Many developing countries have made progress in political openness and economic management but still struggle to attract private sector investments, at least outside of narrow, resource-based enclaves. Potential investors to these countries have many concerns that can broadly be classified into high costs and high actual or perceived risks. Drawing on insights from existing guarantees offered by bilateral development agencies, national governments, utility companies, and even shopping malls, we suggest that Service Performance Guarantees can be part of the solution. A Service Performance Guarantee would trigger highly visible payouts when service delivery standards fall short of those expected from the program. Potential payouts would be covered by a “domestic reserve” funded from premiums paid in by the firms and backed up by a further guarantee issued by a development partner. This is a way of offering investing firms the opportunity to purchase insurance against a wider range of risks than is currently possible. It is also a way of establishing a partnership of donors and recipient governments, accountable to their investor clients.

Barriers to FDI in Developing Countries

Over the last few decades a number of developing countries such as China, India, Brazil, Mexico, Turkey, Malaysia, Indonesia, Vietnam, and Thailand have moved towards Emerging Market status, and attracted substantial volumes of domestic and foreign private investment. Even though private flows have proven sensitive to large global shocks, such as the crisis of late 2008, and may also be affected by domestic political convulsions, such as those that have recently shaken Thailand, most countries of this type have established a substantial track record as hosts for private business.

However, there is more work to be done. While countries differ in many ways, assessments (ICAs) often note the limitations of small markets, poor security and macroeconomic or policy instability. They typically flag the high costs and idiosyncratic risks resulting from poorly functioning infrastructure, as well as institutions that provide services to business. Business climate assessments have diagnosed these problems for a number of years and provided objective measures of some problems as well as reporting investors’ subjective assessments of the importance of different barriers to business. The former include the Doing Business indicators and quantitative estimates of the high costs of unpredictable power outages[1] as well as of high indirect costs that reduce the profitability of firms that could otherwise be quite competitive at factory-floor level.[2] Subjective assessments often point in particular to poor power supply, macroeconomic instability and poorly functioning services, in some cases due to corruption.[3]

Existing Programmes

Donors and international financial institutions have many programs within these countries directed towards strengthening their policy frameworks and improving business climates as well as activities aiming to directly support private investment and diversify economies. These include, for example, infrastructure programs to build or rehabilitate power supply or ports, special economic zones, growth poles or other area-based projects to provide a better local package of services, trade facilitation programs to speed up border clearances, matching grant schemes to encourage firms to invest in new technologies or markets, supplier linkage programs, and syndicated investments.

Many of these programs are insufficiently focused on the results that really matter to investors, however. The “investments” may have been made and the policies may have been “reformed,” satisfying the formal needs of country-donor accountability. But this does not ensure that the clearance times for exports or imported inputs are actually cut, that VAT rebates on inputs into exports are processed speedily, or that power is delivered with fewer outages. And even if the project or program is results-based in the sense that the donor does not pay the country unless the results are delivered, this does not compensate the firms hurt by its failure to deliver the services.

Existing Guarantees

To help firms mitigate risk, donors currently offer political risk and credit guarantees. Trade finance guarantee programs have also escalated in the aftermath of the global crisis, which saw the demise of prominent private insurers. In total, in FY2013, large bilateral and multilateral donors provided $11.5 billion of such guarantees. However, most of these guarantees insured against private risks. The amount linked to political risk insurance was around $3.5 billion, mostly concentrated in the World Bank Group’s MIGA. MIGA covers about 50 projects per year, issuing about $2.5 billion in guarantees. In 2012, 17 of these projects were in Africa, mostly to firms in the infrastructure and service sectors; only four projects provided coverage directly to manufacturing or agribusiness. While investments in these sectors may benefit from guarantees made to other investments (for example, a political risk guarantee on a power purchase agreement that brings in private investors), these data do not suggest that industry or agriculture are major direct clients for guarantees.

