Recommended

Introduction and Country Context

Bangladesh, a country of 165 million people bordering India and Myanmar, is undergoing a rapid economic and social transformation. It has experienced steady economic growth over the last decade driven mostly by readymade garments exports and remittances from a large expatriate community across the world. Bangladesh is a relatively young country with a median age of 26.3 years. Its investment and outcomes in human capital, especially school education and primary healthcare, have been globally recognized. Bangladesh is urbanizing at a rapid rate, integrating into global supply chains; it aspires to join the ranks of middle-income countries over the next decade.[1]

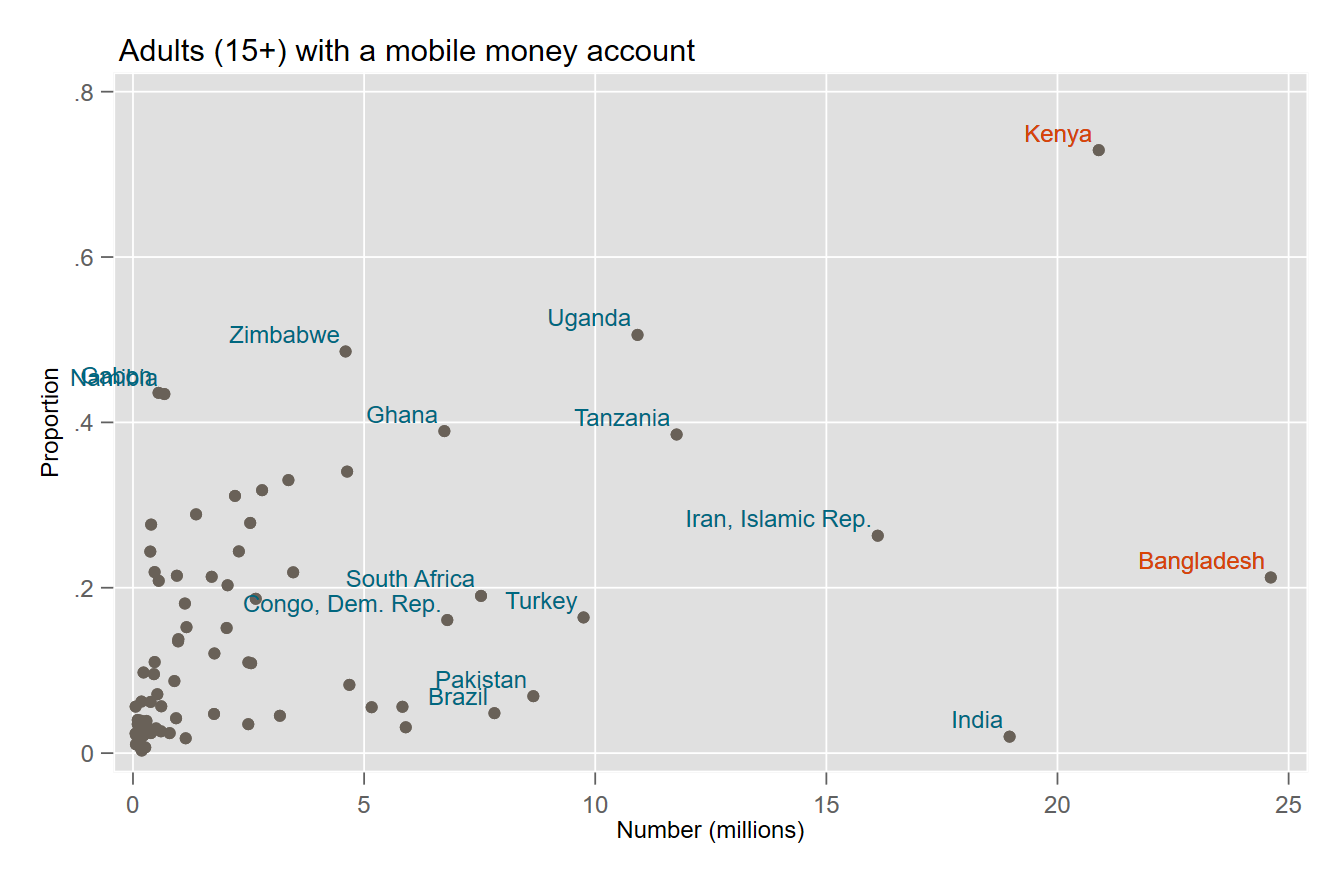

Bangladesh is also witnessing a digital revolution. The mobile subscriber base has grown to over 140 million, covering nearly 85 percent of the population. Leveraging this, the mobile financial services (MFS) sector has shown remarkable growth over the last decade and has been instrumental in the transformation of the digital payments ecosystem in the country. With 67.5 million MFS accounts, Bangladesh has almost a 10 percent share of mobile money accounts worldwide, although only half of the accounts are classified as active.[2] The scope of digitization is not restricted only to digital payments—it includes several widely used services, such as railways, online banking facilities, internet marketing, university admissions, publication of results of public examinations, and e-learning courses, among many others.

