Recommended

The African Development Bank (AfDB), the Asian Development Bank (ADB), and the International Fund for Agricultural Development (IFAD) are among the international financial institutions seeking pledges from donor countries as part of upcoming replenishment cycles in 2019 and 2020. The United States is a leading donor to these funds and has played a crucial role in shaping the institutions’ agendas throughout their histories.

What Are the AfDB, ADB, and IFAD?

Like other international financial institutions (IFIs), the AfDB, ADB, and IFAD provide financial and technical assistance for development in low- and middle-income countries. While the AfDB and ADB have regional mandates, IFAD operates globally in support of the rural poor. In each case, the institutions allocate financing through loans and grants.

All three organizations differentiate financing terms based on the borrowing country’s income and creditworthiness. The AfDB and ADB categorize borrowing countries into hard and soft lending windows. The hard lending windows provide financial assistance, typically in the form of loans on market-based terms. For countries who cannot afford market-based terms, the soft lending windows provide grants and highly concessional loans (with low interest rates and long repayment periods) to the region’s poorest countries. Soft lending windows are financed directly by contributions from wealthy donor countries and are replenished every three to five years.

The African Development Bank’s soft (or concessional) lending window is known as the African Development Fund (AfDF). Similarly, the Asian Development Bank’s soft window is called the Asian Development Fund (ADF). While IFAD does not have separate lending windows, the institution does categorize lending to countries on highly concessional, blend, and ordinary terms.[i] The 15th replenishment of the African Development Fund will take place in 2019, and the 13th and 12th replenishments of the ADF and IFAD, respectively, will occur in 2020.