A Proposal

We propose offering potential investors Service Performance Guarantees (SPGs). [4] A Service Performance Guarantee would trigger highly visible payouts for participating investors when services provided to the firm fall short of the standards specified by the guarantee. Potential payouts would be covered by a “domestic reserve” funded from premiums paid in by the firms and backed up by a further guarantee issued by a development partner. This is a way of offering investing firms the opportunity to purchase insurance against a wider range of risks than is currently possible. It is also a way of establishing a partnership of donors and recipient governments, accountable to their investor clients.

The SPG approach aims to strengthen incentives for delivering results and can be seen as a variant of Results Based Aid. At the same time, however, it aims to provide firms insurance against inadequate delivery of key services, and to ensure that shortfalls in delivery are measured, reported, and raised to a high political level. The form that SPGs should take can be informed by considering existing similar mechanisms used by shopping malls, utilities companies, and governments.

Lessons from Shopping Malls

Shopping malls and hotels offer a useful perspective on competition for investors on the global capital market. A reputation for “all in” service quality has long been a central concern of market-based service firms and they sometimes use guarantees as a mechanism of conveying their clear commitment to servicing their clients. Guarantees can also serve as promotional tools. They may take the form of a promise to provide compensation that may not always be legally binding but will impact adversely on reputation if not carried through:

“A service guarantee is an explicit promise made by the service provider to (a) deliver a certain level of service to satisfy the customer and (b) remunerate the customer if the service is not sufficiently delivered.”[5]

Service quality and the reputation of the management are central for the ability of mall proprietors to continue in business. Failure to provide the full package of specified services such as security, cleanliness and snow removal from the parking lot can give tenants a valid reason to terminate their leases—the terms of the lease embody the contractual obligations of the mall operator. These will be standardized for smaller shops, but the far more complex custom leases of the major anchor tenants will include particular service agreements and remedies. Poor service delivery is very risky for an operator. Much like a country experiencing investor flight, once space is vacated and reputation damaged it is hard to secure new tenants capable of generating the externalities needed to attract others. High vacancy levels, in turn, raise property insurance costs; premiums typically double for property left vacant and subject to larger risks of damage from vandalism or un-noticed roof or plumbing failures.

These service guarantees work to attract tenants. They can serve as a signal to clients of devotion to quality, and their signaling effects are greater for lower-quality providers than for those whose quality is already well known. They are also found to reduce customers' perceived risk.[6] It is not clear from the existing literature whether they have actually improved performance; they have improved quality as perceived by the clients but few studies have focused on the impact on actual service quality and innovation in delivery.

Another lesson is the importance of standardized agreements. General service guarantees are distinct from the customized service-level agreements that malls or hotels may make with critical clients. The former tend to be standardized and usually contained within the details of the lease; the latter are closely framed legally binding contracts often running to hundreds of pages and setting out obligations and remedies in great detail. Since the transaction costs of setting them up are high, they will be offered only to particularly important clients with individualized needs.

Lessons from Citizen Charters and Utility Performance Guarantees

Under a Citizens’ Charter, a government guarantees a certain level of service to customers; these can be citizens but also in some cases firms. The concept of the Citizens’ Charter was developed by John Major’s UK government in 1991 and has since been adopted and modified by many nations including Belgium (1992), France (1992), Spain (1992), Malaysia (1993), Portugal (1993), Canada (1995), Australia (1997), and India (1997).

The experience of citizen charters offers a number of lessons for potential SPGs, some of which parallel the lessons from shopping malls and hotels. Guarantees should be established on the basis of clear and quantifiable standards. Standards must be appropriate for each context; those too harsh will not enable the party providing the service to comply; those too lax will neither inspire trust by the client nor be utilized. Programs involving multiple small clients—individuals and SMEs—will benefit from automatic and public compensation systems because the transactions costs for case by case decisions will be too high to make claiming worthwhile. In most cases, insurance cannot therefore be offered to cover compensate for actual losses because these require detailed computations. The situation is different for large clients, and could involve more of a case-by-case approach.

For most clients, automatic compensation payments against quantifiable standards may therefore be more useful than discretionary processes or ones that require the filing of claims. They also protect claimants from having to reckon with intimidation and retribution by the service provider. One example comes from Victoria, Australia where power customers are compensated automatically for shortfalls in service. If they work well, the public disclosure of performance through the guarantee or charter program can play an important role in helping citizens (in the aggregate) hold their service providers and governments to account. However, guarantees cannot be used as instruments of accountability unless clients are fully aware of their rights and of the mechanisms through which they can be compensated.