Digital Bangladesh and Government-to-Person (G2P) Payments—Primary Education Stipend Program

Digitization of government services and payments is an area of focus for the government. Digital Bangladesh, a government initiative, was launched with the objective of making public services cheaper, faster, more reliable, and delivered at the doorstep of citizens. Improvement in service delivery is assessed in terms of three indicators at the beneficiary level—time, cost, and number of visits (TCV).[3] This allows the government to monitor a range of public services, identify constraints, and redesign processes to improve the quality of service delivery.[4] The initiative has strong political support, with the Prime Minister’s Office acting as the secretariat, which also makes it easier to coordinate and monitor implementation across a broad range of sectors.

The MFS sector plays a key role in supporting the government’s policy to transfer benefits digitally instead of cash payments. One of the most significant applications is the Primary Education Stipend Program (PESP). PESP started in its present form in 2001. Its key objective is to increase educational participation—enrollment, attendance, persistence, and performance—of primary-school-age children from poor families in urban and rural areas. The program provides a stipend of Taka 100 per month per child to mothers in need of financial support, conditional on their child’s school attendance.

The stipend has traditionally been disbursed in the form of cash distributed from a designated school in the vicinity of the beneficiary’s residence. From June 2017, the government of Bangladesh decided to transfer the stipends for nearly 13 million children currently enrolled in the program directly to the mobile banking accounts of their nearly 10 million mothers. This is a significant change driven by the policy objective of increasing the efficiency of program implementation through digitization of government payments, leveraging the spread of MFS in Bangladesh over the past decade.

How has this move from cash to digital affected beneficiaries? How do they perceive the new system vis-à-vis the previous one? What challenges do they face in accessing the stipends? Do mothers have more control over the funds than before? Are they able to navigate the new digital environment, especially those who do not own mobile phones and have limited digital literacy?

To answer these questions, we conducted a field survey using both a quantitative questionnaire and qualitative assessments, with separate modules for school headmasters and mothers with children enrolled in the program. The objective of the survey was to understand the perception and experience of the disbursement of PESP through mobile financial services. A similar survey carried out by CGD in Rajasthan, India provided interesting insights on broader social goals of financial inclusion, digital literacy, and gender empowerment.[5] This model was adapted for use in Bangladesh.

Our conclusions are broadly positive: an overwhelming majority of both mothers and headmasters prefer the new system. Mothers cite greater convenience in access and more control over funds as the main reasons for their stated preference.[6] For headmasters, digital transfers reduce the risk of allegations of mismanagement that might be levied against them, and cut the time spent on administration of cash distribution. We do, however, find that mothers who do not own mobiles, and those who cannot read or write SMS, have a less positive opinion of the new system. This points to challenges of digital capacity both in access to and use of mobile technology for digital transfers, something that policymakers will need to address to ensure the inclusivity of the Digital Bangladesh policy framework.

PESP Beneficiary Selection and Funds Disbursement

PESP uses five basic criteria to identify poor households: (i) insolvent female-headed households; (ii) low-income occupations such as day laborer, fishermen, artisans; (iii) landlessness; (iv) insolvent ethnic minorities; and (v) households with students suffering from disabilities.

At the inception of PESP, the number of stipend recipients were roughly 40 percent of the total students in a school. [7] These used to be selected on both need and merit based on recommendation from class teachers and final approval of school managing committee. The criteria are not considered separately but rather in a composite manner to justify enrolment into PESP. However, in parallel to the introduction of mobile-based payment of PESP, the percentage allocation per school has been removed. Now, all students who pass both the Term and Final Examination and attend classes regularly are eligible for the stipend.

In general, the program appears to have been quite successful. According to a joint report of the government of Bangladesh and UNICEF,[8] disbursing stipends with strict adherence to the requirement that the mother of the beneficiary student is the authorized recipient has worked well. The transaction burden on both the implementer and recipient side was identified as an important issue to address, rather than leakages.

