejected.

Beyond exaggerated and toothless criticism aimed at convincing governments not to borrow from China, the Trump administration sought to compete directly with the Chinese government by offering financing to support development projects. To date, these efforts, branded through initiatives like the Blue Dot Network and Clear Choice, have been modest in size and lacking in coherence or sustained effort.

There may be a limited role for this form of competition, but it needs to be part of a broader and deeper strategy that does not view developing countries as a Cold War-style battlefield. At the same time, adopting a better policy framework is not simply a matter of returning to a pre-2017 approach, which was slow to recognize China’s rise as creditor to developing countries and overly patient in seeking reforms to Chinese lending practices.

Since that time, many things have changed. China has changed, becoming more authoritarian domestically and more aggressive on behalf of strategic interests abroad. Developing countries have changed, many now straining under debt burdens that makes China’s lending model less attractive, but also desperate for financing to confront the economic crises unfolding in their countries.

And finally, US attitudes toward China have changed irrespective of party. The shift reflects a sense that the economic playing field with China is uneven and too slow to level, and that China’s growing authoritarianism and human rights abuses require a tougher line. Democratic and Republican policymakers now view China’s global motives with deeper suspicion, including the role of Chinese firms in the United States and other large economies, as well as China’s behavior in strategically important developing countries.

These dynamics make it difficult, but just as necessary, to pursue a policy re-set when it comes to China’s activities in developing countries. The Biden administration should abandon the current approach in favor of a strategy that confronts China in areas where there is clear harm to developing countries, seeks to cooperate with China on global challenges that unavoidably require active collaboration between the world’s two large economies, and competes with China through a committed effort to mobilize development finance in ways that put sustainable development first.

Confront China

A US policy re-set needs to start with confronting China over its harmful lending practices. As much as developing countries derive some benefit from Chinese financing, there are also clear harms related to inadequate debt risk frameworks, tied procurement arrangements, poor project standards, and generally opaque lending arrangements. For all the bellicose rhetoric of the past four years, direct confrontation on these issues has been remarkably absent from US policy. Whatever the motives of the Trump administration’s tough talk, it did not emerge from a considered strategy aimed at changing China’s behavior. In contrast, the Bush and Obama administrations sought to engage through the US-China bilateral dialogue. Now widely viewed as yielding too little progress in the face of Chinese intransigence, particularly on trade and investment issues, the dialogue made some headway and provided exactly the sort of framework in which frank confrontation was possible, and most likely to get results, when it comes to development policy issues.

In fact, the dialogue late in the Obama administration prioritized development issues, sensing an opportunity for significant progress. Bilateral discussions had already yielded progress on the climate agenda, and in a notable potential step towards reforming its overseas lending policies, China was close to joining the Paris Club of creditors by the close of 2016, before the incoming Trump administration curtailed direct engagement with China on these issues.

In 2021, the Biden administration should initiate a new bilateral dialogue with China, prioritizing comprehensive reform to official lending practices. A global framework to discipline the lending practices of all governments is the end goal, but it will only be achieved if the United States and China can strike a deal with each other. The United States can bolster its position in the bilateral dialogue by enlisting the support of likeminded countries in multilateral settings like the World Bank and G20.

The new bilateral agenda should include:

A framework for procurement standards related to official finance, balancing the objectives of export credit agencies with the interests of developing country borrowers. Development financing that is “tied” to the use of the lending country’s firms can be associated with inflated project costs, poor quality, and poor project selection. This defining feature of Chinese lending, perhaps more than any other, can lead to bad outcomes for developing countries. Yet, China’s use of tied procurement is only unusual in its scale. Export credit agencies, including the US Export-Import Bank, exist for the same purpose. And a new class of development lenders, akin to the China Development Bank, are further expanding the envelope for financing tied to the use of the lenders’ firms for project goods and services. There is a pressing need for procurement standards that discipline all forms of governments’ foreign lending and limit the degree to which attractive (and subsidized) lending terms are attached to procurement requirements.

