Recommended

The experience of the 2007 global financial crisis can tell us a few things about how low-income countries (LICs) could be affected by the coronavirus pandemic in the near term, even as we recognize that the myriad economic problems created by the pandemic are almost certainly greater in number and scale than the problems in 2007. The bottom line is that LICs will need greatly expanded access to financing on a range of concessional terms in the months ahead, something donor countries will need to do a better job facilitating than they did during the 2007 crisis.

The 2007 Crisis Points to Major Challenges for LICs…

For low-income countries, the 2007 financial crisis created a negative demand shock, which led to the worst decline in growth for LICs as a whole since the 1970s. Economists Nikola Spotafora and Andrew Berg point to the global collapse in demand for exports as a driver in the growth slowdowns across these countries. With the pandemic particularly affecting major export markets in Asia and the West, we can expect to see the same type of negative demand shock as a result of the current crisis, though it is too early to assess the magnitude. It is also worth noting that the global financial crisis demand shock was worse for oil-exporting LICs, with that risk even more acute today given the collapse in oil prices induced by Saudi Arabia and Russia. Spotafora and Berg also point to variations in countries’ external reserves as one way in which LIC economic performance varied during the global financial crisis. Generally, countries with higher levels of reserves weathered the external shock better than those with lower reserves. Research by Valerio Crispolti and George Tsibouris examined a wider time period (1980-2007) and found that reserve coverage equal to more than three months of imports helped LICs to better cushion economic activity after a shock. This held particularly for heavily indebted LICs, and it also held when the authors only looked at countries’ experience during the financial crisis.

LIC reserves as a whole have deteriorated since 2007, though they remain at about six months of imports, well above the threshold Crispolti and Tsibouris found. That said, reserve levels in some countries (Burundi and Ethiopia, for example) are below the three-month threshold.

