Recommended

Women continue to face disproportionate barriers to fully contributing to, and benefiting from, economic prosperity and rising living standards. Overcoming those barriers offers an enormous and unique economic, social, and financial opportunity. Strong and growing evidence suggests that identifying effective ways to support women as entrepreneurs, managers, workers, and consumers will increase gender equity, improve firm performance and financial returns, reduce poverty, and promote more inclusive and robust economic growth.

Many development finance institutions (DFIs) are already increasing their focus on gender equity in their investment strategies and internal administration, and supporting new pooled funds, special initiatives, and communities of practice, such as Banking on Women, the 2X Challenge, the Women Entrepreneurs Finance Initiative, and the Gender Finance Collaborative. Many of these initiatives are in early stages. With this survey, we seek to contribute to, and strengthen, their efforts by examining how DFIs are investing with a gender lens and where they should go from here.

By surveying DFIs, we aim to start building a baseline of their gender policies and practices, analyze the data, and make recommendations where stronger policies and practices are needed. The survey’s findings give DFIs an important opportunity to learn from one another and work towards standards for how they can best promote gender equity. The survey also enhances transparency and accountability to taxpayers, shareholders, and importantly, women and girls as those impacted by (or excluded from) DFI investments.

The Survey’s Approach

The Gender Equity in Development Finance survey examines the degree to which DFIs prioritize a focus on gender equity and women’s empowerment. The survey examines (1) external policies and practices governing investments, advisory services, and other development finance programs; and (2) internal policies and practices with respect to DFIs’ own employees and administration.

Our findings are based on data provided by 16 DFIs, including a broad range of multilateral and bilateral institutions of diverse sizes, ages, and locations.[1] The survey was designed to be objective, straightforward, and broadly applicable in order to provide useful information on the content of gender policies and practices that can be analyzed and shared.

The intended audiences are those interested in promoting the empowerment of women in development and finance, supporters and analysts of development effectiveness and gender-lens investing (investments designed to both address gender inequality and deliver financial returns), shareholders and other stakeholders in DFIs, and other finance providers and impact investors with an interest in empowering women.

In conducting the survey, we sought to (1) establish how DFIs are currently incorporating a gender lens in their operations; (2) identify shared DFI strengths; (3) note where there are shared DFI weaknesses—that is, where current policies and practices fall short of reasonable and desirable performance standards; and (4) recommend actions that DFIs can take to reap significant gains from additional efforts. We also identify top performing institutions according to the survey criteria.

For the external component of the survey (institutions’ external investments, advisory services, and programs), we scored 25 questions across 6 categories. For the internal component (institutions’ internal policies and practices), we scored 29 questions across 11 categories. A full list of the survey categories and questions is in the Annex.

All questions are weighted the same in the scoring process. We designed the questionnaire to primarily elicit yes/no responses from DFIs. For every "yes" (e.g., on whether the institution has a gender strategy, or collects data on internal gender pay gaps), institutions received one point. The percentage scores for top performers are the number of points each institution received divided by the total number of points possible.

Summary of Survey Results: What Do the Data Show?

The Good News

Our survey results indicate that DFIs—large and small, bilateral and multilateral, old and new, global and regional—are making serious efforts to integrate gender analysis and objectives into their investment processes and into their own internal policies and administration. Almost all the institutions have both external investment and internal gender strategies. At the portfolio level, nearly all monitor the share of investments with a gender focus. Most incorporate gender into investment deal sourcing and due diligence, choice of investor partners, and investment documents. Most have gender experts on transaction teams and offer gender training to investment partners. And more than half disaggregate results data by gender and use the disaggregated data for developing lessons for future investments.

For their internal policies, gender objectives are incorporated into recruitment, hiring and promotion panels, and speaking roles in institutional events. Most institutions offer opportunities that promote work-life balance, including flexible work practices, and every institution offers maternity, paternity, and family leave. Most offer confidential formal channels for reporting discrimination and harassment, and just over half the institutions report on these issues to their boards. They all track gender in the composition of their boards and most track the gender composition in senior positions and the investment committee. They measure gaps in compensation.

