Recommended

POLICY PAPERS

A Thought Experiment

It’s 2028. The Belt and Road Initiative (BRI) has been underway for 15 years, but the initial enthusiasm and momentum behind BRI has vanished. Many of the governments that initially joined the initiative have publicly withdrawn or quietly wound down their participation. China’s staunchest allies remain engaged but even they have reservations about the wisdom of the initiative. They are saddled with unproductive public investment projects and struggling to service their debts. Domestic public sentiment towards China has soured, and they have come to view their participation in BRI as more of a political liability than an asset. But they worry about the consequences of alienating their most important patron and creditor. China has also assumed a defensive posture. Lacking the goodwill that it possessed at the beginning of BRI, it is now using inducements and threats to prevent its remaining clients from abandoning the initiative. Western donors and lenders watch from the sidelines with a sense of bemusement. They encouraged China to “multilateralize” BRI by establishing a common set of project appraisal standards, procurement guidelines, fiduciary controls, and social and environmental safeguards that other aid agencies and development banks could support. But Beijing chose to go it alone. It opted not to embrace the use of economic rate-of-return analysis to vet project proposals; resisted efforts to harmonize its environmental, social, and fiduciary safeguards with those used by aid agencies and development banks outside of China; and pushed back on the “Western” suggestion that it modernize its monitoring and evaluation practices. China bet that its fast and flexible approach to infrastructure finance would prove to be so compelling that traditional donors and lenders would eventually jump on the bandwagon and co-finance BRI projects. But it miscalculated. Its model was insufficiently attractive on its merits to enlist the participation and support of the other major players in the bilateral and multilateral development finance market. Nor was it sufficiently appealing to sustain elite and public support in partner countries.

China is now substantially weaker at home than it was during the early days of BRI. Its policy banks and state-owned commercial banks faced top-down and bottom-up pressure—from the State Council and cash-poor BRI participants—to fast-track big-ticket infrastructure projects with as little “red tape” as possible. But many of these projects were poorly designed, so the banks are now dealing with unsustainable stock of non-performing loans, leaving them with two equally unattractive choices: restructure the debts of the least creditworthy countries or throw good money after bad by offering new loans to help borrowers repay old loans. With lower-than-expected reflows entering the coffers of China Development Bank, China Eximbank, and the “big 4” state-owned commercial banks, the People’s Bank of China sees the writing on the wall and decides to intervene. It recapitalizes the banks once, and then again, and again. As the country’s foreign exchange reserves dwindle, fiscally conservative voices within China grow louder. They call upon the banks to rein in their overseas lending activities and find common cause with the Chinese public, which sees ample evidence of waste and corruption in BRI projects and has a declining appetite for overseas entanglements. As populist and isolationist pressures mount, China’s political leadership concludes that it no longer enjoys domestic support for its international leadership ambitions. The country turns inward and a period of global retrenchment ensues.

Now consider an alternative scenario. It’s 2028, and there is not much talk in Western capitals about China being a “rogue” donor and lender that threatens the coherence and stability of the global development finance regime. Instead, the current focus of policy discussions in Washington, London, and Brussels is on how to collaborate with Beijing in mutually beneficial ways. The BRI has become a shared project of Chinese banks and a broad coalition of bilateral aid agencies and multilateral development banks around the globe. Beijing and the other big players in development finance have agreed to use a common set of due diligence procedures and project safeguards. Consequently, few development finance institutions outside of China think of BRI co-financing as a high-risk, low-return proposition. They instead view it as an opportunity to support bankable, high-impact projects that they would not be able to finance on their own.

As Chinese and non-Chinese development finance institutions develop strong working relationships characterized by trust and mutual understanding, it becomes even more obvious that they have a shared interest in solving a wide array of problems that affect all parties to these transactions. All lenders want to be adequately protected from repayment risk and ensure that their borrowers are engaging in responsible debt management practices. They all want to avoid corruption and cost overrun problems as well as the reputational risk associated with projects that cause social and environmental harm. They all want contractors to be selected on the basis of merit and value for money and closely supervised during implementation. Robust monitoring and evaluation systems are also a “no-brainer” since each co-financier has an interest in being able to respond to questions and concerns raised by shareholders, legislative overseers, and third-party monitors.

Getting to this point was not easy. After several frustrating years of courting potential co-financiers of BRI projects without success, Beijing came to the realization that its ambition to be a global leader would require that governments and intergovernmental organizations follow its lead. But neither multilateral development banks nor bilateral aid agencies were eager to do so. They needed to be convinced that any projects they co-financed with China would be well-designed and well-supervised. So, Beijing pivoted during the early years of BRI implementation and began to work with the other big players in the development finance market to establish common rules and standards for project design, implementation, monitoring, and evaluation. Now, after many years of voluntary compliance with these rules and standards, China is reaping the benefits: fewer non-performing loans, higher-impact projects, and lower levels of reputational risk in host countries. At this point, no one really thinks of China as a rule-breaker. If anything, most of its peers and partners around the globe consider it to be either a rule-maker or rule-taker, and these improvements in public opinion and elite opinion have a knock-on effect: they make it significantly easier and cheaper for China to exercise leadership in the global development finance market. Rather than having to use carrots and sticks to induce and coerce cooperation, China is reaping the benefits of attractional influence: countries are working with China because of their respect and admiration for it and not because they want to secure concessions from it or avoid the consequences of antagonizing an important donor and creditor.[1]