A commitment to transparency and to environmental and social standards for all government lending. There are currently no global standards that apply across all categories of official lending when it comes to the “safeguards” policies of major multilateral lenders like the World Bank. The practices of China’s lenders are notoriously opaque, which in turn makes it difficult to assess the degree to which they follow any consistent environmental or social (labor, gender, local community) standards.

A post-Paris Club arrangement for addressing poor country debt distress that retains existing principles while allowing for new conventions and convening arrangements that are attractive to China and other non-Paris Club countries. Bringing China into the Paris Club has proved an elusive goal. China’s lending to developing countries accounts for more than all current Paris Club members combined. Without China’s membership or a new arrangement that joins China and Paris Club members, developing countries will continue to face a fractured and ad hoc approach to addressing debt distress.

The United States and other club members will need to make some concessions to bring China into a new arrangement: more limited data reporting, more flexibility on comparability of treatment, more restrictive definitions of official credits (allowing for some of China’s state-owned banks to be deemed “commercial” lenders rather than official lenders). Any of those would weaken the effectiveness of debt treatment in the near term, with the upside being broader coverage and a stronger basis for future progress with a comprehensive group of official creditors. In this vein, the US policy will only be successful here if it is oriented toward convincing China that this agenda is in its interest, whether reputationally (at a time when there is considerable backlash globally to China’s lending practice) or economically (in the sense that better coordination and cooperation will help China better navigate the current crisis unfolding across a large number of its borrower countries).

With China at the table, there is the basis for a bigger agenda that seeks to articulate “rules of the road” for governments and government-owned entities who lend to developing countries. A new sustainable lending agenda should seek to avoid debt distress situations through better lending practices that are responsive to debt risks, transparent when it comes to contract terms, and generally facilitate rather than impede inter-creditor coordination and cooperation with the International Monetary Fund (IMF) and other multilateral institutions.

Cooperate with China

US policy needs to return to seeking cooperation with China on global challenges. The COVID-19 pandemic should have spurred this approach, recognizing that the United States will remain vulnerable to the virus until it is brought under control globally. Instead, we have seen a uniformly combative US stance toward China throughout the crisis, which has left all countries worse off and threatens further disastrous consequences when it comes to containing the pandemic in the months ahead, particularly in developing countries. China should have been more transparent about the virus from the outset, but now its spread represents a global challenge–one which the United States and China are uniquely positioned to bring resources to bear in addressing. Both countries would be well served by developing commitments to avoid beggar-thy-neighbor approaches that would detract from securing and allocating supplies globally.

The same cooperative imperative applies to addressing climate change. Nothing we do in the United States will effectively mitigate climate change within our borders if other countries, and China in particular, are not also taking effective measures.

In short, the world’s largest two economies must find a way to work together to address problems that are not contained within national borders and depend critically on their coordinated action.

The cooperative agenda should include:

Pandemic biosecurity preparedness and response. While the emergence and spread of COVID-19 has worsened the US-China relationship, the reality of a global pandemic provides a compelling motive for cooperation on an agenda for pandemic biosecurity preparedness and response. Both countries are engaged in a race against the clock, investing large sums in vaccine research and favoring their own domestic manufacturers in the process. Beyond vaccine approvals, scaling up production to support widespread distribution of a safe and efficacious vaccine globally will present a host of logistical challenges. With major stakes in supply chains for active pharmaceutical ingredients, adjuvants, and even glass vials, China’s cooperation will be critical to reaching the needed scale—including making a vaccine available to populations in lower income countries.

The US and China also have an important opportunity to commit upfront to transparency, data-sharing, and standard reporting requirements that will give confidence to the safety and efficacy of any newly released vaccine and set the stage for sustained cooperation across a wider array of medicines that are critical for health progress in developing countries. Cooperation between each country’s regulators will be key to this agenda.

Moving forward, both countries should look for opportunities to bolster their commitment to the Global Health Security Agenda with an eye toward identifying mechanisms to incentivize investments by lower income countries in their own preparedness. This should include working through the Health Emergency Preparedness and Response Multi-Donor Fund at the World Bank.[3]

Climate change mitigation and adaptation. The Trump administration’s withdrawal from the multilateral Paris Agreement overshadowed the collapse of a US-China policy dialogue on climate action. Yet, this bilateral dialogue was a centerpiece of the Obama administration’s approach and proved successful in leveraging the weight of the world’s two largest economies and emitters to achieve a multilateral agreement. Restoring a bilateral dialogue should proceed from a US return to the Paris Agreement. In addition to the core elements of a renewed domestic climate agenda in the United States, the two countries should seek to cooperate on a program of support for developing countries as they seek to adapt to climate change realities within their borders.