In short, DFIs have largely laid the groundwork for increasing the benefits of their investments for women and creating equal opportunity for women inside their organizations.

Top Performers

Table 1 shows the DFIs with the highest scores for their external investments, advisory services, and programs, and those with the highest scores for their internal policies and practices.

Table 1. Top performers, external and internal survey scores

| External | Internal |

|---|---|

| IDB Invest (92%) | IDB Invest and IFC (79%) |

| CDC Group (88%) | CDC Group (76%) |

| IFC (84%) | ADB (72%) |

| FinDev Canada and ADB (80%) | JICA (62%) |

| Average (68%) | Average (52%) |

| *All scores are out of a possible 100%. |

Top performing institutions include multilaterals (IDB Invest, IFC, ADB) and bilaterals (CDC, JICA, FinDev Canada). They are based in a range of countries, including the United States, United Kingdom, Canada, and Japan, and operate across the developing world. Though it would be reasonable to assume that DFI performance might differ based on size or age of the institution, survey data do not show such differences. It is encouraging to see that smaller or more recently established institutions are among top performers (e.g., FinDev Canada), as are larger and longer-standing institutions (e.g., IFC). Age, size, geographic focus, and bilateral/multilateral shareholding structure do not predetermine DFI performance with respect to gender-lens investing. This is a cause for optimism and a reason to push for ambitious policies and practices across institutions.

Taking It to the Next Level: Where Is There Room for Improvement?

However, DFIs’ significant investment in process inputs is not yet matched on the output measurement side. It is not clear whether the investment process changes are making a difference in the extent to which gender is mainstreamed or a focus in investment decisions, or in yielding beneficial gender-related outputs and outcomes. DFIs have room to improve in translating strategic aspirations reflected in strategy documents into concrete performance targets. And they could be more transparent about how well they are performing, both in their investments and in their internal practices.

Half of the institutions do not set targets for measuring the implementation of their external gender strategies. Most do not publish the shares of their investments that have a gender focus. Half do not systematically incorporate gender scores or other qualitative factors into each investment approval decision by their investment committees. Most do not train their own staff on how to integrate gender analysis and objectives into investments. And most do not publish their gender-disaggregated data.

For their internal practices, while they measure pay gaps and gender imbalances on boards and in senior positions, most DFIs do not publish targets for narrowing gaps or improving gender balance. On average, women account for a third or less of board members and senior staff. Most DFIs do not train staff and managers on gender, bias, and diversity. And only one institution promotes the sourcing of goods and services for its own operations from women-owned businesses.

The IFC (as part of the World Bank Group) has committed to double its spending with women-owned businesses by 2023.

In sum, DFIs should be strongly commended for building the systems and databases needed to underpin institutional change. But they can reap greater gains from this investment by taking the next step of defining, measuring, and publishing their targets for change with respect to internal and external gender equity and women’s empowerment. This will strengthen their efforts to translate data and analysis into measurable and transformational institutional goals. We believe the result will be major advances in transparency, accountability, and development effectiveness.

Recommendations

In light of these findings, we offer five recommendations:

1. Increase transparency

Establish a common methodology for measuring the volume and share of annual investments with a gender focus and publish the data. Publish and share gender-disaggregated results data, as well as diagnostic and baseline data (without compromising business confidentiality). Publish data on internal gender gaps in pay, board composition, management, hiring, and sourcing.

2. Set targets and timetables

Set targets at the portfolio level for the volume and share of investments with a gender focus, that is, specifically targeting and benefiting women. Set targets and timetables for closing gender gaps in pay, boards, management, hiring, and sourcing.

3. Make gender-related impact, including benefits and risks of DFI investments to women and girls, a key, standalone criterion in every investment decision.

Opportunities for extending and expanding investment benefits, and avoiding harm, for women and girls should be truly mainstreamed in all investments, that is, developed in every investment proposal and required as part of every investment decision.

4. Keep leading through collaboration

Building on the 2X Challenge and We-Fi, keep setting measurement standards; promoting high-impact investments; and sharing strong gender policies, practices, and learning with other impact investors, including private investors interested in empowering women, to push the field forward collectively.