Charting a Course for the Future of BRI

In the coming years, China will confront a series of decisions about how to engage with three different groups: (1) citizens in the countries where it is implementing BRI projects; (2) leaders of the same countries; and (3) donors and lenders outside of China. These decisions will shape the ultimate outcomes that are achieved via BRI—and whether China finds itself in a position that is more similar to the first or second scenario that I have just described. In the remainder of this essay, I will introduce the big decisions that lie ahead and the considerations that ought to be weighed by those who set strategy and make policy in Beijing.

Decision 1: Demand Accountability or Wait for Voters in BRI Countries to Do So?

The fate of China’s bid for leadership in the global development finance market will ultimately depend on its ability to convince low-income and middle-income countries that the “BRI model” is more attractive than other models. Beijing is currently sailing into strong headwinds in Africa, Asia, and Latin America because more and more participants in BRI are discovering two features of the BRI model—political capture and corruption—that are not terribly attractive. Several empirical studies suggest that these are indeed features of China’s existing system for identifying and implementing public investment projects rather than bugs that can be easily eliminated. One of these studies—undertaken an interdisciplinary team of research collaborators from Harvard University, Heidelberg University, the College of William & Mary, University of St. Gallen, Monash University, and the Kiel Institute for the World Economy—demonstrates that governing elites in developing countries routinely manipulate Chinese development projects for personal and political gain. More specifically, it finds that Chinese development projects are disproportionately located in the home regions of presidents and prime ministers, and this form of political capture becomes even more acute in the run-up to competitive elections.[2] Researchers from the University of Gothenburg and the University of Oslo have gone a step further. With data on the precise locations of Chinese development projects and geocoded household survey data on the corruption perceptions and experiences of nearly 100,000 respondents in 29 African countries, they have uncovered causal evidence that individuals who live in close proximity to active Chinese development projects are subjected to higher levels of local corruption.[3]

But these are the symptoms, not the sources, of the problem. There are two underlying weaknesses in China’s existing system for designing and implementing overseas projects that make it particularly vulnerable to political capture and corruption. The first is the existence of informal ties between the government officials who are responsible for reviewing project proposals and the contractors who are responsible for implementing approved projects. This vulnerability in the system was recently exposed when five high-ranking foreign aid officials from the Ministry of Commerce (MOFCOM)—the director general of the Department of Foreign Aid, three deputy directors of divisions within the Department of Foreign Aid, and the director general of the Department of International Trade and Economic Affairs—were charged with corruption and relieved of their duties. One of the officials who had direct oversight of the project bidding process was caught accepting lavish gifts from Chinese companies.[4]

The second source of rot in the system is collusion between host government officials and Chinese contractors with a significant in-country presence.[5] Chinese companies understand that Beijing asks political leaders in host countries to formally propose projects to MOFCOM or one of its banks, and they have learned how to exploit this vulnerability in the project selection system. They use a simple but effective method of deception. They first identify a project that they are uniquely well-positioned to implement and that will personally or politically benefit the leader with whom they are colluding (e.g., by proposing to locate the project in a jurisdiction that will allow the leader to provide targeted benefits to core voters or swing voters). As an additional precaution, they will often inflate the cost of the project to cover the expense of offering an illicit payment to the leader and/or his relatives and allies. Then, they ask the leader to take the candidate project to Beijing and identify it as an official priority of the government—without leaving any “contractor fingerprints” on the proposal submission.[6]

China is paying a heavy reputational price for these weaknesses in its system for designing and implementing projects.[7] Newly published results from a randomized control trial in Uganda provide compelling evidence that the general public prefers development projects financed by USAID, the World Bank, and the African Development Bank over those financed by China.[8] This study also pinpoints a key difference between public perceptions of Chinese development projects and development projects financed by “traditional” donors and lenders: members of the general public have less favorable views of China because it is harder for them to see how its funding is spent and how its projects can be monitored. These findings comport with those from another study, which finds the announcement of Chinese development projects improves public sentiment towards China, but the implementation of Chinese development projects results in public antipathy towards China.[9] While there is probably more than one reason why the implementation of Chinese development projects results in public disillusionment, corruption is one grievance that China cannot afford to ignore.[10] The taint of corruption has put Beijing on its back foot in Kenya, Uganda, Tanzania, Zambia, Ethiopia, Brazil, Ecuador, the Kyrgyz Republic, Montenegro, Malaysia, Bangladesh, Nepal, and the Maldives. This list grows longer by the month, and if Beijing does not manage to address the problem proactively and convincingly, it may very well prove to be the Achilles’ heel of BRI.

