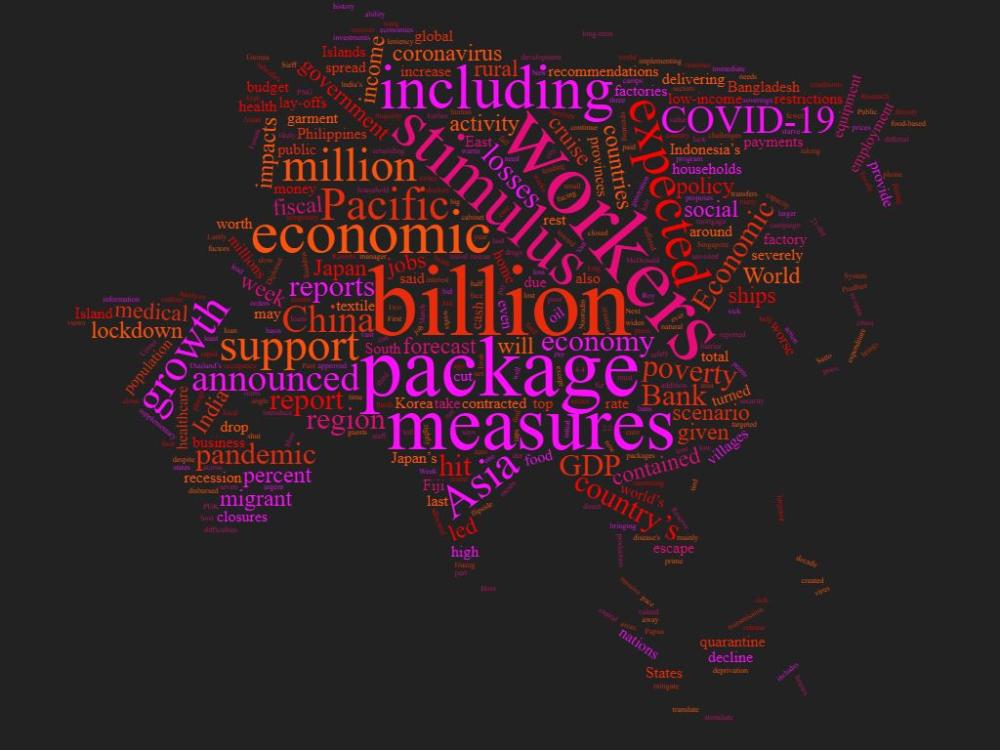

COVID-19 continues to take a humanitarian toll around the world, including in Asia and the Pacific. Countries are rightly taking dramatic measures to slow it, and those measures have economic impacts. Here’s a selection of this week’s coverage on the observed and expected economic impacts across the region, divided into growth and income, sectors and sub-populations, policy responses, and commentary. (Last week we provided a round-up of analysis on the economic impact in Africa.)

Growth and income analysis

-

In a report out last week, the Asian Development Bank revised its growth forecast for the region down to 2.2 percent in 2020, from an initial forecast of 5.5 percent in September 2019. Assuming the outbreak is contained within the year and economic activity resumes, growth is expected to rebound to 6.2 percent in 2021. However, with the “vast uncertainty about the duration and severity of the pandemic ... outcomes can be worse than forecast and growth may not recover as quickly.” A scenario of longer containment and larger demand shocks will lead to $690 billion losses for China (5 percent of its GDP), and $200 billion losses for the rest of the low- and middle-income countries in Asia (2.2 percent of GDP). The losses are tied to a worsening external environment including disrupted economic activity in the United States, the euro area, and Japan and falling commodity prices expected to hit commodity and oil exporters including those in Central Asia.

-

The World Bank estimates that growth in developing East Asia and the Pacific (excluding China) will drop to 1.3 percent in 2020 from an earlier estimate of 4.7 percent, even assuming the pandemic is contained and “sizable fiscal and monetary policy support measures” are implemented. In this scenario, “24 million fewer people are estimated to escape poverty” than would have without the pandemic in 2020. In a worse scenario of extended global recession and severely disrupted value chains, growth is expected to further fall to -2.8 percent and poverty to increase by another 11 million. Before COVID-19, poverty in the region was expected to drop by 35 million in 2020, with over 25 million expected to escape poverty in China alone.

Sector and sub-population analysis

-

In Pakistan, partial and complete lockdowns in various provinces have led to further factory closures, on top of the layoffs and closures of garment and textile factories due to cancelled orders from global clothing brands. Human Rights Watch reports an estimated 12 to 18 million workers may lose their jobs, including “garment and textile workers, domestic workers, home-based workers, and other workers in low-income households.”

-

Manufacturing activities in Japan, South Korea, Indonesia, Vietnam, and the Philippines have contracted sharply, even as China starts to gradually re-open its factories. “Japan’s factory activity contracted at the fastest pace in about a decade in March, adding to views that the world’s third-largest economy is likely already in recession,” Kihara and Leussink report for the World Economic Forum.

