Recommended

On March 25, the heads of the International Monetary Fund and the World Bank Group called on G20 leaders to pursue debt relief with respect to their official bilateral credits to IDA countries (poor countries eligible for concessional World Bank finance through the bank’s “International Development Association”). The two international financial institutions offered to assess the impact of the crisis on each IDA country and to prepare a proposal for how official bilateral creditors could address both the financing and debt relief needs of those countries. On their side, on March 26, the G20 leaders called on these same two institutions to use “all of their instruments to their fullest extent as part of a coordinated global response.” They pledged to “continue to address risks of debt vulnerabilities in low-income countries due to the pandemic.”

All this emphasis on size and speed in ramping up financing for low-income countries (LICs) is absolutely on target. This time will be very different for LICs than the global financial crisis of 2008. They enter this dangerous period with higher debt levels and greater integration into the global financial system. Even apart from the huge risk of the pandemic itself, they are subject to all of the economic and financial crisis transmission channels that higher income countries face: sudden stops in capital flows; the collapse in external demand, exports, and tourism; sinking commodity prices; lower remittances; and supply shocks that will hit both production and consumption. Debt, balance of payments, and banking crises will inevitably rock some LICs, setting back poverty reduction progress for years.

The G20 has not as yet shown marked enthusiasm for this call to action on debt. Of course, no creditors like to be told to extend debt relief, especially when they are rapidly running up their own public debt. So it’s fair to ask how important official bilateral government creditors are in this whole equation. How much of a role do they play in financing IDA countries and how much will their actions affect the ability of IDA countries to weather this crisis? Let’s look at the numbers first for debt stocks in IDA countries.

Source: World Bank International Debt Statistics (IDS).

Note: The IDS database is a comprehensive collection of country responses on loans and repayments to the World Bank’s Debtor Reporting System. Details on the IDS methodology and most recent statistics can be found in the IDS 2020 Report.

Two things stand out: overall public debt in IDA countries has risen rapidly since before the global financial crisis; and (2) while debt to private creditors (mostly in the form of bonds or bank loans) has increased, the biggest increases have come from multilateral and official bilateral credits.

The volume of official bilateral credits has doubled since 2007. The bulk of the increase in multilateral credits comes from IDA lending, on concessional terms. Overall, 80 percent of multilateral debt stocks in IDA countries are concessional loans. This stands in sharp contrast to bilateral debt stocks, where only 27 percent of loans are offered on concessional terms. This divergence between concessional lending in multilateral and bilateral debt stocks spills over into debt service as well—58 percent of multilateral debt service goes towards payments on concessional loans, compared to only 14 percent for bilateral loans.

| Concessional Lending as Percent of Total Lending, Average of 2007-2018 | Concessional Lending as Percent of Total Lending, Average of 2016-2018 | ||

|---|---|---|---|

| Debt Stocks | Bilateral | 28% | 27% |

| Multilateral | 81% | 80% | |

| Debt Service | Bilateral | 18% | 14% |

| Multilateral | 55% | 58% |

Source: World Bank IDS.

Note: Concessional debt is defined as loans with an original grant element of 35 percent or more.

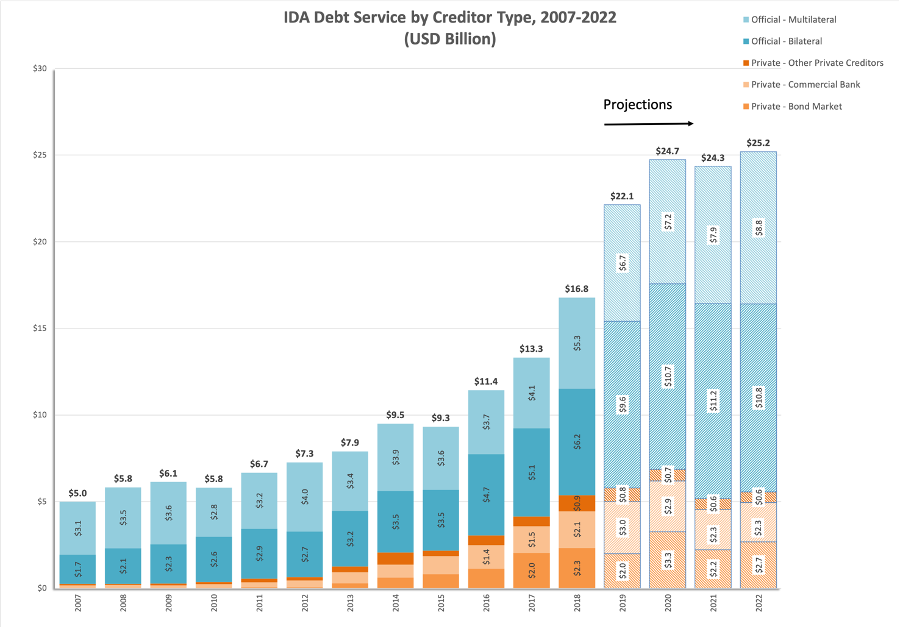

These differences in the breakdown of concessional versus non-concessional loans between the two types of official creditors explain the somewhat different pattern we observe with respect to debt service. Debt service to multilaterals is projected in 2022 to reach nearly 3 times its value in 2007. But the high level of concessionality in this lending has meant that debt service size and growth is restrained. In contrast, the low level of concessionality in bilateral lending has led to rapid growth in debt service to these creditors.Debt service to official bilateral creditors in 2022 is projected at more than 6 times its value in 2007.

Source: World Bank IDS.

Note: From the IDS 2020 Report, “Future principal payments are generated by the World Bank External Debt (WBXD) system according to the repayment terms of each loan. Future interest payments are generated by the WBXD system according to the disbursed and outstanding balance of the loan at the beginning of the period using the interest rate specified in the loan contract. Future debt service payments are the sum of future principal and interest payments due on existing commitments, including the undisbursed portion.”

As a result, a debt rescheduling that pushed debt service due in 2020-2022 to later years would free up $32.7 billion in financing for crisis response spending--not a small contribution. A similar rescheduling of obligations to private creditors, though more complicated and time-consuming, would save $17.6 billion during that period.

Of course, debt repayment is only one side of the ledger. Bilateral creditors can also contribute to the financing needs of IDA countries through new credits. Official bilateral creditors need to tailor financial support for the circumstances of individual IDA countries. Some borrowers will benefit chiefly from new finance, which official creditors have already committed and which could perhaps be augmented. Others would benefit more from generous debt rescheduling to free up financial resources in the near term.

What is unambiguously the case, however, is that all would benefit from more favorable terms for new credits and a reduction in interest rates and lengthening of maturities for existing credits. We already have a standard for concessional terms for IDA countries. IDA credits have a zero or very low interest charge and repayments are stretched over 30 to 38 years, including a 5- to 10-year grace period.

Paris Club and non-Paris Club official creditors could take the decision together to apply concessional terms to current credits and for additional credits offered within the next 3 years to IDA countries. That would be a major early step forward in the all-hands-on-deck response needed for the poorest countries. As noted in this recent CGD paper, this commitment would oblige China in particular to address its outsized contribution to more burdensome debt for LICs.

Some would argue that official bilateral creditors should always lend on concessional terms to poor country governments. Surely, this is a good time to start.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.