The authorities in Beijing are certainly aware of the problem. In 2014, as part of President Xi Jinping’s broader anti-corruption campaign, the CPC Central Disciplinary Committee reviewed existing practices at MOFCOM and quickly zeroed in on the corruption risks that plague its overseas project portfolio.[11] Several years later, President Xi Jinping gave a speech in which he announced that “[w]e will. . . strengthen international cooperation on anticorruption in order to build the Belt and Road Initiative with integrity.”[12]

However, it remains to be seen if the Chinese government will address the root causes of the problem. The authorities are currently trying to get rid of the rot in the system via top-down audits,[13] but they should also learn from the experiences of their peers in the development finance market. Analysis of 23,000 development projects financed by 12 bilateral and multilateral institutions in 148 countries between 1980 and 2016 demonstrates that strong “access to information” (ATI) policies and institutions within aid agencies and development banks have resulted in substantially better-performing projects.[14] More easily monitorable development projects are also less vulnerable to capture and corruption.[15] The reason why transparency leads to better outcomes is simple: staff within development finance institutions and their local counterparts in developing countries more carefully design and supervise projects when they know that there is a significant probability that their decisions and actions will be subjected to public scrutiny.

Given that China subjects its overseas development projects to exceptionally weak public disclosure requirements, it will not reap these benefits unless major changes in policy and practice are introduced.[16] The authorities in Beijing also need to come to grips with the fact that secrecy and opacity place China at a major reputational disadvantage vis-à-vis its peers. The general public trusts and favors donors and lenders who make it easy to monitor their projects, but the opposite is true of non-transparent suppliers of development finance: they are distrusted and held in low esteem.[17] Beijing therefore faces a strategic choice: embrace transparency and safeguard BRI from a wide array performance and reputational problems, or play defense and see if it’s possible to regain the trust of disillusioned populations after the damage is done.

Decision 2: Charm the Leader or the People Who Hire and Fire Him?

China’s ability to exercise leadership in the global development finance market is also contingent on whether public officials in developing countries will continue to treat its policy banks, state-owned commercial banks, and aid providers as preferred donors and creditors. A casual observer might think that China has little cause for concern since a growing number of low- and middle-income countries consider China to be their patron and lender of first resort.[18] However, conceit is the precursor to miscalculation, and this is one area where Beijing’s strategists and planners do not lack confidence. They have developed a “playbook” for winning the affections and allegiances of governing elites in developing countries, which has served China’s interests well in the past.[19] They bankroll presidential palaces, parliamentary buildings, conference centers, hotels, theaters, and sporting facilities that disproportionately benefit those who make and shape policy in urban centers. They also provide flexible, “on-demand” support for projects that help political incumbents reward their supporters, thereby increasing the odds that they will remain in power.[20]

However, it is not clear that this playbook will be a useful guide for the future. Polling data demonstrate that public antipathy towards China is rising rapidly in some of the countries that have chosen to participate in BRI, and the fact that political leaders increasingly feel compelled to cancel or mothball high-profile BRI projects suggests that these changes in public sentiment are making close relations with China a political liability. Therefore, Beijing cannot afford to rest on its laurels. It needs to rethink the ways that it engages with political leaders—in particular, those who are democratically elected—and pay closer attention to the fact that public perceptions can “‘filter up’ and influence political elites to be more [or less] amenable to China’s interests.”[21]

The risk that China will overplay its hand and make unforced errors is most acute in electoral democracies. Sri Lanka is a case in point. China dramatically increased its financial support to Sri Lanka during the Mahinda Rajapaska administration, providing roughly $12.4 billion between 2005 and 2014. It channeled much of this funding to the president’s home region and domestic electoral support base in the Sinhala South.[22] However, many of its projects were plagued by accusations of corruption and political bias, which later became a reputational liability. Public support for China steadily eroded over the course of the Rajapaska administration, and against this backdrop of rising populist antipathy towards China, an opposition politician named Maithripala Sirisena decided to challenge Rajapaksa in the 2015 presidential election. He ran on an anti-China platform and used corruption and political bias in Chinese government-funded projects in the country’s Southern Province to mobilize “his voters” in the Northern and Eastern Provinces. Beijing then made a bad situation worse. In the final months of the presidential campaign, its ambassador to Sri Lanka openly campaigned for Rajapaska and one of its state-owned companies was caught delivering nearly $8 million in cash payments to the personal residence and campaign aides of Rajapaska.[23] China’s efforts to ally itself with the incumbent ultimately backfired. Sirisena won the election—by, among other things, exploiting public antipathy towards China and the grievances of Tamil and Muslim voters in areas in the northern and eastern parts of the country—and then followed through on his campaign promises by suspending and renegotiating contracts with Chinese firms and government institutions.

This public diplomacy debacle was entirely avoidable, and it calls attention to a major blind spot in Beijing: the authorities do not have good instincts when it comes to engaging with electoral democracies, and their clumsy actions in these places can easily provoke a public backlash. Therefore, if China wants to win and maintain the support of leaders in electoral democracies, it needs to focus less on catering to the needs and desires of leaders and focus more on the needs and desires of the citizens who leaders depend upon for their political survival.[24]

Decision 3: Make Development Finance Institutions Outside of China Collaborators or Competitors?

