Table of Contents

Executive Summary

Great Expectations

Great Challenges

The Obstacles: What Holds Investors Back?

The Risk Sharing Track Record: Why Have Guarantees Largely Been Neglected?

Risk Aversion: Is the Criticism Fair?

Financial Returns vs. Development Impact: Is it a Choice?

The Right Goals: Defining Success for Private Sector Windows

Are Subsidies Justified for PSWs?

The Distinct PSW Advantage in Blended Finance

Is There a Case for Grants in the Toolkit?

What About Targeting Returns Instead of Risk?

How Should Access to Blended Finance Be Allocated?

Poor and Fragile States: Is there a Need for Different Approaches?

MDB PSW Governance: Does It Promote or Impede Success?

Cross-MDB Collaboration: Why It Matters but Does Not Happen

Public-Private Development Banks?

Summary: Proposed Research Questions

Executive Summary

As the daunting magnitude of funding needed to achieve the Sustainable Development Goals (SDGs) is better understood, attention has turned to questions of whether and how these expectations can be achieved. What will it take to mobilize the required levels of funding, including from the private sector? What can the for-profit private sector reasonably be expected to finance? Institutional and other private investors have trillions to bring to the table, but there remains a basic mismatch between the supply of finance seeking market rates of risk-adjusted return and the risk and return characteristics of infrastructure and other investments with important development impact.

The spotlight is increasingly on the private sector operations or windows (PSWs) of multilateral development banks (MDBs) and development finance institutions (DFIs). It is time to take a fresh look at PSWs and ask some basic questions about their role and instruments.

Not surprisingly, the spotlight is increasingly on the private sector operations or windows (PSWs) of multilateral development banks (MDBs) and development finance institutions (DFIs). They are the original impact investors, expected to occupy the space and help bridge the gap between clearly public and clearly private projects with development impact.

Stakeholders and shareholders ask MDB PSWs and DFIs to operate commercially, price on market terms, meet profit objectives, and avoid distortive subsidies. Yet they are also asked to make markets, achieve additionality, and target development impact. They are encouraged to deploy subsidies through blended finance, but cautioned to avoid wasting resources and taking on risks and costs that should be borne by the private sector. After many years of activity, the reality is that their purpose and their record remain debated.

It is time to take a fresh look at the PSWs and ask some basic questions about their role and instruments. The aim of this essay is to raise issues that need to be addressed as we think about how PSWs should evolve and adapt to meet the formidable challenges ahead. These questions and the answers gained through careful research can help chart the right course and set the right expectations for MDB PSWs, DFIs, and impact investors generally.

MDB/DFI performance will increasingly and rightly be judged by the magnitude of development resources they mobilize—more than by their own disbursements.

Preliminary analysis suggests a number of findings that help pinpoint where the actual challenges and problems lie. First, it is not useful to think of MDBs as playing a gap-filling role. Their direct finance, even if augmented through capital increases and capital stretching, is dwarfed by the estimated finance gaps for SDG-related investments, infrastructure, small and medium enterprise (SME) finance, and so on. MDB/DFI performance will increasingly and rightly be judged by the magnitude of development resources they mobilize—more than by their own disbursements.

Second, risk-sharing tools have been available to MDBs and DFIs for a long time. For the most part, the problem is not a lack of instruments, but rather that they are rarely used. Guarantees represent a very small share of MDB portfolios. The increase in their use post financial crisis in the case of the International Finance Corporation (IFC) has almost entirely been in the form of short-term trade finance guarantees where risks are low, products are simple, and development impact limited. A combination of risk aversion and practical disincentives on both the supply and demand side discourage use of guarantees in important areas like infrastructure. How can MDB/DFI instruments be made more user friendly for both investors and MDB staff? And how can MDBs be equipped and incentivized to take on more risk? Would this require changing their business models?

How can MDBs be equipped and incentivized to take on more risk? Would this require changing their business models?

Third, lack of collaboration within and across MDBs undermines some of their most important comparative advantages. One of these is the MDB capacity to combine and offer a suite of products and services to clients (sometimes in partnership with others) that helps address a broad range of barriers to investment—from early project development, to early stage enterprise finance, to risk sharing and mitigation and other forms of blended finance, to support for market infrastructure and relevant policy, institutional, and regulatory reforms. No commercial bank has this capacity, but, to date, this kind of seamless effort is rare among the MDBs. Moreover, the failure of MDBs to work together across institutions to harmonize products and pool them to create large and standardized, yet diversified, asset offerings directly impedes their ability to attract institutional investors.

The failure of MDBs to work together across institutions to harmonize products and pool them to create large and standardized, yet diversified, asset offerings directly impedes their ability to attract institutional investors.

Fourth, one finds a surprising lack of clarity and agreement on which overall goals should be PSW priorities. What does success look like? Is it the volume of PSW business, rates of return, total returns, the value of private investment mobilized, market or systemic change, enhanced growth, job creation, or poverty reduction? An “all of the above” answer is not very helpful. The fact that there is no consensus on credible methodologies for measuring additionality or development impact adds to the muddle and undercuts optimal resource allocation across and within projects. Similarly, a lack of empirical evidence on the relationship between PSW financial returns and development impact constrains effective and purposeful portfolio management. It is assumed there is a trade-off at the project level, so portfolios should have a mix of high-return and high-development-impact projects. But is this assumption true in practice?

Fifth, institutions lack clear guidelines or a clear strategy for matching instruments to objectives. When, for example, does it make sense to subsidize firm returns rather than share risk or reduce capital costs? In other words, when is it better to reward firm success than protect firms from failure? If building pipelines of bankable social and other enterprises is a critical success factor, what is the right set of instruments that meet the need? Probably not guarantees, which are not particularly useful in the case of innovative, early stage firms when risks cannot be well assessed. But heavy reliance on grants would quickly drain scarce resources. Are there instruments that fall between pure grants and investments with market returns that could offer better options for filling this finance gap?

When does it make sense to subsidize firm returns rather than share risk or reduce capital costs?

Sixth, limited research is available regarding specific approaches required for mobilizing private investment in poor and fragile states. The new International Development Association (IDA) PSW window managed by the IFC provides more resources for concessional or blended finance, but is that the whole answer? When it comes to subsidies for private investment in very difficult environments, is more always better, or does better targeting matter more?

And finally, not all MDB PSW performance challenges can be laid at the doorstep of MDB management and staff. Shareholders send inconsistent messages about risk tolerance, profit expectations, and definitions of development impact. Executive boards spend a lot of time reviewing and voting on individual projects, but very little time assessing portfolios against agreed criteria. It is time to think about more productive roles for the boards of MDB PSWs. Shareholders may do better to focus on setting strategic objectives and measuring portfolio performance against them. They are also well-placed to drive cross-MDB collaboration since most of the same countries participate in governance across the institutions.

MDB shareholders send inconsistent messages about risk tolerance, profit expectations, and definitions of development impact.

We can also think about the problem more fundamentally and question whether the right people are around the table in MDB PSW boards. In part, this refers to ongoing discussions on voice and voting power for rising emerging markets. But it is also reasonable to ask at this point whether the time has come for MDB PSWs to be capitalized from both public and private sources. Would private sector shareholders boost efficiency, data-driven decision-making, and openness to innovation, or would they undermine the development mission?

In sum, we find that the following research questions identify salient issues of shared interest and utility to the development actors involved as partners, clients, staff, or shareholders of these institutions: governments, private firms, financial institutions, institutional investors, impact investors, foundations, and philanthropists.

