The outlook for emerging and frontier economies is bleak and getting bleaker. Of the many concurrent emergencies threatening developing countries, two are particularly daunting: debt and hunger. Commodity shocks brought on by Russia’s invasion of Ukraine—compounded by droughts and other climate events—have put many developing countries on the brink of famine.

Against this backdrop, 30 percent of emerging markets (EMs) and 60 percent of low-income countries are already in or at risk of debt distress. Debt and famine have distinct drivers. Rising debt levels across much of the developing world are exacerbated by recent central bank moves in advanced economies to normalize interest rates. And while supply chain bottlenecks in the wake of the pandemic were already driving up the cost of food, Russia’s war in Ukraine restricted the supply of key agricultural commodities like wheat and fertilizer, propelling world food prices to their highest recorded levels.

Not every country at risk of debt distress is at risk of a famine, and vice-versa. But for the handful of countries that are vulnerable to both, the interplay between the two crises could exact a devastating human toll. This has already come to a head in Sri Lanka, where the government has defaulted on its debt. The ensuing economic crisis has raised food prices by a staggering 90 percent, leaving over a quarter of the country’s 22 million citizens food insecure. All signs indicate that the crisis that played out in Sri Lanka could be a bellwether for a handful of other emerging economies unless international financial institutions step in now with targeted support and creditors offer much-needed breathing room.

Hunger and food: Overlapping crises

The World Food Programme (WFP) assesses a country to be at a “high risk” of a food crisis when more than 40 percent of the population is experiencing insufficient food consumption. Of the 28 low-income countries that the IMF classifies as in or at high risk of debt distress, 7 (or 25 percent) have also crossed this threshold (square icons on the scatter plot in figure 1).

Food insecurity is significantly more correlated with a country’s income level than its debt-to-GDP ratio. In the three most food insecure countries today—Afghanistan, Somalia, and Niger—food shortages are more a result of conflict and domestic droughts than of rising prices for food imports. However, countries’ abilities to buy food on the international market is severely hampered by deteriorating macroeconomic conditions. Russia’s invasion of Ukraine and resulting Western sanction have dealt an ongoing supply shock to three key commodities: fuel, fertilizer, and wheat, raising the worldwide food import bill from $51 billion to $1.8 trillion internationally, an all-time high. According to the IMF, rising food prices have done more to erode purchasing power since the beginning of 2021 than aggregate average inflation over 2016-2020. This is felt acutely in the poorest countries, where food accounts for up to 90 percent of household spending. And with most of these goods denominated in hard currency—dollars, euros, and pounds—high international prices can contribute to the erosion of emerging markets’ hard currency reserves (which they also need to service their debt).

Figure 1. Eighteen countries could be nearing simultaneous debt and food crises, with government debt-to-GDP ratios of over 60 percent and more than 20 percent of their population experiencing insufficient food consumption. If pressures increase, these countries could join the handful of countries currently in or at high risk of debt distress and widespread food insecurity [black boxes].

*Countries for which WEO data was not available.

Note: The sample shown in this chart includes all countries for which the WFP tracks food insecurity levels and is not an exhaustive list of countries. Additionally, the “percentage of population experiencing insufficient food consumption” metric does not tell the whole story on hunger; some countries, like Nigeria and Ethiopia, which have relatively small and concentrated percentages of their populations facing extreme food scarcity are also hunger hotspots according to the WFP and FAO. Finally, the 40 percent threshold is one requirement of multiple to be defined as high risk – see WFP HungerMap for details.

Sources: Gross government debt/GDP secondary sources, by country: Somalia, Libya, Cuba

A more significant number of countries are hovering on the brink. These are countries that have both limited domestic food production capacity and high debt service costs. Of the 90 countries tracked by the WFP, 18 fit this description, with government debt-to-GDP ratios of over 60 percent and more than 20 percent of their population experiencing insufficient food consumption, including middle-income countries like Kyrgyzstan, Sri Lanka, and Bhutan.

Taking an even broader set of factors beyond food insecurity into account, including debt, fiscal balance, quality of economic institutions, and sociopolitical environment, a recent IMF paper identified 23 countries as highly vulnerable to the food crisis: Afghanistan, Burkina Faso, Burundi, Central African Republic, Chad, Democratic Republic of the Congo, El Salvador, Ethiopia, Malawi, Mali, Mozambique, Niger, Nigeria, Pakistan, Sri Lanka, Syria, South Sudan, Somalia, Sudan, West Bank and Gaza, Yemen, Zambia, and Zimbabwe.

