Recommended

COVID-19 has effectively shut down the global economy, leaving billions of people around the world with little means of support. More than 100 countries have announced measures to provide social assistance, including cash transfers and in-kind food distribution. Their capacity to respond will determine how effective these measures will be—especially for the “new poor,” those who have been thrust into poverty as their livelihoods have been severely affected by the pandemic. Many are urban migrants, unable to work due to lockdowns and not covered by existing social safety nets.

Success in providing assistance will be shaped by two main factors: the fiscal space to scale up spending, and the ability to transfer resources quickly and efficiently to those in greatest need. The World Bank, IMF, and humanitarian organizations have noted that the ability to transfer resources quickly will depend on existing investments in safety nets, transfer mechanisms, and data and information systems, how they can be leveraged, and how countries can innovate on top of existing delivery mechanisms, almost in real time.

We agree. Our message to countries is simple: Use what you have now to scale up quickly and build on your strengths to build back better systems.

While every case is different, it is useful to compare countries at a similar stage of development and with a shared history. Together, India, Pakistan, and Bangladesh constitute over one fifth of the world’s population and almost half of the global poor. All have been severely hit by the COVID-19 pandemic.

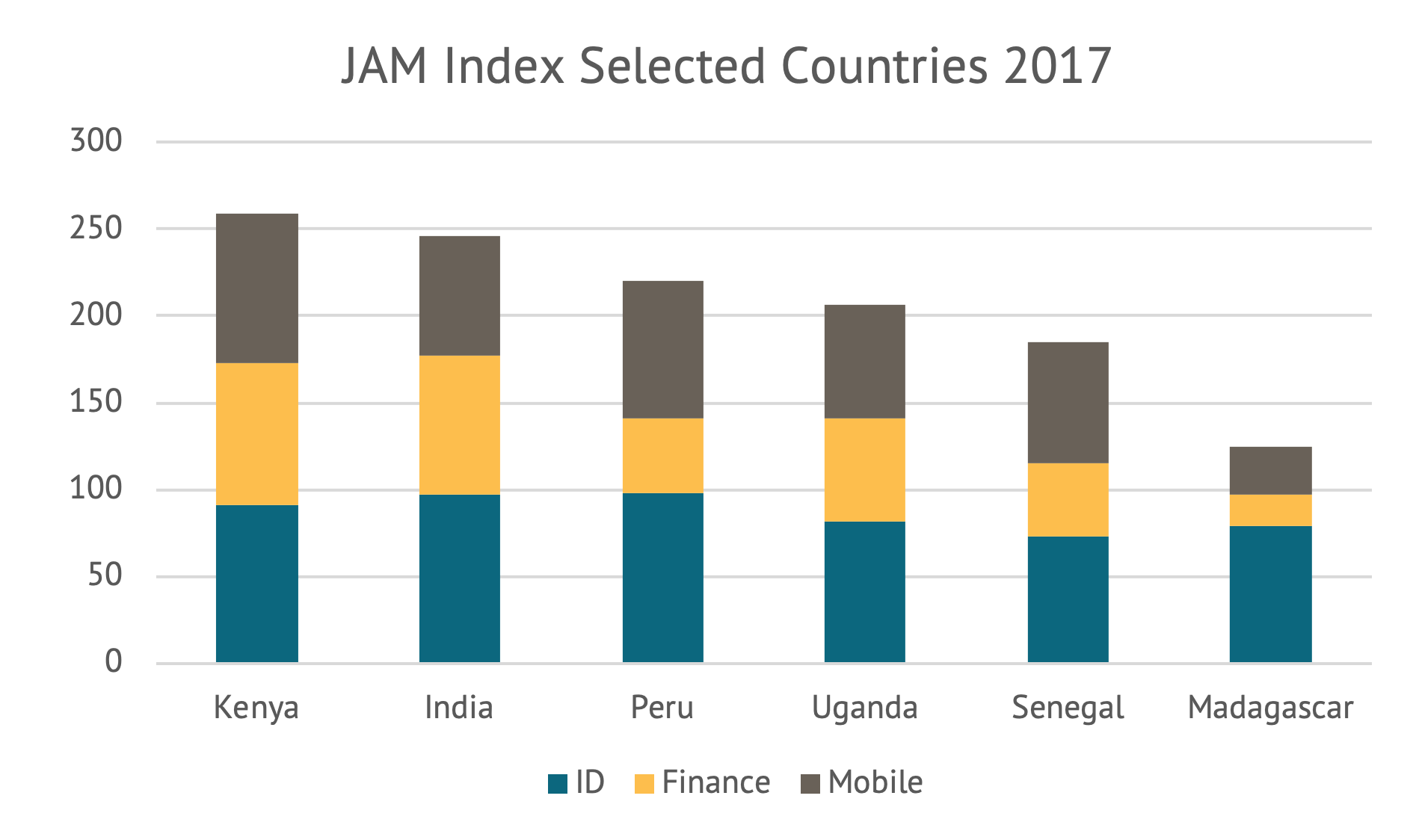

These countries also sustain critical social safety net programs which, despite implementation challenges, deliver social assistance at scale. All have transitioned, to a greater or lesser degree, towards using digital ID, financial accounts, and mobile technology in their social programs. Those are the three pillars of a digital trinity, called JAM in India, that forms the basis for effective and targeted social programs, as we’ve written about extensively. It is still early days and data on actual implementation is scarce, but this blog offers an initial view on the ways in which the JAM is being used to scale up support.

Assessing Digital Capacity in India, Pakistan, and Bangladesh