5. Train management and staff

In integrating gender into investment development and design, and in internal gender, bias, and diversity issues and challenges.

More Detail on Results

External Investment, Advisory Services, and Programs

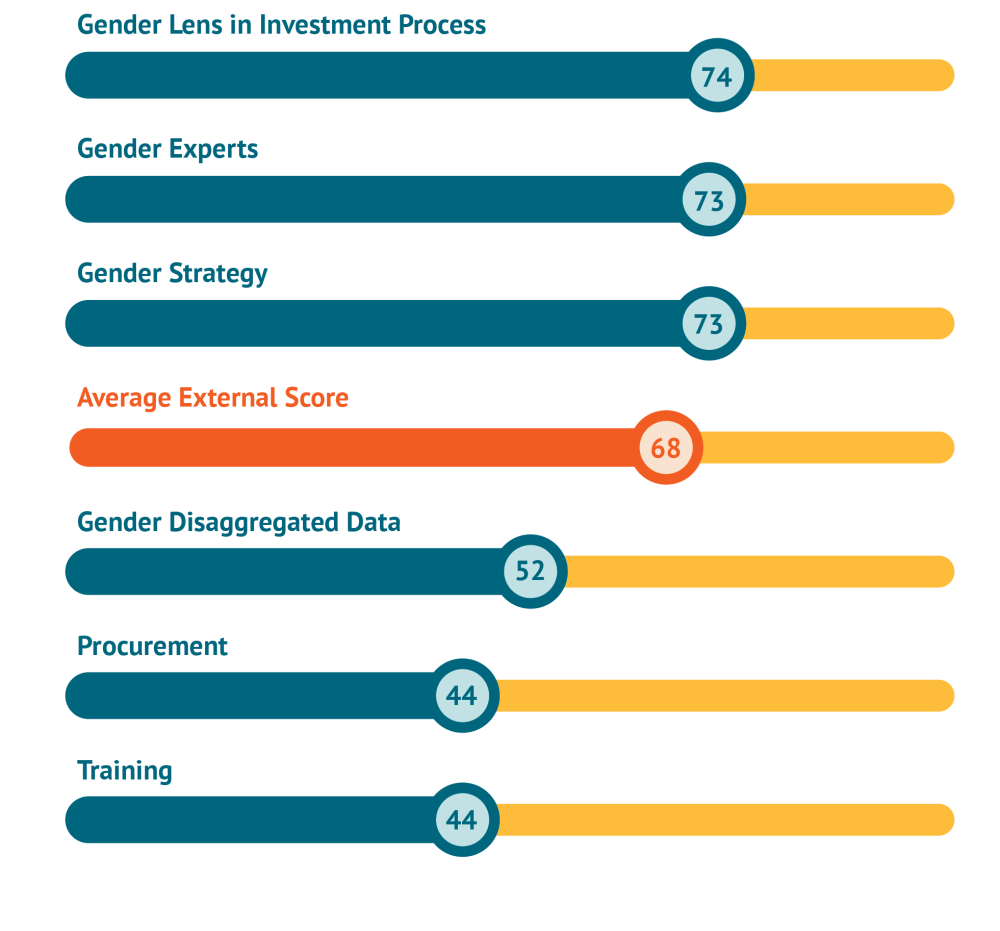

Figure 1. External survey scores

Components of the External Survey

Gender Lens in Investment Process looks at whether institutions incorporate gender objectives or analysis when developing investments, assessing development effectiveness, sourcing deals, and making investment decisions. Gender Experts refers to dedicated staff at the organization who work on gender, and Gender Strategy includes questions about the institutions’ strategies for gender equity and women’s economic empowerment. Gender-Disaggregated Data includes questions about data collection, disaggregation by gender, and use. Procurement looks at whether partners are encouraged to source from women-owned businesses and farms. For the external survey, Training refers to whether institutions require training on gender equity for all employees involved in programs and investments, and whether they provide gender-related training, assistance, or advisory services to partners.

Nearly all DFIs have an external gender strategy. Fourteen out of 16 institutions have a strategy in place to govern gender equity and women’s empowerment, all of which are informed by stakeholders. The vast majority of these (12/16) have been approved by boards and are made public on DFIs’ websites. However, half of the institutions do not set targets for measuring strategy implementation.

