Recommended

Blog Post

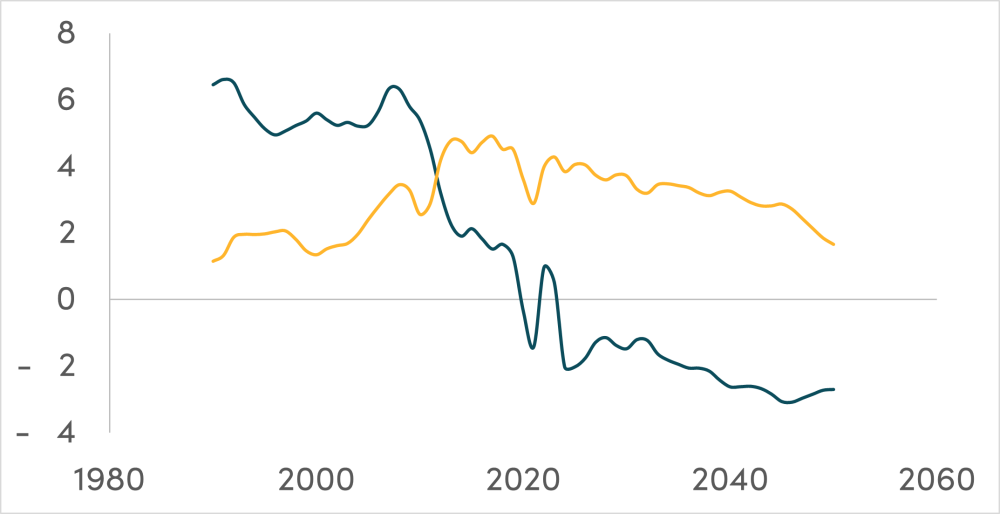

I have argued for a few years now that the real migration crisis in most rich countries is that there aren’t enough migrants. The travel bans and disruption of COVID-19 slashed migration rates just as many high-income countries were seeing their working age populations reach a peak. (The figure below shows the trend in net changes in working age and non-working-age populations in high income countries as a group). This has contributed to upward pressure on prices alongside labor shortages. Headlines from Germany, Austria, Canada, Japan, Taiwan, South Korea, and the US (the list goes on) speak to the widespread problem of not enough people around to do the work that needs to get done.

That said, there are reasons to doubt that a declining working age population would have a long-term effect on prices. They are based on an argument that economists have long made when it comes to migration into economies where the domestic labor force was still expanding, termed the “lump of labor fallacy.” For good or ill, I think those doubts are wrong.

An old argument against migration is that migrants will take jobs away from workers already here. There’s plenty of empirical evidence that usually isn’t true. And a big reason is that there isn’t a “lump of labor” that needs doing in a country that can’t be expanded. Instead, employment expands to fit the homegrown and migrant workforce available (mostly). With regard to migrants in particular, as more people enter the country, that creates more demand for goods and services, which in turn creates more demand for people to provide those goods or services. Migrants also frequently provide complementary skills: they allow domestic workers to be more efficient. They can do that by creating new firms or research, or they can do that by providing childcare which allows domestic parents to work as researchers or entrepreneurs. More migrants means more of the workforce is productively employed.

Annual change (m) in the population 20-64 (teal) <20 + >64 (gold) in high-income countries

But if demand usually expands to create more jobs when migrants arrive, why can’t demand shrink when people retire? I think it isn’t that simple. Retired people don’t go away. They’re still here, still demanding things. And what they demand—even more than the rest of the population—is non-tradeable services in sectors which automation has been slow. That suggests problems ahead.

The lack of workers wouldn’t be a problem if we could use robots to replace them. We’ve seen that in some cases in the past when workers have suddenly gone away. Michael Clemens found that when the Bracero labor migration program covering temporary Mexican worker employment in the US was shut down, farmers automated crop picking in response. But if the 38 percent of US home health aides who was born outside the country were to leave tomorrow, we don’t have the technology to replace them with robots. And, without moving patients and homecare clients to another country, we can’t use trade to deal with the problem either.

Demand for services is going up, there aren’t the workers, you can’t substitute capital or imports in a meaningful way—so you get an increasingly tight labor market. And retirees will suffer because the cost of services they want will climb as demand increases and supply contracts.

As wages rise in services, perhaps some workers in traded goods production will switch over to service jobs, but there are two problems: one is that only about 9 percent of the workforce in the US is still employed in manufacturing and agriculture—there aren’t many workers to move. And, second, while some of those jobs could be replaced by (even) higher rates of automation, there is also the risk that fewer workers simply leads to stranded capital: farms and manufacturing firms that can’t compete globally at higher labor costs, and so shut down instead. Who owns the capital involved? Primarily it is the old age population, again—who are hoping they can use the rents to live a comfortable retirement.

Greater migration can fix all of this. Migrants to the US, for example, arrive at an average age of around thirty—eight or so years below the average age in the US as a whole. Only about 6 percent arrive when they are of retirement age, or about a third of the proportion of the population as a whole. The proportion who are children is very similar to the US average. That means migrants can help reverse the trend to a smaller workforce and a higher dependency ratio. Additionally, because they are younger and poorer than the US average, migrants’ relative demand for goods over services is higher, reducing pressure on the non-traded services sector.

That’s to say nothing of the fact that migrants are a group of people who have demonstrated a willingness to take risks and make investments to move to another country and a better life. That entrepreneurial spirit is reflected in their considerable over-representation in innovation, a feature sorely needed in an aging domestic population associated with less economic dynamism. We need these migrants’ complementary skills more than ever.

So even if labor isn’t usually a lump, it can be more difficult to shrink labor supplies than growth them—especially when the workforce isn’t leaving, it is simply moving to the golf course or retirement home. And that’s why I’m still committed to the idea that the real migration crisis for rich countries is that they aren’t seeing nearly enough immigration.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Adobe Stock