Recommended

Blog Post

High-income countries trying to reach net-zero targets are confronting the fact that existing environmental regulations make it harder to build low-carbon infrastructure. Lobbying groups in the US, for example, are using regulatory tools to block geothermal, solar, and wind facilities. Providing subsidies and incentives for low carbon isn’t enough: revisiting, rewriting, and in some cases retiring these regulations is going to be a vital part of faster progress toward the green economy.

The issue isn’t unique to high-income countries, and it is perhaps particularly important when it comes to climate finance. That’s because multilateral development banks including the World Bank are being asked to do more on climate, but they are constrained by their own bureaucracy, including a set of environmental regulations that add costs and delays to investments that could support global mitigation goals.

Look at answers to World Bank client surveys in some of the countries where you might hope the institution would have a big role to play in financing mitigation projects. When asked what the World Bank’s greatest weakness is, the top answer in Brazil: “processes too slow and complex.” That’s the same top answer as Indonesia and Vietnam. Complex and slow processes rank second out of sixteen and in India and Argentina, and fourth in South Africa and Türkiye. Good project preparation takes time, and rushed projects tend to have worse development outcomes. Nonetheless, there clearly can be too much of a good thing in terms of bureaucracy.

The bureaucratic hassles of borrowing from the World Bank are surely one factor behind seemingly low demand from clients for IBRD lending outside of times of crisis. (Dated) survey evidence suggests that client countries view the Bank as a lender of last resort with infrastructure in particular because of the costs of doing business, something also reported by World Bank staff in a 2010 Independent Evaluation Group survey. The response shouldn’t be to take scarce grant resources and use them to fund inefficient subsidies to drum up demand for climate lending in IBRD countries, it should be to reform lending processes and approaches to make borrowing from the IBRD for climate mitigation at the institution’s unsubsidized (but below-market) rates more attractive.

Part of that process should involve looking at lending instruments and safeguards. The World Bank has two main financing instruments: broad policy lending and specific investment financing. It also divides potential projects into four main categories based on potential environmental impacts: Category A; where the potential impact is large and borrowers and the bank need to undertake assessments and agree mitigation measures; Category B which is lower risk but still requires assessment and mitigation; and Category C which is likely to have minimal or no adverse environmental impacts. A separate category, F, involves projects where funds flow through a financial intermediary.

We can look at the impact of project type and environmental assessments on the bureaucratic burden of project preparation by comparing the length of time it takes to get a project from initial idea to World Bank board approval. Analysis by Christopher Kilby suggests that project preparation times are primarily a function of World Bank processes rather than recipient country characteristics, down to factors including loan type and amount (and US interest in the client country). Kilby’s results suggest Structural Adjustment Programs and Development Policy Loans take 240 days shorter to prepare than investment projects, while a project in a country directly represented by an Executive Director on the World Bank’s board is associated with a 52 day reduction in preparation time. In a later paper with Kevin Gallagher, Kilby looks at the impact of Environmental safeguard categorization and suggests projects have a typical preparation time of 293 days with no safeguards and 416 days with safeguards, though there is some evidence of convergence in preparation times with more recent projects.

We use the database examined by Kilby to look at the impact of environmental assessments in particular, updated through 2021. One missing element in that database (as reported by Kilby) is the date when the project was conceived, but luckily World Bank project ID numbers, which are in the database, are issued sequentially. That means we know project 134156 was greenlighted for preparation by World Bank management just after project 134155 and just before project 134157, for example. We exclude projects prior to 1994 and project IDs below 20,000 (which do not follow a fully sequential numbering system) as well as recent projects (project number above 175,000), because the slower projects won’t have reached the Board yet. We drop earlier loans without an approval date (themselves dropped from the project pipeline). And we drop loans without an IBRD or IDA commitment amount, in order to focus on traditional World Bank projects. We then run the following regression:

[Approval date] - [average approval date of 100 closest below and above projects by ID]

=

[Total IBRD + IDA commitment] + [(Exclusive) IDA financing dummy] + [IDA/IBRD blend dummy] + [Instrument (structural adjustment/policy lending dummy)] + [Sector/theme of infrastructure] + [Environmental assessment category dummy (one each for A, B, F, and other)].