To measure implementation of its external gender strategy, DFC has set external volume targets (for example, $1 billion commitment to empower women across Africa).

Gender is integrated into investment development processes at most institutions but not necessarily into all investment decisions. The survey looks at the integration of gender into the investment process across a number of dimensions—deal sourcing and due diligence criteria; DFIs’ consideration of the gender policies of potential investees, women's ownership and leadership of potential investees, and women’s participation in potential investee fund management teams; gender analysis in investment documents; and inclusion of gender in development effectiveness scores. Importantly, most institutions consider gender in all these aspects of the investment process. But equally importantly, only half the institutions use a gender score or qualitative factors in each investment approval decision. Investment committee members in half the institutions surveyed are not required to separately assess or prioritize gender-related impact when they decide whether to approve or reject a proposed investment. Prioritizing gender-related impact in this context need not mean targeting women only as investment beneficiaries; it could mean instead that every investment must generate significant benefits (or avoid or reduce important risks) for women.

In assessing results, most institutions disaggregate all beneficiary output/outcome data by gender (9/16). Ten out of 16 reported using some disaggregated data for developing lessons for future investments (though they may not disaggregate all beneficiary data). Only 6 out of 16 institutions make this gender-disaggregated data public (figure 2).

As part of their impact reporting, Finnfund makes gender-disaggregated beneficiary data public.

Figure 2. Collection, use, and publication of gender disaggregated data

Fourteen DFIs have signed onto 2X Challenge, a promising platform for continued momentum on gender-lens investing. 2X Challenge criteria dictate that projects must invest in firms or funds that are majority-owned by women, have more gender-equal management teams or workforces than sectoral averages, or provide gender-responsive goods and services to consumers. This collaborative effort among DFIs is commendable, and it can be strengthened further by (1) publishing on a centralized platform data on the DFI deals that meet 2X criteria; (2) making criteria even more ambitious and comprehensive over time (e.g., raising the percentage of women in leadership required to be 2X-eligible, requiring multiple criteria for eligibility as a 2X project, and adding a broader range of criteria for assessing impact on women); and (3) working towards a common results framework to complement the criteria DFIs apply when sourcing deals.

Nearly all DFIs have a dedicated gender lead and team at the institutional level (14/16), and gender experts are included in the development of investments for 10 out of 16 institutions. Gender expertise also extends beyond a dedicated point person or team at most institutions: 11 out of 16 DFIs have a community of practice for the purpose of sharing knowledge and lessons learned.

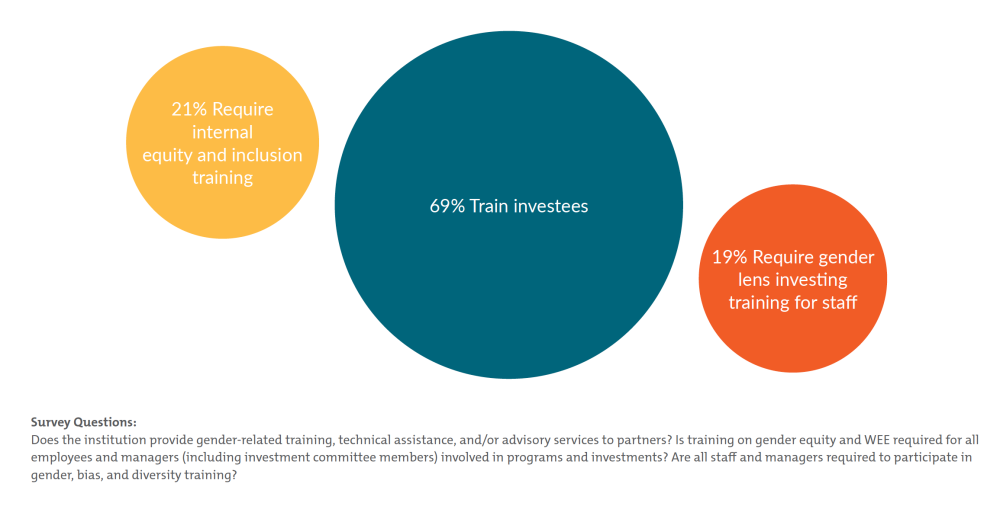

Few DFIs are training their staff on how to integrate gender analysis and objectives into investments (13/16 do not) and on internal improvements to promote gender equity, diversity, and inclusion (11/14 do not).

