Treasury’s Office of International Affairs works with other federal agencies, foreign governments, and international financial institutions to strengthen the global economy and foster economic stability. The United States’ international engagement through Treasury supports our national economic and security interests by promoting strong economic governance abroad and bolstering financial sector stability in developing countries. Through Treasury, the United States exercises leadership in international financial institutions where it shapes the global economic and development agenda and leverages US government investments, while tackling poverty and other challenges around the world.

Structure and Organization

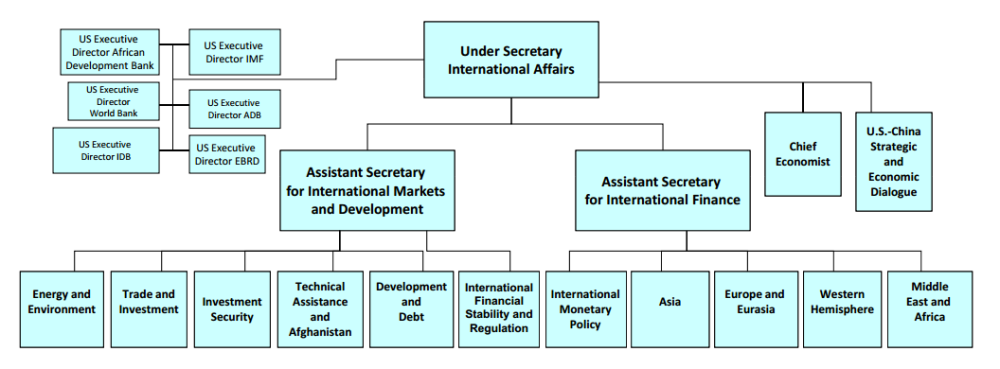

Figure 1: Treasury Office of International Affairs Organizational Chart[1]

The under secretary of the Treasury for international affairs is appointed by the president, confirmed by the Senate, and advises the secretary of the Treasury on international economic issues. The Office of International Affairs manages US contributions to the International Monetary Fund (IMF), the World Bank, the regional development banks (MDBs), and other multilateral funds.

International Programs Budget

Funding for Treasury’s international programs is appropriated annually through the Department of State, Foreign Operations, and Related Programs Appropriations bill. US contributions fluctuate and frequently depend on policy and financing reviews conducted as part of institutions’ replenishment process, which establish resources over a given length of time.

