Recommended

Nearly two years have passed since the G20 committed to recycling $100 billion of Special Drawing Rights (SDRs) from advanced economies to support more vulnerable countries. The most recent allocation of SDRs, the international reserve asset issued by the International Monetary Fund (IMF), was intended to provide urgent support to countries affected by the COVID pandemic, but the allocation formula meant higher-income countries received most of the SDRs issued—hence the G20’s promise.

In the two years since that pledge, however, vanishingly few SDRs have actually been recycled. Donors, while eager to assist, are expressing concerns over potential foreign currency reserve reductions if they recycle SDRs to aid more vulnerable nations. These concerns have some merit, but the numbers show that current recycling commitments do not critically impact reserves for most advanced countries, and any impact can be mitigated.

How SDRs fit into central bank reserves

To understand the impact of SDR recycling on reserves, it is essential to understand the role of SDRs in central bank reserves and how the Voluntary Trading Arrangement (VTA) market works.

Central banks maintain reserves as much as individuals keep emergency savings in a bank account, to act as a safety net in turbulent times. These reserves act as a financial cushion, safeguarding countries against economic uncertainties and facilitating international transactions. Reserves are a mix of assets including foreign currencies, gold, government securities, and SDRs.

What role do SDRs play in that reserve portfolio? SDRs constitute a financial asset that is not currency yet holds value. In limited instances, countries can use them to pay bills to other SDR holders. And they add diversity to the reserve pool, as they can be easily converted into US dollars, British pounds, Japanese yen, euros, or Chinese yuan, which gives central banks flexibility in managing economic policy.

In August 2021, the IMF executed the largest general allocation of SDRs in history, equivalent to $650 billion, to help countries respond to the unprecedented challenges posed by the COVID-19 pandemic. This allocation was then divvied among IMF members according to their quota or shareholding at the IMF. For instance, the United States' quota share at the IMF is 17.4 percent, so the US received 17.4 percent of the $650 billion allocation, or $79.5 billion. By contrast, Guinea-Bissau owns 0.006 percent of the IMF and received $27 million.

Holding SDRs doesn't come with a cost, but using them does. Think of SDRs as a limited resource—since only the IMF can create them, there's a finite number available. Countries that decide to use their SDRs (meaning they’ll have fewer SDRs than the IMF allocated them) will need to pay interest on the amount their holding falls short of their allocation, a rate which varies over time and is currently at 4 percent per year. Countries that hold more SDRs than they were allocated by the IMF earn the interest paid. Since the pool of SDRs is fixed, the interest countries in deficit pay equals the amount that surplus countries make.

Demystifying the Voluntary Trading Arrangements market

In the past three decades, exchanges of SDRs for hard currency have occurred between central banks and other reserve-holding institutions in transactions by mutual agreement, primarily through Voluntary Trading Arrangements (VTAs) arranged by the IMF. The VTA market currently comprises 40 members (39 countries and the European Central Bank), 8 of which have joined since the 2021 SDR allocation (figure 1).

Source: IMF annual update on SDR trading operations 2023. Note: Greece had credit outstanding to the IMF, so it has yet to be approached by the VTA, but the IMF is planning to re-engage this year.

A country that wants to buy or sell SDRs talks to the IMF, and the IMF then picks a member of the VTA market (one of the countries in the list above) to make the trade. Which country the IMF chooses depends on several factors:

- Firstly, the IMF looks at how spread out the SDRs are among the VTA members, assessing how many SDRs each member has compared to how many each was allocated. If a country has fewer SDRs than allocated, it’s more likely the IMF will ask them to buy SDRs, or the reverse if they hold more than their allocation.

- Secondly, each participant in the VTA market designates a trading range—how many SDRs it is willing to buy or sell as a percentage of its total allocation. The IMF will favor countries where the proposed trade doesn’t take them too far from the center of their trading range.

- Together these criteria help ensure that the VTAs don’t take countries too far from their SDR allocation, which could result in SDR interest payments (or receipts).

But the process is not purely mechanistic. The IMF considers other factors: for example, the type of currency involved in the trade or the frequency of past trades, to ensure the system distributes any transaction burden fairly and one country isn’t asked to participate in every deal. And, as the name of the mechanism indicates, these transactions are voluntary and VTA members can choose to reject them for their own reasons.

What happens when donors recycle their SDRs and why central banks might be reluctant?