There are some reasons to think that China might be well-positioned to assume a leadership position in the international development finance market and facilitate coordination and collaboration among donors and lenders that wish to see their infrastructure investments deliver stronger economic returns. My colleagues and I recently completed an evaluation of the national economic growth impacts of approximately 4,300 Chinese government-financed development projects in 138 countries.[25] We found that, on average, projects financed via Chinese grants and concessional loans yield significant economic growth dividends for host countries.

For the average host country, we found that a doubling of Chinese official development assistance (ODA) produces a 0.4 percentage point increase in economic growth two years after the funding is approved. In a companion study, we used an alternative measure of economic output—remotely sensed nighttime light output—and the geo-coordinates of 3,097 Chinese-funded development project locations to determine whether these economic effects are also detectable at subnational scales. Here again, we found that Chinese development projects deliver major economic development gains.[26] In a third study, we measured the distributional effects of Chinese development projects with an innovative measure of economic inequality that can be tracked annually in more than 32,000 subnational localities around the globe.[27] We found that Chinese development projects—in particular, investments in connective infrastructure, such as roads, bridges, railways, and ports—have created create a more equal distribution of economic activity within the provinces and districts where they are implemented. We also found that these Chinese projects narrowed rather than widened economic disparities between these subnational jurisdictions, which suggests that Chinese investments in connective infrastructure are promoting spatially inclusive growth. By contrast, the existing evidence on the economic impacts of development finance from traditional sources (e.g., the World Bank) does not provide equally strong grounds for optimism.[28]

But leadership requires followership and China has not had much success identifying donors and lenders outside of China who are interested in following its lead. There are many reasons why China finds itself in this position, but here I will highlight two that merit special attention: its reluctance to share detailed information about its own project design, supervision, and evaluation policies and practices; and its track record of avoiding collaborative arrangements with other donors and lenders that are based on a common set of rules and standards.

If China wants to be a leader in the global development finance market, it needs to demonstrate to other donors and lenders that it is willing and able to invest in the data and evidence that are necessary to effectively target, monitor, and evaluate overseas investments. Traditional donors and lenders are light years ahead of China in this regard. They use economic rate-of-return analysis and beneficiary analysis to vet incoming project proposals.[29] They use centralized information systems to track where their approved projects are being implemented, when, how, for whom, and by whom. With data from household surveys, satellites, mobile phones, and real-time sensors, they increasingly collect baseline, midline, and endline data on development outcomes in both project and non-project (comparison) areas so that after project completion they can measure the net, attributable impacts of their interventions with counterfactual evidence.[30] Traditional donors and lenders also publish much of this data and evidence so that their overseers and collaborators can independently judge the quality of their work.

China, by contrast, reveals very little about whether, when, and how it uses data and evidence to support its decision-making at the different stages of the project lifecycle.[31] It instead relies on propaganda to spread positive messages about its overseas activities. But this is a self-defeating strategy because China’s traditional methods of communication do not resonate with modern sensibilities. Most bilateral and multilateral donors and lenders think of Chinese propaganda as “white noise”; they simply tune it out. Reliance on propaganda also arouses suspicion and makes it more difficult for the major players in the development finance market to take China seriously. Therefore, if China wants to reduce the risk-aversion of its would-be collaborators, it needs to demonstrate that it is using—or ready to use—data and evidence to design, supervise, and evaluate its projects. It needs to show rather than tell.

Additionally, if China wants to be a leader in the global development finance market, it will have to convince other donors and lenders that it is willing to collaborate and coordinate on the basis of stable, transparent, and mutually acceptable rules and norms. When bilateral creditors are negotiating a debt restructuring deal with a borrower at the Paris Club, they want to know if China is planning to offer that very same government new loans or restructure its existing loans. When a multilateral development bank asks a borrower to design and implement an infrastructure project according to a particular set of environmental and social standards, it wants to know that China is not going to offer to bankroll the same project without insisting upon the use of such standards. When an export credit agency offers a loan on terms that are consistent with the principles codified in the OECD’s “Gentlemen’s Agreement,” it wants to be assured that China is not going to ignore these rules and undercut its firms by blending commercial (trade) finance with concessional (development) finance.

But earning the trust of would-be collaborators is not just about creating a level playing field or addressing historical grievances. It is also about building a consensus around new rules and norms that make it easier for Chinese and non-Chinese development finance institutions to work together to achieve mutually beneficial outcomes. Let’s say, for the sake of illustration, that China Development Bank approaches the United Kingdom’s Department for International Development (DFID) about the possibility of co-financing a large-scale BRI project that is fraught with risk but could deliver major economic development dividends. DFID will most likely want to see the candidate project first subjected to a rigorous cost-benefit analysis, and its parliamentary oversight body may very well demand to see the results of that analysis.[32] It will probably want to ensure that a robust monitoring and evaluation system is put in place so that it can measure value-for-money.[33] It will most likely also want to secure a credible assurance that China will not seek to position itself as the borrower’s “preferred creditor”—either within the four corners of the loan agreement or through a side agreement.[34] Beijing and London will ultimately need to coalesce around a set of behavioral rules and norms that are acceptable to both parties; otherwise, their collaboration will prove shallow or short-lived.