The sector/theme dummy is a 1 if the project theme/sector codes mention any of the words energy, power, water, road/roads, transport, irrigation, port/ports, airport/airports, infrastructure, construction, or housing, and 0 otherwise.

The regression results report how many days, more or less, a project with particular features takes to make it to the World Bank board for approval than the average of projects initially conceived at around the same time. The first column reports results for the whole sample, the second column for the second half of the sample (with the earliest Board approval in 2008), and the third column for the last quarter of the sample (with earliest board approval in 2015).

The results suggest that:

- Project size (commitment amount) is not a major factor in length of project preparation (a $100 million project will take about nine more days than a $10 million project).

- Compared to projects initiated at about the same time, those projects that are purely finance by IDA as compared to IBRD projects take 71 fewer days to reach Board approval, although that effect is not apparent more recently (when IDA/IBRD blend projects appear to take longer).

- Policy lending takes 107 fewer days to reach the board than investment lending (72 days less in the most recent sample).

- Projects that involve infrastructure do not take longer to be approved—this allowing for other features included in the regression.

- Environment category F and B add about 100 days to project preparation while category A projects take nearly a year longer to reach the board, although delays have declined over time (to 43 days in the last quarter of the sample for Category B and 189 days for Category A). Perhaps this is related to World Bank bureaucratic reforms initiated after 2016.

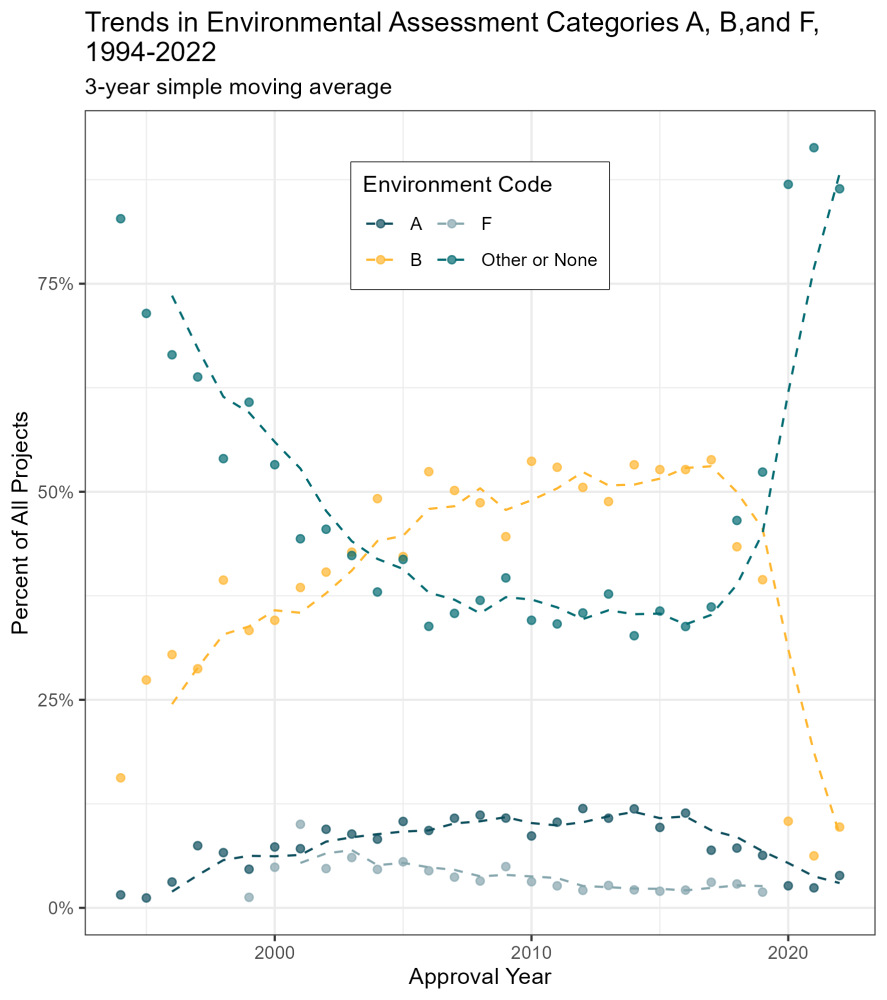

It may be that category A and B projects look different for more reasons than environmental impact. Certainly, policy lending projects are meant to look different. Nonetheless, the results are at least suggestive. And more evidence for that comes from looking at the share of projects rated each category over time, presented in the figure below. It is very clear that Bank staff and borrowers are not keen to put forward projects that might be rated Category A: projects that involve considerable construction, for example. That’s going to be an issue if the World Bank wants to play a bigger role in creating low-carbon economies in middle income countries.