Focus group discussions comprising headmasters and mothers indicated four key problems:

-

disbursement delays due to non-receipt of the stipend from the government

-

the opportunity cost of one day's lost labor and/or travel and food costs for mothers or guardians, especially for schools that are further away from their place of residence

-

loss of staff teaching time on paperwork and disbursal of cash

-

lapse of payment for mothers who miss collection on the appointed day

To address these issues, from June 2017, the government started disbursing stipends to mothers directly through mobile money payments. Bangladesh already had two established mobile money companies (bKash, the market leader, and Rocket), but PESP payments were channeled through SureCash, a less prominent mobile money provider that is operated by a government-owned bank. The reasons for this decision are not known, but there could be several, including preference for government-owned systems or a desire to stimulate competition in the very concentrated mobile money sector. However, it raises questions regarding the density of the agent network and whether beneficiaries would prefer the use of other operators with whom they might already have mobile money accounts. Our questionnaire specifically asked these questions, as well as beneficiaries’ perceptions and experience in dealing with the new digital method of transacting. As far as we know, this is the first survey of its kind to address these issues in the context of introducing digital payments in a large scale G2P program in Bangladesh.

Figure 1. Location of the survey

Survey Description

-

We carried out a rapid assessment of a purposively chosen set of PESP beneficiaries and school administrators regarding their perception and experience of the new digital payments system compared to the earlier cash distribution of the stipend. The survey was carried out by a team of researchers from the Faculty of Business Studies, University of Dhaka.

-

This survey covered mothers in 100 households among 34 villages (with a focus on the poor living in remote-rural areas) as well as 25 school headmasters. Eighty-nine percent of the mothers lived in rural areas. It was implemented in Chuadanga district, around 200 km west of the capital, Dhaka, from 19-30 June 2018. The modest number of respondents limits the power of the surveys, but they offer useful insights from those affected by the change.

-

Eleven percent of the mothers have no education, and only 18 percent are involved in a job. The average household has 2.3 children, and a monthly income of Taka 14,641 (US$ 174).

-

Eighty-one percent of the mothers have one child who receives the stipend, 18 percent have two children (the program’s household maximum); none have more than two children receiving it. All the survey respondents, except one, had experience with the previous system.

Survey Results for Mothers

When asked about their preferences, mothers had very favorable opinions of the new system (figure 2). Almost four in five preferred it to the previous one. Nevertheless, nearly 15 percent found the system to be worse than before, while 6 percent did not find any overall positive or negative change.

Almost all mothers said the new system registration was easy, indicating that the process of onboarding existing beneficiaries went smoothly; a similar proportion reported that they did not have to pay for re-registration.

While 55 percent are able to read and/or write SMS, almost half of the mothers are unable to do either, which may pose a challenge for access and use of the new digital mode of payment.

Figure 2. Survey results

Preferences are shaped by convenience factors

Convenience factors dominate stated preferences, as shown in figure 3. The major factor is the flexibility to withdraw money at a time and place that are convenient to mothers. Other possible reasons, such as not having to pay bribes to obtain cash, receive little support. Rural mothers are more likely than urban mothers to say the system is better because they do not have to travel to school and wait for the payment, reinforcing the flexibility and convenience factors. Over 90 percent of PESP recipients cash out all the stipend they receive.

Figure 3. Factors in mothers’ preferences

Figure 4. Phone ownership among mothers

At the same time, lack of access to a mobile phone or agent poses problems. Nearly a quarter of mothers say that not having a mobile phone makes the system harder for them to navigate. A smaller proportion cite the distance to the nearest agent and difficulties withdrawing money as constraints. Unsurprisingly, mothers who are over one kilometer from the nearest SureCash agent have a less positive view of the new system. But across the full sample only 11 percent cite this as an issue.

Control and digital literacy are still pain points

Mobile phone ownership is key to controlling the cash in this transfer system. Three out of every five mothers own their own mobile phone, and figure 4 shows that 30 percent rely on a male in their household for access to a mobile phone, which poses some questions about mothers’ control.

Of the women who own a mobile phone, 68 percent say they have more control over the stipend in the new system while fewer of the non-owners (58 percent) think they have more control. Of the women who use a husband’s mobile phone, 15 percent said they do not have more control and 31 percent do not know. Nonetheless, 73 percent of non-phone owners still think the new system is better, while 20 percent think it is worse.