-

Similarly, in India the government declared a 21-day lockdown and suspended all transportation in a bid to protect the country’s population of 1.3 billion against the virus. Biswas reports that this led to millions of migrant workers fleeing the cities and trekking to their home villages by foot. “These informal workers are the backbone of the big city economy, constructing houses, cooking food, serving in eateries, delivering takeaways, cutting hair in salons, making automobiles, plumbing toilets and delivering newspapers... (The) lockdown turned them into refugees overnight. Their workplaces were shut, and most employees and contractors who paid them vanished. Most said they had run out of money and were afraid they would starve.”

-

In the Philippines, with about a tenth of its GDP coming from overseas remittances, layoffs in rich host countries such as the United States, the United Arab Emirates, and Saudi Arabia threaten the welfare of millions of low-income families depending on money from migrant workers to afford basic needs. Raghavan, Bearak, and Sieff report that “already, hundreds of Filipino workers aboard cruise ships — one of the industries hit hardest by the pandemic — have returned home to high unemployment and a lack of medical and social protections.”

-

Rozelle et al. report the results of a phone survey of 726 randomly selected villagers in seven rural provinces outside of Hubei, China. They find that “the draconian quarantine measures successfully contained the spread of COVID-19 in rural villages.” However, the quarantine measures led to “a radical decline in employment in China’s rural areas, due at least in part to restrictions preventing migrant workers from returning to work.”

-

Wilson of Al Jazeera reports that “most Pacific Island nations, including Fiji and the Federated States of Micronesia” have banned or restricted international flights, and that “cruise ships have been turned away from popular destinations, such as the Cook Islands and Vanuatu.” So far, the remoteness of many of the island states “including Kiribati, Tuvalu and the Solomon Islands, has created a natural barrier to the disease's transmission.”

-

On the flipside of the Pacific Island nations lockdown, McDonald reports in The Diplomat that the tourism-dependent economies are expected to be severely hit by travel restrictions and bans on cruise ships. Resorts have been closed and the majority of staff laid off—“in a week’s time we will have no guests, zero occupancy means no income,” says a resort manager.

Economic policy responses

-

Two weeks ago, India announced a $22.5 billion stimulus package to “be disbursed through food security measures for poor households and through direct cash transfers.” The Reserve Bank of India has cut its lending rate by 75 basis points from 5.15 percent to 4.4 percent.

-

Earlier this week, Bangladesh announced an $8.5 billion stimulus package “to increase public expenditure mainly through employment generation, introduce stimulus packages and widen social safety net coverage.”

-

South Korea announced cash payments of up to $186 per household except for the top 30 percent. This is in addition to an interest rate cut, a $9.54 billion supplementary budget, and a “rescue package for companies” of up to $81.6 billion.

-

Thailand’s cabinet has approved a stimulus package worth $58 billion “for public heath works and relief measures, and the rest for rebuilding the economy and job creation.”

-

Singapore has announced a third stimulus package worth $3.6 billion, bringing the total economic package to $41.7 billion, or around 12 percent of the country’s GDP.

-

Fiji has unveiled a $400 million stimulus package “with more than half of funds allocated to workers and businesses.” The budget would also provide additional equipment for doctors and healthcare workers.

-

Papua New Guinea announced a stimulus package valued at 5.6 billion Papua New Guinea kina ($1.7 billion), “the largest ever in PNG history.” The package includes support for deferral of mortgage or business loan payments and support for jobs and businesses.

-

Kazakhstan taps on its sovereign fund for an additional $4.1 billion. This brings up the country’s total stimulus package—“aimed at softening the blow from the coronavirus outbreak and the plunge in the price of oil”—to $10 billion.

Commentary

-

Noorudin and Shahid caution that “Bangladesh has a health crisis in the making,” given the country’s very high population density and “thousands of stateless Rohingya housed in sprawling refugee camps in the southeastern region of the country, in conditions prime for rapid spread.” They provide recommendations to the government including stepping up local production of medical equipment, initiating a massive information campaign, and—from the economic angle—offering leniency for small business loans.

-

Van der Eng writes that despite Indonesia’s stimulus package of $12 billion “factors limit the ability of Indonesia’s government to stimulate the economy.”

-

In a press release last week, the World Bank warns that countries in East Asia and the Pacific “must take action now – including urgent investments in healthcare capacity and targeted fiscal measures – to mitigate some of the immediate impacts… Targeted fiscal measures – such as subsidies for sick pay and healthcare – would help with containment and ensure that temporary deprivation does not translate into long-term losses of human capital.”

-

Roy, Boss, and Pradhan outline the challenges and their recommendations in implementing India’s $22.6 billion relief package through “the world’s largest food-based social program, the Public Distribution System.”

-

Jun Saito of the Japan Center for Economic Research proposes three measures for stemming Japan’s economic decline in the face of COVID-19, as reported by Huang: “First, support should be given toward the development of vaccines and drugs for the coronavirus, as well as to the medical sector for it to continue operating, he said. Next, support should be given to workers who have lost their jobs. Lastly, small-and-medium companies that have suffered a loss in demand and are facing financial difficulties from the economic hit of the coronavirus also need financial support.”

Author order on this blog post was randomly assigned.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.