Recommended

The latest round of UNFCCC climate negotiations begins next week in Bonn. Climate finance—and in particular who should pay—remains a hotly contested topic as negotiators strive to make progress on the New Collective Quantified Goal (to replace the current $100 billion target) by COP29 in November 2024 and on rules for the Loss and Damage Fund agreed at COP28 in December 2023.

Developing countries continue to insist that developed countries are responsible and regularly cite the UNFCCC’s emphasis on “common but differentiated responsibilities and respective capabilities” (CBDR-RC). But the world has changed dramatically since the original set of 23 developed country (“Annex II”) climate finance contributors was agreed in 1992. This blog presents some new findings from our fair shares analysis, with a particular focus on China. The key point is that even with reference to CBDR-RC, there remains a powerful argument for non-traditional donors including China to contribute significant shares of climate finance, likely in the 20–30 percent range, with China contributing around 10 percent by 2030.

Previous results: a recap

Most observers recognise that climate finance “fair shares” should reflect both levels of emissions (a measure of responsibility) and levels of income (a measure of capability to provide finance). Getting the choice of metrics right really matters. But the key point is that identifying new contributors and quantifying fair shares have to be considered together (which is why some recent analysis of eligibility thresholds—which suggests that China would not qualify as a new contributor—is problematic).

Our original paper examined a wide range of scenarios that multiplied total cumulative historical emissions and current per capita income for all countries. Two countries with the same aggregate emissions would therefore have ‘fair shares’ in proportion to their per capita incomes, reflecting the UNFCCC and Paris Agreement’s emphasis on equity and “common but differentiated responsibilities and respective capabilities.” This approach allowed the easy identification of which new countries should become contributors and how big their shares should be. It concluded that non-traditional donors (the “non-Annex II” countries not currently required to provide climate finance) should contribute 20–30 percent of any climate finance total, with this finding robust to a variety of different measures of historical emissions, cut-off dates, and income. China ranked second in virtually every scenario (after the US) with a fair share of 5–10 percent.

Crucially, this formulation is already significantly more favourable to developing countries than the models reviewed in our earlier paper, which typically worked out each country’s share of total emissions and of income, and took the average of the two shares. Indeed, had we applied that approach in our model, using (undiscounted) aggregate CO2 emissions since 1979 and aggregate US$ GNI, the “non-Annex II” share would have been 53 percent, with China alone comprising 19 percent (compared to 23 and 8 percent respectively in our model’s baseline scenario).

New results from an updated model

We’ve continued to develop this fair shares model in the following ways, with details set out in this technical note, and below we highlight the findings with particular reference to China.

A more progressive model structure

First, we’ve adapted the model to allow for an even more “progressive” formulation by a) introducing some minimum level of both per capita income and emissions below which countries would bear no responsibility to provide climate finance (akin to a ‘tax free allowance’); and b) applying exponents to both income and emissions terms that progressively ‘tax’ anything above those minimum thresholds. Results depend on the values used, with more progressive formulations increasing the share of existing Annex II countries. This is largely driven by increased shares for the USA. The shares of most other G7 countries actually fall. The non-Annex II share falls to 15 percent in the most progressive option presented, and while China benefits (its share falling below 4 percent), some other “developing” countries (notably Gulf states such as UAE and Qatar) see their fair shares rise. But model structure still matters: other analysis exploring more progressive formulations within a model using average shares suggested a Chinese fair share as high as 5.7–8.1 percent, even with a much higher income threshold before countries contribute (they use a $7,500/hd development threshold in purchasing power parity terms) which ought to favour countries such as China.

