Recommended

Blog Post

Today the IMF forecast the onset of a global recession deeper than any seen since the 1930s and this week the World Bank is expected to announce that the decades-long fall in global poverty is about to shift into reverse. Millions of the people who will be hit hardest by the global economic downturn unleashed by COVID-19 live in countries with little or no social safety net, and limited capacity to muster any fiscal response.

In recent years, many commentators have asked if the World Bank is still relevant. We’re about to find out.

On April 2, World Bank President David Malpass announced up to $160 billion in funds will be made available for COVID response over the next 15 months. A number of questions remain unanswered. Where will those funds go? What are the terms? How fast can the bank scale up lending? And is $160 billion remotely enough to meet this unprecedented challenge?

To track the World Bank’s response to COVID-19, we’ve built a small interactive tool to display how much each country has received to date, and what’s currently in the pipeline for approval. Hover over each country layer on the graph to see links to project documents, or toggle between different loan types.

Is the $160 billion additional to the World Bank’s normal pipeline? (Unclear)

Official statements from the bank have been vague, so we’ll measure the COVID response two ways: COVID-specific funds for the short-term public health response, as well as the acceleration in total lending relative to this time last year—which is what matters for meeting the fiscal needs of low- and middle-income countries in confronting the economic crisis.

On April 2, the bank has announced a first wave of $1.9 billion for 25 countries for COVID-specific health measures. (In future iterations we’ll try to break those out in the tracker tool.) We’ve seen no clear statement on what the total need or goal is here.

For overall lending, we start the clock on December 31, 2019, when China reported the outbreak of a novel coronavirus to the World Health Organization. By our tally the World Bank pipeline includes about $31 billion in new loans with board approval dates since then. That’s about $12.6 billion in new approved lending, including $3.1 billion for low-income countries, with another $18.5 billion in the pipeline for 2020, of which $6.4 billion is targeted at low-income countries.

That’s a modest improvement over the same period a year ago, when the bank lent a total of $10.5 billion overall and $2.6 billion to low-income countries. (Note we’re likely overestimating the surge here, as several of the loans approved this year were already in process pre-COVID, and reflect the normal process of projects working their way through the approval pipeline.)

How quickly can the World Bank respond? (Hopefully faster than in 2008)

Time (and our tracker) will tell, but there are two steps to worry about. The first is the speed of project approval. After Bear Stearns fell in March 2008 (signaling the start of the global financial crisis), it took roughly two years for the World Bank to increase its lending pace by about half, peaking in March 2010. For the current crisis, the graph above tracks this effort by showing new commitments, with projects recorded on the date of board approval (or the scheduled date, for those still in the pipeline). But that money is mostly notional until the second step: disbursement. We’ll try to update our tracker as disbursements get underway.

What are the terms of this assistance, and will the poorest countries have access to this money? (Again, unclear)

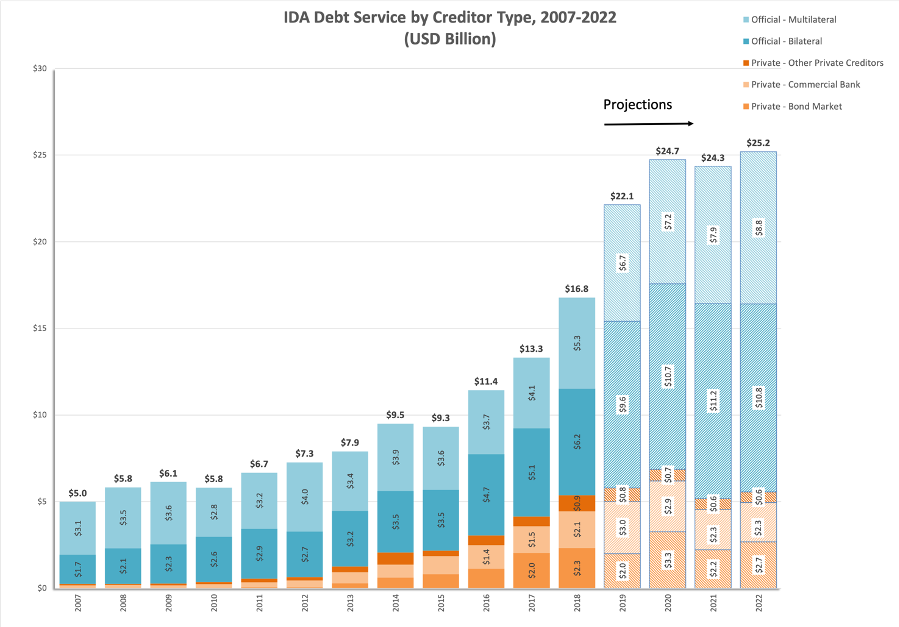

To our knowledge, the bank hasn’t specified how much of its COVID response will come from the International Bank for Reconstruction and Development (IBRD) versus the International Development Association (IDA) concessional window. The former effectively excludes low-income countries, the 31 poorest countries in the world, with GDP below $1,025 per capita (a list that may grow as growth turns negative post-COVID).

So far, the bank has approved $3 billion for low-income countries since December 31, 2019. The biggest loans include $500 million for Ethiopia and $420 million for Somalia.

Another way to look at this is to separate out IDA and IBRD lending, which you can do with the dropdown menu. While the total IBRD portfolio is somewhat bigger than IDA’s, so far $7.5 billion of the total $12.7 billion approved has come from IDA.

One way to improve low-income countries’ access to more funds would be to make IBRD loans available on the more concessional IDA terms. On top of suspending debt service payments during the COVID crisis—which is mostly a question for bilateral lenders like China—offering new loans on better terms is critical for the poorest borrowers.

Another dimension to worry about here is conditionality. President Malpass’s initial statements implied the bank would exploit this crisis to push business-friendly structural reforms on borrowers. While we don’t see signs of that in the initial package of COVID health projects, it’s something to watch as the pipeline moves on to broader economic stimulus.

Is $160 billion enough? (No)

Advanced economies have already responded with extraordinary fiscal measures. In the United States, for instance, the $2 trillion package passed in late March equates to over 10 percent of America’s $19 trillion GDP last year, and more is likely to come.

The equivalent response for low-income countries would be about $60 billion. That’s beyond IDA’s current capacity for low-income countries, highlighting the need to think creatively about the division between IBRD and IDA in the World Bank’s portfolio. Poorer countries have limited scope to monetize stimulus without inducing accelerating inflation, and their ability to borrow commercially will probably dry up during the crisis, putting a huge onus on concessional lenders including IDA but also some of the regional development banks.

For lower-middle income countries, total GDP rings in at about $6.7 trillion, implying the equivalent of the United States’ initial rescue package would be over $700 billion.

Reaching that scale will require extraordinary measures from the World Bank and other development lenders. Our CGD colleagues Clemence Landers, Nancy Lee, and Scott Morris estimate that the World Bank, together with the regional development banks, could muster as much as $500 billion in additional lending to reach total exposure of $1 trillion if pushed—but a big chunk of that would need to come from the African Development Bank and other institutions.

Technical note: For those interested, the tracker begins with the World Bank’s convenient project pipeline page here. Some info is missing though, which we pull from Project Information Documents in PDF with a Python script. The data is processed in Stata and exported to Tableau. You can download the code here. Full credit to Dmytro Rudnik for building the interactive features above, and thanks to Tableau for an in-kind grant to CGD of free licenses.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.