|

|

FY10 |

FY11 |

FY12 |

FY13 |

FY14 |

FY15 |

FY16 - Enact |

FY17-Request |

|

Multilateral Development Banks |

1,553 |

1,495 |

1,959 |

2,044 |

2,075 |

2,000 |

1,817 |

1,802 |

|

International Development Association |

1,263 |

1,233 |

1,325 |

1351 |

1,355 |

1,288 |

1,197 |

1,384 |

|

International Bank for Reconstruction and Development |

- |

- |

117 |

181 |

187 |

187 |

187 |

6 |

|

Inter-American Development Bank |

- |

- |

75 |

107 |

102 |

102 |

102 |

22 |

|

Inter-American Investment Corporation |

5 |

21 |

5 |

- |

- |

- |

- |

- |

|

Multilateral Investment Fund[3] |

25 |

25 |

25 |

15 |

6 |

3 |

- |

- |

|

Asian Development Bank |

- |

106 |

107 |

101 |

107 |

107 |

6 |

- |

|

Asian Development Fund |

105 |

- |

100 |

95 |

110 |

105 |

105 |

99 |

|

African Development Bank |

- |

- |

32 |

31 |

32 |

32 |

34 |

32 |

|

African Development Fund |

155 |

110 |

173 |

163 |

176 |

176 |

176 |

214 |

|

North American Development Bank |

- |

- |

- |

- |

- |

- |

10 |

45 |

|

International Funds and Programs[4] |

492 |

454 |

490 |

505 |

592 |

402 |

464 |

450 |

|

Global Agriculture and Food Security Program[5] |

- |

100 |

135 |

128 |

133 |

- |

43 |

23 |

|

International Fund for Agricultural Development |

30 |

29 |

30 |

29 |

30 |

30 |

32 |

30 |

|

Clean Technology Fund |

300 |

185 |

185 |

175 |

210 |

185 |

171 |

- |

|

Strategic Climate Fund |

75 |

50 |

50 |

48 |

75 |

50 |

50 |

- |

|

Green Climate Fund[6] |

- |

- |

- |

- |

- |

- |

- |

250 |

|

Global Environment Facility |

87 |

90 |

90 |

125 |

144 |

137 |

168 |

147 |

|

Technical Assistance |

25 |

25 |

27 |

26 |

24 |

24 |

24 |

34 |

|

Debt Relief[7] |

40 |

50 |

187 |

11 |

- |

- |

- |

- |

Activities

Shaping the Global Development Agenda: Treasury’s Office of Development Policy and Debt leads US engagement in the multilateral development banks (MDBs), which provide financial and technical assistance to developing countries to help them strengthen economic management and reduce poverty. MDBs use money contributed by member countries (including donor countries and developing countries) to support lending, grants, and technical assistance programs for infrastructure and other development projects. Most MDBs have two major funds: one that provides non-concessional assistance, including loans at market-based terms to middle-income governments, and another that provides concessional assistance, including grants and loans at below-market terms to low-income governments. These funds are often described as lending windows or facilities. In addition to providing assistance to country governments, some MDBs make loans through their non-concessional window to private sector firms in middle-income countries.[8]

|

Multilateral Development Bank |

Description |

US Voting Share |

Does the US have the largest voting share? |

|

International Bank for Reconstruction and Development (IBRD) |

The World Bank Group's IBRD offers non-concessional loans and guarantees to middle-income countries and selected creditworthy low-income countries. |

16.4%[9] |

Yes |

|

International Development Association (IDA) |

The World Bank Group's IDA offers concessional loans to low-income countries. |

10%[10] |

Yes |

|

Inter-American Development Bank (IDB) |

IDB offers non-concessional loans and guarantees to middle-income countries and selected creditworthy low-income countries in Latin American and the Caribbean. IDB’s windows include the Fund for Special Operations (FSO) offers concessional loans to low-income countries in Latin American and the Caribbean, the Inter-American Investment Corporation (IIC), and the Multilateral Investment Fund (MIF), which offer loans to private sector firms in developing countries. |

30%[11] |

Yes |

|

North American Development Bank (NABD) |

NADB offers financing for environmental infrastructure projects within the areas up to 100 km north and 300 km south of the US-Mexico border. [12] |

50%[13] |

Equal voting share with Mexico |

|

Asian Development Bank (ADB) |

ADB offers non-concessional loans, equity investments, and loan guarantees to middle-income countries and selected creditworthy low-income countries in Asia. |

12.7%[14] |

Second largest voting share behind Japan |

|

Asian Development Fund (ADF) |

ADF, an instrument of ADB, offers concessional loans and grants to low-income countries in Asia. |

12.7%[15] |

Second largest voting share behind Japan |

|

African Development Bank (AfDB) |

AfDB offers non-concessional loans, equity investments, and loan guarantees to middle-income countries and selected creditworthy low-income countries in Africa. |

6.5%[16] |

Second largest voting share behind Nigeria |

|

African Development Fund (AfDF) |

AfDF, an instrument of AfDF, offers concessional loans and grants to low-income countries in Africa. |

5.3%[17] |

Second largest voting share behind Japan |

|

European Bank for Reconstruction and Development (EBRD) |

EBRD offers non-concessional loans, equity investments, and loan guarantees primarily to private sector firms in developing countries in Europe, as well as some loans to country governments in the region.[18] |

10.13% |

Yes |

Multilateral channels allow the United States to take advantage of the MDBs’ ability to borrow in capital markets, gain access to a range of lending instruments, and maintain a broad geographic reach and sectoral diversity. For these reasons, working through the MDBs increases the United States’ opportunity to achieve positive development outcomes beyond what it can accomplish through bilateral channels. In addition, through commitments to the MDBs as either the largest or second largest shareholder, the US reinforces its unique influence in shaping the global agenda.[19]

Investing in Sustainable Development: Treasury facilitates US commitments to select multilateral funds and programs. The United States contributes to two funds to address food insecurity: the Global Agriculture and Food Security Program, a multi-donor trust fund that finances country-led agriculture and food security investment strategies, complementing US bilateral efforts through the Feed the Future Initiative; and the International Fund for Agricultural Development, which provides low interest loans and grants to finance rural agricultural development projects. The United States demonstrates its leadership and commitment to the fight against global hunger through engagement in these multi-donor funds.

Treasury’s Office of Environment and Energy manages US interests and obligations in international funds and programs that advance access to energy and address important environmental challenges. Through guidance from this office, the United States seeks to improve global efforts to conserve critical ecosystems through the Global Environment Facility. Historically, Treasury has also made contributions to the World Bank’s Climate Investment Funds, which include the Clean Technology Fund and the Strategic Climate Fund. In fiscal years 2016 and 2017, the administration requested funding through both Treasury and the Department of State to fulfill a pledge to the Green Climate Fund , a multilateral trust fund that provides support to developing countries to mitigate and adapt to climate change.

