Recommended

A fragile global recovery from the shock of the COVID pandemic is being buffeted by the impact of war on food, fuel, and fertilizer prices along with rising interest rates and general inflation. It is surely an urgent moment for multilateral support from the IMF and World Bank. And yet, the institutions’ financial statements suggest that support is declining. Figuring out why and what to do about it should be priority one at the upcoming World Bank-IMF annual meetings.

There is no doubting the heads of the IMF and World Bank have been concerned that the world is in a state of emergency for some time. Kristalina Georgieva was eloquent at the IMF-World Bank Spring meetings this year:

“We are facing a crisis on top of a crisis. First, the pandemic… Second, the war: Russia’s invasion of Ukraine… The economic consequences from the war spread fast and far, to neighbors and beyond, hitting hardest the world’s most vulnerable people. Hundreds of millions of families were already struggling with lower incomes and higher energy and food prices… And for the first time in many years, inflation has become a clear and present danger for many countries around the world…. 60 percent of low-income nations [are] already in or near debt distress”

And David Malpass was clear about some of the consequences in early March:

“Indicators of poverty, growth, inequality, nutrition, education, and security are all rapidly deteriorating …. In addition, rising inflation and interest rates are hitting the world’s poorest the hardest.”

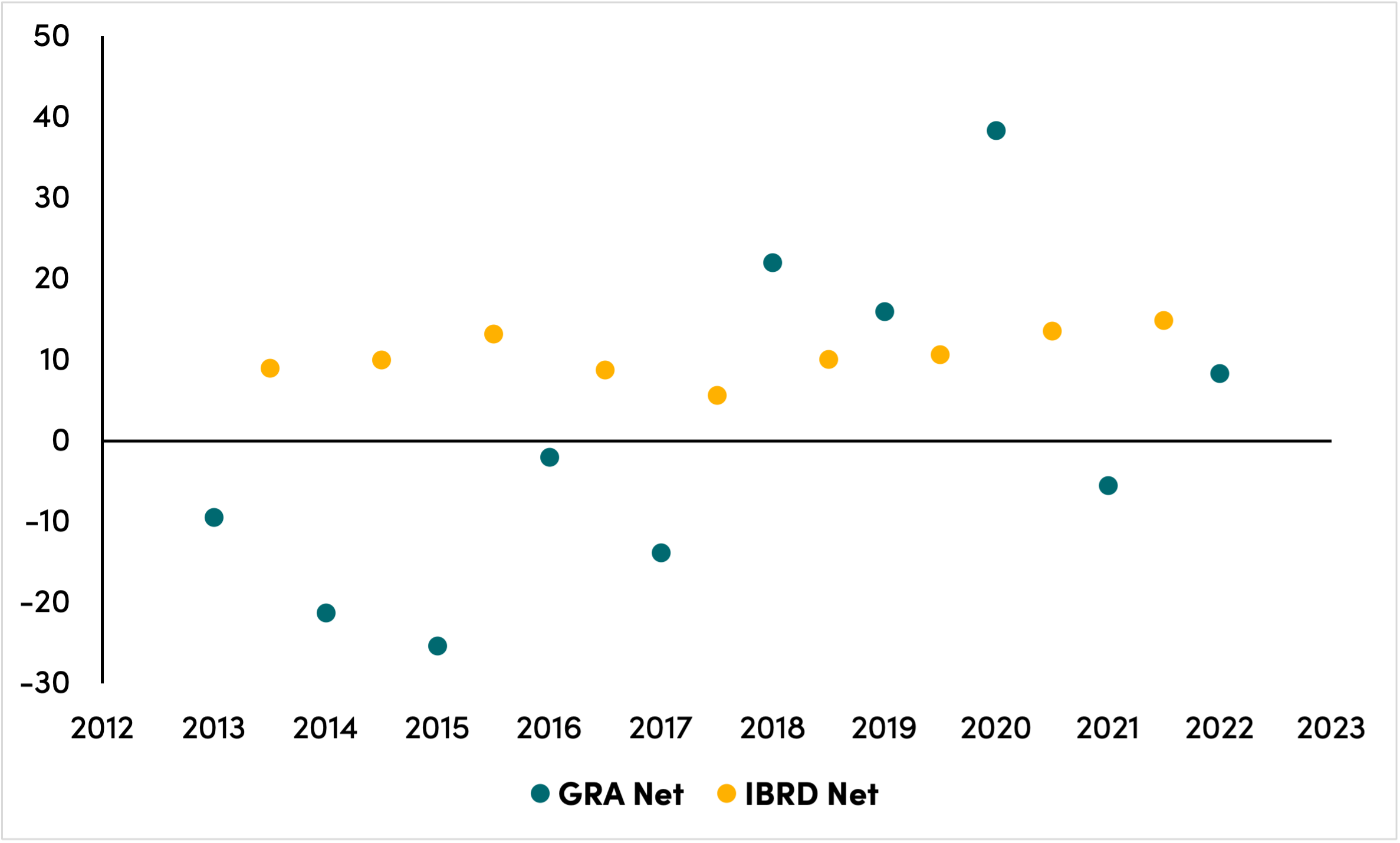

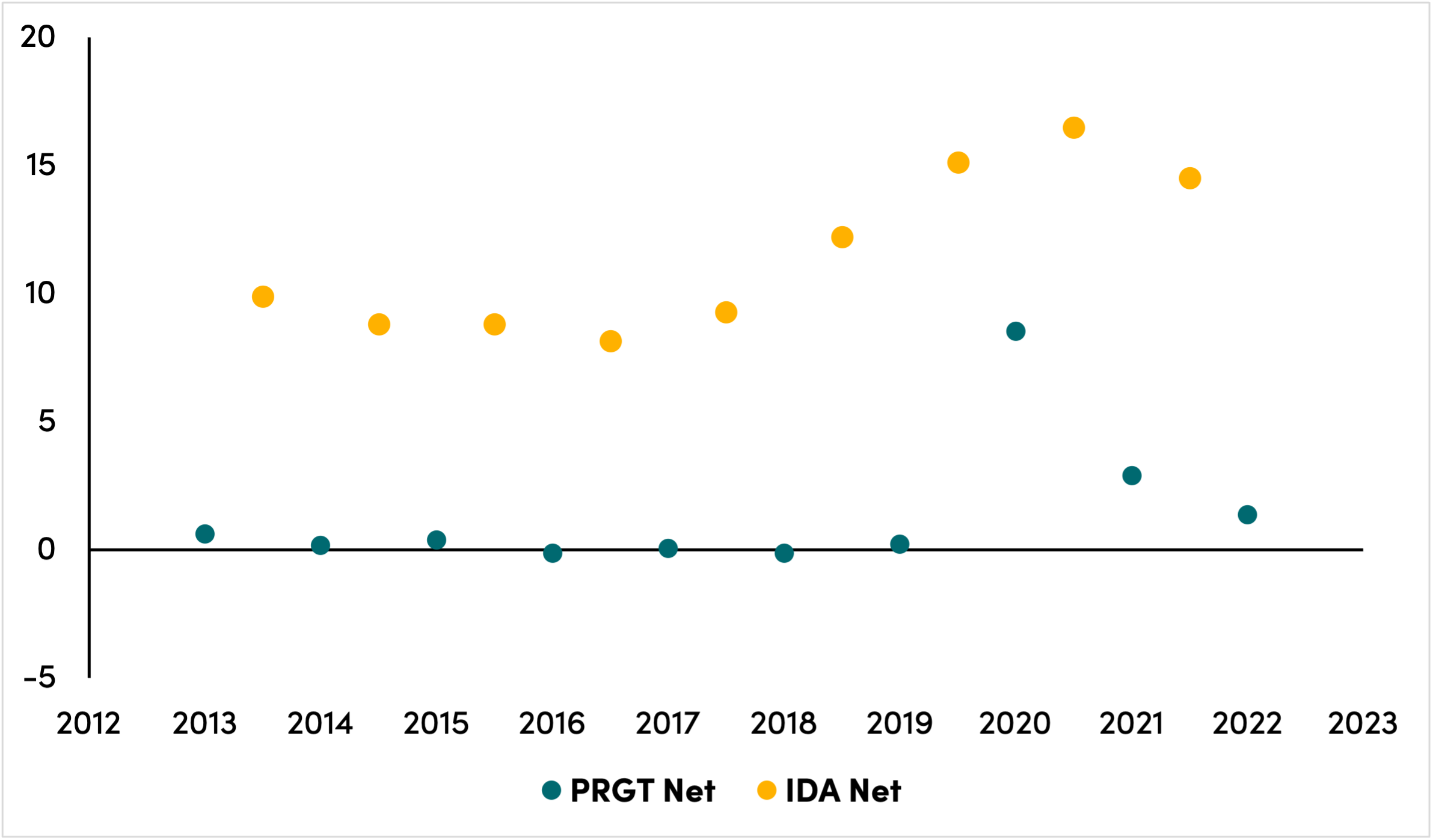

But, six months on, the IMF’s and the World Bank’s balance sheets don’t appear to match the rhetoric. Below are two graphs displaying World Bank and IMF non-concessional and concessional support over the past few years. They report “year start” net outflows for the World Bank in July (the start of its fiscal year) and for the IMF in