Recommended

The COVID-19 pandemic resulted in the deepest global recession since World War II. Countries across the world implemented substantial mitigation measures in response to the economic shock of the pandemic, with the size of the economic stimulus measures averaging about 5.6 percent of GDP. Social protection policies—some aimed at protecting the income and livelihoods of families and others aimed at protecting employment through job retention schemes—were an essential part of these stimulus packages. On average, countries spent about 2 percent of GDP on social protection measures, although high-income countries spent almost five times more than low-income countries.

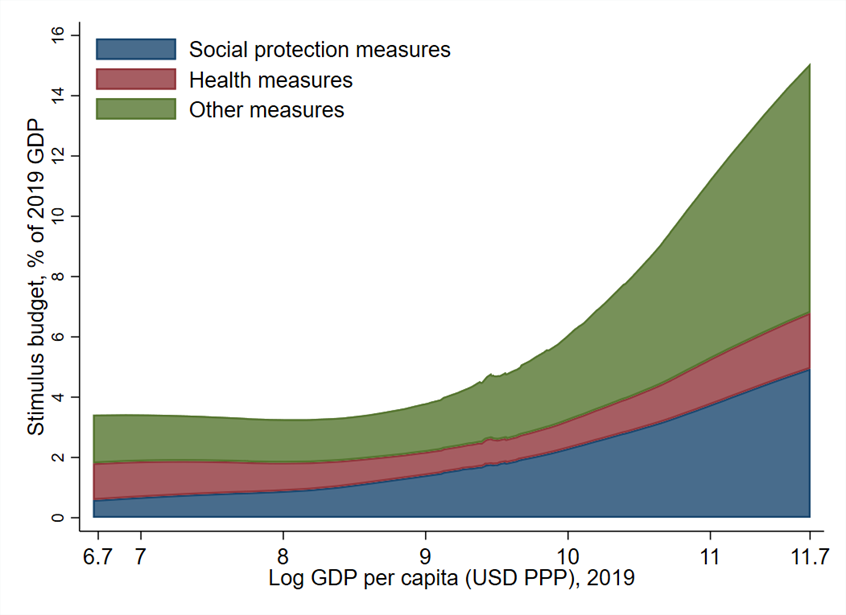

In a new paper, we compile a database of the budget allocated to different social protection programs implemented as part of the pandemic stimulus package in 154 countries and investigate the effectiveness of income protection versus job protection policies on economic recovery in the second half of 2020 through 2021. The database reveals interesting patterns. The size of the stimulus budget and its share of social protection varied across countries (Figure 1). On average, high-income countries allocated almost 3.5 percent of their GDP to social protection response, with several countries exceeding 5 percent of GDP. Upper-middle-income countries’ social protection response budget averaged 1.9 percent of GDP, almost half of their overall stimulus package. Lower-middle-income countries’ budget was 1 percent of GDP. Among low-income countries, the social protection response budget was just 0.8 percent of GDP—less than a fourth of these countries’ overall stimulus budget.

Figure 1. Stimulus budget, expressed in % of 2019 GDP

Note: this graph plots the size of economic mitigation measures (distinguishing between social protection and other measures, expressed in percent of 2019 GDP) by log GDP per capita (2019 data, expressed in USD at PPP). The share of each type of spending is plotted by a LOWESS (Locally Weighted Scatterplot Smoothing) function.

Source: Social protection budget data are from the authors’ dataset. Data on the budget for economic mitigation measures are from the IMF (2021). GDP data are from World Bank (2021c).