At EBRD, gender training is part of the induction program for new employees, managers, and board members.

Figure 3. External and internal gender training

Internal Policies and Practices

Figure 4. Internal survey scores

Components of the Internal Survey

Work-Life Balance looks at flexible work policies, leave policies, and daycare options, while Events asks about gender balance on panels and in meetings. Employee Input and Recourse asks about channels available to provide feedback on gender policies and report discrimination and harassment, and whether the organization has an ombudsperson. Recruitment, Hiring, and Promotions includes questions about how employees are recruited, hired, and promoted, while Mentorship and Upward Mobility refers to opportunities for women to advance in the workplace. The Institutional Gender Strategy category includes questions about the institutions’ strategies for internal gender equity, work-life balance, and upward mobility for women employees. Certification refers to gender-related certifications like EDGE, while Pay Gap includes questions about the measurement and publication of gender pay gaps. Gender Representation in Leadership includes questions about board members, senior management/highest paid staff, and investment committee members. For the internal survey, Training looks at whether all staff are required to participate in gender, bias, and diversity training, and Procurement refers to whether there is a policy encouraging sourcing for the institutions from women-owned businesses.

Channels are available for employee input on gender policies and for reporting discrimination and harassment. Most DFIs offer communication channels to provide feedback on gender policies and practices (10/14), report discrimination and harassment (13/14), and inform management on the occurrence and institutional response to discrimination and harassment (8/14). That said, most DFIs (9/14) lack an independent ombudsperson empowered to provide confidential support on gender-related issues.

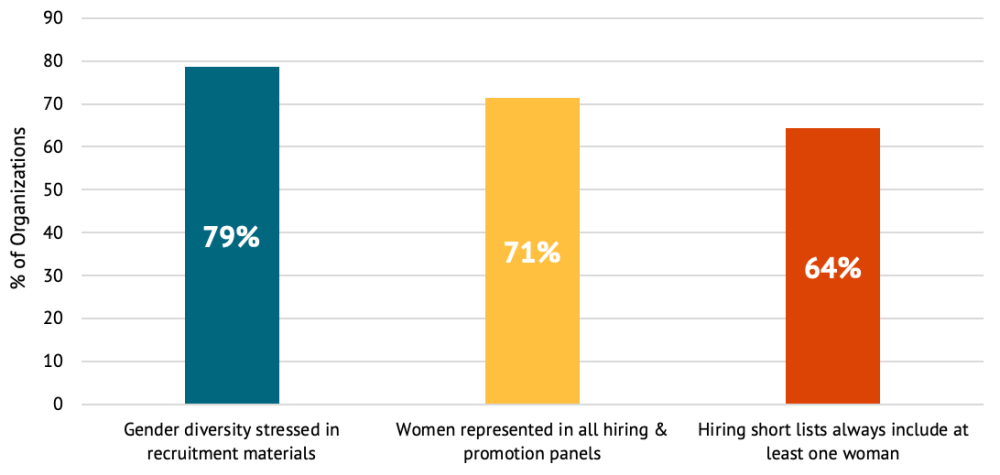

Women are represented in hiring and promotion panels, and diversity is stressed in recruitment materials. Most DFIs emphasize gender diversity in recruitment materials (11/14), require that hiring short lists include at least one woman (9/14), and ensure that women are represented in hiring and promotion panels (10/14). However, recruitment efforts for the most part (10/14) do not include specific outreach to women’s networks.