January. That means FY2022 numbers for the World Bank appear at the midpoint between 2021 and 2022 on the y-axis and calendar year IMF numbers for 2022 appear above 2022 on the y-axis. Note also calendar year 2022 lending for the IMF is actually based on multiplying net transfers January to August by 12/8, to give an annualized estimate, and Special Drawing Rights (SDRs) are exchanged into dollars at approximately year-end value.

World Bank and IMF non-concessional lending is directed primarily to richer middle-income countries (although current IMF non-concessional operations include Benin, Ethiopia, and Senegal, which are ineligible for World Bank non-concessional lending). For the World Bank’s IBRD, net lending did rise from immediately before the pandemic, and the increase has been sustained through 2022. That said, FY2022 net lending (which ended in the middle of this year) is only 12 percent larger than lending in 2017. For the IMF, the net outflows of 2018 to 2020 contrast strongly with the early 2010s, but the period January 2021-August 2022 has seen aggregate net lending worth just $361 million.

Turning to concessional support for low- and lower-middle-income countries, IDA did lend into the crises, disbursing on net 66 percent more in the four fiscal years 2019-22 than the four years before that. At the same time, net disbursements actually fell in FY 2022 compared to previous years. Meanwhile, the IMF’s Poverty Reduction and Growth Trust (PRGT) saw a dramatic rise in support in 2020, but it has collapsed since then.

World Bank (IBRD) and IMF (GRA) net non-concessional lending, $bn

World Bank (IDA) and IMF (PRGT) net concessional lending $bn

Sources: IMF lending, World Bank lending, SDR exchange rate.

Note: IBRD = International Bank for Reconstruction and Development; GRA = General Resources Account; IDA = International Development Association; PRGT = Poverty Reduction and Growth Trust