India scores high in all three JAM areas, with almost universal ID coverage through Aadhaar, high financial inclusion, and widespread mobile ownership, as well as a diverse benefits system that reaches the vast majority of households. Almost all benefits are linked to Aadhaar, both cash and in-kind through the Public Distribution System for food rations. The direct benefit transfer system provided the impetus for the opening of some 380 million Jan Dhan bank accounts—opened as part of a government initiative for those who were not financially included—making India a government-to-person payment-driven, bank-based delivery model. India’s system is therefore quite integrated.

But its systems are still fragmented in some respects. There is no up-to-date national socioeconomic survey. The most widely used database to target government benefits, the Socio-economic and Caste Census, was conducted in 2011. Most programs are implemented at state and local levels, raising the risk that migrants will fall through the cracks. Capacity varies considerably across states. Concerns over privacy mean that it is not possible to consolidate beneficiary rolls across the nation, even if linking beneficiaries to Aadhaar makes this technically feasible.

Pakistan has a widely held digitized national ID, the CNIC. Mobile coverage is high, but financial inclusion is still modest and there are large gender gaps in both mobile and financial inclusion. The main safety net program, the Benazir Income Support Program (BISP) has modest coverage, considering the size and needs of the population. In the past Pakistan has leveraged its ID program to implement custom safety net transfers, including for displaced people and flood victims (the Watan card). This is valuable experience to draw on as Pakistan undertakes COVID-19 mitigation schemes at scale.

Pakistan’s core systems are highly integrated with the national ID number linked to a wide range of databases including tax, asset registration, banking, and more. ID is required to register mobile SIM cards (although several can be registered under a single ID) as well as to be a beneficiary of BISP.

Bangladesh also has a widely held national ID system, but with lower capability to remotely authenticate beneficiaries of government programs . It has high mobile coverage and moderately high financial coverage thanks to widespread use of mobile money. Its dispersed, low-cost network of mobile money agents has helped to drive the adoption of person-to-person (P2P) mobile payments.