But There are Also a Wider Array of Problems this Time…

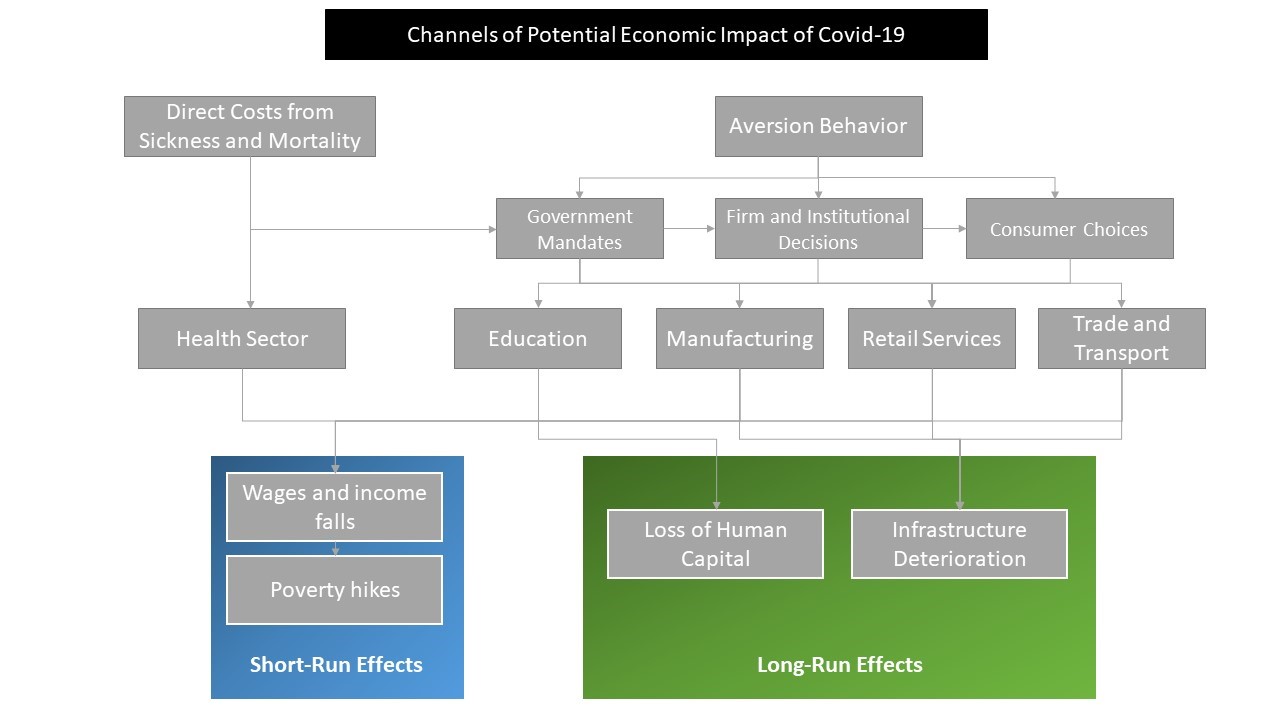

More concerning for LICs today is that, unlike the global financial crisis, the pandemic represents a simultaneous external and domestic shock. Even as they face collapsing export demand, some LICs may also face a collapse in domestic economic activity as a result of disease effects and efforts to mitigate the spread of the virus. These effects (characterized here and here) also implicate countries’ fiscal positions, with higher demand on government budgets and a decline in tax revenues. My CGD colleagues Dave Evans and Mead Over outline the channels through which the virus will affect economic activity within countries, drawing on their earlier World Bank report on the economic effects of the Ebola epidemic in West Africa.

Pointing to the Need for More Effective Donor Support…

LICs are in a uniquely vulnerable position because their ability to weather the economic effects of this crisis is much more dependent on the behavior of external actors relative to, say, the United States or European countries. For LICs in particular, balance of payments support through the IMF and fiscal support from international donors are key, and the latter all the more so given the pandemic’s effects on public budgets in these countries. Here again, the experience of the global financial crisis is sobering for these countries. Headline numbers suggest that the multilateral development banks (MDBs) in particular scaled up support dramatically for client countries. But this was achieved with non-concessional support, and therefore almost entirely targeted at middle-income country clients.

The MDBs had no ability to scale up their concessional finance activities for LICs beyond front-loading some commitments and expediting disbursement of some loans. Any increases were entirely dependent on increased donor contributions to the banks during this period. For example, the World Bank’s middle-income lending arm, the IBRD, increased its lending by 245 percent from pre-crisis levels to a peak of $44.2 billion in FY2010. Over the same period, IDA lending, which targeted LICs, went from $11.8 billion to just $14.5 billion.

It is not at all clear how much donor country governments will prioritize their role as donors during a period when they are grappling with their own domestic health and economic crises. Tentative statements from the G7 and G20 over the past week lack a clear commitment to mobilize grant resources through bilateral and multilateral aid channels.

Finally, it is worth emphasizing the nature of financing that LICs in particular will need. External debt risks for LICs have increased in recent years, in large part due to greater LIC access to financing from a new array of creditors. Commercial creditors (bond markets and banks) became increasingly comfortable financing LIC governments as low yields in other markets became the norm. At the same time, nontraditional government creditors (first and foremost, the Chinese government) scaled up their financing to LICs dramatically. Both types of creditors have pushed up the cost of financing for LICs, compared to their traditional sources of credit (MDBs and government creditors that tend to follow MDB practices on concessionality). LIC debt risk today is a function of overall volume of debt and the less concessional financing terms associated with this debt.

As a result, large scale counter-cyclical lending to LICs now will need to be sensitive to financing burdens. At a time when high-income countries can finance themselves on remarkably low terms, the calculation for LICs isn’t the same. They will remain dependent on the behavior of donor-based financing mechanisms, particularly if financial markets begin to pull back from higher-risk markets.

That said, it is also the case that even non-concessional terms from the MDBs are still more favorable than other sources of financing, and certainly more so than commercial financing. From this standpoint, one element of an MDB support package could be to open up eligibility for the World Bank’s IBRD (and the equivalent of the IBRD in other MDBs), which makes non-concessional loans, to finance low-income countries. This could also be achieved within the World Bank by greater leveraging of IDA’s balance sheet through bond issuances, a recent innovation that wasn’t available at the time of the global financial crisis. The other MDBs have taken similar steps in recent years to relax the distinctions between concessional and non-concessional eligibility, and these measures could be better exploited for crisis response in the weeks ahead.

As bodies like the G7 and G20 move toward more concrete commitments in the weeks ahead, it will be critical that these governments consider the financing needs of low-income countries. Yes, the big number commitments associated with the global financial crisis will be needed. But the composition of those commitments will also matter. In sum, scaling up grants along with low- and no-interest loans through the MDBs and bilateral channels will be critical to cushioning the inevitable economic blow of this pandemic in the months ahead.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.