Figure 5. Recruitment, hiring, and promotion

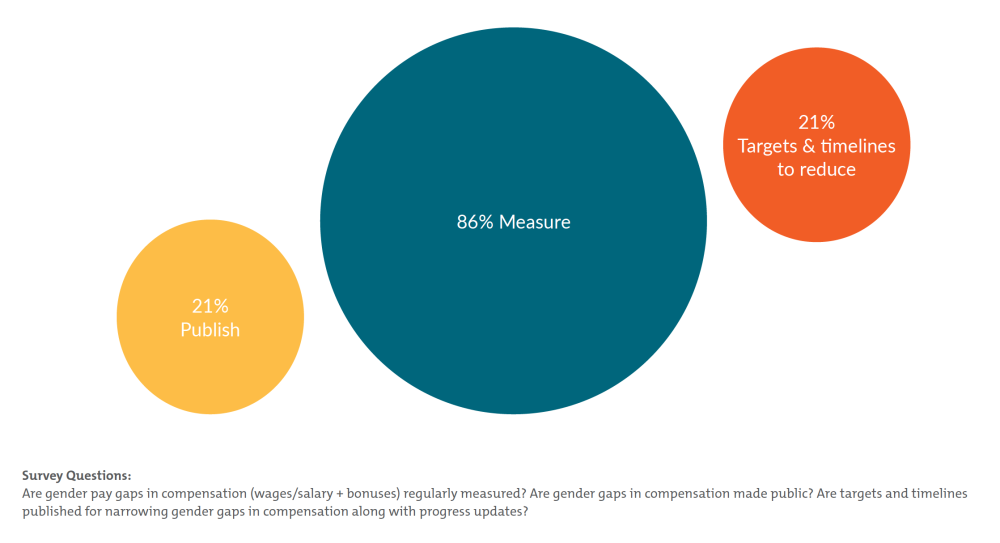

Most DFIs are measuring gender pay gaps within their institutions but most do not publish the data. Twelve out of 14 DFIs measure gender pay gaps, but most institutions do not make pay gaps public or set targets for narrowing them. Only three institutions make gaps public or set targets and timeframes for narrowing them. Half of DFIs are not collecting gender disaggregated data on the average time spent in each pay grade to assess how gender gaps are related to promotion rates.

Figure 6. Pay gap

Policies and practices are in place for promoting work-life balance. Thirteen out of 14 DFIs have policies in place that allow for flexible work and all DFIs provide paid family leave. Slightly less than half of DFIs provide on-site childcare or childcare subsidies (though this is certainly influenced by the size of the institution and the availability of government-provided childcare).

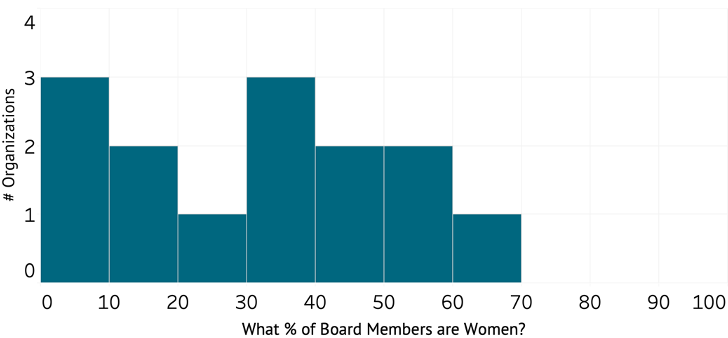

Women are underrepresented on DFI boards and in senior management, and targets are generally not set or made public for improving board and management gender diversity. Only 3 out of 14 institutions set public targets for improving gender diversity on the board; 6 institutions set targets for improving diversity in senior management; and 1 sets public targets for improving gender diversity in the investment committee. This is in spite of the fact that on average just 31 percent of board members, 33 percent of senior managers, and 29 percent of investment committee members are women.

Proparco has set a target of 44 percent women representation on its board of directors by 2020 as part of a larger objective to reach gender parity at the board level.

Figure 7. Women's representation on boards

Figure 8. Women's representation on boards

For Full Results

Visit cgdev.org/genderfinancesurvey to explore all underlying data collected through the Gender Equity in Development Finance Survey.

Glossary

Development finance: Financial investments for the purpose of achieving measurable development impact.

Investment: Investments by DFIs include any financial instrument that entails a return on, or a fee for, the provision of finance or contingent finance, such as debt, equity, guarantees, or insurance.