And the dramatic drop in category B projects in 2020-21 is also revealing: it reflects the World Bank’s efforts to get financing to countries suffering from the global pandemic. The Bank reports that the average gap between completion of a project concept document and Board approval dropped from 10.6 months in 2019 to 7.8 months in 2021 (at a period during which annual IBRD and IDA commitments climbed from $45 billion to $67 billion). Clearly, World Bank staff and management appear to believe that if you want to get financing delivered fast, don’t trigger safeguards.

The results suggest the Bank should embrace large scale policy lending for climate. It is unlikely to trigger safeguards and is comparatively bureaucracy-free. That will make it more attractive to client countries, but also is likely to have a larger impact. Supporting policy change on issues such as carbon subsidies and pricing will have a larger effect on global emissions than financing the marginal infrastructure investment that may or may not have been low carbon without the World Bank’s financing.

Still, when it comes to the bureaucracy of environmental review, it is time for a reassessment. The World Bank Group should meet standards for environmental protection and social safeguards—it has financed some damaging projects with far too little in the way of remediation in the past. But the cost of the existing regime in terms of global climate and development outcomes may be too high. And that involves not just the review process but additional constraints including the ban on finance for nuclear power. If the Bank and other multilateral institutions are to play a greater role in climate finance, reforming their overly-bureaucratic investment approach through greater policy lending and a reformed safeguards regime needs to be part of the package—and that needs shareholder support.

Los países de ingresos altos que intentan alcanzar objetivos de emisiones netas cero se enfrentan al hecho de que las regulaciones ambientales existentes dificultan la construcción de infraestructura baja en carbono. Grupos de presión en los Estados Unidos, por ejemplo, están utilizando herramientas regulatorias para bloquear instalaciones geotérmicas, solares y eólicas. Proporcionar subsidios e incentivos para la energía baja en carbono no es suficiente: volver a examinar, reescribir y, en algunos casos, retirar estas regulaciones será una parte vital para lograr un progreso más rápido hacia la economía verde.

La cuestión no es única de los países de ingresos altos, y es quizás especialmente importante en lo que respecta a la financiación climática. Esto se debe a que se les está pidiendo a los bancos multilaterales de desarrollo, incluido el Banco Mundial, que hagan más en materia de clima, pero están limitados por su propia burocracia, incluido un conjunto de regulaciones ambientales que agregan costos y retrasos a las inversiones que podrían respaldar los objetivos de mitigación global.

Si nos fijamos en las respuestas a las encuestas de los clientes del Banco Mundial en algunos de los países donde se espera que la institución tenga un gran papel en la financiación de proyectos de mitigación, el resultado es preocupante. Cuando se les preguntó cuál era la mayor debilidad del Banco Mundial, la respuesta más común en Brasil fue "procesos demasiado lentos y complejos". Lo mismo ocurrió en Indonesia y Vietnam. Los procesos complejos y lentos ocupan el segundo lugar de dieciséis posibles respuestas en India y Argentina, y el cuarto lugar en Sudáfrica y Turquía. Es cierto que una buena preparación del proyecto lleva tiempo y que los proyectos apresurados tienden a tener peores resultados de desarrollo. Sin embargo, está claro que también puede haber demasiada burocracia, incluso para una buena preparación de proyectos.

Las complicaciones burocráticas de pedir prestado al Banco Mundial son seguramente uno de los factores detrás de la aparentemente baja demanda de préstamos del BIRF por parte de los clientes fuera de los tiempos de crisis. La evidencia de encuestas sugiere que los países clientes ven al Banco como un prestamista de último recurso en materia de infraestructura debido a los costos de hacer negocios, algo que también fue reportado por el personal del Banco Mundial en una encuesta del Grupo de Evaluación Independiente de 2010. La respuesta no debería ser tomar recursos escasos de subvenciones y utilizarlos para financiar subsidios ineficientes para fomentar la demanda de préstamos climáticos en los países del BIRF, sino reformar los procesos y enfoques de préstamo para hacer que pedir prestado del BIRF para la mitigación del clima a tasas no subsidiadas (pero por debajo del mercado) sea más atractivo.