Goals, new approaches, and better metrics

It is also reasonable to ask whether the time has come for MDB PSWs to be capitalized from both public and private sources.

- What overall financial and development goals should PSWs prioritize?

- How can ex ante metrics for additionality and development impact be strengthened to promote better resource allocation within and across projects? How should access to blended finance be allocated?

- Should PSWs take on more risk? Would that require changes in PSW incentive structures and business models? What does the evidence say about the relationship between risk, development impact, and financial returns?

- What guidelines can be developed to match PSW instruments more effectively with financial and development objectives? How can these instruments be made more useful and user friendly for both investors and MDB/DFI staff?

- What special PSW approaches and instruments are needed in poor and fragile states?

Collaboration and governance

- How can internal collaboration between the public and private finance parts of MDBs be strengthened to maximize impact on the environment for private investment?

- How can shareholders drive cross-MDB collaboration to reduce wasteful competition (e.g., competitive subsidy offers) and promote risk diversification benefits for investors as well as for the MDBs?

- Should governing boards of PSWs shift from project review to portfolio review against agreed criteria?

- Is there a case for public-private development banks?

Great Expectations

The grand vision of the Sustainable Development Goals (SDGs) was rooted in expectations that private finance and domestic resource mobilization would provide the bulk of the funding needed to reach the SDGs. Attention is now rightly turning to questions of whether and how these expectations can be achieved. What will it take to mobilize the required magnitudes of funding? And especially, what can the for-profit private sector reasonably be expected to finance?

At a time when their record on mobilization and development impact is still debated, MDB PSWs and DFIs are nevertheless being asked to step up to a critical role in helping to fill huge financing gaps associated with meeting SDG targets.

The second question shines a spotlight on the private sector operations or windows (PSWs) of the multilateral development banks (MDBs) and bilateral development finance institutions (DFIs). As the original impact investors, their mandate has always been to mobilize private investment that combines financial and development returns. At a time when their record on mobilization and development impact is still debated, MDB PSWs and DFIs are nevertheless being asked to step up to a critical role in helping to fill huge financing gaps associated with meeting SDG targets. Their performance will increasingly and rightly be judged by the magnitude of resources they mobilize, not just by their own disbursements.

It is time to take a fresh look at these MDB PSWs (including the private finance operations of MDBs without separate entities) and to ask some basic questions about their role and instruments. What does success look like, both for mobilization of private finance and for development impact? How should it be measured? Are subsidies or concessionality justified when funding private companies? If so, what should be their purpose and how should they be allocated? Do poor and fragile states need special approaches? Must MDB governance change to improve performance?

The purpose of this essay is to raise issues that should be addressed as we think about how the role of PSWs should evolve and adapt to meet the formidable challenges ahead. These questions can help frame a research agenda that assists in charting the right course and setting the right expectations for PSWs. The focus is on the private finance operations of MDBs, but much of the content is relevant to bilateral DFIs and impact investors as well.

The essay begins with a discussion of financing gaps and obstacles to the flow of private finance for development. This is followed by a brief review of the PSW track record for risk sharing and risk aversion. The essay then takes up the question of how to define PSW goals in a way that promotes both leverage and development impact. The subsequent sections consider instruments that serve those goals, including concessional or blended finance, and explore how blended finance could be allocated for maximum gains. The following sections review the particular challenges of poor and fragile states and examine possible changes in PSW governance to promote success. The final section proposes research questions confronting PSWs (and DFIs and impact investors) that best address the shared concerns, interests, and challenges of key public and private development actors.

Great Challenges

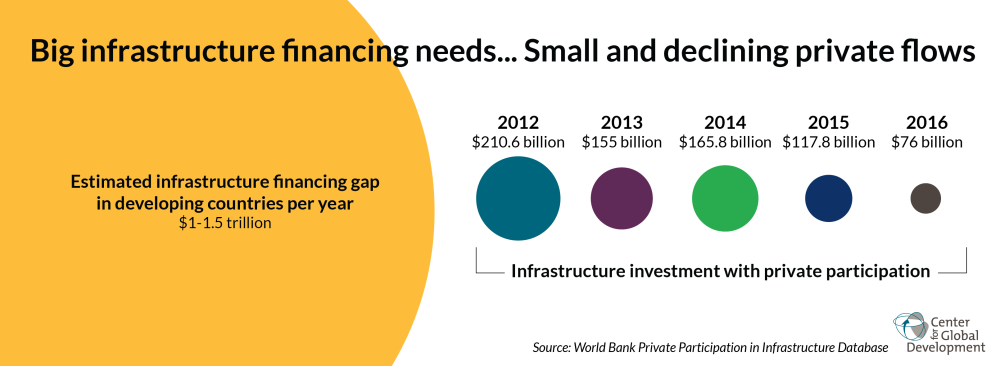

For infrastructure alone, developing country needs have been estimated at roughly $3 trillion per year or more, and the financing gap estimated at $1-$1.5 trillion per year.

The needs are daunting. Much of the focus has been on infrastructure where developing country needs have been estimated at roughly $3 trillion per year or more, and the financing gap estimated at $1-$1.5 trillion per year.[1] Just for infrastructure investments related to climate change mitigation and adaptation, annual finance gaps have been estimated at $166-$322 billion per year for non-OECD (Organisation for Economic Co-operation and Development) countries.[2] But these should not overshadow other gaps critical to growth and poverty reduction prospects. An International Finance Corporation (IFC)-McKinsey report puts the unmet credit needs for all formal and informal micro, small and medium enterprises (MSMEs) in emerging markets at $2.1-$2.5 trillion.[3] Women entrepreneurs are particularly hard hit: 70 percent of women owners of formal small and medium enterprises (SMEs) are unserved or underserved by financial markets, with global unmet credit needs of $285-$320 billion.[4] Underinvestment in seed/startup/venture capital forms anther critical gap that receives less attention. Even impact investors are reluctant to enter this space: the 2017 Global Impact Investing Network report finds only 3 percent of impact investor assets under management in seed/startup finance, and only 6 percent in venture capital.

This is hardly an auspicious moment to rely on increased cross-border private flows as a source of finance. In the aftermath of the global financial crisis, international financial flows remain depressed. While they averaged about 10-15 percent of global gross domestic product (GDP) pre-crisis, the new normal appears to be less than 5 percent of global GDP.[5] To be sure, these declines have been dominated by trends in flows to developed markets, led by a collapse in bank lending. Financial flows to emerging markets are up slightly as a share of GDP, led by foreign direct investment (FDI) and debt flows. Bank lending and portfolio equity flows to emerging markets remain slightly down.[6] But the cyclical effects of monetary tightening in the United States and improved growth in developed economies do not suggest a particularly favorable near-term outlook for those developing countries with financial vulnerabilities.

From 2011-2015, International Development Association (IDA) countries received less than 4 percent of the value of infrastructure projects in developing countries with private investment.

In any case, poor countries have consistently received a minimal share of these cross-border flows. The picture for private investment in infrastructure in poor countries, for example, is bleak. From 2011-2015, International Development Association (IDA) countries received less than 4 percent of the value of infrastructure projects in developing countries with private investment.[7]

At the same time, trends suggest that poverty will be increasingly concentrated in poor countries. By 2030, economists project that 40 to 60 percent of the poor will be living in states now deemed fragile.[8] The importance, therefore, of finding ways to foster more private capital flows to the most vulnerable poor countries will only increase.