Development finance institutions: Publicly funded institutions that make financial investments in the private sector for the purpose of achieving development impact.

Gender equity: Fairness of treatment for women and men, according to their respective needs. This may include equal treatment or treatment that is different but which is considered equivalent in terms of rights, benefits, obligations, and opportunities (ILO, ABC of women worker’s rights and gender equality, 2000).

Gender strategy: A document that outlines an institution’s policies, practices, statements, goals, and objectives that define the institution’s approach to achieving greater gender equity and women’s empowerment.

Gender analysis: Assessment of how the benefits of the investment can be expanded, and the risks can be minimized, by interventions and design elements that strengthen positive impacts and avoid harm for women and girls.

Gender focus: Gender equality is the main objective of the investment and is fundamental in its design and expected results. The investment would not have been undertaken without this objective (OECD, Gender Equality Policy Marker).

Gender mainstreaming: The process of integrating a gender lens into all aspects of an organization’s strategies and initiatives, and into its culture, systems, and operations (Bill & Melinda Gates Foundation).

Gender score: A metric for evaluating an investment’s impact on women and girls, women’s economic empowerment, or gender equity. The gender score can be part of a larger development effectiveness score or a standalone score. The score can measure an investment’s positive impact or negative risks.

About the Survey

This survey was undertaken with the financial support of the Government of Canada provided through Global Affairs Canada and the Bill & Melinda Gates Foundation. Responsibility for the information and views expressed herein lies entirely with the authors.

Annex. List of Development Finance Institutions

Asian Development Bank (ADB)

African Development Bank (AfDB)

Belgian Investment Company for Developing countries (BIO-Invest)

CDC Group

Spanish Company of Financial Development (COFIDES)

KfW Deutsche Investitions- und Entwicklungsgesellschaft (KfW DEG)

US International Development Finance Corporation (DFC)

European Bank for Reconstruction and Development (EBRD)

European Investment Bank (EIB)

FinDev Canada

Finnish Fund for Industrial Cooperation (Finnfund)

Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO)

Inter-American Development Bank Invest (IDB Invest)

International Finance Corporation (IFC)

Islamic Development Bank (IsDB)

Japan International Cooperation Agency (JICA)

The Norwegian Investment Fund for Developing Countries (Norfund)

Development Bank of Austria (OeEB)

Société de Promotion et de Participation pour la Coopération Economique (PROPARCO)

Swiss Investment Fund for Emerging Markets (SIFEM)

The Swedish Development Finance Institution (Swedfund)

Annex. Survey Questions

External Gender Policies and Practices

Gender Strategy

Is there an institutional strategy for gender equity and women's economic empowerment (WEE)?

Has the institutional strategy been reviewed or informed by external gender experts and key stakeholders?

Was the strategy approved by the Executive Board?

Is the strategy made public, including on a web page dedicated to gender? If yes, please link to the strategy.

Are there public documents reporting periodically on the implementation of the strategy? If yes, please link.

Are data monitored for the share of investments that have a significant gender focus (# gender focused projects/total # of projects)? If yes, please explain how significant gender focus is defined and link to the data.

Are data monitored for the share of investment volume that has a significant gender focus (gender focused investment/total investment)? If yes, please explain how significant gender focus is defined and link to the data.

Are there quantitative and qualitative targets set at the institutional level for measuring implementation of the gender strategy? If yes, please link.

Gender Lens in Investment Process

Is gender analysis integrated into the development of all investments and advisory services, and included in documents submitted to the investment committee?

Are ex ante gender scores calculated, or qualitative factors included, for all investments as part of assessing development effectiveness?

Do investment documents require identification of gender specific benefits or mitigation of gender specific risks?

Are gender objectives incorporated into processes and criteria for sourcing deals and conducting due diligence?

Is a gender score, or qualitative factors, incorporated into each investment approval decision by the investment committee?

For investments in funds, are efforts made to support fund management teams that include women?

For investments in firms, financial institutions, farmer groups, etc., are their gender policies and strategies assessed as part of investment criteria?

For investments in firms, financial institutions, farmer groups, etc., is the gender composition of ownership and leadership assessed as part of investment criteria?