Integration is, however, lower than in India or Pakistan. Many of its extensive and varied social and safety net programs are operated by NGOs; many have their own beneficiary identification and delivery systems, leading to fragmentation of databases and making it difficult to bring payment systems together under one platform. Recently, however, the government has moved towards using mobile money to transition from cash to digital payments, especially in large-scale education stipend programs, which can be leveraged for a rapid COVID-19 response.

COVID-19 response

Given those differences in baseline digital capacity, how will Bangladesh, India, and Pakistan structure their response? All three countries have announced steps to scale up social protection through a range of programs but face different issues in maintaining and expanding existing programs and initiating new ones to deal with the “new poor.”

India

India is able to reach a high percentage of households through the combination of multiple programs including food rations, pensions, LPG cooking gas subsidies, food-for-work programs, farmer subsidies and making transfers to holders of Aadhaar-linked Jan Dhan accounts. Already, this approach appears to have been able to support quite a high proportion of poor households by scaling up food rations and various financial transfers. Initial survey results suggest that the system has provided material assistance, although some difficulties have been reported in cashing out payments and using the funds to purchase supplies.

In addition to the federal government, many states have announced their own programs to help people who fall through the system, especially migrants. But states face hard budget constraints due to expenditure ceilings imposed by the Fiscal Responsibility and Budget Management Act. Although the central government has allowed states to borrow up to 50 percent of their yearly credit needs upfront, the current uncertainty may prevent them from significantly expanding the range, scope, and scale of social assistance programs.

Lessons so far: The architecture of direct benefit transfers and JAM facilitates both scale-up and portability of benefits. But it is not possible to get an integrated view across programs which hinders coordination between the central and state-level initiatives. Many people fall through the cracks, especially migrants whose place of current residence does not match their registration location. In crises that disrupt supply chains there is an important role for efficient in-kind systems, but these have to be designed to ensure portability across states.

Pakistan

Building on the platform for BISP, the main social safety net program, Pakistan has announced a major scaleup of financial assistance to people affected by COVID-19. The Ehsaas Emergency Cash program distributes cash to 12 million families whose livelihood is severely impacted by the pandemic or its aftermath. People apply for the benefits through mobile phones. Their claim is assessed, which can include a check against databases, linking records with the national ID number. If they are approved, they can collect their benefit, after biometric authentication, at one of 17,000 cash disbursement centers that have been set up. From its inception in early April, cash has reportedly reached about one quarter of those entitled to the transfer, indicating a significant degree of state capacity to scale up transfers quickly.

Lessons so far: Pakistan is able to use its ID system and mobiles to initiate a large-scale centrally managed transfer program to uniquely identified and verified recipients. Because of the links with the National Socio-Economic Register and several other databases, the government can apply a range of exclusion rules to help target the transfers without making beneficiaries go through time-consuming application and verification procedures. Drawing on its past experience disbursing flood relief in 2007, Pakistan is also using mobile technology to offer recipients a choice of providers, although special payment points are needed because of low financial inclusion. It is not known how easily people are able to purchase supplies with their financial grants.

Bangladesh

Bangladesh has announced a range of programs but has not yet begun to implement them, and faces questions on how it will proceed. Some programs will be able to disburse through mobile money accounts, but many will not. There are also questions about the resilience of the mobile agent network: many agents provide service as a side business while their main income is from small shops, including in markets. They may not find it worthwhile to offer cash-out services if they are not able to open for normal business.

Lessons so far: Little is known about implementations yet, but it will be harder to implement centrally driven programs than in India or Pakistan. The mobile-money model of financial inclusion is excellent for low-cost reach-out to people but may be vulnerable to major disruptions to the real economy.

Countries’ investments in digital capacity—digital ID, socioeconomic databases, financial inclusion, and mobile payments—are playing an important role in shaping their social protection responses to COVID-19 in South Asia. The response, in turn, can spur innovations in delivery systems which will have longer-run effects. How they handle the challenge will provide many lessons, not only for the region but for many countries using social transfers to mitigate the impact of the pandemic—especially for the “new poor.”

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.