For infrastructure finance, attention is focused on new classes of investors, particularly institutional investors that target moderate returns in investment-grade, long-term investments. The OECD estimates the global assets of institutional investors in OECD countries alone at $92.6 trillion.[9] Investment of only 1 percent of those funds in developing country infrastructure would go a long way to filling the financing gap.[10] But such flows are still largely theoretical. African pension funds, for example, hold an estimated $350 billion in assets, but they are not invested on the continent (with the recent exceptions of South Africa and Kenya). Recent trends are not promising: annual infrastructure investment with private participation declined sharply from 2012 to 2016.

Much is also expected of impact investors, though on a vastly smaller scale. Impact investment assets under management reached nearly $114 billion in 2016 and are growing annually by double digits.[11] But this new industry is still grappling with fundamental questions that make it hard to predict where its funding will reach scale. The most basic of these is whether to accept below-market risk-adjusted returns combined with development impact, or try to target investments where there is no trade-off.

By 2030, economists project that 40 to 60 percent of the poor will be living in states now deemed fragile. The importance of finding ways to foster more private capital flows to the most vulnerable poor countries will only increase.

Public and private stakeholders are asking whether and how MDBs will rise to these challenges, given that their total commitments (sovereign and non-sovereign) are about $116 billion per year, with infrastructure funding of about $45 billion per year.[12] In the face of needs of this scale, the first impulse of the international community is naturally to call for more capital for these institutions, including for their PSWs. Some, for example, have called for increasing annual MDB infrastructure lending to $200 billion.[13]

While this sounds right and reasonable (though ambitious), in and of itself, it will not fill gaps. The increased volume of MDB finance will have to be coupled with greater catalytic power and development impact.

The Obstacles: What Holds Investors Back?

To assess barriers to private finance, it is useful to look separately at the concerns of infrastructure investors and impact investors. The problems they confront are substantially, though not entirely, different.

The potential supply of private finance is ample. The problem is rather the mismatch or gap between investor risk appetite and risk levels for infrastructure investment in developing countries.

Private infrastructure finance. As discussed, the potential supply of private finance is ample. The problem is rather the mismatch or gap between investor risk appetite and risk levels for infrastructure investment in developing countries. This has been understood for decades, and for decades the MDBs have been called upon to help close this gap.

Infrastructure investors face a wide range of risks in any country, especially given long construction and payback timeframes: construction risks; completion risks; operational risks; transfer risks; and macroeconomic, exchange rate, policy, and regulatory risks. In developing countries, where government and market institutions are often weak or dysfunctional, many of these risks cannot be managed by individual project sponsors or investors. A recent Brookings paper groups risks into four categories of failure:[14]

- Public investment and planning failure. Governments don’t spend enough on infrastructure and don’t have strong capacity for choosing, structuring, and executing the most productive projects.

- Policy failure. The list under this category is long and clearly consequential, including political or macroeconomic instability; corruption; weak or market unfriendly regulation; protracted, complicated, and nontransparent government decision-making; troubled or insolvent utilities (often with arrears to suppliers); lack of political support for private participation and PPPs (public-private partnerships); weak customer willingness to pay for services; lack of functional dispute settlement in local courts; and nontransparent policies governing access to land.

- Project development capacity failure. The lack of project development capability and the lack of funding for initial analysis, pre-feasibility, and feasibility studies have long been characterized as central problems, especially for early project development. Yet recent accounts suggest this is changing; a growing number of project development companies, including from middle-income countries, are interested in operating in other developing markets. Nevertheless, the problem persists for low-income countries: projects in Africa take an average of seven years to complete development.[15] Brookings cites two particularly pervasive problems: the inability to negotiate and execute PPPs, and the poor integration of climate change mitigation and risk management into project design.

- Private finance failure. This failure is, of course, partly driven by all of the above, but also by some additional challenges, especially for institutional investors: asset illiquidity, the lack of standardized assets, counterparty risk, exchange rate risk, and underdeveloped local capital markets. A fundamental problem is that most institutional lenders seek operational, liquid assets, not greenfield, illiquid assets. They are interested in refinancing after construction risks have already been addressed. Institutional debt financing of greenfield projects has historically required the participation of monoline credit insurers, which retreated after the global financial crisis.[16]

45 percent of investors in developing countries named breach of contract, and 58 percent named adverse regulatory changes, as the most important political risks they will face in the next three years.

An OECD review of the empirical literature on risk and private infrastructure investment assesses the most important political/policy risks influencing investor decisions.[17] Based on the 2013 MIGA (Multilateral Investment Guarantee Agency)-EIU (Economist Intelligence Unit) Political Risk Survey, 45 percent of investors in developing countries named breach of contract, and 58 percent named adverse regulatory changes, as the most important political risks they will face in the next three years. The next highest-ranking political risks were transfer and convertibility restrictions (43 percent of respondents), civil disturbances (33 percent), and non-honoring of financial obligations (31 percent). Interestingly, the incidence of contract breaches was found to be greater in middle-income than in low-income countries.

Apart from political risk (the second most important set of risks), the same 2013 survey of investors ranked macroeconomic instability first, lack of qualified staff third, and lack of financing fourth as the most important constraints to foreign investment.

The literature also suggests that infrastructure investment is much more sensitive to sovereign risk than foreign direct investment. One study shows that a difference of one standard deviation in a country’s sovereign risk is associated with a 27 percent increase in the probability of having private participation in infrastructure investment.[18] Corruption plays an outsized role in infrastructure investment decisions: decreasing the corruption score by 10 points can increase private investment by an estimated 15 percent.[19]

The nature of the relevant failures and the evidence about the importance of political risk make the case for MDB involvement self-evident. The public and private sides of MDBs have tools that can help manage many of these risks, especially if they work closely together. But the record shows that MDB risk mitigation tools have been greatly underutilized. The reasons, discussed below, are multifaceted: internal MDB disincentives, public and private MDB operational silos, investor dissatisfaction with the tools, and an overarching MDB culture of risk aversion, shared to varying degrees by management, staff, and shareholders.

The record shows that MDB risk mitigation tools have been greatly underutilized.

Impact investment. Many impact investors are interested in financing inclusive business models, some of which include infrastructure such as off-grid power solutions. They are often focused on supporting innovations necessary to create commercially viable and scalable business models that reach or employ the poor. A critical problem for them is the shortage of models/transactions with proven commercial viability and scalability. This, in turn, is related to a shortage of finance, mostly grants, to take innovative inclusive business models through the stages of pioneer firm development before scaling is possible.[20] Bringing together philanthropic grant providers with impact investors seeking returns has proven a challenge. As a consequence, impact investors grapple with high search and transaction costs to find what are often small, complex, and high-risk deals.

As a relatively new industry, they also confront basic questions about impact investment objectives and methods that complicate their investment decision-making:

Impact investors grapple with high search and transaction costs to find what are often small, complex, and high-risk deals.

- Are below-market returns acceptable where there is strong development impact?

- How should impact be defined at the market level?

- Does picking winners distort the market? Is it right to select the firm that benefits from first-mover returns?

- What is actually innovative? Does innovation include taking an existing business model from one country to another?

- Should all or most beneficiaries of impact investments be poor?

- What is the right risk-adjusted return threshold in different markets?

- What is the best role for grants in supporting pioneer firms?