October will mark two years since the G20 pledge to recycle $100 billion of SDRs. However, only 81 percent of that figure has been pledged, and less than 0.5 percent of the $100 billion has actually been recycled and reached a vulnerable country (according to the ONE Campaign’s tracker). Recycling is a transfer of SDRs distinct from the VTA system: In recycling, SDRs are lent to various vehicles within the IMF to facilitate lending to vulnerable countries. While central banks can call those SDRs back, recycling inevitably reduces total reserves. The VTA system, by contrast, involves an exchange of SDRs for hard currency where central bank reserves do not change.

Why might donors and central banks find themselves hesitant to fulfill this commitment? As countries choose to recycle their SDRs, their own SDR holdings inevitably will decrease. This means that they become more likely to be asked by the IMF to buy SDRs through VTA trades. More VTA trades would, in turn, reduce their foreign currency holdings in exchange for acquiring more SDRs.

So yes, in the short term, as countries recycle their SDRs, their foreign currency reserves inevitably decline. However, SDRs are only a part of the broader central bank reserves, which leads us to the question: How much of their foreign exchange reserves might central banks “lose” due to the recycling commitments?

Pledges have reached $81 billion in SDRs; however, the countries involved in the recycling process collectively hold reserves exceeding $9 trillion, which means that the recycling efforts constitute approximately 0.89 percent of their total reserves. (Some G20 countries haven’t pledged any SDRs for recycling: Argentina, Brazil, India, Indonesia, Mexico, Russia, South Africa, Turkey, and the United States. If we add them to our calculations, then the total reserves exceed $11 trillion which means recycling commitments are only 0.73 percent of G20 total reserves.) There is variation between countries here: for instance, Luxembourg and Australia have pledged to recycle an amount of SDRs equivalent to approximately 12 percent and 6 percent of total reserves, respectively. However, many other countries, like Switzerland and Sweden, have comparatively much more limited in their generosity (see Table 1)

Table 1. Total SDR recycling pledges as % of reserves

|

Pledge as % of reserves |

Countries |

|---|---|

|

0.01% to 0.5% |

Switzerland, Denmark, Norway, Sweden, Singapore, Oman, Qatar, China, Korea |

|

0.5% to 2% |

Saudi Arabia, Portugal, Japan, Estonia, Italy |

|

2% to 5% |

Greece, Lithuania, Germany, Malta, Canada, Finland, Spain, Belgium, United Kingdom, Netherlands, France |

|

>5% |

Australia, Luxembourg |

Source: The ONE Campaign for recycling, IMF International Financial Statistics for reserves. Note: All countries except Qatar are members of the VTA. Switzerland, Singapore, Oman, and Qatar are not part of the G20 group but have pledged to recycle SDRS.

Why are central banks wrong?

Central banks will likely experience a minor loss in their foreign currency reserves during the initial stages of SDR recycling. However, this is just one side of the story; there are essential aspects central banks might be overlooking.