Building Financial Sector Capacity in Developing Countries: Treasury’s Office of Technical Assistance (OTA) provides bilateral technical assistance by sending financial advisors to work with developing country governments to improve financial management practices. OTA’s activities help countries become less reliant on foreign assistance by improving their capacity to manage public finances and strengthening countries’ financial sectors.

This technical assistance helps countries improve domestic revenue mobilization (DRM), the process of countries transparently raising their own funds, and adopt sound public financial management practices. OTA approaches DRM systematically by leveraging the office’s areas of expertise, including revenue policy, budgeting, and debt management.[20] Additionally, OTA has recently ramped up projects providing technical assistance to strengthen anti-money laundering/countering the financing of terrorism policies. As of December 2016, OTA was operating nearly 100 projects in 50 countries.[21]

From 2005 to 2015, public domestic finance increased from $838 billion to approximately $1.86 trillion in developing countries, offering additional resources for social service delivery, public security, and physical infrastructure.[22] Leveraging targeted aid to catalyze countries’ domestic revenue furthers US national interests. Regimes with strong financial sector governance contribute to global financial sector stability and growth and can support achievement of broader national security goals.

Promoting Financial Stability: Treasury’s Office of International Monetary Policy and Office of International Financial Stability and Regulation lead US engagement in the International Monetary Fund (IMF), an organization of 188 member countries that promotes the stability of the international monetary system. A complement to other international financial institutions that focus primarily on poverty reduction and development, the IMF has a distinct role in overseeing the global financial system to ensure its effective operation.

The IMF’s core responsibility is to assist member countries in addressing balance-of-payments problems, which arise when a country lacks sufficient financing to both meet international payments and maintain reserves. The IMF employs lending mechanisms similar to those of multilateral institutions, although unlike development banks the IMF does not lend for specific projects. It provides temporary support to member countries, not just the least developed, to boost foreign exchange reserves, help mitigate financial and economic shocks, and protect against natural disasters. The IMF also carries out technical assistance and financial surveillance activities that help strengthen underlying economic fundamentals of member countries and the global financial systems at large.[23]

The secretary of Treasury serves as US governor to the IMF, and the United States is the single largest shareholder, with a 16.53 percent share of votes. The IMF obtains most of its financial resources through quota subscriptions from member countries.

Facilitating Diplomatic Engagement: Treasury leads US bilateral diplomatic engagement with developing countries aimed at strengthening economic governance. Through the Offices of African Nations, East Asia, Europe and Eurasia, Middle East and North Africa, South and Southeast Asia, and the Western Hemisphere, Treasury officials meet with counterparts abroad, convening economic and financial dialogues.[24] Representatives from Treasury provide economic policy guidance on issues ranging from bolstering regional infrastructure to advancing policy measures that support open trade and investment climates. These dialogues further contribute to the maintenance and strengthening of US bilateral relationships.

Endnotes

[1]Adapted from U.S. Department of Treasury to include the Office of International Monetary Policy and Office of International Financial Stability and Regulation. Formerly the Office of International Monetary and Financial Policy, it split into two offices in the summer of 2016.

[2] U.S. Department of Treasury, “U.S. Department of the Treasury International Programs Congressional Justifications for Appropriations.” (U.S. Department of Treasury, 2016 2011), https://www.treasury.gov/about/budget-performance/Pages/cj-index.aspx.

[3] The Multilateral Investment Fund is part of the Inter-American Development Bank Group and primarily provides technical assistance to the private sector in Latin American and the Caribbean.

[4] The President’s FY2017 budget request also included $12.5 million for the Central America and Caribbean Catastrophe Risk Insurance Program, and $20 million for a World Bank Global Infrastructure Facility.

[5] USAID provided funds for GAFSP in FY2010 and FY2015.the lobal griculture and ood ecurity rogram.

[6] The FY2017 budget request for the Treasury Department includes $250 million to commit towards the US pledge to the Green Climate Fund (GCF), a multilateral trust fund that provides support to developing countries to mitigate and adapt to climate change. The FY2017 request for the State Department includes $500 million for the GCF—for a combined total of $750 million. In FY2016, the administration’s budget request included a $150 million contribution to the GCF through Treasury and a $350 million commitment through the State Department. While Congress did not appropriate funding for the GCF in either fiscal year, the State Department transferred $500 million from the Economic Support Fund to the GCF. U.S. Department of Treasury, “U.S. Department of the Treasury International Programs Congressional Justification for Appropriations - FY2017” (U.S. Department of Treasury, 2016), https://www.treasury.gov/about/budget-performance/CJ17/FY%202017%20Congressional%20Justification%20FINAL%20VERSION%20PRINT%202.4.16%2012.15pm.pdf.