To some degree, the profitability of enterprises that serve the base of the pyramid may have been oversold, especially relative to risk levels and especially within the time frames desired by investors. Whereas the Silicon Valley venture model relies on a few explosive successes with many failures, the danger for impact investment is that it may ultimately yield a few small successes with heavy losses on many failures.[21]

The Risk Sharing Track Record: Why Have Guarantees Largely Been Neglected?

A focus on mobilizing private finance for development is not new for the MDBs. Risk-sharing tools were contemplated from the start.[22] Guarantees for crowding in private finance were expected to be a major business line when the World Bank was established.

From 2001-2013, project (non-trade) guarantees, for both public and private entities, totaled only 4.2 percent of MDB lending.

Yet guarantee operations were not actually initiated until the 1980s and remain a small share of the portfolio today. From 2001-2013, project (non-trade) guarantees, for both public and private entities, totaled only 4.2 percent of MDB lending. Excluding MIGA, which only does guarantees, the share of guarantees in total MDB lending amounted to only 1.7 percent in 2013.[23] Guarantees also tend to be used almost exclusively in middle-income countries because they work better with more developed capital markets.

Guarantees are offered in the form of partial risk guarantees (PRGs), which cover risks to debt (loan or bond) repayment posed government action or inaction; partial credit guarantees (PCGs), which cover all or part of the financial obligation regardless of the reasons for nonpayment; and trade finance guarantees, covering a portion of a bank’s portfolio of trade finance.

From the perspective of MDB staff, loans require less effort for transactions of equal value and risk.

The evidence points to guarantee usage problems on both the supply and demand side. On the supply side, MDB staff prefer lending for a variety of reasons. Guarantees are complicated, not well understood by many staff, and differ project by project, as compared to loans, which are relatively simple and standardized. Guarantees are booked on MDB balance sheets in the same way as loans: equivalent value loans and guarantees must be backed by the same amount of equity. The risk of calling the guarantee is assessed as the same risk as loan default. This is despite the fact that guarantees have a significantly lower call rate than loan defaults or arrears.[24] So from the perspective of staff and their performance goals, loans require less effort for transactions of equal value and risk.

On the demand side, guarantee transaction costs are higher because the borrower must negotiate contracts with both the lender and the guarantor.[25] Thus the benefits of guarantees in terms of lowering borrower capital costs are offset by higher transaction costs and fees. A World Economic Forum survey of 40 major infrastructure actors reveals a lack of enthusiasm for these risk-sharing tools: less than 20 percent perceive MDB risk-mitigation tools as successful for both the private and public partners in an infrastructure project.[26] Market participants report problems both with the products (too complex) and MDB processes (too slow and nontransparent).

A World Economic Forum survey of 40 major infrastructure actors reveals a lack of enthusiasm for these risk-sharing tools: less than 20 percent perceive MDB risk-mitigation tools as successful for both the private and public partners in an infrastructure project.

A very recent survey of 187 blended finance deals by Convergence reveals consistent findings. Only 12 percent of blended finance deals involve a guarantee or insurance instrument. Half of deals involve technical assistance and 42 percent involve junior or subordinated capital.[27] Within the World Bank Group, guarantees and other risk management products represented only 5.2 percent of IFC’s long-term commitments (excludes short-term trade finance) in FY17.[28]

All this suggests that simply pressing the MDBs to deploy more guarantees under current terms is unlikely to result in either a substantial actual increase in use or much greater catalytic effect. The toolkit clearly must include other instruments. But it would be useful to explore options for making guarantees more attractive to all parties by examining policies for

- equity backing,

- pricing,

- more accurate risk targeting, and

- product standardization to reduce transaction costs.

Risk Aversion: Is the Criticism Fair?

MDB PSWs are often characterized and sometimes criticized as risk averse. Risk aversion should not be surprising: PSWs operate on a commercial basis, price on market terms, and invest only in for-profit projects. PSW staff thus generally assess risk in the same way as commercial bankers.

IFC investments reached $18.3 billion in FY13, but the growth was almost entirely driven by short-term finance instruments, mainly trade finance.

The 2013 report on Results and Performance of the World Bank Group by the Independent Evaluation Group (IEG) provides indirect evidence of risk aversion based on the evolving mix of products and sectors in the IFC portfolio. IFC investments reached $18.3 billion in FY13, but the growth was almost entirely driven by short-term finance instruments, mainly trade finance. Short-term finance instruments accounted in that year for more than 40 percent of IFC’s commitments, while real sector investments generally remained at the same level since the financial crisis. The greater concentration of short-term finance in the portfolio can reasonably be viewed as a move toward less complicated products with lower risk.

More broadly, both short-term and long-term finance through financial intermediaries grew to nearly 60 percent of the portfolio, while infrastructure finance actually declined.

A similar pattern is found in IFC commitments in IDA countries. The commitments grew rapidly, driven by short-term finance, which rose to 57 percent of IDA country commitments. The share of real sector investments, including infrastructure, declined.

This shift toward more short-term finance projects was accompanied by an overall decline in IFC development outcome ratings, according to the IEG, continuing the trend of recent years. A substantial decline in development outcomes for infrastructure projects, as well as weak performance in IDA countries, led this overall decline.

The relative decline of real sector finance, particularly for infrastructure, suggests that the IFC retreated from the same activities that private banks exited during the period—not the countercyclical role that a PSW would ideally play.

This picture suggests an increase in risk aversion that persisted long after the financial crisis. The relative decline of real sector finance, particularly for infrastructure, suggests that the IFC retreated from the same activities that private banks exited during the period—not the countercyclical role that a PSW would ideally play.

The story for MIGA, which insures private investors and lenders against various forms of political risk, is very different. A new tool was added to its arsenal during this period: insurance coverage against the risk of non-honoring of financial obligations by a sovereign or sub-sovereign entity. This new product helped drive a major shift in the composition of its portfolio away from the financial sector, which dropped from 70 to 20 percent, and toward infrastructure, which rose from 21 to 50 percent, though from a low base.

In the MIGA case, a new instrument helped drive change and clearly responded to infrastructure investor demand. In the case of the IFC, we observe an apparent reluctance or lack of incentive to use its tools in more complicated and riskier projects.

Financial Returns vs. Development Impact: Is it a Choice?

At the project level, PSWs tend to assume that there is a trade-off between their own financial returns and development impact. And because projects with the highest returns are expected to have the best prospects for mobilizing private finance, this suggests that there is also a trade-off between leverage and development impact.

This logic leads PSWs to argue that a portfolio approach is essential to manage a balance between these objectives: some projects are chosen for their financial returns and some for their development impact. Achieving both in the same project is viewed as desirable but not realistic in many cases.

More empirical work would be useful to assess whether there is, in fact, a trade-off between PSW financial performance and broad measures of development impact.

It is not clear how much evidence supports this view. A recent Brookings report looks at the relationship between the environmental, social, and governance (ESG) performance and financial performance of IFC client firms. The study finds no causal link between better ESG performance and worse financial performance; nor is there evidence that better ESG performance causes better financial performance. And the study finds no evidence that financial returns decline with the income level of the country.[29]

More empirical work would be useful to assess whether there is, in fact, a trade-off between PSW financial performance and broad measures of development impact. If the evidence of trade-offs is weak, it would have significant implications for PSW strategies and portfolio management. It could suggest that a greater push into frontier markets—countries and sectors—with high potential development impact need not come at the expense of PSW financial returns or associated leverage.

