The new US International Development Finance Corporation (DFC) has barely opened its doors—and its original mandate is already under siege.

Tacked on the very end of the second large spending bill signed into law on December 20—all the way on page 1764—was a little-noticed European Energy Security and Diversification Act of 2019. The measure intends to help European and Eurasian countries lessen their dependence on potentially nefarious foreign energy sources (read: Russia). It enlists a number of US federal agencies, encouraging diplomacy and energy project support. Unfortunately, it also creates a significant loophole in the primary development mandate of DFC.

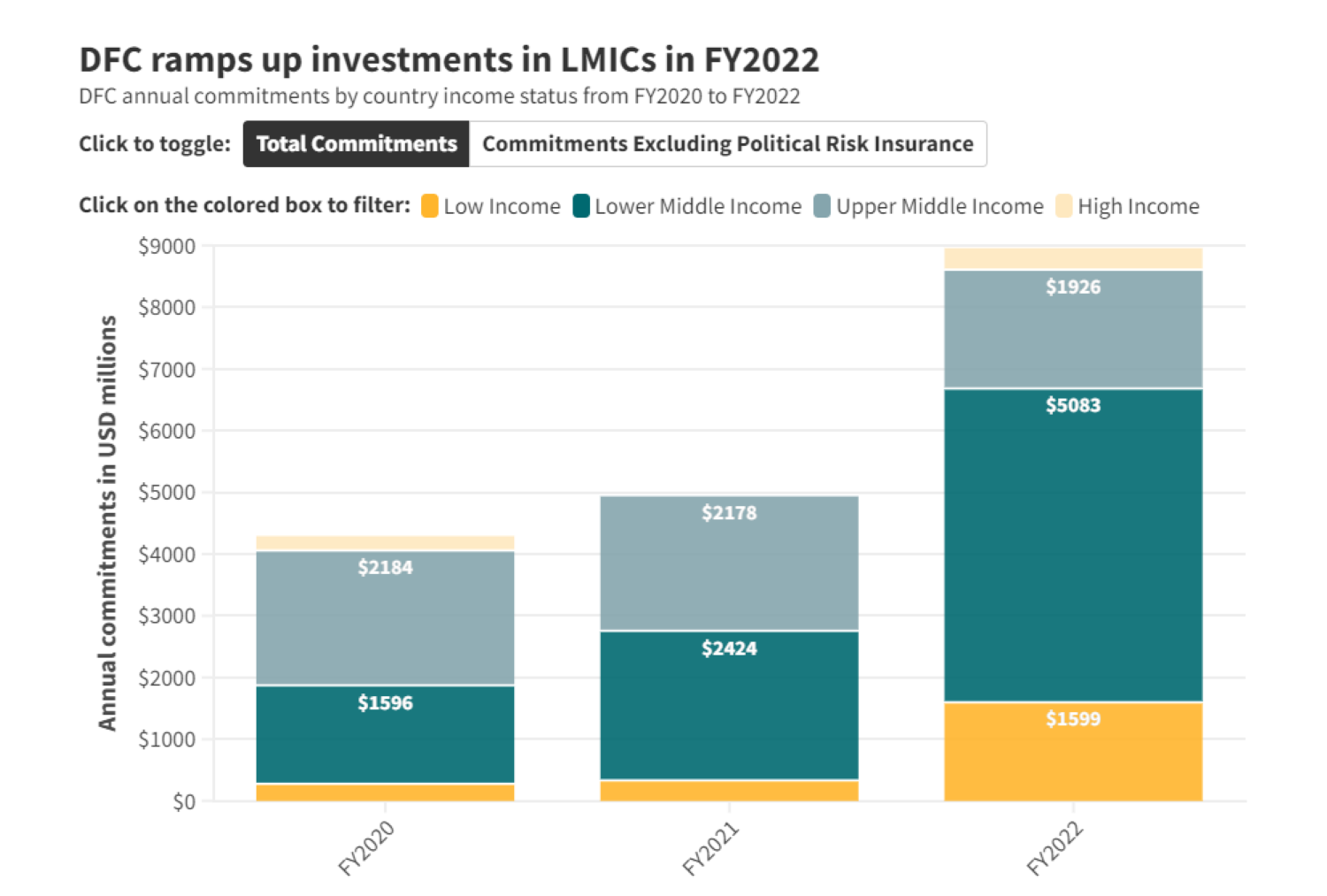

Here’s the context: The BUILD Act, which created DFC, requires the new agency to prioritize investments in low- and lower middle-income countries. The law allows exceptions for DFC to fund deals in upper middle-income countries if a project clearly supports both economic or foreign policy goals and development objectives.

In contrast, the new European Energy Security and Diversification Act specifically allows DFC investments in high-income countries—and adds a new exception that projects can be greenlit if they are:

necessary to preempt or counter efforts by a strategic competitor of the United States to secure significant political or economic leverage or acquire national security-sensitive technologies or infrastructure in a country that is an ally or partner of the United States.

In other words, DFC no longer needs to have developmental objectives. This is a terrible precedent—and threatens the new agency in its first nascent months.

Here’s why: For years, DFC’s predecessor agency, the Overseas Private Investment Corporation (OPIC), was under constant criticism from both sides of the political aisle. Conservative Republicans condemned what they saw as corporate welfare. Liberal Democrats complained that public resources were being used to support investors instead of projects that helped poor people. To respond to both concerns, the BUILD Act’s authors explicitly laid down the agency’s development mandate (it’s even in the name), set a high bar for upper middle-income countries, and deliberately prohibited projects in high-income countries. These limits to only emerging and frontier markets were to guard against the very objections from the left and the right about misusing the agency. Allowing DFC in high-income Europe or creating a development-free national security exception re-opens the door to the same old habits that got OPIC in political trouble in the past.

Congress should rescind this provision in the next spending bill. If there’s a real need for a national security investment window to counter Russian economic aggression, that should be created and run separately from DFC. Until that happens, DFC management and its board should set an extremely high bar for using this exception. And a transparent way for the board (and the public) to monitor the portfolio’s overall balance of DFC’s multiple objectives would be wise. Otherwise, we’re back to the same old debates and fights that the BUILD Act had finally put to rest.

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.