From the perspective of its would-be collaborators, China has not clearly or consistently signaled that it is willing to abide by a stable, transparent, and mutually acceptable set of rules and norms. In 2006, China was invited to join the Paris Club as a full-fledged member because of its status as an increasingly important sovereign lender. It rejected this offer and chose instead to be an “ad hoc participant,” placing it “under no obligation to act in solidarity with Paris Club members or even to inform the Paris Club about the management of its credit activities.”[35] Then, in 2011, the donor community encouraged China to voluntarily comply with a common set of aid transparency standards. China’s negotiators flatly rejected this proposal, stating that the “principle of transparency should apply to north-south cooperation, but . . . it should not be seen as a standard for south-south cooperation.”[36] Nor have efforts to negotiate a mutually acceptable set of export financing rules—that would supplement or supersede the OECD’s “Gentleman’s Agreement” on Officially Supported Export Credits—borne much fruit.[37]

There are some signs that change is coming. President Xi Jinping’s April 2019 speech at the Second Belt and Road Forum for International Cooperation may have represented a key turning point. At that event, he announced that, during the next phase of BRI, China would “adopt widely accepted rules and standards and encourage participating companies to follow general international rules and standards in project development, operation, procurement and tendering and bidding.”[38] Another recent announcement suggests that Beijing is contemplating a pivot away from its traditional role of status quo challenger and towards a new and far less familiar role: defender of international rules and standards. In March 2019, China announced that it will establish a Multilateral Cooperation Center for Development with eight multilateral and bilateral development finance institutions in order to (a) invest in more upstream project preparation work; (b) build the capacity of lenders and borrowers to more effectively manage and mitigate risks related to debt sustainability, procurement, corruption, and environmental and social issues; and (c) facilitate greater information-sharing and coordination between Chinese and non-Chinese development finance institutions.[39]

However, it is not yet clear that China has fully reconciled the tension between its global leadership ambitions and its traditional disregard for international development finance rules and standards. For the better part of the last 20 years, Beijing has positioned itself as an alternative source of financing for governments that would prefer not to deal with the more established players in the global development finance market. It has tacitly encouraged low-income and middle-income countries to bypass the prevailing rules and norms of the international development finance regime by bankrolling large-scale infrastructure projects with substantially less “hassle factor” (i.e., relatively fast and flexible project preparation procedures, less stringent environmental and social safeguards, no competitive bidding requirements). It has also spurned invitations to participate in the Paris Club, the OECD’s Creditor Reporting System, the International Aid Transparency Initiative, and the Gentleman’s Agreement on Officially Supported Export Credits. So, its newfound interest in harmonization and compliance of international rules and standards is naturally going to be viewed with skepticism.

China’s actions will ultimately speak louder than its words, so if Beijing wants to persuade its peers in the development finance market that it is ready to make a strategic pivot, the best thing that it can do is roll up its sleeves and begin the hard work of actually complying with international rules and standards—by insisting upon bankable project proposals that appropriately mitigate social, environmental, and fiduciary risks; following international competitive bidding rules; blacklisting firms that engage in fraudulent, corrupt, or collusive practices; institutionalizing information disclosure policies and institutions that keep government officials and contractors honest; and establishing robust monitoring and evaluation systems that enable measurement of impact and cost-effectiveness. If China does so in an open and collaborative way, it will enable others to make independent judgments about its credibility as a leader of the global development finance market.

The views expressed here are those of the author and should not be attributed to AidData, the Center for Global Development, or funders of their work.

References

Abi-Habib, Maria. 2018. How China Got Sri Lanka to Cough Up a Port. 25 June 2018. The New York Times.

Belt & Road News. 2019. Despite US Rejection & Indian Objection, BRI projects set to become ‘Project of the Millennium’. 5 May 2019.

BenYishay, A., Trichler, R., Runfola, D., and Goodman, S. 2018. A quiet revolution in impact evaluation at USAID. Washington DC: Brookings Institution.

Blair, Robert A., Robert Marty, and Philip Roessler. 2018. Dashed Expectations? Chinese Foreign Aid and Soft Power in Africa. Paper Presented at the Annual Meeting of the American Political Science Association. Boston, Mass. August 30 – September 2, 2018.

Bluhm, Richard, Axel Dreher, Andreas Fuchs, Bradley Parks, Austin Strange, and Michael Tierney. 2018. Connective Financing: Chinese Infrastructure Projects and the Diffusion of Economic Activity in Developing Countries. AidData Working Paper #64. Williamsburg, VA: AidData at William & Mary.

Brautigam 2019. Misdiagnosing the Chinese Infrastructure Push. 4 April 2019. The American Interest.

Brazys, Samuel, Johan A. Elkink, and Gina Kelly. 2017. Bad Neighbors? How Co-located Chinese and World Bank Development Projects Impact Local Corruption in Tanzania. Review of International Organizations 12: 227-253.

Brazys, Samuel and Alexander Dukalskis. 2018. Grassroots Image Management: Confucius Institutes and Media Perceptions of China. AidData Working Paper 66. Williamsburg, VA: AidData.

