Recommended

Evidence of the punishing depth and duration of the pandemic crisis for the developing world is mounting, including a sharp spike in poverty and recovery delayed by badly lagging vaccination progress. This damage comes on top of the daunting challenges of financing the Sustainable Development Goals (SDGs), especially for poorer countries, the growing number of poor countries in or near debt distress, and the increasing urgency of mobilizing finance to combat climate change, not least because of its impact on the most vulnerable people and countries.

The multilateral development banks (MDBs) should be central to the international financial system’s arsenal for addressing these challenges. These are the institutions purpose-built for expanding resources available to countries—beyond their own budgets—for stimulus and recovery spending, social protection, growth-promoting infrastructure, sustaining education progress, vaccination delivery and other urgent health needs, and climate change mitigation and adaptation.

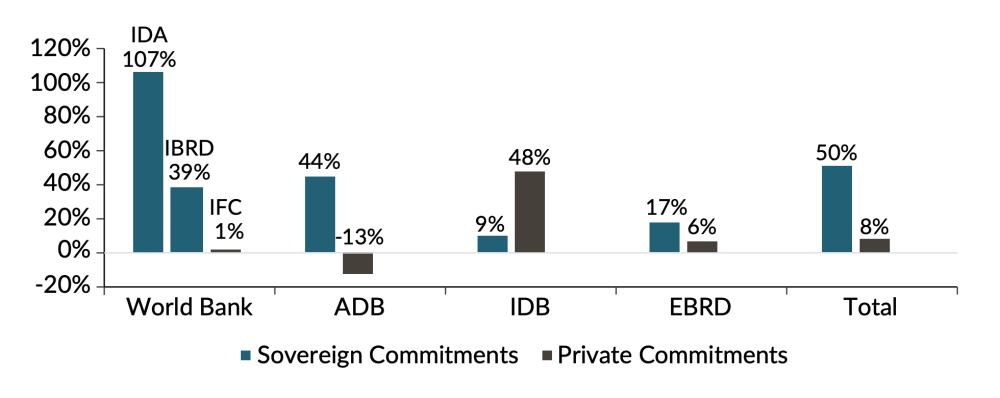

How have the MDBs responded to the COVID-19 crisis? A CGD note just published assembles data published so far for four of the major MDBs on their financial commitments to governments and the private sector in 2020 compared to 2008-2009 during the Global Financial Crisis (GFC). The figures below summarize the sobering results.

Notes:

a. The GFC percent change was calculated for 2008-2009 average annual commitments compared to 2005-2007 average annual commitments, as reported in IEG source below (pg. 12). The COVID-19 percent change compares the 2020 commitments to the 2019 commitments.

b. Unless otherwise noted, calculations reflect total commitments/approvals as reported by individual institutions.

c. The African Development Bank is not included here because 2020 data are not yet public.

Sources: IBRD Statement of Loans, IDA Statement of Credits and Grants, IFC Financial Statements, AsDB Annual Report, IDB Annual Report, IDB Invest Annual Report, EBRD Interim Reports, EBRD Press Release, IEG: The World Bank Group’s Response to the Global Economic Crisis

Figure 2. Percent change in commitments from 2019–2020, sovereign and private

Source: See above.

Key findings

-

MDB total lending rose substantially (by 39 percent) in 2020, but by much less than in the GFC period of 2008-2009 (76 percent), despite the much larger impact of the pandemic on developing countries.

-

Performance across institutions is very uneven, and not especially aligned with the relative impact of crises on different regions.

-

The World Bank’s IDA (its concessional window for poor countries) stands out as the top performer on the sovereign lending side with a 107 percent increase in 2020.

-

IDB Invest (IDB Group’s private sector arm) excelled on the private sector finance side with a 48 percent increase.

-

But across all institutions, MDB private finance rose by only 8 percent in 2020—barely countercyclical—with IFC commitments flat, Asian Development Bank commitments down, and EBRD commitments up only 6 percent.

Key takeaways

What can we conclude from these preliminary findings? Hopefully more data will be available soon for more granular analysis (something the G20 should insist on to track performance across institutions, regions, country income groups, sectors, and finance instruments). But here are three early observations.

-

The MDB system is not big enough to make a meaningful contribution to either crisis response or SDG finance, especially in poor countries. IMF analysis demonstrates the urgent need to expand fiscal space for poor countries for crisis-related spending and for more SDG-related spending. Yet, even with the 2020 increases, MDB lending in 2020 still totaled only 0.5 percent of developing country GDP, a drop in the bucket of finance gaps. The CGD note offers a back-of-the envelope calculation for thinking about how large MDB lending capacity would have to be in order to contribute 3 percentage points of GDP annually to the poorest countries and 0.5 percent of GDP to emerging markets. Using these targets, annual MDB finance should amount to about $230 billion per year, about 60 percent more than what these four MDBs collectively committed in 2020.

-

MDB collective surge performance does not appear to be calibrated to the severity of the crisis. In 2009, the GDP of developing countries grew 2.8 percent. In 2020, it shrank by 2.2 percent. Yet the size of the increase in MDB finance in 2008-09 on average was twice that in 2020. The reasons are not yet clear and may stem from the demand side as well as the supply side. Those developing countries that can seem to be choosing to go to private capital markets rather than the MDBs. On the supply side, MDB capital should not be viewed as a binding constraint to lending: all of the MDBs analyzed here have received capital increases since the GFC, and there is a strong case for using the headroom they have on their balance sheets for a surge in lending during a crisis of this magnitude and duration. Whatever the reason, it is clearly important to examine how better to match MDB finance with needs going forward. The IMF is currently stepping into the breach, using the speed possible under its emergency finance facilities and the resources to be made available under the Special Drawing Rights allocation. That solution is suboptimal given the IMF’s mandate and expertise for focusing on external imbalances and financial stabilization, not the dominant challenges of this crisis—at least so far.

-

MDB private finance arms do not play a significant countercyclical role in crises. Fears about whether their risk tolerance would permit such a role now seem justified. Their performance should intensify evaluation of whether their business models need fundamental re-examination or adaptation. Certainly shareholders will be carefully considering where to put more public resources in the wake of the deep and lasting damage from the pandemic. It is hard to make the case for more capital to expand MDB private finance if it is only procyclical.

In a crisis of the magnitude and likely duration of the COVID-19 pandemic combined with pressing SDG finance challenges, the system of international financial institutions, including the MDBs, must fire on all cylinders. It is time for a rethink by shareholders and other stakeholders of MDB financial fire power individually and as a group, their capacity to respond both quickly and to long-term challenges, and their ability to act as a coherent system for greater scale and impact.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.