Back in August, President Biden nominated Scott Nathan to serve as CEO of the US International Development Finance Corporation (DFC). This week, Nathan will finally have the chance to share his vision for the still-relatively-new agency before the Senate Foreign Relations Committee.

While not well known in development circles, Nathan boasts both government and private investment experience. If confirmed, the job he’ll assume is a big one. DFC features prominently in the administration’s vision for ending the global pandemic, tackling climate change, advancing gender equity, and driving infrastructure investment in low- and middle-income countries around the world. An ambitious set of goals layered on top of DFC’s core mandate to deliver development impact while advancing US foreign policy objectives and ensuring prudent fiscal management.

Ahead of tomorrow’s hearing, we profile four big questions facing the agency.

DFC today

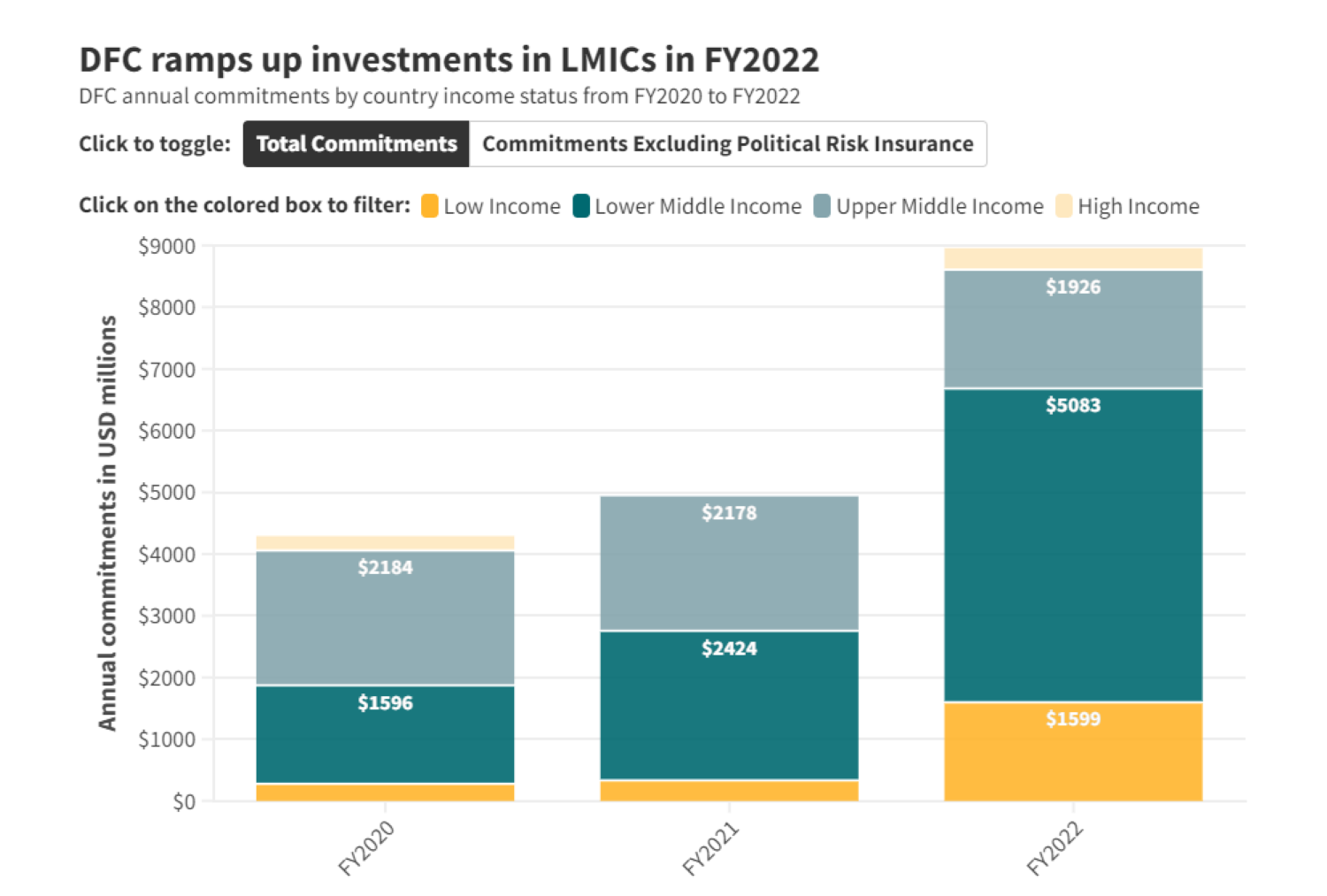

First, a quick reminder of where things stand. DFC is wrapping up its second year of operation. The agency’s profile has grown considerably in that time, as has its portfolio. At DFC’s September board meeting, the agency moved forward with a historic number of investments—contributing to a record $6.7 billion in commitments in FY2021. That’s a big increase when you consider its predecessor, the Overseas Private Investment Corporation (OPIC), hewed close to $4 billion in later years.