Carlson, Elizabeth and Brigitte Seim. 2018. Honor among Chiefs: An Experiment on Monitoring and Diversion Among Traditional Leaders in Malawi. 2018. AidData Working Paper #62. Williamsburg, VA: AidData at William & Mary.

Custer, Samantha, Matthew DiLorenzo, Takaaki Masaki, Tanya Sethi, and Ani Harutyunyan. 2018a. Listening to Leaders: Is development cooperation tuned-in or tone-deaf? Williamsburg, VA: AidData at William & Mary.

Custer, Samantha, Brooke Russell, Matthew DiLorenzo, Mengfan Cheng, Sid Ghose, Jake Sims, Jennifer Turner, and Harsh Desai. 2018b. Ties That Bind: Quantifying China’s public diplomacy and its "good neighbor" effect. Williamsburg, VA: AidData at William & Mary.

Dreher, Axel and Steffen Lohmann. 2015. Aid and Growth at the Regional Level. Oxford Review of Economic Policy 31(3-4): 420-446.

Dreher, Axel, Andreas Fuchs, Roland Hodler, Bradley C. Parks, Paul A. Raschky and Michael J. Tierney. 2016. Aid on Demand: African Leaders and the Geography of China's Foreign Assistance. AidData Working Paper #3 Revised. Williamsburg, VA: AidData at William & Mary.

Dreher, Axel, Andreas Fuchs, Bradley Parks, Austin M. Strange, and Michael J. Tierney. 2017. Aid, China, and Growth: Evidence from a New Global Development Finance Dataset. AidData Working Paper #46. Williamsburg, VA: AidData at William & Mary.

Dreher, Axel, Andreas Fuchs, Bradley Parks, Austin Strange, and Michael Tierney. 2018. Apples and Dragon Fruits: The Determinants of Aid and Other Forms of State Financing from China to Africa. International Studies Quarterly 62 (1): 182-194.

Dreher, Axel, Andreas Fuchs, Roland Hodler, Bradley C. Parks, Paul A. Raschky, and Michael J. Tierney. 2019. African Leaders and the Geography of China's Foreign Assistance. Journal of Development Economics.

Eichenauer, Vera Z., Andreas Fuchs, and Lutz Brückner. 2018. The Effects of Trade, Aid, and Investment on China's Image in Developing Countries. AidData Working Paper #54. Williamsburg, VA: AidData at William & Mary.

Financial Times. 2016. China rethinks developing world largesse as deals sour. 13 October 2016. Financial Times.

Findley, Michael G., Helen V. Milner, and Daniel L. Nielson. 2017. The Choice among Aid Donors: The Effects of Multilateral vs. Bilateral Aid on Recipient Behavioral Support. Review of International Organizations 12(2): 307-334.

Hausmann, Ricardo. 2019. China’s malign secrecy. Project Syndicate. 2 January 2019.

Honig, Daniel, Ranjit Lall, and Bradley C. Parks. 2019. When Does Transparency Improve Performance? Evidence from 23,000 Public Projects in 148 Countries. Working Paper.

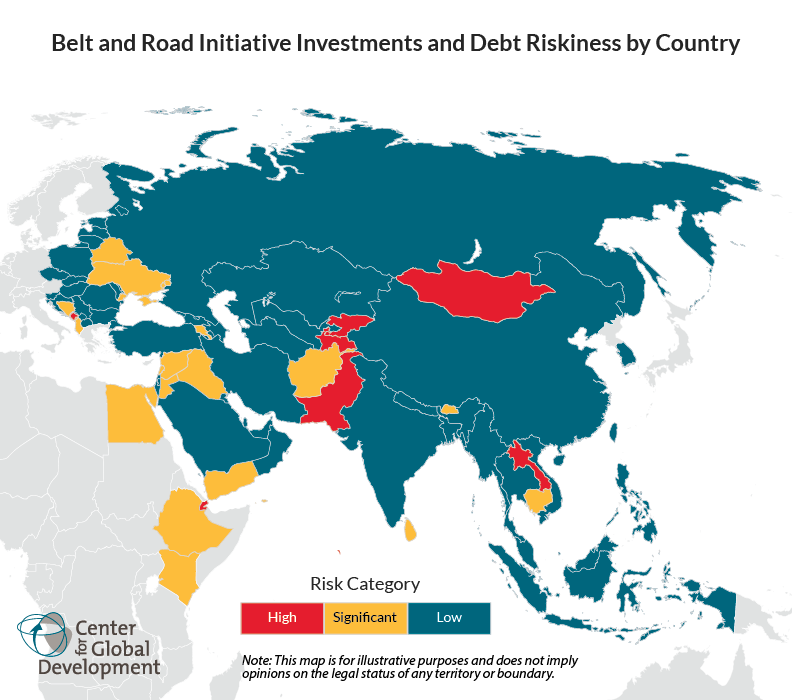

Hurley, John, Scott Morris, and Gailyn Portelance. 2018. Examining the Debt Implications of the

Belt and Road Initiative from a Policy Perspective. CGD Policy Paper. Washington, DC: Center for Global Development.

