Recommended

It’s well known that China and other emerging economies within and beyond the G20 are now major players in the global economy—and are also providing substantial finance to developing countries. But how much of this finance is really “developmental”, i.e. concessional and with the purpose of promoting development, and how does it compare across countries? To date, we know of no consistent measure of development finance that includes non-DAC countries.

In a new working paper, we aim to address this gap with a new measure of cross-border, concessional finance—Finance for International Development (FID). FID is designed to be a measure which is more consistent across all development actors—going beyond just OECD members. Our measure is distinct in two main ways: First, it aims to measure the grant-equivalent of all concessional finance (from grants, to lending that does not exceed thresholds set by the IMF or OECD). And second, for consistency between countries, it only considers finance which is cross-border (about a sixth of OECD’s aid measure, Official Development Assistance (ODA), is provided within the provider’s territory).

With FID, we provide the latest and most comparable development finance, both country-by-country estimates and the total for 40 economies which account for 88 percent of the global economy (GNI).

How much are the flows of global aid and concessional finance?

Countries outside the OECD are becoming increasingly important to the global economy, including its financial flows. China in particular (among others), is also providing substantial volumes of finance to lower income countries. The OECD’s Development Assistance Committee (DAC) measures aid across its 30 members—but this measure does not extend to other major economies despite their increasing importance.