To the extent this is a supply-side problem, that the IMF and World Bank don’t have the resources to provide more support, the annual meetings should urgently prioritize a World Bank capital increase and better use of existing capital, while the IMF’s richer members should speed up SDR payments to the PRGT and the new Resilience and Sustainability Trust Fund.

But it is also worth noting most economies are steering clear of borrowing from the IMF: only 21 countries have any sort of GRA arrangement and 23 have a PRGT arrangement. Out of a lending capacity of $936 billion, GRA credit outstanding is $93 billion—one-tenth of that. PRGT credits outstanding are notably below IMF forecasts made a year ago and are at about 40 percent of PRGT total available loan resources. Meanwhile, while IDA is able to distribute pretty much all the money it has on offer, the IBRD hasn’t been reaching its lending ceiling: commitments in FY2022 were $33.1 billion compared to a ceiling of $37.5 billion.

That suggests, while supply of finance may be an issue, there’s also a demand side problem. It may be a matter of time: interest rates have only recently begun to rise, for example. But ask finance ministers and central bankers (as my colleagues Mark Plant and Liliana Rojas-Suarez did) and they’ll tell you IMF lending instruments are ill-suited to global crises. Look at World Bank client surveys and you’ll see that borrowers report the considerable costs and delays associated with policy conditionality, safeguards, procurement, and financial management systems. So, something else that should be urgently addressed at the annual meetings: in the midst of apparently unprecedented crises, why aren’t more countries turning to the IMF and the World Bank? Have we got the crisis narrative wrong or is it that finance ministries really, really don't want to take on loans from H Street on the potentially inappropriate terms H Street is willing to offer loans?

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.