DFC inherited OPIC’s portfolio and our best effort to calculate share of exposure by country income classification shows highest concentration in lower- and upper-middle-income countries.

*Some information for DFC’s investments in vaccine manufacturing are unavailable. The agency has announced three distinct projects to bolster COVID-19 vaccine supply.

DFC recently published project data on its website in a downloadable spreadsheet—for which we’re grateful—though the dataset is missing some fields that the file promises will be available with the next update. We were also excited to hear glowing remarks on Publish What You Fund’s new DFI Transparency Tool from DFC’s VP of the Office of Development Policy, Elizabeth Boggs Davidsen.

One of the more challenging tasks on the agency’s early agenda was constructing a framework for assessing the prospective development impact of its investments, which would also be used to track progress throughout a project’s lifespan. DFC launched Impact Quotient (IQ) in summer 2020 and now has more than a year of experience calculating project IQ scores and using the tool to guide more robust monitoring and evaluation efforts.

The agency is actively staffing up to meet a range of new demands, but it’s likely to take time to find individuals with the right set of skills and experience. Meanwhile, nonsensical budget scoring practices continue to hamper DFC’s use of its equity authority—though some lawmakers are actively pursuing a fix.

Given that context, here are four big questions we think DFC’s next CEO will need to be prepared to answer.

How will DFC navigate pressure to stray from its core development mission?

Passage of DFC’s authorizing legislation—the Better Utilization of Investments Leading to Development (BUILD) Act—was made possible thanks to the support of a large coalition with a diverse set of policy goals. Nevertheless, the Act delineated a strong development mandate for the new agency—directing DFC to focus on projects in low- and lower-middle-income countries and those that deliver significant development benefits.

In the intervening years, the new agency with a unique toolkit has attracted increased attention from lawmakers—some of whom would like to expand DFC’s remit by pushing it to work in higher-income environments without clear development objectives. For instance, bills introduced in the current Congress would look to DFC to invest in liquified natural gas, support high-income country supply chains for critical minerals, and finance 5G networks in Central and Eastern Europe. We’ve pointed to the distinct downsides likely to accompany such a shift. One underlying concern is that it could direct staff time and attention away from deals in low- and lower-middle-income countries—markets which tend to be smaller and harder to work in but where development finance is needed most. We also recall past criticisms of OPIC including charges the agency was too politicized or that it crowded out the private sector, rather than crowding it in.

DFC’s new leader will face the arduous task of maintaining a strong base of support for DFC while ensuring the agency doesn’t stray too far from its development mission—even in pursuit of worthy objectives.

More often than not, the push from lawmakers to see DFC enter new territory is a response to concerns about China’s growing global influence (and that of Russia in certain markets), which raises a more fundamental question.

What does it mean to act as a counterweight to China?

Lawmakers are almost certain to ask Nathan about how DFC intends to counter China’s growing global role. That aim was integral to the sales pitch than helped advance the BUILD Act and it remains an important motivating factor for many DFC champions on Capitol Hill and beyond.

In fact, President Biden and G7 leaders unveiled the Build Back Better World (B3W) Partnership in June, and the White House factsheet on B3W gave DFC top billing. Framed as an alternative to China’s Belt and Road Initiative (BRI), B3W aims to enhance support for high-quality, transparent infrastructure projects in lower-income countries. And the White House effectively upped its FY22 budget request for DFC, citing B3W.

But even as DFC assumes a more prominent role on the global stage with expanded capacity to pursue high-quality, transparent investments with measurable impact, the agency is just one part of the equation if the goal is to advance a viable and attractive alternative to China’s overseas lending. DFC’s primary financing mechanisms engage private sector actors—whereas China frequently extends loans to sovereigns, acting through a number of institutions. And the scale of BRI’s annual commitments dwarf DFC’s (even as the latter is growing and the former appears to be shrinking).

Part of the challenge will be getting the narrative right. Ensuring that stakeholders are aware of the important role DFC can and is playing while recognizing its limitations and the jobs for which it is less ably equipped.

Greater cooperation and collaboration with other development finance institutions—whether multilateral development banks or other bilateral entities—can also help mount stronger response. As our colleague has pointed out, co-financing arrangements enable multilateral development banks to act as a force multiplier for DFC investments. And the agency can likewise benefit from their in-country presence and robust project pipelines. There are signs DFC is moving in this direction, but a strong steer from the top could help the agency better harness this opportunity.

Which global challenges is DFC best positioned to tackle (and where can it leave the task to others)?

DFC’s growing profile has advantages—perhaps most concretely the potential for increased resources—but it has drawbacks too. The last administration directed the agency to work on bolstering domestic production of COVID-related products, an effort that (according to a recent report) yielded no obvious impact and left a blemish on the agency’s early record. While the current administration is calling on DFC to tackle challenges more squarely within its mandate, competing demands for the agency’s attention still carry risks.