Unfortunately, PSW/DFI data on their project returns as compared to their development impact are not made available to the public. This lack of transparency not only weakens accountability for portfolio management; it also impedes the flow of information that could provide useful signals to markets on business opportunities with development impact.

The Right Goals: Defining Success for PSWs

This question of how to judge PSW performance is clearly fundamental for decision-making with respect to instruments and projects. At the moment, the answers are not very satisfying. Three goals are typically cited: (1) transaction viability with minimum use of subsidies; (2) “additionality,” which, when aggregated, becomes contributions to filling finance gaps; and (3) project results. Each is subject to measurement limitations.

This question of how to judge PSW performance is clearly fundamental for decision-making with respect to instruments and projects. At the moment, the answers are not very satisfying.

The aim for transaction viability is to target carefully only the risks that the private sector will not bear, and to provide just enough concessional finance to cover those risks. The “just enough” aspect could be judged by comparing risk-adjusted returns in the sector for unsubsidized private projects with those of subsidized projects. They should be the same.[30] If subsidized project risk-adjusted returns are higher, resources are being wasted. It is, of course, hard to make this comparison in practice because different projects, even in the same sector, are not perfectly comparable.

In addition, making one or even successive projects viable and investable tells us little about whether these activities have any effect on how well markets function post-project. A lot is made of demonstration effects, but we have certainly seen repeated MDB PSW transactions with little impact on subsequent firm behavior or activity in target sectors. Again, there are potential trade-offs here that would benefit from being substantiated—projects that the private sector would be very unlikely to undertake itself may be less likely to impart a demonstration effect.

The question of additionality is even more vexing. It inherently involves comparing the total amount of project finance mobilized in projects with MDB participation with a counterfactual—what would have happened had there been no MDB involvement. The problems are the same as those in any case where an intervention is tested on one entity or group without a comparable control group. It is hard to say how much of any benefit is attributable to the intervention.[31] Project sponsors have every incentive to overstate the scope and size of the MDB concessional instruments needed. And MDBs have every incentive to claim credit for private finance mobilized, which may well have happened in any case.

Although frequent reference is made to the need for PSWs to measure or demonstrate additionality, there is no consensus on what would constitute acceptable evidence. It has not even been definitively established whether it is possible to infer additionality from investment data.

Frequent reference is made to the need for PSWs to measure or demonstrate additionality, yet there is no consensus on what would constitute acceptable evidence.

Auctioning access to subsidies would reveal the least amount of concessional finance necessary to attract private investors. But turning theory into practice in this case is not straightforward. Project sponsors resist revealing their bottom lines. MDBs worry over introducing more complexity and uncertainty into their deal flows. And they argue that often only one project sponsor comes forward to offer a viable project proposal for a particular product or service, so competitions do not add value. Nevertheless, it is worth exploring how auctions could be conducted in a way that addresses these concerns.

In addition, the use of concessional finance does not necessarily expand the finance envelope. If the subsidy element in concessional lending to the public sector is the same as the grant that catalyzes an equivalent amount of private finance, the total financing mobilized is the same.[32] Of course, there may be other reasons to incentivize private participation in a project, and governments may not want to finance the upfront costs of concessional lending.

Project results are measured in terms of their impact on beneficiaries at the micro level. But there is limited attempt to measure broader impact—either at the sectoral or macroeconomic level.

This transactional mindset is very different from the sovereign-lending mindset. MDB budget loans, for example, generally serve three purposes—to help fill the immediate budget gap, to incentivize short-term policy adjustments to contribute to gap filling, and to promote longer-term policy and institutional changes that put public finances on a more sustainable footing. The aim is to avoid perpetual deficits and associated perpetual demand for budget loans. One could make a case for an analogous rationale for private transactions, given that public resources are too scarce to continue funding the same activities indefinitely.

If the goal is to maximize both leverage and development impact, the role of PSWs should not only be to make one transaction viable, but also to pave the way for further transactions that do not need PSW support. That is, PSW transactions should influence not only the risk-adjusted returns for a given transaction, but also the perceived risk-adjusted returns for future transactions.

PSW transactions should influence not only the risk-adjusted returns for a given transaction, but also the perceived risk-adjusted returns for future transactions.

PSWs should occupy the space between clearly public and clearly private projects. Ideally, they should play a role in shifting out both the demand curve for investment in a sector (the projects seeking finance at different return levels) and the supply curve (the finance seeking projects at different returns). PSWs, working with other parts of MDBs, should, in short, seek to influence underlying market conditions.

Market conditions here encompass a broad range of factors: business models; technology; the pace of innovation; the degree of competition; market infrastructure; information flows and costs; skill availability; finance options; and the policy, regulatory, and institutional environment. This list affirms the importance of (1) a diverse and flexible toolkit, and (2) close collaboration between the public and private parts of MDBs.

One can think of assessing PSW success or failure with respect to influencing market conditions in three dimensions: systemic impact, market or sectoral impact, and sustainability.

Systemic impact can be identified as changes that affect the macroeconomy and are not confined to a particular sector. Capital market development, for example, creates systemic impact through the emergence of new capital assets, the entry of new investor classes into frontier markets, the entry of new countries or subnational entities into capital markets, private provision of new instruments to manage risk like insurance or currency risk, or financial inclusion generally. But systemic impact can also stem from the economic inclusion of women or specific excluded populations. Or it could mean private innovations in education with significant benefits for human capital, employability, and productivity across the economy.

One can think of assessing PSW success or failure with respect to influencing market conditions in three dimensions: systemic impact, market or sectoral impact, and sustainability.

Systemic impact can be distinguished from market making or market impact, which occurs within a sector with limited spillover to other parts of the economy. Examples include new business models in a sector, new products or services, new sectoral technologies, new customers and clients, or new market infrastructure. At least one impact investor, Omidyar, has decided to place “an increasing emphasis on driving market-level change.”[33]

And finally, we can posit the goal of sustainability in private sector operations, e.g., helping a firm or firms reach sufficient scale and profitability to enter a sustained growth stage and access commercial finance, rather than further MDB support.

This taxonomy provides a notional ranking, ranging from transaction viability to systemic impact, which helps us think about where non-concessional and concessional finance would have the greatest benefits and therefore the strongest case for deployment. But more work is needed to assess whether these are the impact categories that make the most conceptual and practical sense, and what kinds of activities fall within each category. PSWs are not the only interested parties here. Impact investors are also interested in developing credible but practical metrics at the market level.

All of this is hard to measure both ex ante and ex post. It involves tracking change, especially change in the behavior and participation of market actors. Have they, for example, introduced new business models, new products and services, new delivery or payment channels, new technologies? Have they engaged new customers or suppliers? Are there new market entrants? Is the activity supported by the project sustained, replicated by other actors, or scaled after the project ends? Do supported firms graduate to commercial finance? Do financial institutions start using their own resources to continue or expand the supported lending? Have prices fallen and quality of service improved in formerly inefficient and uncompetitive markets for key inputs?

We should find ways to judge PSWs’ performance based on the quality and power of the partnerships they build, not just on the credit they can or should take for the impact of their own activities.

And it requires a fundamental change in approach to questions of attribution that have been at the core of much of impact evaluation. PSWs are only one of many actors and factors that make and affect markets. In fact, change at this level generally is only possible through collaboration and collective action.[34] We should find ways to judge PSWs’ performance based on the quality and power of the partnerships they build, not just on the credit they can or should take for their activities’ impacts

Importantly, this approach should strengthen both mobilization of private finance and development impact. Better market or systemic conditions are likely to do more to promote subsequent private investment than repeating similar PSW transactions.

