Recommended

We’d been eagerly awaiting an update to the US International Development Finance Corporation’s (DFC) downloadable project data for insight into the development finance agency’s recent investments and overarching portfolio composition. A new drop finally came earlier this month detailing transactions through FY2022 and timed with the release of DFC’s inaugural draft transparency policy. Here are some of our key takeaways and—since they asked—recommendations for DFC’s data practices in the future.

As a reminder, the Better Utilization of Investments Leading to Development (BUILD) Act—which established DFC—was signed into law in October 2018. But DFC didn’t begin operations until December 2019, a few months into FY2020. The agency inherited the portfolio of its predecessor OPIC as well as that of USAID’s development credit authority and certain legacy lending programs.

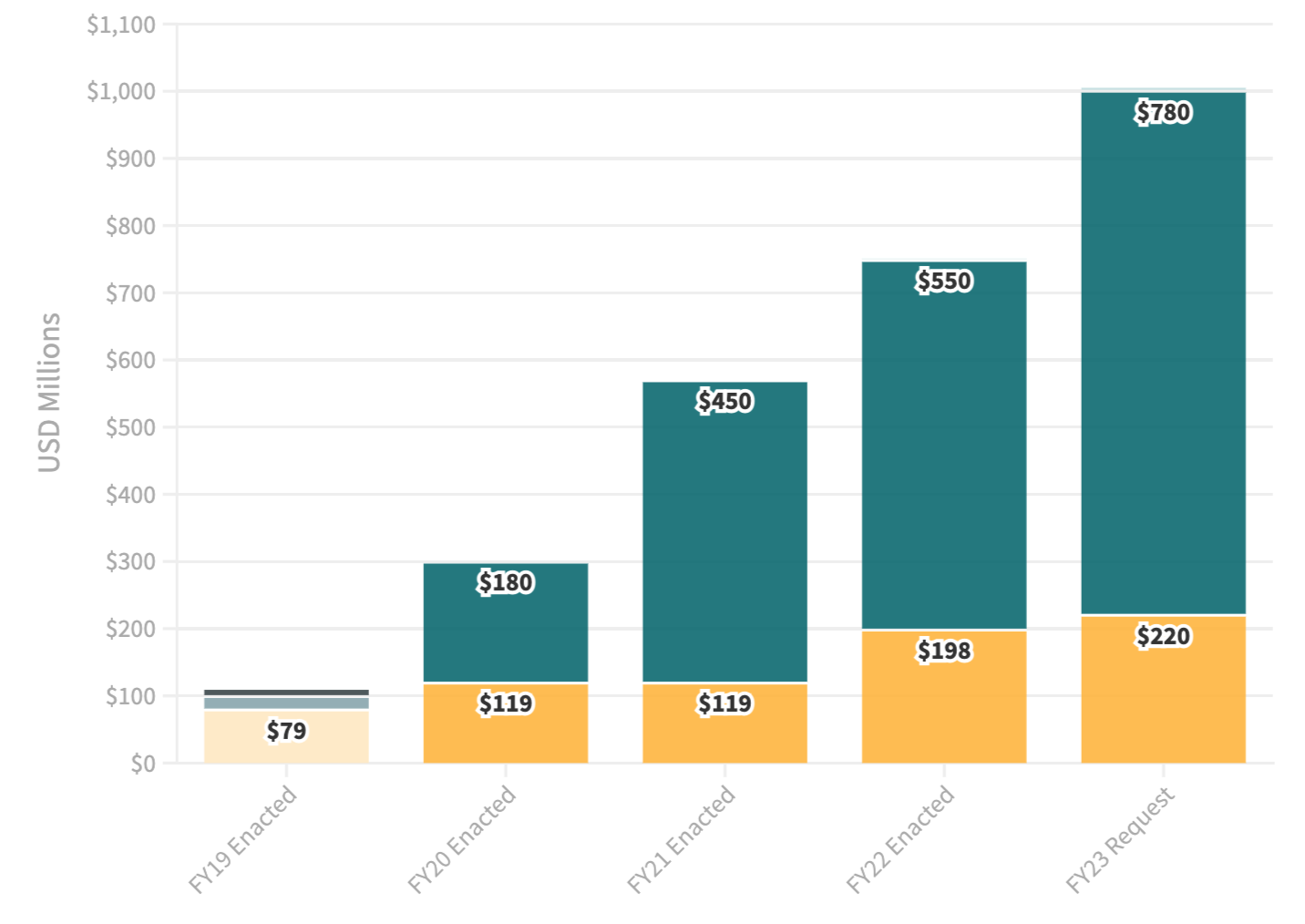

Portfolio Growth

Before delving into the details of DFC’s portfolio composition, it’s striking how significantly the agency’s portfolio volumes have expanded over the past few years with annual commitments more than doubling over the past couple of years. The surge reveals the heavy strategic emphasis leadership is placing on growth. According to its annual report, DFC also increased its staff by close to 15 percent in FY22, a move critical to making the increase in annual commitments possible and sustainable. While the data shows a large increase in committed funding in FY22, press releases and other agency materials indicate many of these deals were in the works far earlier.

