Our recent report on the Unintended Consequences of Anti–Money Laundering Policies for Poor Countries focused on a process known as “de-risking,” where banks cut off ties with whole classes of clients that are perceived to be high risk. At the end of November the World Bank released the results of two separate surveys aimed at gauging the extent to which de-risking is a problem. The headline result is that banks around the world are closing accounts of money transfer organizations (MTOs) and are severing links with banks in other countries.

These careful, timely reports provide crucial evidence that de-risking is a very real phenomenon and that we should be worried about it. The reports come up short of being able to completely identify the scope of the problem, but they are an excellent starting point.

Remittance companies, banks, and governments are all reporting that accounts are being closed

The first of the two World Bank surveys, focused on whether de-risking is affecting the remittance market, was sent to a large number of governments, banks, and MTOs. Responses from each of the three groups confirmed that de-risking might be a problem: nearly half of the MTOS surveyed reported that they had at least one bank account closed last year. The same proportion of responding banks reported that they had closed at least one MTO account that year. About half of responding governments indicated that they had received complaints from MTOs about access to bank accounts.

The problem also appears to be getting worse. As the above figure shows, the 82 MTOs that responded to the survey were more likely to report that they lost a bank account in recent years. Respondents from the United States, United Kingdom, and Australia appear to be the worst hit: between 55 percent and 82 percent of MTOs report that they lost at least one bank account last year, although these results might be partially driven by differences in response rates across countries.

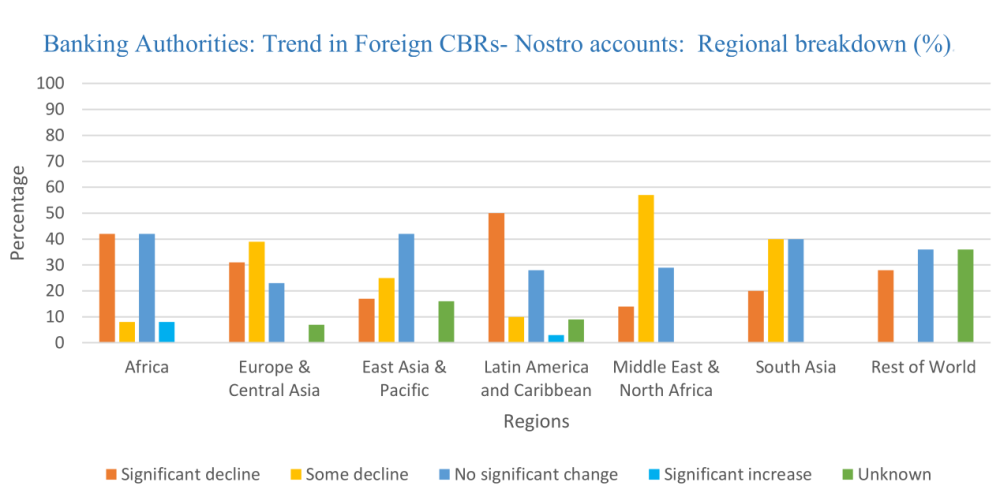

Banks appear to be withdrawing correspondent connections, with Africa seeing a significant decline

The second survey carried out by the World Bank focused on whether large international banks are severing correspondent relationships, accounts they provide for banks in other countries which are crucial for moving money around the globe. The responses from regulators, large international banks, and smaller local and regional banks indicate that a significant number of banks are terminating correspondent accounts. Of the 20 international banks surveyed, 15 reported they had seen a decline in correspondent accounts in the past two and half years.

Certain regions appear to be worse hit than others. The majority of large banks responding to the survey indicated that they have completely withdrawn correspondent banking services from certain jurisdictions. Banking authorities (regulators) in some regions reported that they had noticed some decline or a significant decline in their banks’ access to correspondent accounts. As shown in the graph below taken directly from the report, regulators in Latin America/Caribbean and Africa are most likely to a report a significant decline in correspondent connections.

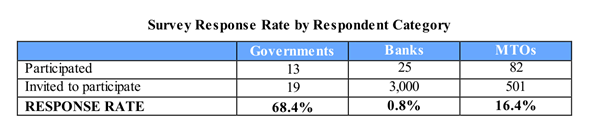

Low response rates mean we don’t know how generalizable these results are

To date, the World Bank surveys are the best available evidence we have on the effects of de-risking around the globe. However, the results are hampered by a few limitations which prevent us from fully understanding the scale of the problem. For one, the response rates by banks and MTOs to the remittances survey are very low, as can be seen in the table below taken from the report. This can skew the results in a number of unpredictable ways, and the World Bank itself has cautioned against overinterpreting the results. For example, MTOs which have lost bank accounts might be much more likely to fill out a survey on de-risking, making the problem look worse than it really is.

The response rates are significantly better in the correspondent banking survey, but a lack of consistency in bank responses means that, while it is possible to know how many banks have cut correspondent relationships in recent years, it is hard to know precisely what the net effect has been.

The push for more and better data

These results will go a long way to convincing policymakers that de-risking is a problem, but we need to push further. In our own report, we outline a number of quick wins where data that already exists on MTO markets or correspondent banking links can be used to understand de-risking. For example, in the report we use data held by the UK’s Financial Conduct Authority to determine that there have been no unexpected drop in the number of MTOs operating in the United Kingdom, despite several reports of companies losing bank account access. In addition to public authorities, a number of private actors, such as SWIFT and CHIPS, have information on correspondent banking links which could be used to get a sense of the true scale of the problem.

With these two new reports from the World Bank, we can say with greater certainty that de-risking is an issue. But we still have some distance to go before we know the true extent of the problem.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.