This blog is the fourth in a series on the effects of Basel III on Emerging Markets and Developing Economies (EMDEs) based on the analysis of a CGD Task Force exploring these issues. Senior Fellow Liliana Rojas-Suarez co-chairs the Task Force. The first blog on cross-border spillovers can be accessed here, the second on trade finance can be found here, and the third on regulatory asymmetries between domestic and foreign banks can be found here.

While Basel III has been primarily developed as response to advanced countries’ experience during the Global Financial Crisis, it is expected to be adopted by most emerging and developing countries in due course if it has not been already. This raises the question of what the impact of such regulatory reform will be on volume, cost, and composition of domestic credit in these economies and for the development of financial systems more generally. This is against the background of many emerging markets not yet having fully exploited the potential for financial development and inclusion in their economies.

The indications so far are that the impact will be less on the aggregate volume of credit but rather on the composition with certain segments, including infrastructure and small and medium enterprise (SME) finance facing higher costs.

The Challenges for Infrastructure Finance with Basel III

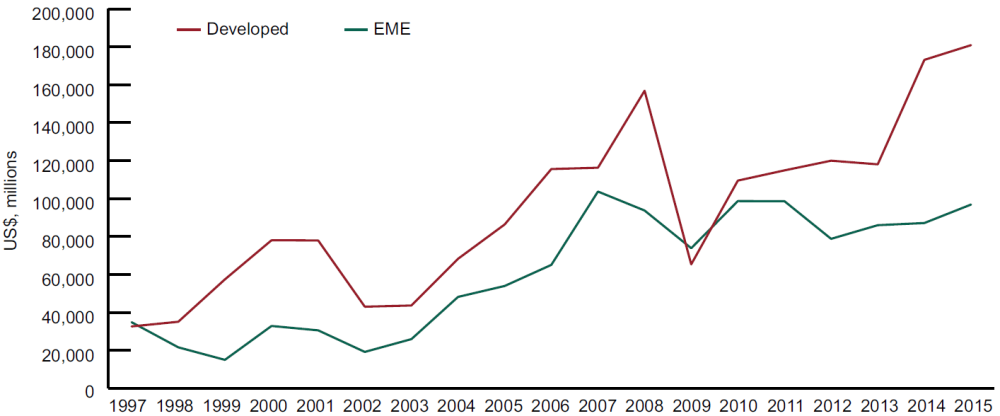

Infrastructure finance is a particular concern in many emerging markets and developing economies (EMDEs) given the limited sources of funding available and the high infrastructure gap in these countries. As shown in Chart 1, project finance lending increased steadily for both advanced and emerging markets between the early 2000s and the Global Financial Crisis. While project finance lending in advanced countries recovered rapidly after the crisis and has expanded further, it has stalled in EMDEs. There have also been specific examples where banks in the developed world have divested from their project finance portfolio. While this might be partly explained by reduced cross-border flows from advanced countries (and as discussed in a previous blog), partly by the turn of the commodity cycle, increasingly tightening regulation might have played a role and might play an increasing role going forward.

Chart 1: Project Finance Lending to EMDEs

There are several changes under the Basel III framework that can affect bank lending for infrastructure:

First, there will be a tightening of the large exposure rule, i.e., how much a bank can be exposed to a given borrower or project. Given that infrastructure projects are typically large, this might prevent lending especially by smaller banks.

Second, under Basel III, there is a tightening of capital requirements for infrastructure projects which makes lending for such projects costlier.

A third constraint comes through liquidity requirements, newly introduced under Basel III, under the so-called net stable funding ratio (NSFR) and liquidity coverage ratio (LCR). These requirements will force banks to (i) match longer-term lending (such as for infrastructure) with longer-term funding, which, of course, implies that banks have access to this type of funding, and (ii) hold more cash-like assets for project funds. Both requirements are more difficult to fulfill for banks in many EMDEs.

Finally, there might be reluctance to commit to longer-term funding structure given the increased uncertainty over further regulatory tightening. Since the 2008 crisis, there have been frequent changes to regulatory standards, ranging from Basel II.5 to Basel III to recent additional reforms to Basel III (sometimes referred to as Basel IV) and discussion on another round in a few years (sometimes referred to as Basel IV or V).

The Challenges for SME Financing with Basel III

Similar dampening effects of regulatory tightening might be expected for SMEs lending, as higher capital requirements are imposed on SMEs than on large corporate loans and for non-collateralized loans. Given that SMEs often have fewer assets available that can be used as collateral, this makes bank borrowing for them more expensive, possibly prohibitively expensive.

Such tighter capital requirements, however, do not take into account, that in spite of SMEs being riskier, there might be certain diversification benefits that are not taken into account when considering a whole portfolio of SME loans rather than individual loans. Specifically, holding a diversified portfolio of small business loans might result in less risk for banks’ capital than lending to a few large enterprises even if the latter are less risky.

Recognizing Trade-Offs

In summary, tightening regulatory requirements to increase financial stability can have repercussions for the composition of banks’ loan portfolios, with riskier sectors seeing a reduction in lending. If and only if there are clear financial stability benefits to be had, this might be a price worth paying. At a minimum, however, an open discussion on potential trade-offs between financial stability and development should be had in EMDEs when it comes to the implementation of Basel III.

The next blog in this series will discuss challenges posed by the implementation of Basel III in EMDEs on capital markets development.

Thorsten Beck is the co-chair of CGD’s Impact of Basel III on Emerging Markets Task Force.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.