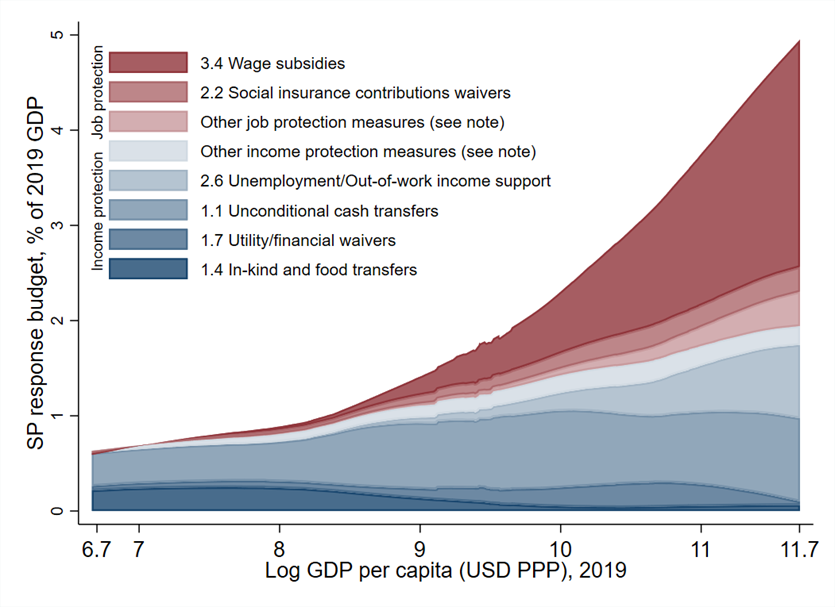

The composition of social protection programs also differed across countries (Figure 2). Many countries tried to preserve employment, with job protection policies taking the form of short-term work arrangements, furloughs, and/or wage subsidies funded by the government. Others relied mostly on income-support measures, such as cash transfer programs or new or expanded social assistance programs. Our data shows that low-income and lower-middle-income countries devoted most of their (small) social protection budgets to measures preserving the income of their citizens, through either direct cash transfers or the provision of in-kind and food transfers. In contrast, higher-income countries aimed their (larger) social protection budgets at preserving jobs by directly subsidizing wages and reducing the social insurance costs to employers. Upper-middle-income countries combined both policy approaches—preserving income and preserving jobs—with unconditional cash transfer taking the forefront. Expenditure on income protection measures was on average about 1.2 percent of GDP, with less variation across country income groups than expenditure on job protection. That spending averaged 0.8 percent of GDP but ranged from almost zero in low-income countries to 1.9 percent of GDP in high-income countries.

Figure 2. Share of social protection response budget by program type of measure

Note: this graph plots the social protection response budget (by type of program, expressed in percent of 2019 GDP) by log GDP per capita (2019 data, expressed in USD at PPP). The share of each type of program is plotted by a LOWESS function. Detailed program codes can be found in Table 1. “Other job protection measures” includes program codes 2.3, 2.4, 2.5, 3.3, 3.6, 3.7, and 3.8. “Other income protection measures” includes program codes 1.2, 1.3, 1.5, 1.6, 2.1, and 3.5.

Source: Social protection budget data are from the authors’ dataset, expanded from Gentilini et al. (2021). GDP data are from World Bank (2021c).

Which combinations of job protection and income protection policies deliver better economic outcomes, at least in the short term?

In most countries, the labor market policies introduced in response to the COVID-19 pandemic pursued two main goals: limiting social hardship caused by the pandemic and ensuring a rapid and sustainable post-pandemic economic recovery. The weights of the job protection and income protection measures in the policy response, in theory, should depend on the government’s perception of the nature of the crisis. The optimal response to transitory and exogenous shocks, such as natural disasters, should focus on job preservation by subsidizing businesses to maintain jobs and reduce workers’ welfare losses. Such policies support workers and ensure that firms can jumpstart their activities once the crisis is over. But the impact of the pandemic could be more structural and permanent. The pandemic-induced changes forced businesses to develop new value chains that rely on digitization and automation processes, and many companies learned to operate with fewer workers. These structural changes will require significant reallocation of resources. Policies focusing on job protection may hinder the movement of labor from unviable jobs to better-performing industries and slow the recovery. Using the new data on social protection measures introduced during the pandemic, we attempt to assess which combinations of job protection and income protection policies lead to better economic outcomes in the early recovery period.

We estimate the relationship between four economic outcomes (GDP growth, unemployment, rates of labor inactivity, and poverty) and variables representing expenditures on the two types of social protection policies and country-level controls. Our analysis shows that, in the short run, higher expenditure on job protection is associated with a more robust economic recovery, increased employment, and decreased inactivity and poverty rates; whereas expansion of income protection measures appears to have no significant economic effect.

The importance of pre-pandemic social protection systems

We then take our analysis further to account for the effects of pre-pandemic characteristics of social protection systems. We find that social protection response had a significant economic impact in countries with weaker pre-pandemic social insurance systems. In countries with broader social insurance coverage, income and job protection programs appear to have a limited impact on post-pandemic recovery. We speculate that some programs implemented during the pandemic—particularly those protecting jobs—may have been redundant in these countries as automatic stabilizers were already in place.

The interpretation of our results might raise concerns about the potential influence of omitted variables since economic outcomes may themselves determine the size and composition of social protection policies. To address this identification issue, we instrument the share of the social protection response budget allocated to job protection policies, by the electoral cycle in the country. Our exclusion restriction relies on the assumption that the share of social protection response spending allocated to job protection correlates with a country’s electoral cycle, but the economic effects of the pandemic (our dependent variables) are not correlated with the electoral cycle. Addressing endogeneity in this way, we continue to find statistically significant effects of job protection policies on the employment rate and inactivity rate, suggesting that these results are more likely to be causal.

These findings underscore the importance of investing in the development of social protection systems during periods of economic growth to protect households and firms during economic downturns without implementing additional measures. The effects of structural economic changes induced by the pandemic (the new value chains, production processes, and labor institutions) are expected to fully materialize in five to eight years. They might affect the relative performance of the two policy options analyzed in the paper. The shortcoming of job protection programs may become apparent if some of the changes in demand and supply introduced by the pandemic become permanent, and protecting jobs hinder the necessary reallocation between obsolete firms and newly created firms due to changes in demand and work habits. More research is therefore needed to understand the longer-term effects of various types of social policies on labor markets and economic recovery.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Adobe Stock