Next Steps: Test, Evaluate and Learn

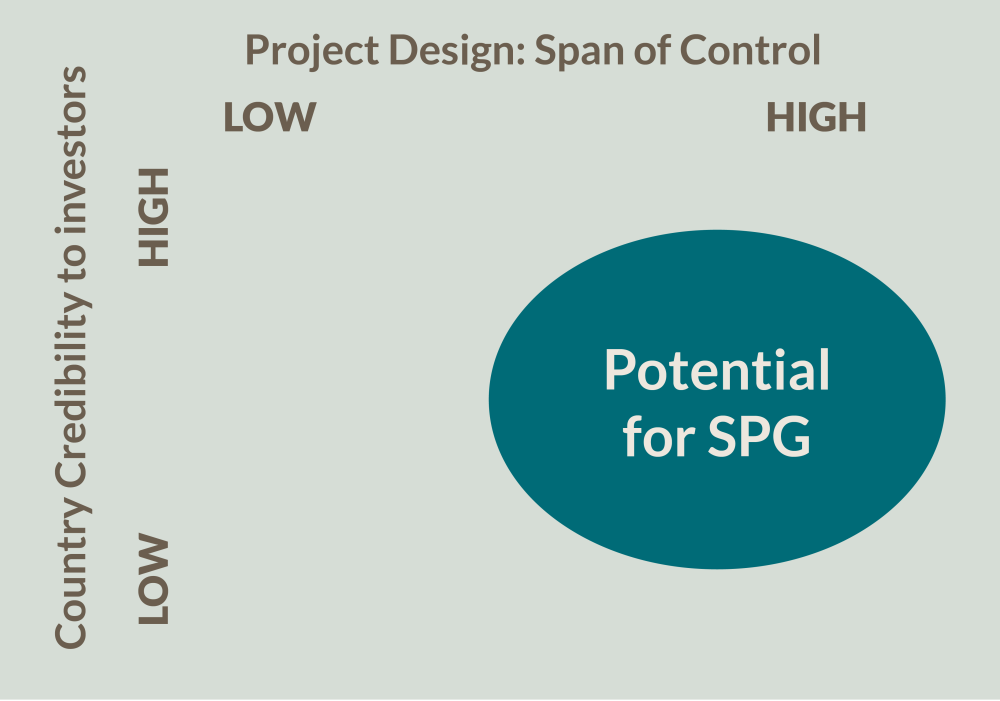

An SPG would only be expected to be feasible in certain contexts. The approach is not feasible in countries with poor and unstable governance and little credibility with investors; neither might it be attractive for countries already well established with a broad span of investors. It greatest appeal would be in well-managed countries looking to broaden investments to a wider range of sectors, and in particular to diversify outside the extractive sectors. The design of the operation also requires the agency issuing the SPG to have a span of control wide enough to manage the insured risks. A suitable location should be identified to test the SPG concept. In order to minimize the risk of over-complexity, a location in which the World Bank is already running or preparing to run a growth pole project would provide project infrastructure upon within which the SPG could be inserted.