Isaksson, Ann-Sofie, and Andreas Kotsadam. 2018. Chinese Aid and Local Corruption. Journal of Public Economics 159: 146-159.

Lake, David. 2009. Hierarchy in International Relations. Ithaca, NY: Cornell University Press.

Legovini, A., Di Maro, V., and Piza, C. 2015. Impact evaluation helps deliver development projects. WPS 7157. Washington DC: World Bank.

MOFCOM. 2014a. MOFCOM held a media debriefing on the Measures for the Administration of Foreign Aid. Retrieved from http://www.mofcom.gov.cn/article/fbhfn/fbh2014/201412/20141200824824.shtml.

MOFCOM. 2014b. Announcement from MOFCOM’s Party Committee on Inspection and Improvement. 11 June 2014. Retrieved from http://www.mofcom.gov.cn/article/ae/ai/201406/20140600620170.shtml.

Nye, Joseph. 2004. Soft Power: The Means to Success in World Politics. New York: Public Affairs.

Parks, Bradley C., Matthew DiLorenzo, and Daniel Aboagye. 2019. Closing the Broken Feedback Loop: Can Responsive Aid Strengthen State Legitimacy? Closing the Broken Feedback Loop: Can Responsive Aid Strengthen State Legitimacy? AidData Working Paper #73. Williamsburg, VA: AidData at William & Mary.

People’s Daily. 2014. Xi Eyes More Enabling Intl’ Environment for China’s Peaceful Development (3). 30 November 2014. Retrieved from http://en.people.cn/n/2014/1130/c90883-8815967-3.html

Pilling, David and Emily Feng. 2018. Chinese investments in Africa go off the rails. 8 December 2018. Financial Times.

Reuters. 2018. China's Xi offers fresh $295 Million Grant to Sri Lanka. 22 July 2018.

Sabet, S. M. and Brown, A. N. 2018. Is impact evaluation still on the rise? The new trends in 2010-2015. Journal of Development Effectiveness 10(3): 291-304.

Tran, Mark. 2011. Transparency Could Be the Sticking Point for China at Busan. The Guardian’s Poverty Matters Blog. 14 November 2011.

White, Howard. 2019. The twenty-first century experimenting society: the four waves of the evidence revolution. Palgrave Communications 5 (1).

Warner, Andrew. 2010. Cost-Benefit Analysis in World Bank Projects. Washington, DC: Independent Evaluation Group of the World Bank.

Wiebe, Franck. 2008. Aid Effectiveness: Putting Results at the Forefront MCC’s “New Institutional Approach.” Washington DC: Millennium Challenge Corporation.

Winters, Matthew. 2014. Targeting, Accountability and Capture in Development Projects. International Studies Quarterly 58 (2): 393-404.

World Bank. 1994. “Operational Policy (OP) 10.04: Economic Evaluation of Investment Operations.” in World Bank Operational Manual: Operational Policies. Washington DC: World Bank.

Xu, Jiajun and Richard Carey. 2014. China’s Development Finance: What Issues for Reporting and Monitoring Systems? IDS Bulletin 45 (4): 102–13

Zhang, Denghua and Graeme Smith. 2017. China’s foreign aid system: structure, agencies, and identities. Third World Quarterly 38 (10): 2330-2346.

[1] On this issue of why global leadership via hard power is more expensive than global leadership via soft power, see Nye 2004 and Lake 2009.

[2] Dreher et al. (2019) find that the average leader’s home region receives roughly three times as much financial support from China during his or her time in power, but once leaders lose power, Chinese development projects vanish from their home regions. Yet curiously, they find no evidence of political targeting bias in the subnational distribution of World Bank-funded projects. The most likely explanation for these inconsistent results is that China and the World Bank have widely divergent project appraisal systems. The World Bank uses ex ante, cost-benefit analysis to screen candidate projects. It employs a simple rule—“the expected present value of the project’s net benefits must be higher than or equal to the expected net present value of mutually exclusive project alternatives”—to safeguard its projects from political capture. However, Chinese development finance institutions do not have analogous institutional safeguards in place, which creates significant scope for leaders to exploit Chinese projects for personal and political gain.

[3] By contrast, they find that those individuals who live near active World Bank development projects are not exposed to higher levels of local corruption (Isaksson and Kotsadam 2018). Also see Brazys et al. 2017.

[4] Zhang et al. 2017.

[5] Dreher et al. 2019; Brautigam 2019.

[6] Another downstream consequence of these corrupt deals is that cost inflation makes it harder for borrowing governments to repay their loans and less likely that Beijing will achieve good value-for-money on its investments.

[7] China is interested in reaping reputational returns from its overseas investments. In 2014, Zhang Xiangchen, a MOFCOM assistant minister, acknowledged that “[t]he work of foreign aid relates to China’s image. We cannot tolerate any negligence or projects of poor quality” (MOFCOM 2014a). President Xi Jinping has also said “[w]e should increase China’s soft power, create a good Chinese narrative, and better communicate China’s message to the world” (People’s Daily 2014).

[8] Findley et al. 2017.