[7] Until 2013, the budget included funding to meet potential US bilateral debt relief commitments under the Heavily Indebted Poor Country framework, as well as for Multilateral Debt Relief Initiative commitments. U.S. Department of Treasury, “U.S. Department of the Treasury International Programs Congressional Justification for Appropriations- FY2013.” (U.S. Department of Treasury, 2012), https://www.treasury.gov/about/budget-performance/Documents/FY2013_CPD_FINAL_508.pdf.

[8] The African Development Bank, Asian Development Bank, and Inter-American Development Bank provide loans to private sector firms. Rebecca M. Nelson, “Multilateral Development Banks: Overview and Issues for Congress,” CRS Report (Congressional Research Service, December 2, 2015), https://fas.org/sgp/crs/row/R41170.pdf.

[9] Corporate Secretariat, “International Bank for Reconstruction and Development Subscriptions and Voting Power of Member Countries” (World Bank Group, March 7, 2017), http://siteresources.worldbank.org/BODINT/Resources/278027-1215524804501/IBRDCountryVotingTable.pdf.

[10] Inter-American Development Bank, “Capital Stock and Voting Power,” Inter-American Development Bank, February 2009, http://www.iadb.org/en/about-us/capital-stock-and-voting-power,3166.html.

[11] Ibid.

[12] Rebecca M. Nelson, “Multilateral Development Banks: U.S. Contributions FY2000-FY2015,” CRS Report (Congressional Research Service, November 3, 2015), https://fas.org/sgp/crs/misc/RS20792.pdf.

[13] U.S. Department of Treasury, “U.S. Department of the Treasury International Programs Congressional Justification for Appropirations - FY2017,” 20.

[14] Asian Development Bank, “Annual Report 2015 - Members, Capital Stock, and Voting Power” (Asian Development Bank Group, 2016), https://www.adb.org/sites/default/files/institutional-document/218696/oi-appendix1.pdf.

[15] Martin A. Weiss, “The Asian Development Bank,” CRS Report (Congressional Research Service, February 12, 2004), http://research.policyarchive.org/3699.pdf.

[16] African Development Bank, “Distribution of Voting Power by Executive Director.” (African Development Bank Group, December 31, 2016), http://siteresources.worldbank.org/BODINT/Resources/278027-1215524804501/IDACountryVotingTable.pdf.

[17] African Development Fund, “Distribution of Voting Power of Executive Directors as of 30 September 2016.” (African Development Bank Group, September 30, 2016), https://www.afdb.org/fileadmin/uploads/afdb/Documents/Boards-Documents/ADF_-_Voting_Powers_as_at_30_September__2016.pdf.

[18] European Bank for Reconstruction and Development, “Financial Report 2015.” (European Bank for Reconstruction and Development, 2015), http://www.ebrd.com/news/publications/financial-report/financial-report-2015.html.

[19] Scott Morris and Madeleine Gleave, “Realizing the Power of Multilateralism in US Development Policy,” in White House and the World 2016 Briefing Book (Center for Global Development, 2015), /publication/ft/realizing-power-multilateralism-us-development-policy.

[20] U.S. Department of Treasury, “Department of the Treasury International Affairs Technical Assistance - 2015 Report to Congress.” (U.S. Department of Treasury, 2016), https://www.treasury.gov/about/organizational-structure/offices/Documents/2015%20OTA%20Report%20to%20Congress%20-%20FINAL.pdf.

[21] U.S. Department of Treasury, “OTA Projects (as of 12/31/2016).” (U.S. Department of Treasury, December 31, 2016), https://www.treasury.gov/about/organizational-structure/offices/Documents/OTA%20Projects%20(As%20of%2012-31-2016).pdf.

[22] Casey Dunning, “Time for US to Ramp Up Efforts on Domestic Resource Mobilization,” Center For Global Development, US Development Policy, (April 21, 2015), /blog/time-us-ramp-efforts-domestic-resource-mobilization.

[23] Jenny Ottenhoff, “International Monetary Fund (ABCs of the IFIs Brief),” CGD Brief, (September 23, 2011), /publication/international-monetary-fund-abcs-ifis-brief.

[24]Treasury leads US engagement in the G-20, the US-China Strategic and Economic Dialogue, the US-India Economic and Financial Partnership, the Asia-Pacific Economic Cooperation forum, the Association of Southeast Asian Nations, and others.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.