On Saturday the Center for Global Development, OECD, and the International Development Finance Club (IDFC) will co-host a session on the sidelines of the World Bank-IMF meetings in Bali examining the role of the IDFC in the sustainable development agenda. (If you’re in Bali, please be sure to join us.)

The event—The Role of Development Banks in the 2030 Agenda—is an opportunity to preview new work from CGD on this topic, based on a survey of IDFC members that I conducted over the past six months. An early look at some of our findings is available in a new CGD policy brief, Rising to the SDG Challenge: The Unique Contribution of the International Development Finance Club.

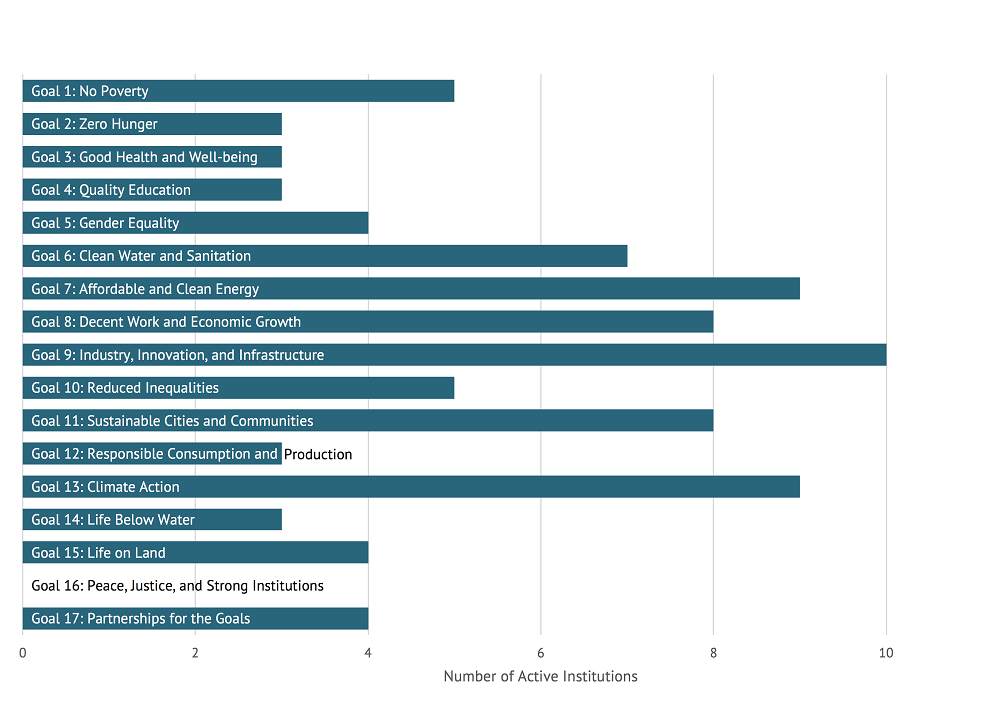

The IDFC represents a unique mix of bilateral agencies, national development banks, and regional development banks. As such, it holds promise for bringing new and productive collaborations to the SDG agenda that extend well beyond the work of the major multilateral development institutions. Our efforts to map the scale and scope of IDFC members’ development financing through a membership survey and public databases provide some interesting takeaways:

-

The collective scale of these organizations greatly exceeds that of the World Bank and other major multilateral development banks (see figure below).

-

There is a high degree of alignment between IDFC-reported activities and the SDGs, though only a minority of IDFC members have an explicit SDG strategy that informs their operations.

-

IDFC institutions appear to be well matched to respond to key SDG requirements, including the call for nationally led development strategies and the need for substantial private sector and non-sovereign investments, particularly in infrastructure.

-

Through a greater commitment to SDG-oriented activities and the use of internal mechanisms to guide operational strategies, IDFC members could better demonstrate the value of organizing around national, bilateral, and multilateral development institutions to address the leading development challenges in the years ahead.

Figure. The total assets of IDFC institutions are significantly greater than the total assets of core MDBs ($US millions)

Have a look at the policy brief for other early findings and conclusions—and watch this space for the full CGD report in the weeks ahead.

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.