Are Subsidies Justified for PSWs?

Especially as PSWs are pushed to do more in frontier markets, another basic issue emerges with more urgency: whether subsidizing private investors through blended finance is a good use of scarce public resources. The answer is still the subject of debate, including among MDB shareholders.

MDB boards regularly present managers and staff with a set of conflicting goals.

MDB boards regularly present managers and staff with a set of conflicting goals. PSWs are expected to operate on a commercial basis, price products on market terms, meet profit objectives, and avoid subsidies that crowd out or disadvantage private actors. At the same time, they are pressed to enter risky country and product/service sectors, create new markets, and invest in a way that is additional—that fosters private investment with development impact that would not otherwise have occurred. This conflicting logic confronts PSWs with the challenge of finding investments that are simultaneously commercially viable and have risk-adjusted returns unacceptable to the private sector.

Yet it is not hard to find justification in economic theory for subsidies for investments with development impact based on the presence of externalities—where social benefits exceed private benefits or where social costs exceed private costs. Subsidies can promote investments with high social returns that private firms cannot capture, or reduce the social costs of investments that private firms do not have to bear.

A few examples show a broad range of investments with externalities, all important in developing countries:

It is not hard to find justification in economic theory for subsidies for investments with development impact based on the presence of externalities.

- Investments in startups or later stage firms with high growth potential that have a multiplier effect on job creation through their supply chains

- Piloting innovations that create new markets or serve new clients, particularly the poor or excluded

- Piloting innovations that raise economy-wide productivity by fostering the public good of experimentation and adaptation through data feedback

- Promoting capital accumulation, which generates a virtuous economy-wide cycle of increased growth, leading to better human capital and stronger institutions, leading to higher productivity, leading to more growth

- Solving coordination failures that prevent relevant actors, public and private, from cooperation essential to achieving desired outcomes

- Investing to reduce high prices for key inputs (power, internet access, etc.) that discourage investment and damage competitiveness economy-wide

- Filling information or skill gaps that lead to systematic underestimation of risk-adjusted returns for particular investments with development impact

- Investments to reduce carbon emissions whose costs are not borne by emitting firms[35]

Given that there are plenty of externalities to be captured, theory does not help us very much on how to allocate scarce subsidy resources.

Given that there are plenty of externalities to be captured on the benefit side or reduced on the cost side, theory does not help us very much on how to allocate scarce subsidy resources. In the extreme, one could justify subsidizing any investment that contributes to growth and job creation, especially where existing levels of private investment are low. But this hardly promotes selectivity. Impact investors tend instead to target investments that directly serve the poor. But that might be too narrow.

And importantly, there is the question of whether subsidies are better deployed to lend concessionally to governments for their investment or to catalyze private investment. Uncritical enthusiasm for crowding in the private sector could result in excessive subsidies that cover what are really commercial risks when public investment would be cheaper and more transparent. On the other hand, the case for government funding of infrastructure is tempered by the risk of inefficiency in public investment management. Recent IMF research comparing public costs to infrastructure benefits reveals “average inefficiencies in public investment processes of around 30 percent.”[36] The risk of excessive subsidies to the private sector has to be weighed against the risk of resources wasted by government inefficiency.

The risk of excessive subsidies to the private sector has to be weighed against the risk of resources wasted by government inefficiency.

All this points to the need for strong analysis, country-by-country and sector-by-sector, to identify areas with the greatest potential externalities for either public or private investment. MDBs should have a considerable comparative advantage in such analysis, but PSWs do not now play a significant role in shaping country strategies. The questions of how to do such analysis and how to incorporate it fully into country strategies as a key factor in determining resource allocation both deserve serious attention by PSW management and staff. Getting the different parts of MDBs on the same page in country strategies, and giving the public and private finance entities equal input and ownership, are critical challenges.

The Distinct PSW Advantage in Blended Finance

One recent example of advances in the use of blended finance by MDB PSWs is the newly launched IFC-managed PSW under IDA18. It envisions an expanded toolkit and enhanced collaboration across different parts of the World Bank Group: guarantees, currency risk-sharing, blended finance including first loss, political risk insurance, and support for relevant policy/regulatory reforms. This is clearly an important step forward in MDB force multiplying and tailoring tools to the circumstances of different projects.

The aim should be to capture the unique potential capability of PSWs—a one-stop shop approach to provide clients with tools that facilitate building a finance stack suited to their needs.

In addition, the World Bank Group’s new “cascade” approach explicitly contemplates collaboration between the public and private finance parts of the Bank to support reform and risk sharing to mobilize private finance where possible and reserve public finance for use where market solutions are not possible. The formidable challenge, not to be underestimated, will be to change incentives so that both parts of the Bank no longer focus on the volume of their own disbursements as the principal measure of success. Unless staff reckon that interdependence serves their interests, they will continue to operate in silos.

More broadly, the aim should be to capture the unique potential capability of PSWs—a one-stop shop approach to provide clients with tools that facilitate building a finance stack suited to their needs. One of the most significant barriers to mobilizing private finance is the high transaction costs for firms that must engage many different potential sources of funding and types of funders to put together the right financing instruments and package at different stages of a project or firm. In a recent survey of over 100 key blended finance stakeholders, Convergence found that the top-ranking “significant poor practice” in current blended finance activities is “fragmentation/lack of coordination among key blended finance actors and solutions.”[37]

PSWs and their MDB partners should have the capacity to combine and offer a suite of products to clients (including in partnership with other finance actors) that identifies and helps mitigate the relevant risks in order to catalyze more private finance. To date, this kind of seamless effort is rare among these institutions. The question of how to create not just the right organizational structure but also the right incentives to make this happen is critical to prospects for increasing MDB/PSW success in mobilizing private finance.

Is There a Case for Grants in the Toolkit?

Supporting innovation should be at the center of any effort to promote private sector development in poor countries.

PSWs currently offer limited technical assistance grants principally to help build pipelines of bankable projects and strengthen firm capacity. But these do not directly address what is often the most fundamental problem: the absence of business or financial models that work in poor countries. This problem has to be addressed by incentivizing innovation. Indeed, supporting innovation should be at the center of any effort to promote private sector development in poor countries, where advanced country business models for production and distribution often do not succeed, as we have seen in sectors like finance, retail, services, agriculture, and infrastructure.

Grants at both the firm (including financial institutions) and market level are needed to support innovation for two main reasons: (1) almost by definition, non-grant risk-sharing tools are hard to construct for innovative models where there is great uncertainty on both the demand and supply side, and where some degree of failure is both inevitable and instructive; and (2) even if they could be estimated, the scale of first-mover costs and risks is often too large to be borne by any individual firm or transaction. Examples of such first-mover costs and risks include a lack of market infrastructure for new product/service delivery or payment; the costs of marketing and building demand for new products/services; the costs of filling information and skill gaps to understand the behavior and preferences of new customers (e.g., women entrepreneurs) and how to serve them.

Empirically, it may be possible to demonstrate that a combination of small grants with PSW financial tools is cost effective in two senses. It may have considerably greater catalytic and development impact than financial tools alone. And it may do more to expand PSW business opportunities in the same market.

The notion of reimbursable grants as part of the toolkit is also well worth exploring.