Multilateralism. Beyond these two pressing challenges, the Biden administration should look to China’s robust participation in multilateral institutions like the IMF and World Bank as productive settings for cooperation. The aim is to increase the level of Chinese financial contributions to these institutions, where the money will be spent transparently, and to use the norms and membership obligations of these institutions to exert pressure on China to reform its bilateral lending and aid practices. After years of pressure from the United States and other donor countries, China has been increasing its multilateral aid, now counting among the top 10 donors to the World Bank. But China continues to be a reluctant multilateral donor and the United States should continue to press for higher contributions.[4]

In turn, the United States will also need to adjust its stance toward China’s multilateralism, which has grown increasingly obstructive. Actively encouraging China’s full participation in the IMF and World Bank also means accommodating China’s legitimate desire for adequate voice and voting rights in each institution. Though often exaggerated, frustration over progress in its voting position in the IMF has been cited by China-watchers as a motivation for China’s creation of the Asian Infrastructure Investment Bank (AIIB).

The success of the AIIB to date, with over 100 member countries, poses a challenge to the United States and China together—will pressures toward economic decoupling include a decoupling when it comes to multilateral institutions, or can the two countries embrace a common set of institutions? So far, China has chosen to lead the AIIB in a manner that embraces multilateral norms and standards. This approach deserves a more welcoming stance from the United States. Short of US membership in the institution, which would come with considerable legal, political, and budgetary hurdles in the United States, US policy can be more welcoming by encouraging greater cooperation between US-led multilateral institutions (the World Bank, Inter-American Development Bank, etc.) and the AIIB.

Compete with China

The United States competes with China geo-strategically around fundamental issues of democratic governance, rule of law, and human rights. These issues should continue to anchor the US agenda in developing countries. But current US policy has also sought to define competition in a narrower, commercial sense. The 2019 launch of the US International Development Finance Corporation (DFC) was framed by the Trump administration as a US government-backed effort to compete with China’s array of development financing institutions, albeit on a smaller scale.

DFC is well positioned to play this role to a limited degree, but there is also a risk that targeting competition with China could undermine DFC’s development effectiveness. Making appropriate use of DFC vis-à-vis China’s engagement in developing countries will require embracing new opportunities that would enhance competition with China in ways that benefit these countries and avoiding certain activities that could ultimately cause harm.

Embrace international competitive bidding and open procurement. A striking feature of the statute creating DFC was the elimination of a strict “US nexus” for DFC investments. Unlike Ex-Im Bank, DFC is not obligated to only finance projects in support of US firms and investors. This brings DFC much closer in principle to the open procurement model that prevails at the multilateral development banks and stands in stark contrast to Chinese government lenders like China Development Bank and China Exim, which require the use of Chinese firms in any transactions they finance. Truly embracing an open model at DFC will improve the development prospects of its investments by relying on competitive mechanisms for allocating financing. But underlying political pressures will continue to weigh on DFC to promote US firms as part of its US taxpayer-funded mission. Too much indifference to these pressures could harm the agency over time through budget cuts or more restrictive changes to its governing statute. DFC can best balance these pressures and distinguish itself from Chinese lenders by putting forward projects in the early years that clearly demonstrate the value of an open process in terms of development impact and reputational benefit for the United States, and by promoting DFC financing within the United States to encourage a larger pool of high quality prospects among US firms.

Expand use of sovereign lending under a sound debt risk framework. DFC was conceived as a private sector investor in developing economies, building on the legacy of OPIC. But there is an exaggerated notion of what can be achieved in terms of strictly private sector finance, particularly in relation to China’s financing activities. Large scale public infrastructure, which defines China’s flagship Belt and Road initiative, typically requires lending to governments and/or the use of sovereign guarantees. The harm of China’s model is not that it lends to governments per se.