Parte de ese proceso debería involucrar la revisión de los instrumentos de préstamo y salvaguardas. El Banco Mundial tiene dos instrumentos de financiamiento principales: préstamos de política general y financiamiento de inversiones específicas. Además, divide los proyectos potenciales en cuatro categorías principales según su posible impacto ambiental: Categoría A; donde el impacto potencial es grande y los prestatarios y el banco deben realizar evaluaciones y acordar medidas de mitigación; Categoría B, que presenta un riesgo más bajo pero aún requiere evaluación y mitigación; y Categoría C, que probablemente tenga impactos ambientales mínimos o nulos. Una categoría separada, F, involucra proyectos en los que los fondos fluyen a través de un intermediario financiero.

Podemos examinar el impacto del tipo de proyecto y las evaluaciones ambientales en la carga burocrática de la preparación del proyecto al comparar el tiempo necesario para llevar un proyecto desde la idea inicial hasta la aprobación de la junta directiva del Banco Mundial. Un análisis de Christopher Kilby sugiere que los tiempos de preparación de proyectos son principalmente una función de los procesos del Banco Mundial en lugar de las características del país receptor, incluso tomando en cuenta factores como el tipo y la cantidad de préstamo (y el interés de EE. UU. en el país cliente). Los resultados de Kilby sugieren que los Programas de Ajuste Estructural y los Préstamos de Política de Desarrollo tardan 240 días menos en prepararse que los proyectos de inversión, mientras que un proyecto en un país representado directamente por un Director Ejecutivo en la junta directiva del Banco Mundial se asocia con una reducción de 52 días en el tiempo de preparación. En un artículo posterior con Kevin Gallagher, Kilby examina el impacto de la categorización de salvaguardias ambientales y sugiere que los proyectos tienen un tiempo típico de preparación de 293 días sin salvaguardias y de 416 días con salvaguardias, aunque hay alguna evidencia de convergencia en los tiempos de preparación con proyectos más recientes.

Utilizamos la base de datos examinada por Kilby para analizar el impacto de las evaluaciones ambientales en particular, actualizada hasta 2021. Un elemento faltante en esa base de datos (según lo informado por Kilby) es la fecha en que se concibió el proyecto, pero por suerte los números de identificación del proyecto del Banco Mundial, que están en la base de datos, se emiten de manera secuencial. Eso significa que sabemos que el proyecto 134156 fue aprobado para su preparación por la dirección del Banco Mundial justo después del proyecto 134155 y justo antes del proyecto 134157, por ejemplo. Excluimos proyectos anteriores a 1994 y números de identificación de proyectos por debajo de 20.000 (que no siguen un sistema de numeración completamente secuencial), así como proyectos recientes (número de proyecto por encima de 175.000), porque los proyectos más lentos aún no han llegado al Consejo. Descartamos préstamos anteriores sin fecha de aprobación (también descartados del proceso de proyectos). Y descartamos préstamos sin un monto de compromiso del BIRF o la AID, con el fin de centrarnos en los proyectos tradicionales del Banco Mundial. Luego, ejecutamos la siguiente regresión:

[Fecha de aprobación] - [fecha de aprobación promedio de los 100 proyectos más cercanos por ID por encima y por debajo]

=

[Compromiso total de AID + BIRF] + [Indicador de financiamiento exclusivo de AID] + [Indicador de mezcla de AID/BIRF] + [Indicador de instrumento (ajuste estructural/prestamos de política)] + [Sector/tema de infraestructura] + [Indicador de la categoría de evaluación ambiental (uno para cada categoría A, B, F y otras)].

El indicador de sector/tema es igual a 1 si los códigos del proyecto mencionan alguna de las palabras energía, energético, agua, carretera/carreteras, transporte, riego, puerto/puertos, aeropuerto/aeropuertos, infraestructura, construcción o vivienda, y 0 en caso contrario.