EM currency devaluations

To combat domestic US inflation, the US Federal Reserve has raised interest rates 300 bps over the past nine months (figure 2). By increasing the returns associated with US bonds, rate hikes increase demand for US dollars, which raises the value of the dollar against other currencies, including emerging market currencies. This has two major consequences for global financial flows. First, it makes the cost of importing goods, including food, which is denominated in dollars, more expensive—on top of the supply-driven price increases. In fact, even if global commodity prices fall in dollars terms, as has been reported recently, the dollar’s strength prevents this dynamic from trickling down to the country level in EMs facing the most severe devaluations. Second, since much of emerging market debt is denominated in US dollars, this makes EM debt service more expensive.

Figure 2. The US Federal Reserves is raising rates faster than any time since 1994, drawing capital out of EM currencies and making dollar-denominated debt service and imported goods more expensive.

Figure 3 shows some of some of the EMs hardest hit by this dynamic. Sri Lanka’s currency devaluation was precipitous. Other EMs, especially Ghana, continue to steadily decline, adding to pressure on both the food and debt front.

Figure 3. The Sri Lankan rupee and Ghanaian cedi have been some of the hardest hit currencies, losing approximately 45 and 40 percent of their value against the dollar since the start of the year, making dollar denominated debt service and imports nearly twice as expensive.

Falling foreign exchange reserves

Since the beginning of 2022, emerging markets and developing countries’ foreign currency reserves have fallen by $379 billion, the biggest such drawdown since 2008. Since EMs pay for both commodity imports and debt service in foreign currency, increasing prices further increase the rate at which countries spend down these reserves. In addition, several countries, including Pakistan and Mongolia, have attempted to defend their currencies against devaluation by selling their foreign exchange dollars and purchasing local currency (figure 4). This can become dangerous if foreign exchange (FX) reserves get low and force a country into a tradeoff between spending FX on debt service or on importing basic goods for its citizens.

Figure 4. To pay for more expensive dollar denominated debt service and imports (and in some cases, defend against devaluations), countries have drawn down huge portions of their foreign currency reserves.

Sri Lanka

This tradeoff was made painfully clear in Sri Lanka, which depleted 47 percent of its foreign exchange in 2022. Even into 2022, the government continued to prioritize its international debt service obligations, restricting the import of 367 items deemed “non-essential,” including fresh fruit, fish, and dairy products, to conserve precious FX. However, in late May, the country was forced to default, suspending payments on $7 billion of its $51 billion in foreign debt. With inflation at 45 percent and food prices up 90 percent since last year, four out of five of Sri Lanka’s 22 million citizens are now forced to skip meals.

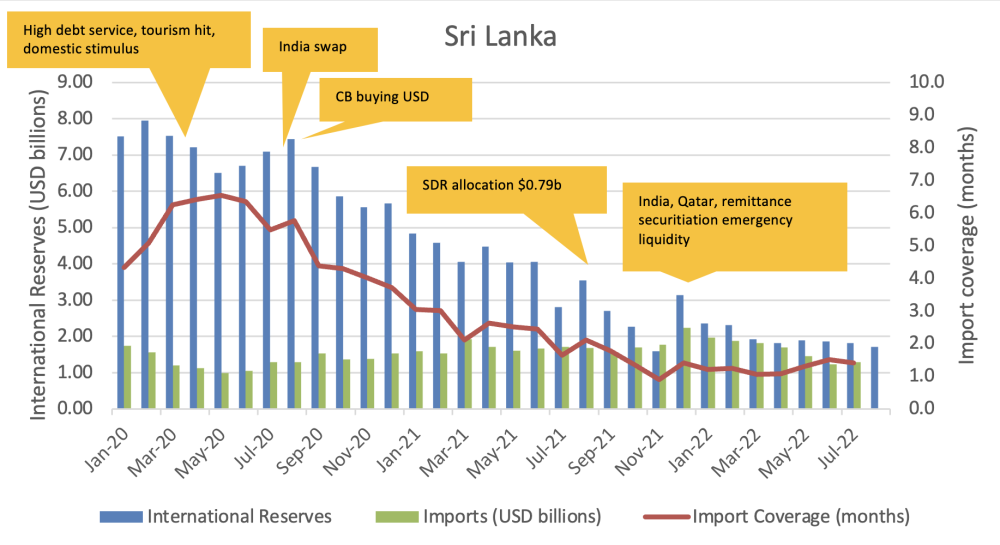

As shown in figure 5, import coverage—the number of months’ worth of imports a country can buy using its existing level of FX reserves—is a good proxy for the sustainability of a country’s external balance (the balance between its FX reserves and its FX spending), especially as it relates to food security. According to the IMF, “the rule of thumb” minimum level of import coverage a country should have is three months’ worth. By May 2022, Sri Lanka’s had fallen to just one, highlighting the precariousness of its economic situation.

Figure 5. Sri Lanka’s FX reserves have fallen precipitously since 2020, to only one months' worth of imports, forcing it to choose between financing debt service or basic imports for its citizens (it ultimately chose the latter, forcing it into default).

