Recommended

Cigarettes and alcohol are getting more affordable in countries struggling with the human and economic impact of high levels of cancer and cardiovascular disease. Why? The rate of inflation is rising all over the world, driven by economic effects of the COVID-19 pandemic and the war in Ukraine. And in about 70 percent of all countries with fixed value or specific taxes on health-harming products, inflation is eroding the level of health taxes., Unless health taxes are adjusted to account for inflation to maintain the real value of taxes, efforts to curb death and disability through targeted taxation will be reversed. Public health spending may also be affected, especially if revenues from health taxes are earmarked to bolster health budgets.

Even before these economic crises hit, all over the world, health taxes were too low relative to the costs and consequences of the use of tobacco, alcohol, and sugar-sweetened beverages (SSBs). But inflation makes everything worse.

Figure 1. Annual costs of death and disability compared to corrective taxes on alcohol, tobacco and SSBs, 2019 or latest year

In this blog, I examine why policymakers should ensure that inflation does not erode corrective taxes on killer products and make them more affordable. Using a survey of recent health tax measures, I show that some countries have ensured that health taxes are stepped up while most have hesitated, and call on countries to adjust for inflation and protect health gains.

Inflation on the rise and country responses

Inflation is accelerating in advanced and emerging market and developing economies due to post-pandemic demand and the economic crisis sparked by the war in Ukraine, with food and energy prices increasing to record highs (Figure 2).

Source: IMF, World Economic Outlook (April 2022) https://www.imf.org/en/Publications/WEO/Issues/2022/04/19/world-economic-outlook-april-2022

Most health taxes are specific taxes vulnerable to inflation erosion

In response to energy and food price spikes, many countries are either cutting taxes on these items or providing subsidies to cushion the increase in prices. Japan, Turkey, and Italy have raised energy subsidies, while Indonesia and Italy have placed price caps on some fuels. While rising inflation has led governments to cut taxes on food and fuel, other taxes may also come under pressure as their value is eroded by inflation, particularly if they are specific taxes like those most often placed on tobacco, alcohol, and SSBs with a fixed monetary value per unit, per volume, or per amount of health harming content (alcohol, sugar).

More than 70 percent of countries have specific excises on cigarettes making tax collection vulnerable to rising inflation if not indexed (Figure 3). More than half (58 percent) of the 43 countries with SSB taxes in 2019 had specific taxes (World Bank, 2020). Many countries also place specific excises on alcohol in relation to volume, or the health-harming content of alcohol, and face similar revenue vulnerabilities from high inflation.

Figure 3. Cigarette excise taxes by type, 181 countries (2020)

Indexation of specific health taxes

To maintain the real value of an excise tax it should be indexed to the consumer price index (CPI). To maintain the excise component constant as share of income, indexation should be in relation to a broad income definition such as nominal GDP or wages per capita. In practice indexation to CPI is most common in developing countries as CPI data is more readily available than income or wage data, even though product affordability will increase in countries where real incomes are growing rapidly. In the current global context of per capita income growth lagging behind inflation, indexation to income may be a more politically palatable approach if feasible.

Automatic indexation is uncommon

In principle, automatic indexation of specific excises would address the risk of tax erosion by inflation. However, in the case of cigarettes, a WHO survey shows that only just over a quarter of countries have automatic indexation (33 countries out of 126 countries that have specific or hybrid specific-ad valorem cigarette excises). Although comprehensive data is not available for automatic indexation of alcohol and SSB excises, it is not likely to be a significantly different approach from the treatment of cigarette excises.

One argument against automatic indexation to maintain the real value of health taxes is that this would further add to inflationary pressures. However, this would not be a significant contributor to overall inflation. For example, the weight of tobacco, alcohol and non-alcoholic drinks in India’s CPI is 3.64 percent. A 10 percent increase in excises to recoup losses for inflation in India in 2020 and 2021 would add less than 0.2 percent to annual inflation (assuming that taxes are half of retail prices). And, if additional health taxes were used to lower taxes on other items, such as food or fuel, there would be no overall inflationary impact at all.

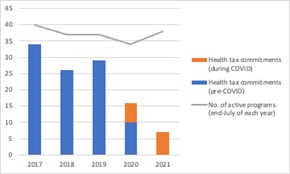

Health taxes on the ground in 2022

Those countries with automatic indexation of excises have broadly maintained the REAL value of their health taxes despite rising inflation. For example, in 2022, Mexico, Philippines, South Africa, and Turkey increased their tobacco taxes by 7 percent, 9 percent, 5.5 percent, and 47 percent respectively to compensate for 2021 inflation. A few countries without automatic indexation of excises have also increased tobacco excises by more than past inflation in 2022 including Indonesia, Lithuania, and Nigeria. At least one country, Paraguay, increased health taxes on tobacco to partially offset the budget impact of fuel tax cuts.

But in most countries, inflation is eroding the value and effectiveness of health taxes with no indication that specific excises will be increased. In India, no tobacco excise tax increases are planned despite inflation of around 6 percent, and in Pakistan the 2022 budget proposes tobacco tax increases of 10.8 percent compared to inflation of over 20 percent since the last tax increase. Others have opted for delay: for example, Australia has deferred the introduction of an SSB tax from 2022 to 2023.

Policy recommendations

Policymakers (and their International Monetary Fund (IMF) and Multilateral Development Bank partners) shouldn’t hesitate to take immediate action. Health taxes work to reduce consumption and its human and economic costs. We recommend that:

- Governments do not need to protect harmful product producers by lowering or postponing their tax payments. This will simply create space for producers to increase their pre-tax prices and raise margins.

- Specific taxes on unhealthy products should be regularly or automatically indexed to consumer price inflation or, if timely data is available, indexed to nominal per capita GDP or nominal wage growth. This will prevent the erosion of the tax base, deter unhealthy product consumption, promote improved population health, and protect health spending where taxes are earmarked to health budgets.

- International financial institutions such as the IMF can usefully remind their members of the need to raise specific health taxes at least in line with inflation or incomes, including during the annual economic check-up known as the IMF Article IV Consultation held with all 190 member countries.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Adobe Stock