Membership

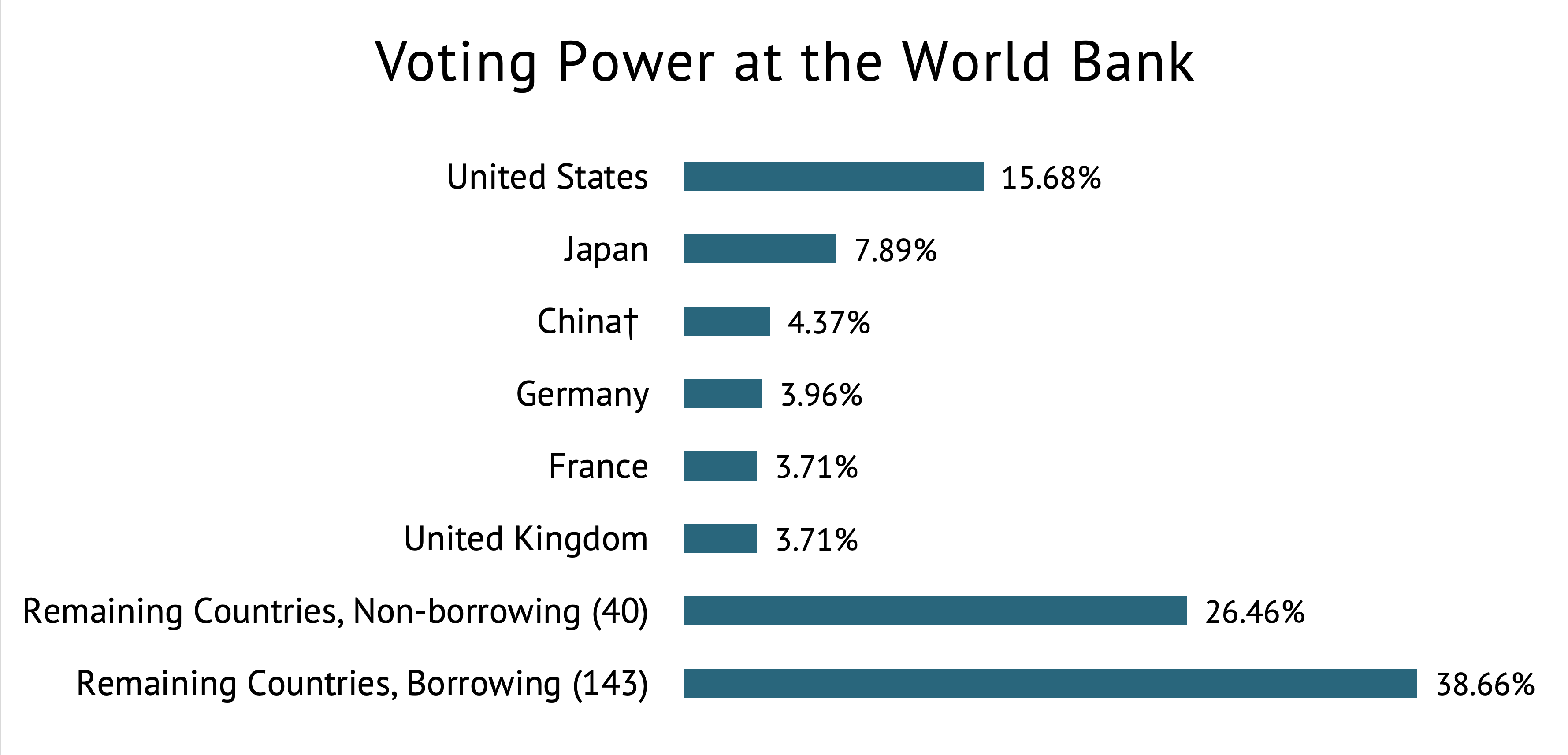

The AfDB, ADB, and IFAD are owned by member governments. Within each institution, a country’s voting shares and level of board representation are based roughly on its financial contributions. The United States has the largest voting share in IFAD and ties with Japan for the top voting share position at the ADB. The United States is the second-largest shareholder in the AfDB after Nigeria (see table 1).

Table 1. Top countries by voting share

Source: African Development Bank Group, “Distribution of Voting Power by Executive Director” (December 2018); Asian Development Bank, Annual Report: Sustainable Infrastructure for Future Needs. (2017); IFAD, “Voting Rights of IFAD Member States” (January 2019).

Governance

Run by their own management and staffed by international civil servants, each IFI is supervised by a board of governors, a board of executive directors and a president. Each institution’s board of governors is the highest decision-making body and consists of one governor for each member country, generally a member countries’ secretary of the treasury, minister of finance or a high-level designee. The governors delegate day-to- day authority over operational policy, lending, and other business matters to the board of executive directors who work onsite at the institution’s headquarters. The AfDB, ADB, and IFAD each have a president who is responsible for the overall management of the institution and serves as the chair of the board of directors.

Where Do AfDB, ADB, and IFAD Operate?

-

AfDB is headquartered in Abidjan, Côte d’Ivoire. The institution’s headquarters were temporarily relocated to Tunis, Tunisia, from 2003 to 2014 because of political unrest in Côte d’Ivoire, and some headquarter functions still remain in Tunis.[ii] The AfDB’s geographic portfolio is most concentrated in North Africa, specifically in Morocco (17.6 percent), Tunisia (14 percent), and Egypt (10.1 percent).[iii]

-

ADB is headquartered in Manila, Philippines, with a geographic focus in China (24.7 percent of outstanding portfolio), India (22.5 percent), and Indonesia (13.2 percent).[iv] ADB has a satellite office in Washington, DC.

-

IFAD is headquartered in Rome, Italy, with investments in Asia and the Pacific (33.9 percent), East and Southern Africa (24.5 percent), and West and Central Africa (18.4 percent).[v] IFAD is also represented in Washington by a satellite office.

Table 2. Overview of AfDB, ADB, and IFAD

Source: Overseas Development Institute, “A Guide to Multilateral Investment Institutions,” (April 2018); see also African Development Bank Group, “Corporate Information: Member Countries” and Asian Development Bank, “About ADB: Members.”

Operations

Total lending by AfDB, the ADB, and IFAD was $46.7 billion in FY2018. The largest share of this total consistently comes from the ADB, which accounted for $35.8 million or three-quarters of these institutions’ combined financing in FY2018. AfDB approved financing worth $10.1 billion in 2018, and IFAD approved financing worth $825 million. All three institutions have increased financing levels over the past five years (see figure 1).

Each institution seeks donor support through “replenishments,” which enable their grant-making and subsidized lending activities, largely in the poorest countries. While each of these three institutions have mandates to fund interventions to improve the quality of life for the world’s poorest populations, operationally each institution pursues different priorities based on their regional or thematic areas of focus. These priorities, likewise, translate to differences in the replenishment agendas of the three institutions.