Figure 1: The Potential Space for an SPG

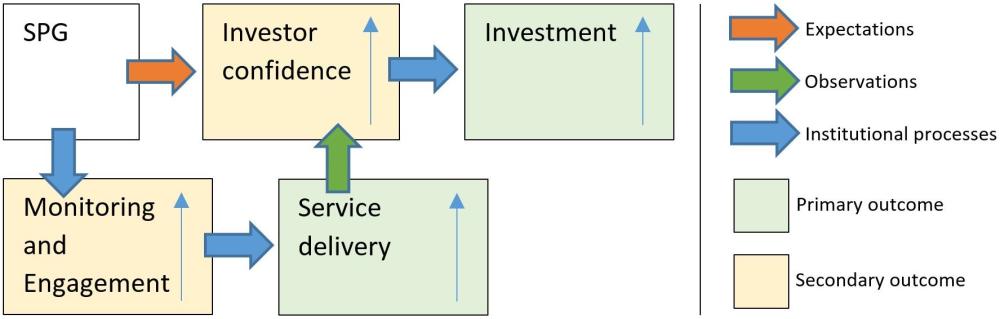

Once a location has been identified, it is imperative that the first SPG is properly evaluated to provide opportunities to improve the theory underlying the concept. Rigorous evaluation of SPGs poses challenges owing to the difficulty of establishing the counterfactual: it is challenging to know how a given zone would have performed in the absence of its SPG. Most experimental methods are not applicable as SPGs cannot be assigned at the firm level, but rather only at the service zone level, and it is extremely unlikely that new service zones will be numerous enough to adequately power a randomized assessment of SPG effectiveness. However, a rigorous assessment of SPG performance is possible using an explicitly specified model of intervention causation and the synthetic control method.[7] Figure 2 provides an approximate model of how causation is understood in an SPG program.

Figure 2: Causal Model for an SPG

The synthetic control method relies on the existence of sufficiently numerous and relevantly similar control cases. Fortunately, special economic zones are sufficiently numerous in every region of the world to allow the construction of a set of relevantly similar control zones for any future implementation of an SPG. Even in Sub-Saharan Africa, where the use of zones is least developed, there were already 114 active zones in 25 countries as early as 2005[8] (FIAS 2008).

Conclusion

Service Performance Guarantees can be seen as an extension of results-based aid but provide a different pattern of accountability—of a “partnership” of donors and recipient governments towards their investor clients. This is in contrast to conventional results-based aid approaches that condition disbursement to governments on the achievement of service outputs or outcomes without a direct link to the clients for the services. For example, even in a results-based education project that disburses against learning outcomes, a child would not be compensated for time devoted to sub-standard education that yields nothing in the form of learning.

The design of SPGs can draw on a wide range of experience—the ways in which shopping malls and hotels court their clients including through service guarantees (as understood in the service sectors), political risk guarantees, citizen charters, and right-to-service movements. While these are all very different, they offer some lessons that can be used to inform the design of SPGs, either as standalone instruments or, more likely, as components of productivity-related projects and programs that aim to increase private investment. Much more work would, of course, be needed on the detailed design of such instruments before they could become operational.

[1] World Bank, Doing Business 2014: Understanding Regulations for Small and Medium-Size Enterprises (Washington, DC: The World Bank Group, 2014)

[2] Benjamin Eifert, “Do Regulatory Reforms Stimulate Investment and Growth? Evidence from the Doing Business Data, 2003-07,” Center for Global Development Working Paper 159 (2009)

[3] Benjamin Eifert, Alan Gelb, and Vijaya Ramachandran, “The Cost of Doing Business in Africa: Evidence from Enterprise Survey Data,” World Development 36, no. 9 (2008): 1531-1546.

[4] We use the term Service Performance Guarantees (SPGs) to avoid confusion since the term Service Guarantee is used in the literature in different contexts.

[5] Jens Hogreve, and Dwarne D. Gremler, “Twenty Years of Service Guarantee Research: a Synthesis,” Journal of Service Research 11, no. 4 (2009): 322-343

[6] Ibid.

[7] The synthetic control allows for the analysis of an intervention using a synthetic control case constructed from other, similar cases. See:

Abadie, Alberto and Javier Gardeazabal. (2003), “The Economic Costs of Conflict: A Case Study of the Basque Country.” The American Economic Review, Vol. 93, No. 1., pp. 113-132.

Adadie, Alberto; Alexis Diamond and Jens Hainmueller. (2009) “Synthetic Control Methods for Comparative Case Studies: Estimating the Effect of California's Tobacco Control Program” Journal of the American Statistical Association, Vol. 105, No. 490., pp.493-505. DOI: 10.1198/jasa.2009.ap08746

[8] FIAS. (2008), Special Economic Zones: Performance, Lessons Learned, and Implications for Zone Development. Washington: World Bank, April.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.