Tobacco use is the world’s leading cause of preventable death, claiming eight million lives per year, which together with tobacco-attributable disability is equivalent to an annual global productivity loss of 1.8 percent of GDP.

Extensive evidence shows that tobacco taxation is the most effective and cost-effective measure to reduce tobacco use.

The 2021 edition of the Tobacconomics Cigarette Tax Scorecard assesses progress that governments have made with cigarette taxation policy to reduce smoking and save lives during COVID-19. These policies have greater relevance than ever as smokers have significantly higher risks of hospitalization and mortality from COVID-19 than never-smokers.

The scorecard assesses the effectiveness of 160 countries’ cigarette tax policies, looking at retail price, change in affordability over time, tax share of retail price, and tax structures—scoring on a scale of zero (poor) to five (best practice) using data for 2020 published in the WHO 2021 Report on the Global Tobacco Epidemic. CGD previously welcomed the inaugural 2020 scorecard as filling an important gap in the metrics of tobacco control.

The big picture—a long way to go

The scorecard highlights that, overall, governments have made insufficient progress in strengthening their cigarette taxation policies. Only eight countries score in the top-performing bracket in 2020 (albeit twice as many as in 2018), with Botswana, Canada, France, Peru, and Seychelles joining Ecuador, New Zealand, and the United Kingdom (while Australia lost its top performing spot). High and uniform specific excises, high cigarette prices and decreasing affordability of cigarettes are present in these top performers.

At the other end of the spectrum, 26 countries remain in the lowest-performing bracket—mostly in low-income countries or fragile states, including 13 countries with no excise tax on cigarettes and very low cigarette prices. Large countries with high smoking prevalence (i.e., China, India, Indonesia, and Vietnam) continue to score poorly on the scorecard.

Some progress on cigarette taxation despite COVID-19

While COVID-19 could have been a setback for tobacco taxation, if governments hesitated to raise or reduced indirect taxes as economies were buffeted, this does not appear to be the case. The scorecard shows that overall cigarette taxation scores improved, despite the pandemic, with the global average score rising twice as much between 2018 and 2020 as it did in the previous four years. Overall, cigarette tax scores improved in all World Bank income per capita groups and in all WHO regions between 2018 and 2020. The four components of the scorecard improved in all four World Bank income groups, except that price fell in low-income countries and cigarettes became more affordable relative to income in lower-middle income countries.

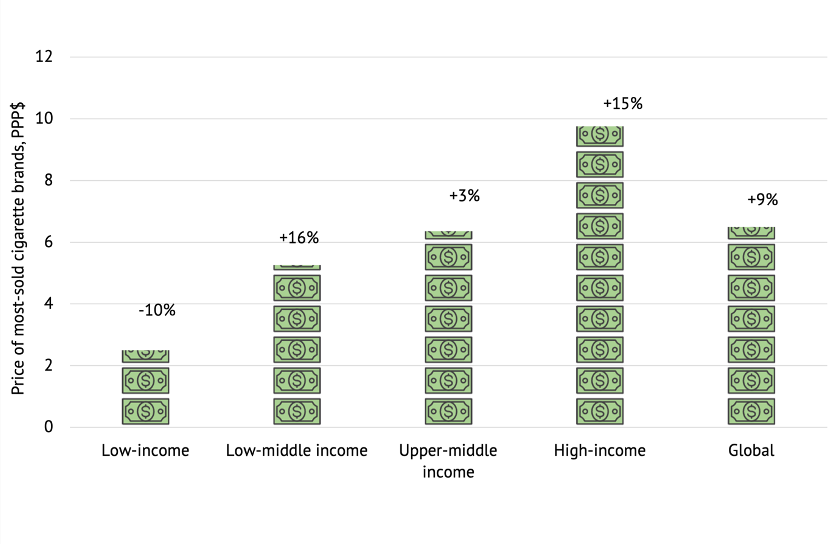

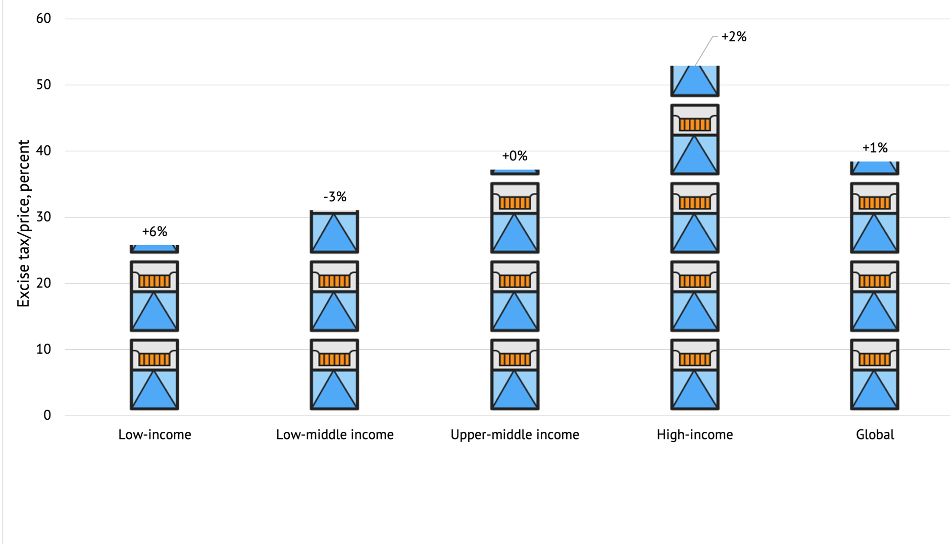

Cigarette prices rose in most markets and by substantial amounts in lower-middle income and high-income countries during 2018–2020, while most countries’ income fell making cigarettes less affordable overall. And excise taxes as a share of price inched up, suggesting that overall tax receipts did not fall (see charts).

Figures 1 and 2. Cigarette price by World Bank Income Group, 2020 (PPP$ per pack), and Cigarette excises as a share of price, 2020 (percent)

Source: Cigarette Tax Scorecard 2021

Important tax policy advances were made in Bahrain, Qatar, and Saudi Arabia that reflect the introduction of substantial cigarette excises after previously relying on ad valorem import duties. Another tax advance was in Belize, which introduced a uniform specific excise because the country had no excise tax previously. Tax structure improved significantly in Armenia, Kyrgyzstan, Mozambique, and the Philippines by moving from a tiered tax system to uniform specific excises with automatic adjustments. Peru also saw improvement, with annual indexation of tax for inflation beginning in 2020. Georgia and Nicaragua also introduced substantial tax increases. Nonetheless, there were also setbacks: Lebanon exempted local producers from the excise on tobacco, and Kenya and Thailand reintroduced tiered excises.

The generally robust performance of tobacco taxation during a global economic downturn gives hope that further progress can be made post-COVID-19 as countries focus on raising revenue to build back better, including from taxes on unhealthy products.

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.