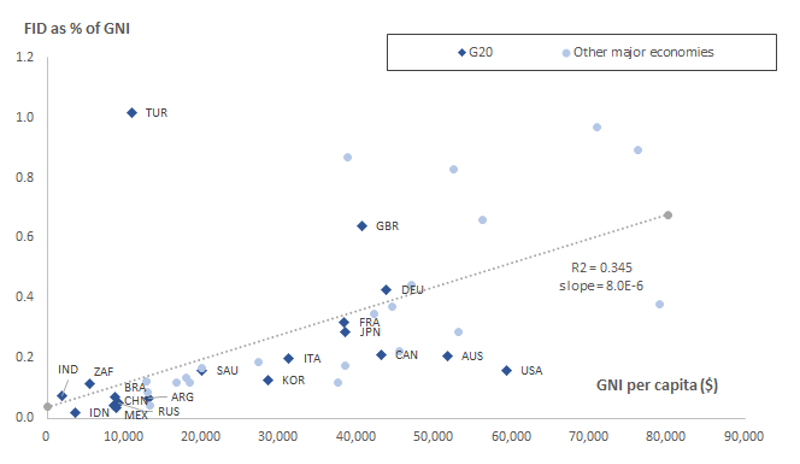

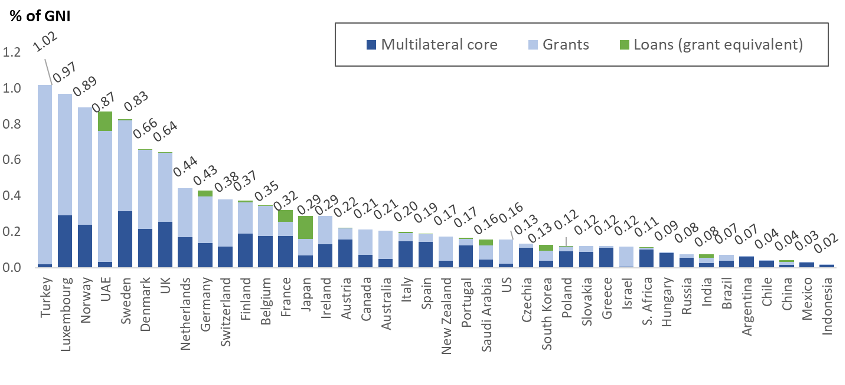

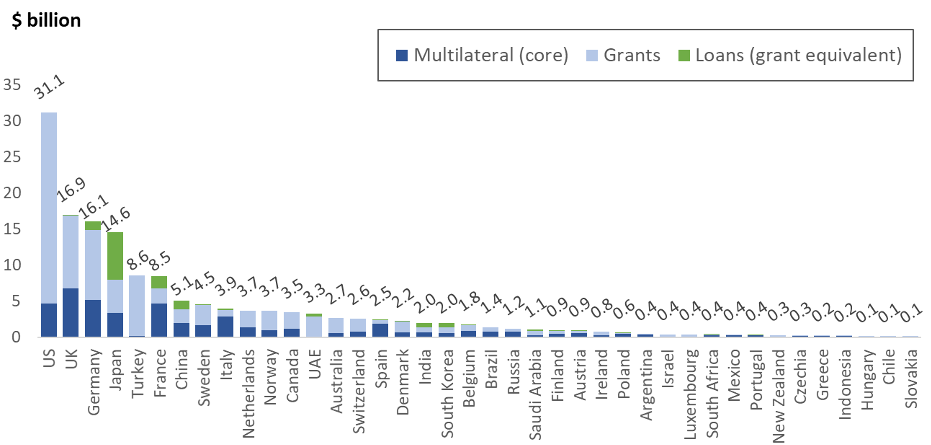

Our measure shows that, across 40 of the largest economies, the annual value of Finance for International Development in 2017 was $150 billion—equivalent to 0.2 percent of those countries’ national income (although this hides a wide range: from over 1% of national income for Turkey, to 0.02% for Indonesia). Put another way, for every $1000 generated by those 40 economies, just 21 cents is being provided to developing countries, including through the UN and multilateral system.

If we focus for a moment just on the element that countries provide to the core resources of the UN (including the World Health Organization) and other multilateral organisations, concessional finance amounts to just 0.07 percent of the income of this G-40.

At a time when governments are rightly focused on their responses to a global pandemic, such figures make it clear that a very limited share of income is going into joint efforts to tackle global issues.

Country-by-country estimates

The absolute estimates of FID by country show that there were seven providers that each provided over $5 billion: the US, UK, Germany, Japan, Turkey, France, and China. The US provided $31 billion, a fifth of the global total. Turkey was the largest provider outside the Development Assistance Committee (DAC); their FID mainly represents its very large humanitarian support in Syria.

Figure 1. Total Finance for International Development (FID), 2017

In terms of assessing the effort this represents, it’s more relevant to compare to national income. The results against GNI are shown below.

Figure 2. FID as a share of gross national income 2017, (current $)

What about China?

The figure of $5.1 billion for China may seem low relative to the major amounts that we know are being lent as part of China’s Belt and Road Initiative, of maybe $400 billion. In part, this reflects that many quoted lending figures refer to the cumulative stock, whereas ours is an annual flow (this could be $20 billion per year net, built up over 20 years). We only count the subsidy element rather than face value, and only for interest-free and concessional Chinese loans, which is a small part of the overall portfolio. We also only use official figures—whereas Aid Data, in older data, have identified just over half as much again that is not reported officially by China.

The story for China is interesting—the concessional element of their financial assistance (ie, FID) is not much larger than Sweden’s (of $4.9 billion)—but part of it is spread thinly to support its large loan portfolio. Still, the total is tiny relative to their economy size—at just 0.04 percent.

It is understandable that countries—including China—contribute less of their GNI, given their per-capita income levels are far lower than most DAC countries. Our paper looks at this, and finds India and South Africa look generous, giving more than might be expected given their lower income level.

But this is not true of China.

Next steps

We plan to update this exercise annually, and to improve the methodology as we do so. We see this measure as a complement to OECD’s ODA (indeed we draw heavily on the data behind ODA to produce our estimate). There are three areas we’d like to improve:

- Currently, some DAC countries do not provide enough detail to count lending which is concessional, but which is below the threshold for ODA (indeed, we know more about this lending for China and India, than we do for some DAC members).

- Whereas we currently use the method for calculating the grant equivalent of loans stipulated by the OECD for ODA, we think our existing method on loan concessionality should better-reflect the true alternative borrowing costs for specific country contexts.

- We could adjust technical cooperation for differences in relative prices and wages: for the same dollar value, India can provide a lot more technical expertise than the UK for example

These estimates will also provide the basis of our new Commitment to Development Index (CDI) coming out later this year, when we’ll combine FID for “quantity” with a “quality” assessment. Stay tuned for more on the CDI!

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Center for Global Development