Figure 1. Annual financing of AfDB, ADB, and IFAD, FY2014–FY2018

African Development Fund Replenishment

Discussions surrounding the 15th replenishment of the African Development Fund will take place over the course of three meetings in 2019 between donors and African Development Bank representatives. Negotiations for final donor contribution amounts will be settled by the end of the year. In the last replenishment in 2016, the US committed $513.9 million over three years out of a total replenishment of $5.9 billion, making the US the second-largest donor to the African Development Fund (after the United Kingdom). [vi] According to the US Treasury, every dollar in US contribution to the Fund helps leverage an additional $11 in donor contributions from other countries.[vii]

Financing from the upcoming replenishment will prioritize AfDF investments to stabilize fragile and conflict-affected (FCA) countries, promoting peace and security in a region where two-thirds of FCA countries are located. Other priorities include supporting full employment for Africa’s youth, as Africa’s demographic shift has resulted in high levels of unemployment, and climate change mitigation and adaptation, with AfDB on track to commit 40 percent of its annual funding to green finance projects by 2020.[viii]

A core focus of AfDF operations is sustainable infrastructure. In partnership with USAID, the AfDB contributed $4.52 billion (exceeding its initial commitment of $3 billion) to energy infrastructure across sub-Saharan Africa as a part of the US’s Power Africa Initiative.[ix] AfDF also provided grants to build infrastructure to increase access to clean water and improve sanitation across the continent. Other recent areas of focus in the AfDB’s soft lending window include Feed Africa; Industrialize Africa; Integrate Africa; and Improve the Quality of Life of the People of Africa.

Asian Development Fund Replenishment

The Asian Development Fund is expected to begin discussions surrounding its 13th replenishment in late 2019 or early 2020. In the last replenishment, in 2016, the US was the third-largest donor after Japan and Australia and pledged $189.6 million to the Fund over four years. According to a recent Treasury budget document, every dollar in US contribution to the Fund helps leverage $20 in other donor contributions.[x] Using priorities from the most recent ADF replenishment as a guide, the institution is likely to use incoming funds to prioritize several themes, including gender, fragile and conflict-affected situations, food security, private sector development, governance, climate change, and promoting regional public goods.[xi]

Like the AfDF, the ADF prioritizes support for sustainable infrastructure for future needs, such as investments in clean energy, transportation, clean water and sanitation, and broadband internet. Under its most recent replenishment, the ADF earmarked funds specifically for disaster risk reduction in the region, including preventative and emergency response operations.

International Fund for Agricultural Development

The International Fund for Agricultural Development is expected to begin discussions surrounding its 12th replenishment in late 2019 or early 2020. During the 11th replenishment, the US declined to pledge. However, Congress appropriated $30 million in FY19 for a contribution to IFAD—consistent with the prior US commitment of $90 million over the three-year period from 2016–2018. As part of the next replenishment, IFAD is also looking to reform its financial architecture to maximize the value of donor contributions. IFAD has committed 50 percent of its total funding to the African continent and 25 to 30 percent of its total funding to fragile situations. In 2017, IFAD went above this commitment and invested 35 percent of its funding in fragile environments. A key area of focus for the institution is its Platform for Agricultural Risk Management, a global partnership with the goal of reducing food insecurity caused by climate and market shocks. IFAD has also focused on increasing the economic impact of family remittances and migrants’ investments in their countries of origin through its leadership in the Global Forum on Remittances, Investment, and Development, and the Financing Facility for Remittances.

[ii] African Development Bank Group, “Contact Us”

[iii] Overseas Development Institute, “A Guide to Multilateral Investment Institutions,” (April 2018)

[iv] Ibid.

[v] IFAD, Annual Report 2017

[vi] US Department of the Treasury, “International Programs – Congressional Justification for Appropriations FY2018”

[vii] Ibid.

[viii] African Development Bank Group, Speech by President Akinwumi A. Adesina, delivered March 20, 2019

[ix] USAID, “Power Africa: A 2017 Update”

[x] US Department of the Treasury, “International Programs”

[xi] Center for Global Development, “Mapping the Concessional Financing Landscape: Key Data on the Role of Multilateral Institutions and Funds.”

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.