Los resultados de la regresión muestran cuántos días más o menos lleva que un proyecto con características particulares llegue a la junta directiva del Banco Mundial para su aprobación que el promedio de los proyectos concebidos alrededor de la misma época. La primera columna informa los resultados para toda la muestra, la segunda columna para la segunda mitad de la muestra (con la aprobación más temprana de la junta directiva en 2008) y la tercera columna para el último cuarto de la muestra (con la aprobación más temprana de la junta directiva en 2015).

- El tamaño del proyecto (monto comprometido) no es un factor importante en la duración de la preparación del proyecto (un proyecto de $100 millones tomará aproximadamente nueve días más que uno de $10 millones).

- En comparación con los proyectos iniciados alrededor del mismo tiempo, aquellos proyectos financiados únicamente por AID en comparación con los proyectos de BIRF tardan 71 días menos en alcanzar la aprobación de la Junta Ejecutiva aunque ese efecto no es evidente más recientemente (cuando los proyectos de de la mezcla IAD/BIRF parecen tardar más).

- Los préstamos de política general toman 107 días menos para llegar a la junta Directiva que los préstamos de inversión (72 días menos en la muestra más reciente).

- Los proyectos que involucran infraestructura no tardan más en ser aprobados, lo que permite otras características incluidas en la regresión.

- La categoría F y B del medio ambiente agregan alrededor de 100 días a la preparación del proyecto, mientras que los proyectos de categoría A tardan casi un año más en llegar al Junta Directiva, aunque los retrasos han disminuido con el tiempo (a 43 días en el último cuarto de la muestra para la Categoría B y 189 días para la Categoría A). Quizás esto esté relacionado con las reformas burocráticas del Banco Mundial iniciadas después de 2016.

Es posible que los proyectos de categoría A y B parezcan diferentes por más razones que el impacto ambiental. Ciertamente, los proyectos de préstamos de políticas están destinados a verse diferentes. No obstante, los resultados son al menos sugestivos. Y más evidencia de ello proviene de la observación de la proporción de proyectos calificados en cada categoría a lo largo del tiempo, presentada en la figura siguiente. Es muy evidente que el personal del Banco y los prestatarios no están dispuestos a presentar proyectos que puedan ser calificados como Categoría A: proyectos que implican una considerable construcción, por ejemplo. Eso será un problema si el Banco Mundial quiere desempeñar un papel más importante en la creación de economías bajas en carbono en países de ingresos medios.

Además, la caída dramática en proyectos de categoría B en 2020-21 también es reveladora: refleja los esfuerzos del Banco Mundial por proporcionar financiamiento a países afectados por la pandemia global. El Banco informa que la brecha promedio entre la finalización de un documento conceptual de proyecto y la aprobación por parte de la Junta Directiva disminuyó de 10.6 meses en 2019 a 7.8 meses en 2021 (en un período durante el cual los compromisos anuales del BIRF y la AID aumentaron de $45 mil millones a $67 mil millones). Claramente, el personal y la dirección del Banco Mundial parecen creer que, si se quiere que se entregue financiamiento rápidamente, no se deben activar las salvaguardias.

Los resultados sugieren que el Banco debería adoptar el financiamiento de políticas a gran escala para el clima. Es poco probable que esto desencadene salvaguardas y es comparativamente libre de burocracia. Eso lo hará más atractivo para los países clientes, pero también es probable que tenga un impacto más grande. Apoyar el cambio de políticas en cuestiones como los subsidios y la fijación de precios del carbono tendrá un efecto mayor en las emisiones globales que financiar la inversión en infraestructura marginal que puede o no ser baja en carbono sin el financiamiento del Banco Mundial.

Sin embargo, cuando se trata de la burocracia de la revisión ambiental, es hora de una reevaluación. El Grupo del Banco Mundial debe cumplir con estándares de protección ambiental y salvaguardas sociales, ya que ha financiado algunos proyectos dañinos con muy poco en términos de remedio en el pasado. Pero el costo del régimen existente en términos de clima global y resultados de desarrollo puede ser demasiado alto. Y eso no solo implica el proceso de revisión, sino también restricciones adicionales, incluida la prohibición de financiamiento para la energía nuclear. Si el Banco y otras instituciones multilaterales van a desempeñar un papel más importante en la financiación del clima, la reforma de su enfoque de inversión excesivamente burocrático a través de una mayor política de préstamos y un régimen de salvaguardas reformado debe ser parte del paquete, y eso necesita el apoyo de los accionistas.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.