Updating model with projections to 2030

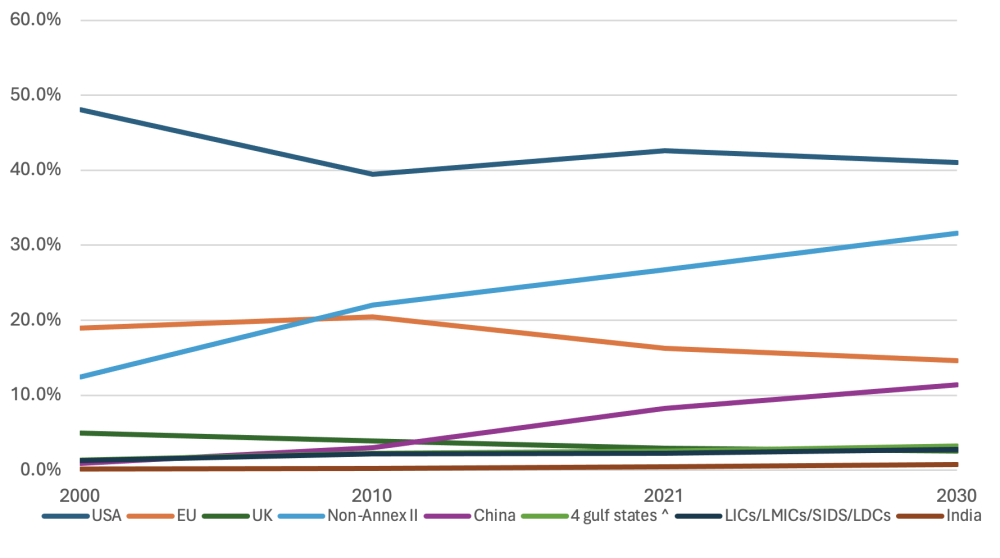

Patterns of emissions and income are changing rapidly with significant implications for fair shares. Our existing model allows fair shares to be calculated for any point in time in the past, and new updates incorporate projections through to 2030. The chart illustrates how fair shares are changing over the period 2000–2030 for selected countries and groups. China’s rapidly rising share in particular highlights the importance of keeping fair shares under regular review, and of avoiding being bound by the classification of developed and developing countries that pertained in 1992. However, the collective share of low-income (LIC), lower-middle income (LMIC), least developed countries (LDCs), and small island developing states (SIDS) remains negligible.

Figure 1: How fair shares are evolving over time

Introducing country caps

This updated model now also includes the facility to cap individual country shares at some user-defined level. This can have significant implications. For example, if the US’s share is capped at 20 percent, all other countries face an increase of about 50 percent in their fair share, with that of non-traditional donors collectively rising from 23 percent to 34 percent.

So what does this mean for the NCQG negotiations?

There is no single or simple answer to the ‘fair shares’ question, with results depending on a set of technical and political choices, all of which can be contested. And yet the basic message of this analysis is clear: while responsibility for providing climate (and loss and damage) finance continues to rest primarily with developed countries, the principle of common but differentiated responsibilities itself increasingly demands that richer developing countries that have emitted significant quantities of GHGs should also start contributing, with a collective fair share in the 20–30 percent range and likely to increase over time. China would be the most significant—but by no means the only—new contributor, with figures starting at 5 percent and rising to at least 10 percent by 2030 likely in the right ballpark.

While negotiators disagree on whether the current legal texts impose any such obligation, they do not prevent such contributions, as the UAE’s commitment to the Loss and Damage Fund at COP28 illustrates. The Paris Agreement drops references to the Annex classification of countries and encourages developing countries to contribute voluntarily. Many developing countries already provide climate finance through contributions to the MDBs, and some have significant (if unreported) bilateral programmes as well. Indeed, ODI estimated that China may have been the seventh largest provider of climate finance in 2017 when taking these into account (although they still fall well short of their fair share in most if not all scenarios considered above).

Finding a way to acknowledge and encourage such contributions (without necessarily conferring the same degree of obligation or opening the door to other responsibilities of “developed” countries) could help overcome political hurdles and unlock agreement on the NCQG with a wider contributor base.

There is much to play for in the forthcoming climate finance negotiations. Evidence that Annex II countries finally met the $100 billion commitment in 2022, now confirmed by the OECD, should remove at least one obstacle, although current donors will still need to come forward with much more generous offers of climate finance. But amongst non-traditional donors, the analysis above suggests that China has a particularly important role to play, notwithstanding its significant contributions in other areas, such as the rapidly falling costs of renewable energy and electric vehicles. Detailed burden sharing arrangements, either amongst traditional or non-traditional donors, are unlikely to be feasible, but agreement on a collective contribution from non-traditional donors would help. One other thing is clear however: the fair share of LICs, LMICs, SIDS, and LDCs is negligible, and they should continue to be exempted from any such responsibility.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: MohammadRakibulHasan / Adobe Stock