The notion of reimbursable grants as part of the toolkit is also well worth exploring. Reimbursement, partial reimbursement, or reimbursement that captures some of the upside can be tied to achievement of certain development or financial outcomes. Reimbursing firms could be incentivized by being assured of subsequent access to PSW finance instruments. These options might be particularly effective in crowding in those impact investors that are willing to accept below-market returns and already use grants as part of their mix of instruments.

In addition, PSWs are well placed to form partnerships with private sources of grants and other concessional finance from philanthropists and others. Mutual gains should result, with PSWs benefiting from expanded leverage and finance envelopes, and private funders benefiting from access to PSW project pipelines.

Analysis of the most catalytic ways to use limited grant resources, including case studies of small grants and reimbursable grants with large systemic or market impact, would make an important contribution to PSW resource allocation.

What About Targeting Returns Instead of Risk?

To incentivize private investors seeking favorable risk-adjusted returns, PSW loans and blended finance instruments generally target risks and sometimes capital costs. It makes good sense to think instead about rewarding firm success by subsidizing returns if targeted outcomes are achieved.

To incentivize private investors seeking favorable risk-adjusted returns, PSW loans and blended finance instruments generally target risks and sometimes capital costs (such as in the case of lengthened maturities). They aim to partially protect firms and investors from failure. As Owen Barder and Theo Talbot of CGD have pointed out, it makes good sense to think instead about rewarding firm success by subsidizing returns. They also demonstrate that the cost of subsidizing returns need not exceed that of reducing risks.[38]

PSW commitments to add to firm revenue streams if certain targets are met have several important advantages. They discourage firms from weak due diligence and taking on undue risk. They incentivize socially beneficial activity by adding to profit margins, either indefinitely or temporarily. They can help a firm reach commercially viable scale so that the activity becomes sustainable after PSW payments end. They allow capital markets to operate normally, building financing structures that work in the context of revenues augmented if outcomes are achieved. And they foster accountability and effectiveness by linking public development dollars directly to development outcomes required for payouts to the firm.

This opens up the world of instruments that have thus far been used mostly in the health sector, like advance market commitments. And it points to the possibility of PSW support for social impact bonds, which mobilize upfront private sector funding for beneficial activities for which there is not enough fiscal space. These bonds are only repaid if agreed development outcomes are demonstrably achieved. PSWs could invest in such bonds or provide guarantees or first loss protection to private investors. Social impact bonds create obvious opportunities for PSWs to collaborate with their sovereign bank partners. The sovereign side is an excellent source of knowledge and expertise on designing, executing, and evaluating social interventions most likely to produce desired outcomes. An examination of where and when PSWs should work on the return side would open up important opportunities for PSWs and other impact investors.

How Should Access to Blended Finance Be Allocated?

PSW decisions about concessional finance are generally made on a project-by-project basis. There is an understandable MDB staff desire to preserve project demand-driven flexibility and to avoid setting country or sectoral targets in the manner of sovereign lending.

An overarching framework is needed that ties allocation of concessional resources to each project’s expected contribution to market or systemic impact.

This approach makes sense if the singular concern is the viability and results of individual projects. It does not make sense if there are additional important objectives of broader systemic or market consequence. In that case, an overarching framework is needed that ties allocation of concessional resources to each project’s expected contribution to market or systemic impact. Several options for such a framework could be explored, such as the following:

- Decisions could be based on an ex ante scoring mechanism using, for example, the impact taxonomy suggested above, with higher scores assigned the more systemic the expected impact.

- Subsidy auctions could be standardized and embedded in regular PSW systems to reduce transaction costs and uncertainties for both PSWs and firms competing in the auctions. In addition to the efficiency advantage of identifying the minimum subsidy necessary, auctioned subsidies could be tied to well-specified performance targets or outcomes, promoting impact and accountability and incentivizing firms to innovate—e.g., build business models and financing strategies capable of meeting outcome goals. One other benefit of this approach is that it does not require picking only one winner to support. Several firms could win access to different levels of concessional finance, depending on their expected outcomes.

- An entirely different option is to tie access to concessional resources for the private sector to regulatory and institutional sectoral reforms by governments. The idea would be to form a kind of compact that aligns the interests of governments and the private sector (as well as the interests of the private and public sides of MDBs). The private sector would have the combined incentive of concessionality and a stronger investment climate, and governments should see a better private investment payoff from systemic and sectoral reforms.

Poor and Fragile States: Is there a Need for Different Approaches?

Following the global financial crisis, recent trends in private capital flows to low-income countries show some positive—though possibly transitory—developments. Median net capital flows to low-income countries (LICs) rose from 3.25 percent of GDP in 2009 to nearly 7.5 percent of GDP in 2013, followed by a sharp reversal in 2014 when the share fell back to the 2010 level.[39]

A one-size-fits-all approach does not address the distinct challenges of investing in poor and fragile economies.

As a share of total flows to developing countries, private capital flows to LICs rose from 1.8 percent in 2003-2007 to 3.2 percent in 2010-2013. Flows to LICs tend to be less procyclical than flows to more developed economies and less sensitive to changes in global risk aversion than flows to emerging markets.[40] In 2012, FDI to LICs reached $24.3 billion, six times the 2002 level, though this was concentrated in a few LICs (Bangladesh, Cambodia, Mozambique, and Tanzania).[41]

Some LICs that issued sovereign debt also had private issuances, though on weaker terms—with an average coupon rate of 8.2 percent and average maturities of 8.7 years and almost exclusively in dollar denominations. Financial sector development also seems to be advancing, with private credit in LICs rising from 20.2 percent of GDP in 2003 to 30.7 percent in 2012 (as compared to 83.7 percent in MICs).[42]

All this gives MDB PSWs a basis to build on. However, the evidence, especially from fragile and conflict-affected states, suggests that a one-size-fits-all approach does not address the distinct challenges of investing in poor and fragile economies. For post-conflict countries, the hurdles are particularly high: World Bank research finds that conflict-affected countries typically require 6-7 years to attract significant private investment in infrastructure from the date of conflict resolution.[43]

UKAID researchers point to the need for further research to develop better solutions in the following areas:

Transaction costs in fragile states, given limited deals and deal sizes, are very high in relation to potential project returns.

- The necessity of combining project investments with sustained support for policy, legal, regulatory, and institutional reform in the relevant infrastructure sectors and capital markets

- The importance of community engagement when only small-scale investments are feasible

- Capturing and deploying lessons learned on how local contractors, project managers, and government procurement can be strengthened to reduce execution risk in infrastructure projects

- Developing more expertise in conflict analysis to improve risk assessment and diagnostics

- Addressing the high transaction costs, which are major barriers to investment[44]

Regarding the last, a CSIS study makes a persuasive case that transaction costs in fragile states, given limited deals and deal sizes, are very high in relation to potential project returns:[45]

- Costs to investors to assess the investment climate and find investible projects are too high

- Costs to entrepreneurs/project sponsors to understand their financing options and compare terms are too high (especially with multiple donors, MDBs, commercial institutions, and financing instruments to assess)

- There are too few deals to generate standardized contract templates that would reduce costs of future deals.

Finding ways to reduce such transaction costs would create public goods that PSWs along their sovereign lending MDB partners would seem to be well placed to provide. It would be useful to explore options for creating (and funding) neutral advisory services, information sources, and standardized legal documents that would benefit a broad range of firms and investors, including, of course, the PSW investors themselves.

MDB Governance: Does It Promote or Impede Success?