Figure 5. Mothers’ opinion of the new system according to their digital literacy

Digital literacy is important for accessing benefits in this transfer program. Figure 5 shows that mothers with ability to read and write SMS have higher opinions of the new system: the relationship is statistically significant at the 95 percent confidence level.[9] We also find that mothers who do not own a mobile phone are more likely to say the new system is worse because they cannot read SMS. But it is still only a small proportion of our respondents who cite this issue, and only 23 percent of mothers overall say that the new system is worse because they cannot read SMS.

The importance of digital literacy emerges as we explore associations. Being able to read or write SMS is associated with:[10]

|

a positive opinion of the new system |

saying the new system is better because they can draw money when they want to[11] |

saying it is easy to withdraw cash when you need it |

saying they have more control over the stipend in the new system |

owning a mobile phone |

Ownership of mobile phone is related to having more control over the stipend transfer. Two-thirds of mothers who own mobiles reported having greater control, compared to 57 percent of those who do not. As noted above, dependence on male members, especially husbands, reduces the agency of the mothers vis-à-vis their claim to G2P transfers that PESP seeks to enhance.

The program has had a substantial impact on financial inclusion. Only 31 percent of the mothers have, or previously had, a bKash account. Just over half of the mothers who have a bKash account would prefer to receive the stipend in their existing account. This suggests that the use of SureCash might impose some additional inconvenience, but not to the point where it is not an overwhelming factor in preference for the new system.

The ability to withdraw cash is important, and mothers who are less than one kilometer from the nearest SureCash agent are also more likely to say that they have more control over the stipend money in the new system.

Survey Results for Headmasters

Headmasters prefer the new system because it saves time and reduces risk of allegation of malpractice in the distribution of stipends.

Eighty percent of the headmasters surveyed said the new system is better than the previous one, while only 4 percent (n = 1) thought it worse. The reason that was prioritized most by headmasters for it being better was that it saves administration and teachers’ time.

Open-ended feedback revealed another reason. Several headmasters valued the fact that under the new system, they and their teachers are less vulnerable to corruption allegations. These could be difficult to disprove and lead to administrative action against them, potentially rendering headmasters and staff vulnerable to extortion.

Still, 28 percent of the headmasters said a drawback of the new system is that they get complaints when there are problems with the payments, and one in five mentioned difficulties correcting mistakes. All but one headmaster (96 percent) said that parents bring problems with the stipend to them; 83 percent report that they are sometimes or always able to resolve the problems.

Ninety-six percent think that more transfers should be done through mobile payments. This very positive view appeared to reflect more their own experience with digital payments than strong views on the experience of the mothers. The impact of the digital transfer on student outcomes and mothers’ agency were less apparent to headmasters. About half of them said mothers do not have more control over the stipend money in the new system. This contrasts with the perception of mothers as we have explained above. About a third of headmasters held the view that the new system increased children’s attendance.

Conclusions

Even with modest statistical power our survey results indicate that the digitization of PESP payments has been a success. It is a win-win for both headmasters and mothers. Direct transfer of stipend has lessened administrative burdens on teachers as well as the risk of allegations of mismanagement against them. There is overwhelming support on the part of providers for greater use of digital payments instead of cash distribution. For the mothers, it is more convenient to withdraw cash through agents whenever they choose to do so, thereby saving time and cost compared to the old system. There have been gains in closing the financial inclusion gender gap. Nearly 70 percent of mothers did not have a mobile money account before—they do now, due to the design of the PESP transfer. So far, almost all simply cash out their stipends, but having accounts opens the possibility that they will use more financial services in the future. This would be encouraged by interoperability of payments between the mobile money providers and between mobile money and the banking system.

The main constraint to still more beneficial impact appears to be the uneven capability to effectively operate digital devices. Mothers who own mobile phones and are able read and write SMS report having greater control over the transfers compared to those who do not and express greater satisfaction with the reform. Bangladesh, like other poor countries, will need to grapple with this problem as it seeks to move its administration of G2P transfers, and programs more generally, into the digital era.

We acknowledge the contribution of Ishter Mahal, Jamil Sharif, and Mahfuzul Hoque for their inputs into the research design and helpful comments in reviewing this note.

[1] https://www.adb.org/news/features/bangladesh-challenges-and-opportunities-moving-upper-middle-income-status

[6] There is no cash out fee for stipend recipients

[7] Key informant interview with district education officer, Chuadanga

[8] https://reliefweb.int/sites/reliefweb.int/files/resources/Bangladesh_Primary_Education_Stipends_survey.pdf

[9] Using a Fisher’s exact test and 95 percent confidence intervals.

[10] All are statistically significant with 95 percent confidence intervals using a Fisher’s exact test.

[11] Significant at 90 percent confidence level.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.