In turn, it is not necessarily a strength of the US model if it only pursues commercial projects. The US government should be open to making greater use of DFC’s sovereign lending instruments, recognizing the need to work with governments when it comes to large infrastructure and to do so in a way that distinguishes the United States from China. DFC can offer a compelling alternative model by implementing a strict framework that commits to guard against over-indebtedness; contract and project transparency to guard against corruption and promote accountability; competitive procurement arrangements to ensure low costs and high quality; and strong project safeguards to guard against environmental and social harms. In short, China’s model is not problematic because it lends to governments; it is problematic because it does so in a way that exploits the lack of safeguards and standards in these critical areas.

Define DFC’s role within the full US government toolkit, recognizing that not every competitive response to China needs to come from DFC. DFC is the US government’s only dedicated source of development finance (loans and equity investments), yet it is just one part of a broader toolkit to support development goals globally. Offering developing countries a better alternative to Chinese finance can also mean the provision of traditional aid through USAID, a multi-sector compact through the Millennium Challenge Corporation, export credits through Ex-Im Bank, or technical assistance through the Treasury Department. The US government has long struggled with effective coordination across an array of agencies and programs on behalf of development objectives, and there is no easy fix. But recognizing the full array of tools in the toolkit will mean broader reach for the US government in responding to China and will avoid setting up DFC to fail.

Co-finance with bilateral and multilateral institutions that apply comparably high standards. With just $22 billion in existing exposures, DFC is too small to match the Chinese government’s $350 billion global footprint. But the US government is in a strong position to leverage DFC’s capital by partnering with multilateral institutions like the World Bank (with over $300 billion in existing exposures), as well as bilateral development finance institutions in Europe and Japan. Collectively, these sources of development finance, which tend to adhere to a comparable regime of standards, outpace Chinese lending and could serve as an effective check on Chinese activities globally. With scaled up co-financing arrangements governed by a common set of standards, these institutions can deliver projects with higher development impact and exert pressure on China to address the weaknesses in its financing model.

Avoid competing with China based on large subsidies and cutting corners on standards. Financing from the Chinese government is attractive to developing countries because it is typically cheaper than commercial lending and has fewer strings attached (environmental standards, labor standards, transparency requirements) than other official lenders like the World Bank require. Direct competition with Chinese lenders will create pressure to offer deeper subsidies no matter the circumstances of the borrower and to expedite project approvals by giving short shrift to project standards. The pressure comes from the desire to win projects, particularly if there are US firms involved. Though this competitive race to the bottom would seem to benefit developing countries to some degree by offering them the cheapest possible financing, it also risks loading these countries with too much debt and delivering projects that lack basic standards and protections for local populations. In short, the United States should avoid a competition with China that entails adopting the worst features of Chinese finance.

Avoid putting strategic relationships at the forefront of the investment model. Using development finance primarily to compete with China rather than to achieve development gains for poorer countries will create pressure to go where the stakes are highest vis-à-vis China, not necessarily where the potential gains are highest in terms of development progress. Attaching too much importance to strategically important countries could also lead to poor project selection, by making US decisions overly deferential to the political interests of a borrowing country government when it comes to badly conceived projects.

Avoid a focus on large projects in large countries and markets. DFC has a statutory mandate to focus on the poorest countries, with activities in higher income developing countries permitted on an exceptional basis. In practice, this has already proved challenging for an agency that seeks to earn positive rates of return on behalf of US taxpayers.[5] Competing directly with China means focusing on large-scale financing for inherently high-risk projects. Such projects (transport infrastructure and energy) are even riskier in poorer countries. In practice, this will tend to push the DFC into safer markets, which means devoting a large amount of its capital to the relatively wealthier economies. This dynamic threatens to undermine DFC’s core development mandate.

Policy recommendations

The Biden administration should re-set US policy towards China to prioritize confrontation and cooperation, with a more limited role for competition. A “3 C’s” agenda will better discipline China’s approach as a creditor, marshal resources from China to meet global challenges, and improve US standing in the developing world.