Some responsibility for concerns about PSW impact and additionality rests with the shareholders, partly because of their own lack of clarity on desired risk-reward trade-offs noted above. The inconsistent messages create a situation in which management and staff regularly receive criticism from both sides (the risk averse and the additionality skeptics) and therefore have little useful guidance going forward. In addition, executive board members do not always have the technical knowledge to assess innovations in risk management and financial instruments. This lack of understanding can translate into board risk aversion that stifles change and adaptation.

Serious efforts to pursue systemic and market impact require collaboration across bank departments.

PSW boards have, in fact, been criticized for doing too much of some things—individual project approval, for example—and too little of others—overall performance assessment against agreed strategic goals. There is little question that PSW projects should be viewed on a portfolio basis. Rather than project-by-project approval, it would seem to make more sense for boards to focus on assessing the portfolio against agreed criteria. This would require, of course, agreement by the board on what the criteria should be, which would help clarify and reveal shareholder preferences.

More broadly, boards can play a useful role in supporting management efforts to address difficult bureaucratic challenges within bank groups. Serious efforts to pursue systemic and market impact require collaboration across bank departments. A combination of policy, regulatory, and institutional reform; project development support; technical assistance for governments and firms; support for innovation and first movers; project finance, and different concessional tools must be brought together for success. The ability to bring these efforts together is in fact the strongest comparative advantage of MDBs, yet it falls short in practice despite reorganizations to break down silos. Boards, working with management, can and must keep realization of this capacity on the front burner.

Cross-MDB Collaboration: Why It Matters but Does Not Happen

Lack of collaboration has a direct impact on mobilizing institutional and other investor interest.

Collaboration across MDBs is even rarer. In fact, competition is more the norm. The result is fragmented and sometimes duplicative efforts that fail to reach scale. Lack of collaboration has a direct impact on mobilizing institutional and other investor interest. MDBs do not work together to harmonize products and pool them to create large and standardized, yet diversified, asset offerings so that institutional investors face lower transaction costs and more easily assessed risk adjusted returns.

In general, global pools provide significant benefits for risk management. Currency risk hedge funds and disaster insurance facilities, for example, depend on diversification for viability and competitive pricing. And MDBs themselves would benefit if they could share exposure to risk by joining forces, particularly for large projects.

Given high transaction costs associated with finding and developing bankable projects, MDBs could benefit from systematically sharing or pooling project pipelines.

In addition, given high transaction costs associated with finding and developing bankable projects, MDBs could benefit from systematically sharing or pooling project pipelines. No one MDB can finance all the projects for which it has undertaken due diligence. Nor does it make sense for multiple MDBs to assess feasibility for the same projects. Combining efforts therefore would generate two important benefits: sharing due diligence costs across MDBs, and joining MDB forces to crowd in more private investment. This kind of collaboration happens now on an ad hoc basis; it makes sense to incorporate it into standard processes.

Shareholders, particularly large shareholders, are well placed to prioritize and drive cross-MDB collaboration since they participate in governance across the MDBs. The benefits should unite the interests of creditor and lender shareholders. Work to devise fora and mechanisms for inter-MDB governance would be effort well spent.

Public-Private Development Banks?

Finally, we can think about the problem more fundamentally and question whether the right people are around the table in PSW boards. Private actors, including impact investors and foundations, now undertake nearly all the activities that PSWs do—from lending and investing at different risk levels, to blended finance, to insuring against various risks, to project development, to technical advice. It is reasonable to ask if the time has come for PSWs to be capitalized from both public and private sources. Private sector actors would then be shareholders and have seats on governance boards. Their voices would likely make a difference—in efficiency, data-driven adaptive decision-making, and openness to innovation.

It is reasonable to ask if the time has come for PSWs to be capitalized from both public and private sources.

Different governments can be expected to react very differently to this notion. Some would strongly resist, fearing dilution and a weakening of the development mission in favor of profit objectives. Others without the fiscal space to contribute to further MDB capital increases may welcome private capital. They may also welcome the benefits of bringing private sector strengths to governing MDBs. Private shareholders could certainly be expected to care as much as public shareholders about extracting maximum benefit from their capital.

A careful examination of the merits of public-private development banks would need to encompass challenges and opportunities across a range of dimensions: development mission and priorities, development effectiveness and results measurement, financial and fiduciary policies, risk tolerance, safeguards, transparency, legal arrangements, and governance. It should include a look at development banks that have both public and private shareholders (e.g., FMO—the Netherlands’ development finance company).This potentially transformational approach deserves objective and thorough study, although its difficulties should not be underestimated.

Summary: Proposed Research Questions

This potentially transformational approach deserves objective and thorough study, although its difficulties should not be underestimated.

This essay has suggested a variety of questions, consolidated below, that confront MDB PSWs (and, to a large extent, DFIs and impact investors generally) as they seek to rise to formidable challenges and expectations. The questions vary significantly in scope and type. Some are fundamental, others are operational. Some relate to financial instruments, others to country approaches, some to impact measurement, and some to the roles and responsibilities of shareholders.

In sum, we find that the following research questions identify salient issues of shared interest and utility to the development actors involved as partners, clients, staff, or shareholders of these institutions: governments, private firms, financial institutions, institutional investors, impact investors, foundations, and philanthropists.

Goals, new approaches, and better metrics

- What overall financial and development goals should PSWs prioritize?

- How can ex ante metrics for additionality and development impact be strengthened to promote better resource allocation within and across projects? How should access to blended finance be allocated?

- Should PSWs take on more risk? Would that require changes in PSW incentive structures and business models? What does the evidence say about the relationship between risk, development impact, and financial returns?

- What guidelines can be developed to match PSW instruments more effectively with financial and development objectives? How can these instruments be made more useful and user friendly for both investors and MDB/DFI staff?

- What special PSW approaches and instruments are needed in poor and fragile states?

Collaboration and governance

- How can internal collaboration between the public and private finance parts of MDBs be strengthened to maximize impact on the environment for private investment?

- How can shareholders drive cross-MDB collaboration to reduce wasteful competition (e.g., competitive subsidy offers) and promote risk diversification benefits for investors as well as the MDBs?

- Should governing boards of PSWs shift from project review to portfolio review against agreed criteria?

- Is there a case for public-private development banks?

[1] Amar Bhattacharya, Jeremy Oppenheim and Nicholas Stern, “Driving Sustainable Development Through Better Infrastructure: Key Elements of a Transformation Program,” The Brookings Institution, July 2015, https://www.brookings.edu/wp-content/uploads/2016/07/07-sustainable-development-infrastructure-v2.pdf; “Risk Mitigation Instruments in Infrastructure Gap Assessment,” World Economic Forum, July 2016, http://www3.weforum.org/docs/WEF_Risk_Mitigation_Instruments_in_Infrastructure.pdf.

[2] Eric Plunkett and Vikalp Sabhlok, “Mind the Gap: Bridging the Climate Financing Gap with Innovative Financial Mechanisms,” Global Green Growth Institute, November 2016, http://gggi.org/wp-content/uploads/2017/03/Mind-the-Gap_web.pdf.

[3] Peer Stein, Tony Goland and Robert Schiff, “Two Trillion and Counting: Assessing the credit gap for micro, small, and medium-size enterprises in the developing world,” World Bank, October 2010, http://documents.worldbank.org/curated/en/386141468331458415/Two-trillion-and-counting-assessing-the-credit-gap-for-micro-small-and-medium-size-enterprises-in-the-developing-world.