[9] Blair et al. 2018. Also see Eichenauer et al. (2018), who find that the US government reaps public opinion dividends from its aid projects in Latin America and the Caribbean, but China does not.

[10] A case in point is the $683 million China Eximbank loan for the construction of a 30-kilometer road from Matara to Beliatta in Sri Lanka. This road, which was part of a larger Southern Expressway project connecting the president’s home district to the capital city of Colombo, earned the dubious distinction of being the single most expensive road project (in unit cost terms) ever built in Sri Lanka. In the run-up to Sri Lanka’s 2015 presidential election, an opposition politician used this 30 km road project—and others like it—to challenge and ultimately defeat the incumbent (Mahinda Rajapaksa) and his close alliance with China.

[11] MOFCOM 2014b.

[12] Abi-Habib 2018.

[13] Belt & Road News 2019.

[14] ATI policies and institutions are also particularly effective in conjunction with bottom-up methods of project oversight, such as civic monitoring and independent media scrutiny. See Honig et al. 2019.

[15] See Winters 2014 and Carlson and Seim 2018.

[16] China ranks dead last among the 45 international donors and lenders that were evaluated in the 2018 edition of Publish What You Fund’s Aid Transparency Index. See http://www.publishwhatyoufund.org/reports/2018-Aid-Transparency-Index.pdf.

[17] Findley et al. 2017.

[18] It is also important to keep in mind that China’s baseline levels of influence with governing elites in developing countries are not particularly high. In 2017, AidData conducted a survey of 3,500 leaders from 126 low- and middle-income countries and it found that China ranks 21st out of 35 development partners in terms of agenda-setting influence. The survey, which was undertaken roughly four years after BRI was announced, identifies the five most influential donors and lenders as the IMF, the World Bank, the United States, the European Union, and UNICEF (Custer et al. 2018a).

[19] Custer et al. 2018b; Dreher et al. 2018.

[20] Dreher et al. 2019. By way of example, soon after Maithripala Sirisena was elected as the president of Sri Lanka, he attended a ceremony to celebrate the opening of a Chinese government-financed hospital in his home district of Polonnaruwa and informed the crowd in attendance that “[w]hen the Chinese ambassador visited my house to fix the date for this ceremony, he said that Chinese President Xi Jinping sent me another gift. . . . He has gifted 2 billion yuan [US$ 295 million] to be utilized for any project [that I] wish” (Reuters 2018, emphasis added).

[21] Brazys and Dukalskis 2018: 10.

[22] China’s spending spree in the Sinhala South—including an international convention center, 35,000-seat cricket stadium, a 300-acre botanical garden, a 235-acre “Tele Cinema Park” for TV and film production, a string of luxury hotels and housing developments, an airport, a deep water seaport, a road from the seaport to the airport, and a road from the President’s hometown (a rural village with approximately 12,000 residents) to the capital—was off-putting to large swathes of the electorate. It ultimately contributed to the underlying political conditions that resulted in Rajapaska’s ouster. As explained by Jayadeva Uyangoda, a professor of political science at Colombo University, “[a] perception began to grow here that China was in fact using corruption as a controlling device…. For the first time, China became a domestic political issue in Sri Lanka as people began to view Chinese assistance to Rajapaksa as a means of buying his support by helping him increase his grip on the country” (Cited in Chowdury 2015).

[23] Abi-Habib 2018.

[24] On this point, see Parks et al. 2019.

[25] Dreher et al. 2017.

[26] Dreher et al. 2016.

[27] Bluhm et al. 2018

[28] Dreher et al. 2016, 2017; Dreher and Lohmann 2015; Bluhm et al. 2018.

[29] World Bank 1994; Wiebe 2008; Warner 2010.

[30] Legovini et al. 2015; Sabet and Brown 2018; BenYishay et al. 2018.

[31] The authorities in Beijing acknowledge that change is needed. In 2012, Yu Zirong, the deputy director-general of MOFCOM’s Department of Foreign Aid, that “[w]e have long emphasized project implementation but neglected evaluation. We should say the Western aid practice is a very important reference point for us” (MOFCOM 2014a).

[32] The Chinese government does acknowledge that its existing project appraisal standards are in need of significant revision. In 2016, an NDRC official told the Financial Times that “[t]hese days we need viable projects and a good return. We don’t want to back losers” (Financial Times 2016). More recently, the chief economist of China Export and Credit Insurance Corporation (Sinosure) has characterized the due diligence procedures that China’s policy banks use to assess the economic viability of projects as “downright inadequate” (Pilling and Feng 2018).

[33] DFID, for example, “requires[s] a statement of evidence from rigorous studies to support new proposals, and … how the proposed [project] will collect the needed evidence if it doesn’t exist” (White 2019).

[34] On the reputationally toxic nature of these side agreements, see Hausmann 2019.

[35] Hurley et al. 2018

[36] Tran 2011.

[37] The purpose of the OECD’s Gentleman’s Agreement is to avoid a “race to the bottom” dynamic in which each country’s export credit agency tries to give its firms a competitive edge over firms in other countries by adding deal-sweeteners like grants and concessional loans to commercial financing arrangements. See Xu and Carey 2014.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.