To this end, the Biden administration should:

Confront China over its harmful lending practices by opening a new bilateral dialogue prioritizing comprehensive reform to official lending practices. The bilateral agenda should include:

- A framework for procurement standards related to official finance, balancing the objectives of export credit agencies with the interests of developing country borrowers

- A commitment to transparency, environmental, and social standards for all government lending

- A post-Paris Club arrangement for addressing poor country debt distress that retains existing principles while allowing for new conventions and convening arrangements that are attractive to China and other non-Paris Club countries

Cooperate with China in seeking to address global challenges. The cooperative agenda should include:

- Pandemic biosecurity preparedness and response

- Climate change mitigation and adaptation

- Multilateralism, with China increasing its engagement in institutions like the IMF and World Bank and the US accommodating China’s desire for adequate voice in these institutions

Compete with China to offer development finance that prioritizes development, notably through changes to the way the US Development Finance Corporation operates.

- Embrace international competitive bidding and open procurement

- Expand use of sovereign lending under a sound debt risk framework

- Define DFC’s role within the full US government toolkit, recognizing that not every competitive response to China needs to come from DFC

- Co-finance with bilateral and multilateral institutions that apply comparably high standards

- Avoid competing with China based on large subsidies and cutting corners on standards

- Avoid putting strategic relationships at the forefront of the investment model

- Avoid focusing on large projects in large countries and markets

Additional reading

Amanda Glassman and Scott Morris, 2019. “The US and China Have Very Different Takes on IDA and the Global Fund: Why That Matters for the Future of Multilateral Aid.” CGD Blog. Center for Global Development.

John Hurley, Scott Morris and Gailyn Portelance, 2018. “Examining the Debt Implications of the Belt and Road Initiative from a Policy Perspective.” CGD Policy Paper 121. Center for Global Development.

Sebastian Horn, Carmen Reinhart, and Christoph Trebesch, 2019. “China’s Overseas Lending.” NBER Working Paper 26050. NBER.

Scott Morris, 2020. “Testimony Before U.S.-China Economic and Security Review Commission: China in Africa.” Congressional Testimony, May 8, 2020.

Scott Morris, 2019. “The Kunming-Vientiane Railway: The Economic, Procurement, Labor, and Safeguards Dimensions of a Chinese Belt and Road Project.” CGD Policy Paper 142. Center for Global Development.

Scott Morris, 2016. “Responding to AIIB: U.S. Leadership at Multilateral Development Banks in a New Era.” Discussion Paper. Council on Foreign Relations.

Scott Morris, Brad Parks, and Alysha Gardner, 2020. “Chinese and World Bank Lending Terms: A Systematic Comparison Across 157 Countries and 15 Years.” CGD Policy Paper 170. Center for Global Development.

Scott Morris and Gailyn Portelance, 2019. “Examining World Bank Lending to China: Graduation or Modulation?” CGD Policy Paper 135. Center for Global Development.

Tania Ghossein, Bernard Hoekman, and Anirudh Shingal, 2018. “Public Procurement in the Belt and Road Initiative.” MTI Discussion Paper No. 10. The World Bank Group.

World Bank, 2019. “Belt and Road Economics: Opportunities and Risks of Transport Corridors.” The World Bank Group.

[1] Sebastian Horn, Carmen Reinhart, and Christoph Trebesch, 2020. China’s Overseas Lending: A Response to Our Critics. CGD Note. Center for Global Development.

[2] Axel Dreher, Andreas Fuchs, Bradley C. Parks, Austin Strange, and Michael J. Tierney, forthcoming. “Aid, China, and Growth: Evidence from a New Global Development Finance Dataset.” American Economic Journal: Economic Policy.

[3] 2020. “Concept Note: Global Health Security Challenge Fund.” Joint concept note with Center for Strategic and International Studies, Nuclear Threat Initiative, Center for Global Development, and Georgetown University Center for Global Health Science and Security.

[4] In turn, the United States should reassert its leadership position as a multilateral donor, which has waned considerably over the past three years even as China’s contributions have increase.

[5] Clemence Landers, 2020. How’s My Driving? What We Can Gauge from DFC’s First Board Meeting. CGD Blog. Center for Global Development.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.