Gender Experts

Is there a dedicated gender lead and team at the institutional level?

Are gender experts included in the development and implementation of all investments?

Does the institution have a gender community of practice for the purpose of sharing knowledge and lessons learned?

Training

Is training on gender equity and WEE required for all employees and managers (including investment committee members) involved in programs and investments?

Does the institution provide gender-related training, technical assistance, and/or advisory services to partners?

Gender Disaggregated Data

Does the M&E framework for investments and advisory services disaggregate all beneficiary output and outcome data by gender?

Are these gender disaggregated data made public (while protecting individual business confidentiality)? If so, please link to the data.

Are gender disaggregated data and gender outcomes used to develop lessons learned for future investments?

Procurement

Are partners (investees) encouraged to source from women-owned businesses and farms where relevant?

Internal Gender Policies and Practices

Institutional Gender Strategy

Is there a current institutional strategy for internal gender equity, work-life balance, and supporting upward mobility for women employees?

Has the institutional strategy been reviewed or informed by external gender experts and key stakeholders?

Is the internal strategy made public on a web page dedicated to gender? If yes, please provide a link.

Does the strategy include targets at the institutional level for gender equity, work-life balance, and women's upward mobility?

Are there public documents reporting periodically on the implementation of the strategy? If yes, please link to document(s).

Gender Representation in Leadership

Are targets and timetables for improving gender diversity at the Board level published, along with regular updates on implementation progress?

Are there targets and timetables for improving gender diversity at the senior management level or for staff at the highest pay grades, published, along with regular updates on implementation progress?

Are there targets and timetables for improving gender diversity at the investment committee level published, along with regular updates on implementation progress?

Work-Life Balance

Are flexible work practices included as employee benefits: telecommuting, alternative work schedules, part-time work, job sharing?

Is there a paid leave policy for maternity, paternity, adoption, and other family leave?

Is there onsite childcare or a childcare subsidy?

Recruitment, Hiring, and Promotions

Is gender diversity stressed in recruitment materials?

Does recruitment outreach always include networks for women?

Do hiring short lists always include at least one woman?

Are women represented in all hiring and promotion selection panels?

Are gender disaggregated data on the average time spent in each pay grade collected?

Employee Input and Recourse

Is there a well-established and frequently used communication channel for providing feedback on gender policies and practices to senior management?

Is there an independent ombudsperson empowered to provide confidential support on gender-related issues?

Is there a confidential formal channel for reporting discrimination and harassment to staff empowered to investigate and take action to respond?

Are management and the Board provided regular updates on the incidence and actions taken to respond to discrimination and harassment?

Do employee satisfaction surveys include questions regarding gender equity, work-life balance, and women's upward mobility?

Mentorship and Upward Mobility

Are there programs for mentorship, sponsorship, and upward mobility?

Pay Gap

Are gender pay gaps in compensation (wages/salary + bonuses) regularly measured?

Are gender gaps in compensation made public? If so, please link.

Are targets and timelines published for narrowing gender gaps in compensation, along with progress updates?

Training

Are all staff and managers required to participate in gender, bias, and diversity training?

Events

Are women included, as a matter of institutional policy, as speakers in all conferences, panel discussions, high level meetings, and working groups?

Procurement

Does the institution have a policy to encourage sourcing goods and services for the institution from women-owned businesses? If so, please link.

Certification

Does the institution have any gender related certifications (e.g. EDGE)? If so, please list.

[1] We contacted representatives (primarily gender leads and human resources departments) from 21 development finance institutions: ADB, AfDB, BIO-Invest, CDC Group, COFIDES, KfW DEG, DFC, EBRD, EIB, FinDev Canada, Finnfund, FMO, IDB Invest, IFC, IsDB, JICA, Norfund, OeEB, Proparco, SIFEM, and Swedfund. Of these, 16 institutions responded to the external survey (76 percent response rate), and 15 institutions to the internal survey (71 percent response rate), though SIFEM was excluded from analysis because it does not have a staff. Institutions that did not respond to either survey and are therefore not included in the data are AfDB, KfW DEG, EIB, IsDB, and OeEB. We hope to be able to include these institutions in future survey rounds.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.