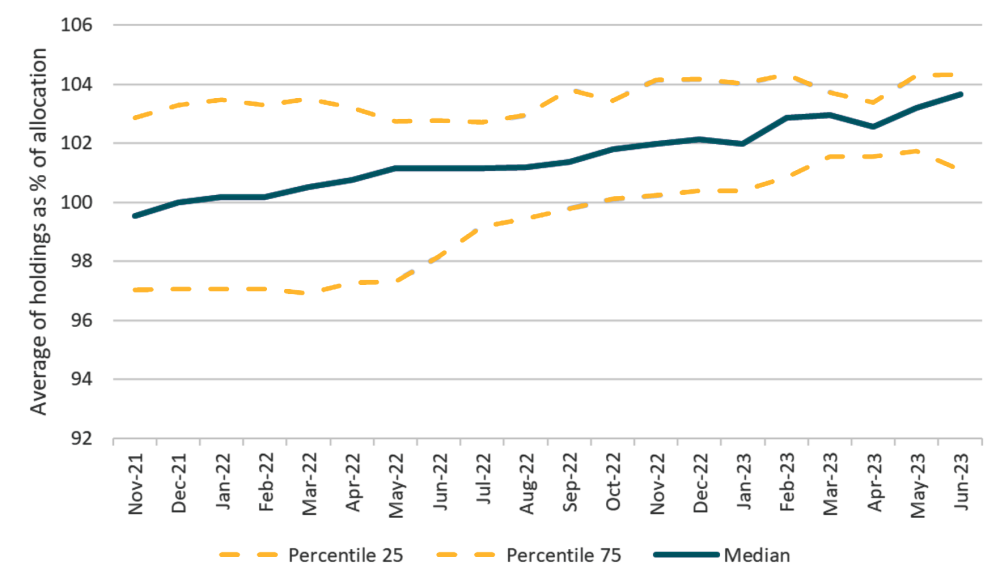

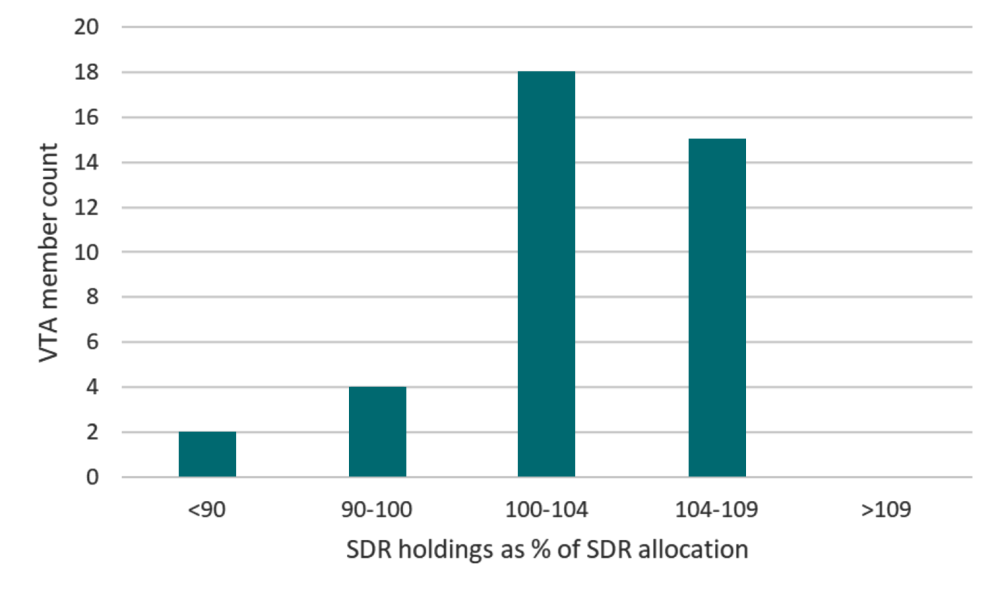

Firstly, donors’ holdings of SDRs will decrease after recycling, which means the IMF will likely contact them to buy SDRs. But as donors begin buying SDRs, their holdings ratio will naturally increase. And countries still need SDRs to make various payments to the IMF, so even if the holdings ratio decreases in the beginning due to recycling, it will tend to balance out in the longer term. As a result, members’ holdings tend toward their allocation to avoid paying the SDR interest rate (Figures 2 and 3), complementing the VTA mechanics described above.

Figure 2. Distribution over time of VTA members’ SDR holdings as a percent of SDR allocation

Source: IMF data query tool

Figure 3. Distribution of VTA members’ SDR holdings as a percent of SDR allocation (as of June 30, 2023)

Source: IMF data query tool. Data updated as of June 30

And crucially, recycling SDRs is not a gift or donation but a loan. Countries can get back the recycled SDRs early if needed. And the recycling done through the IMF is repaid when the recipient country repays the loan it gets from the IMF. Plus, countries which lend their SDRs for recycling get paid the SDR interest rate by the IMF. So even if a country's SDR holdings go below their allocation, any cost they incur is reimbursed by the IMF as part of the loan agreement.

Lastly, it is crucial to remember that these transactions are entirely voluntary. Countries can reject VTA offers if concerned about their foreign currency reserves. This autonomy allows them to make informed decisions per their economic circumstances.

Bottom line

The impact of SDR recycling on central banks’ foreign reserves will likely be minimal and short-lived—low at first and expected to balance out over time. The VTA market effectively addresses donors’ concerns, and its well-thought-out design prevents any possible imbalances within the country or among VTA partners. VTA market arrangements should not be considered an excuse to avoid recycling SDRs to vulnerable countries. Any reform should instead focus on deepening the VTA market by expediting transactions and increasing membership to distribute transactions across a broader range of countries.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Panuwat / Adobe Stock