LMICs look to be DFC’s sweet spot

The BUILD Act directs DFC to prioritize investment in low and lower-middle-income countries. Deals in these countries are often smaller and harder to come by. Still, the latest data shows DFC is succeeding in ramping up investments in lower-middle-income countries as it grows its portfolio. Over 50 percent of its approvals in FY22 were in LMICs, close to double FY21 levels. This is encouraging. These are some of the markets where DFC will likely have the most development impact and provide the greatest financial additionality, especially relative to upper-middle-income countries (UMICs) with more established financial markets and access to capital at lower costs.

LICs remain a far smaller part of DFC’s portfolio in absolute terms. While the data suggests DFC’s commitments in LICs grew substantially in FY22, this figure is skewed by a large commitment to provide political risk insurance for an onshore natural gas liquefaction project in Mozambique. (As our friends with the Energy for Growth Hub pointed out when the project was initially approved back in 2020, Mozambique has tremendous unmet energy needs despite its substantial natural resources.) Having the face value of such an enormous political risk insurance project included in the agency’s commitments can be misleading. DFC is providing coverage for up to $1.5 billion in losses due to a set of specified factors. This has significant implications for the agency’s exposure, but its upfront financial commitment would be far smaller. To address this issue, several charts in this blog post offer the chance to toggle between displaying DFC’s total commitments with and without political risk insurance projects.

Notable growth in Asia, Africa

Since its inception, DFC’s toolkit has regularly been invoked as an alternative to Chinese financing—albeit of relatively modest size and with a private sector focus. And the new data shows DFC has been making inroads in Asia while achieving steady growth on the African continent. Though the agency has a limited presence overseas, it has benefitted in recent years from having staff based in the Indo-Pacific and Africa.

DFC support is concentrated in the finance and insurance sector

Like its predecessor OPIC, DFC’s portfolio boasts a large share of finance and insurance deals—particularly compared to direct investment in infrastructure projects. And the agency’s continued ramp-up in financing channeled through intermediaries has helped DFC grow its overall commitment levels. These intermediaries typically provide a faster investment alternative to greenfield projects that require significant time to bring to financial close.

DFC is slowly ramping up equity investments

Since opening its doors, DFC has managed to increase the number and value of equity deals year over year despite budget-scoring rules that don’t appropriately account for the value of these investments. Some lawmakers have sought to remedy the illogical budget treatment, which would enable the agency to make greater use of its direct equity authority—as intended by the BUILD Act.

Most of DFC’s equity investments have been in LMICs, with a few of its recent deals benefiting UMICs in the Western Hemisphere and Asia. DFC has often used its equity authority to invest in investment funds in developing markets rather than taking direct equity stakes in projects.

New data provides intel on 2X progress

For the first time in its downloadable project data, DFC included a marker for investments in its 2X Women’s Initiative. Originally launched under the Trump administration in March 2018, 2X aims to mobilize private finance to advance women’s economic empowerment.

In 2021, our colleagues used DFC’s active project database, a mobile application launched by the agency, and DFC press releases to compile a detailed list of DFC’s 2X Initiative projects. With the latest data, we had a chance to see how those estimates stack up against the agency’s own calculations—and the progress that’s been made since. It turns out they weren’t too far off—but slightly overestimated the agency’s commitments.

In addition to tagging 2X investments, the data lists a project’s qualifying criteria. DFC transactions must meet at least one of four criteria and can meet more than one; a fifth criterion pertains to the qualification of on-lending facilities through financial intermediaries. While insufficient on its own, a criterion (5A) specifying “at least 30% of DFC’s loan proceeds or the Financial Intermediary’s portfolio will support/ be on-lent to businesses that meet one of the four 2X criteria” was the most commonly cited. Given support for financial services has accounted for a significant share of DFC’s commitments since it opened, this is perhaps not surprising. Though, as our colleagues pointed out in their 2021 analysis, the concentration may also reflect the fact that limited access to capital is a major constraint for the private sector in many lower-income markets and can pose a particular challenge for women-owned enterprises.

Transparency in the future

DFC is currently accepting public comment on its new transparency policy through early October. Here are three things we hope to see DFC incorporate in its future data.

Development impact

OPIC’s downloadable data included a field for projects’ anticipated development impact based on the agency’s ex-ante scoring. While some projects were not scored, most were categorized as either highly developmental or developmental—in rare instances, project impacts were classified as indeterminate. DFC made early commitments to impact measurement, launching its Impact Quotient (IQ) framework—which has since been revised. But the agency’s downloadable data no longer provides basic scoring information in a way that can be searched or filtered. As the agency is called upon to meet a growing set of national security objectives, making this information accessible is all the more important. This also seems like a no-brainer addition since the projects’ ex-ante development impact category appear in the summary pdfs linked from the database. We’re also anxious to see the improved IQ in action—and would be excited to have additional, more nuanced insight into expected development outcomes from DFC’s investments and, eventually, ex-post data on performance.

Mobilization

As multilateral development banks ramp up their focus on private capital mobilization (PCM), we think there’s a strong case for DFC to report mobilization numbers. DFC’s ability to bring in investors to projects that they would have otherwise been reluctant to take on will be a crucial measure of its success.

Climate finance?

Another area where DFC could step up its transparency game would be in publishing details about its climate-focused investments. The agency announced ambitious climate pledges in early 2021. A marker and details—as with 2X—would enable external stakeholders to understand the agency’s progress towards those commitments and the administration’s broader climate finance goals. This could include a breakdown between mitigation and adaptation projects.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.