FX pressures elsewhere

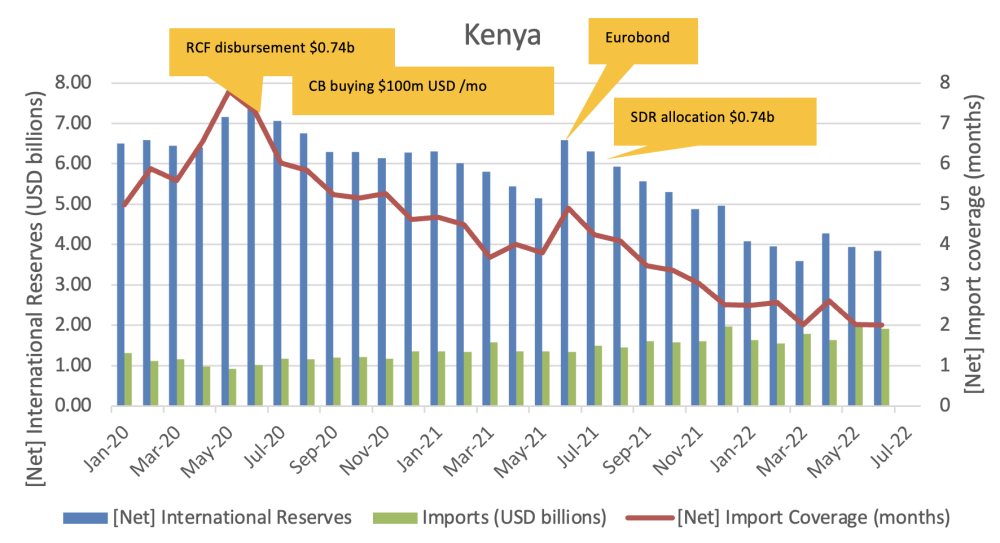

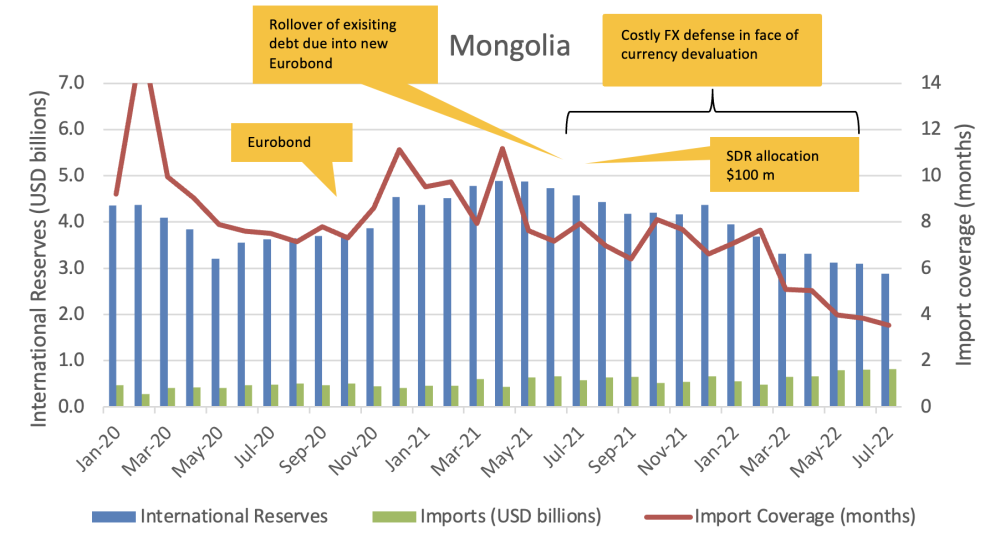

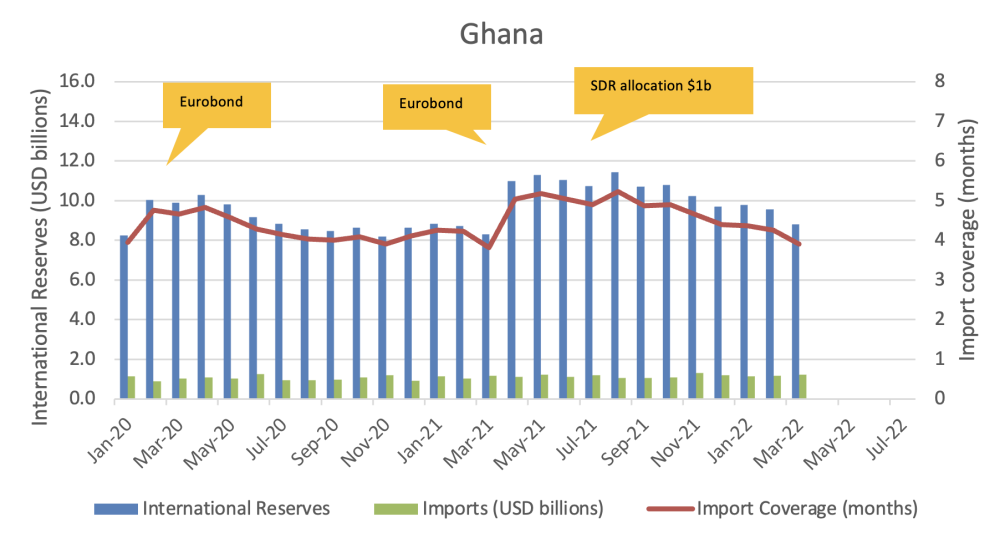

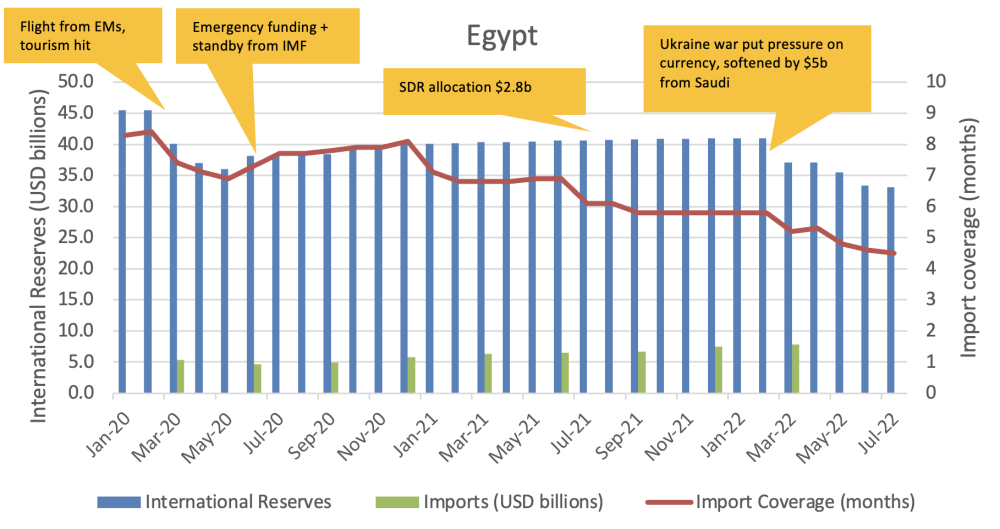

The Sri Lanka scenario could play out in other countries that are exhibiting similar external vulnerabilities. Figure 6 shows comparable charts for a handful of sovereigns whose external sectors are also under intense pressure. None is in the dire straits that led to Sri Lanka’s default, but Kenya currently has only two months of import coverage, and Mongolia’s figures are rapidly approaching the three-month threshold.

Figure 6. Though not as dire as Sri Lanka, other sovereigns are experiencing similar trends of rising import bills and falling FX reserves.

Click to show full-size graphs

High spreads suggest a loss of market access

With similar dynamics manifesting in other EMs, the obvious question is how to avoid another Sri Lanka. In the pasts, with FX reserves dwindling, countries would take on additional external borrowing, providing finance ministries with a flush of hard currency to bridge the gap. Indeed, looking at the graphs above, many of the sharp upticks in FX reserves are attributable to large Eurobond issuances. During the low interest rate environment that has reigned over the past few years, these were possible since investors were willing to lend money to emerging and frontier market sovereigns with limited repayment history to chase higher returns.

However, the safety valve is now closed to the most vulnerable countries. For many EMs, including all those in the sample above, the spread against the US Treasury 10-year bond—a widely accepted indicator of the perceived risk of an asset—has risen above the threshold of 10 percentage points, suggesting that these countries could not borrow on international markets even if they wanted to (figure 7). That makes it less likely for future Eurobonds to replenish the dwindling FX reserves of the countries on the brink.

Figure 7. At least 11 EMs’ bonds are currently trading at a spread of over 10 percentage points with the US 10Y Treasury Bond, indicating a loss of market access

Conclusion

The global safety net is once again being tested. With many countries locked out of private capital markets, demand for IMF and MDB financing could balloon over the coming months. International financial institutions (IFIs) need to provide both timely and targeted support. The IMF will soon be launching a food shock window to help countries grappling with the food crisis. The IFIs had previously announced a joint action plan to address food insecurity. But steps must also be taken on the debt side to prevent balance of payments crises from morphing into food major food crises. A good starting point to give some countries breathing room would be to revive the debt service suspension initiative, and to make debt suspension immediate (by all creditors, including bondholders and China) upon application for a debt restructuring.

Thanks to Cindy Huang and Erin Collinson for helpful comments on a previous draft

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.