Announcements made in conjunction with the Climate Leader’s Summit and UN General Assembly previewed a prominent role for DFC in the administration’s efforts to address global climate change. The agency announced a commitment to achieve net-zero greenhouse gas emissions by 2040 and plans to make climate-related projects account for a third of its annual investments starting in FY2023. While the agency will retain modest flexibility to finance nonrenewable energy projects with a strong case for development impact, sustained leadership will be needed to guide investment strategies that reconcile critical goals—including promoting energy access in places where it’s needed most—with tackling the urgent threat of climate change head-on. It will be important to hear from Nathan how he hopes to square these objectives. It’s also worth remembering the experience of OPIC, which under the Obama administration ramped up financing for renewable energy projects—investments that helped push the agency’s portfolio toward higher-income markets. CGD’s own analysis suggests the development finance agency is well placed to advance climate goals in other ways, such as adaptation in agriculture. Recent announcements on that front appear encouraging.

Climate isn’t the only global challenge the administration expects DFC to lean in on. Amid the global pandemic, DFC has taken steps to build a robust portfolio in health—a sector that historically received limited attention (and financing) from development finance institutions. The agency’s Health and Prosperity Initiative has included partnerships to advance vaccine manufacturing and a $383 million project to back the purchase of COVID-19 vaccines by Gavi for distribution to lower-income countries (see the table below for more). But DFC’s health portfolio still has room to grow, as highlighted by our colleagues in a recent policy paper (and a CGD-hosted discussion), particularly through investments in innovation and regional manufacturing hubs.

DFC investments related to global COVID-19 vaccine manufacturing and distribution

| Date formally announced | Country | Description | Volume |

|---|---|---|---|

| June 30, 2021 | South Africa | Joint financing package—including resources from IFC, Proparco, and DEG—for Aspen Pharmacare Holdings Limited, to refinance existing debt and strengthen the company’s balance sheet, supporting Aspen’s operations including production of vaccines, and other therapies in African and emerging markets. | ~$113 million |

| July 9, 2021 | Senegal | Technical assistance grant to Fondation Institut Pasteur de Dakar (IPD) to support development of a vaccine production hub that will serve Senegal and the other countries of West Africa. The project, which will also receive support from the International Finance Corporation (IFC), the French development agency, AFD, and the European Investment Bank (EIB). | $3.3 million |

| September 22, 2021 | Global | Risk management solution through political risk insurance to Gavi, the Vaccine Alliance, to mitigate risk and overcome financial hurdles with governments that are funding COVID-19 vaccine purchases through the COVAX Facility. | $383 million (total amount of insurance) |

| October 25, 2021 | India | Financing arrangement formalizing $50 million to expand Biological E.’s capacity to produce COVID-19 vaccines. | ~$50 million* |

*Referred to as a US government financing arrangement, unclear what volume is actually attributable to DFC’s balance sheet

DFC has also carried forward the 2X Women’s Initiative, a signature endeavor launched under the Trump administration to mobilize billions aimed at catalyzing women’s empowerment. The continuity of effort comes at a vital time. The COVID-19 pandemic has had a disproportionate impact on women and girls, who have lost employment opportunities and income, faced business closures, and encountered increased rates of gender-based violence. This summer, the agency set a bold new target of mobilizing $12 billion in gender equity investments by 2025 and established a technical assistance pilot program. Establishing a more ambitious target was an important first step, but to make a robust contribution to gender-inclusive recovery DFC should also look outside its more traditional areas of business—exploring investment in care work, for instance—and integrate gender analysis into both ex-ante and ex-post analyses.

What’s needed to ensure DFC can deliver?

DFC will require resources to deliver on these priorities. As described above, technical assistance submitted to the Hill by the Office of Management and Budget in September included a request for increased funding for DFC’s administrative expenses and program account. Draft appropriations measures in both chambers would provide the agency with additional funding compared to last year, though the level in the Senate bill is a good deal higher.

This line of questioning is unlikely to get a satisfying answer if limited to the topic of annual appropriations, where the nominee can be expected to tow the administration line. But there’s a more complicated set of issues for Congress and the agency to consider when it comes to potential limiting factors affecting DFC’s work in the short and medium term.

For instance, a boost in administrative expenses seems vital, but hiring—especially for roles that require a unique set of skills—will still take time. There’s some ongoing debate about the extent to which DFC might benefit from establishing field offices or otherwise locating staff in regions where the agency operates. In the absence of a robust presence outside of Washington, are there authorizations or resources that would help the agency harness the global footprint of the US government?

Pursuing equity investments under the prevailing budget scoring practice helps drain the program budget. If changed, how much more could the agency expect to do via direct equity and with investments writ large given the same program account?

While still far from reaching its exposure cap, there have been some efforts on Capitol Hill to ensure it has plenty of headroom by authorizing an increase from $60 to $100 billion.

When does DFC start contemplating reauthorization? The BUILD Act authorizes DFC for seven years from the date of enactment, which would expire in fall 2025, still a few years off. But OPIC faced the unenviable position of relying on short-term authorizations—which occasionally lapsed. In an environment where even must-pass authorization bills have been subject to delay, perhaps reauthorization discussions are not so far off.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.